September 26th, 2024

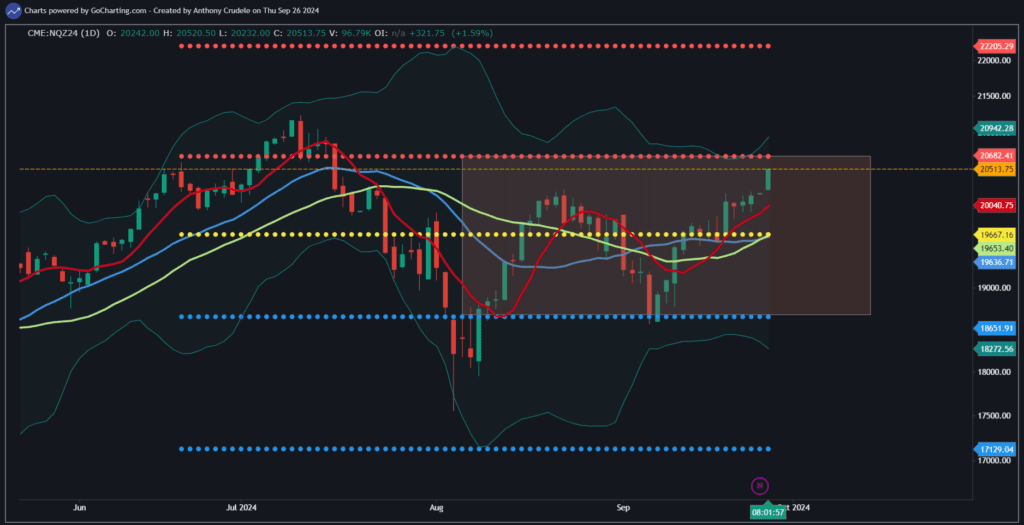

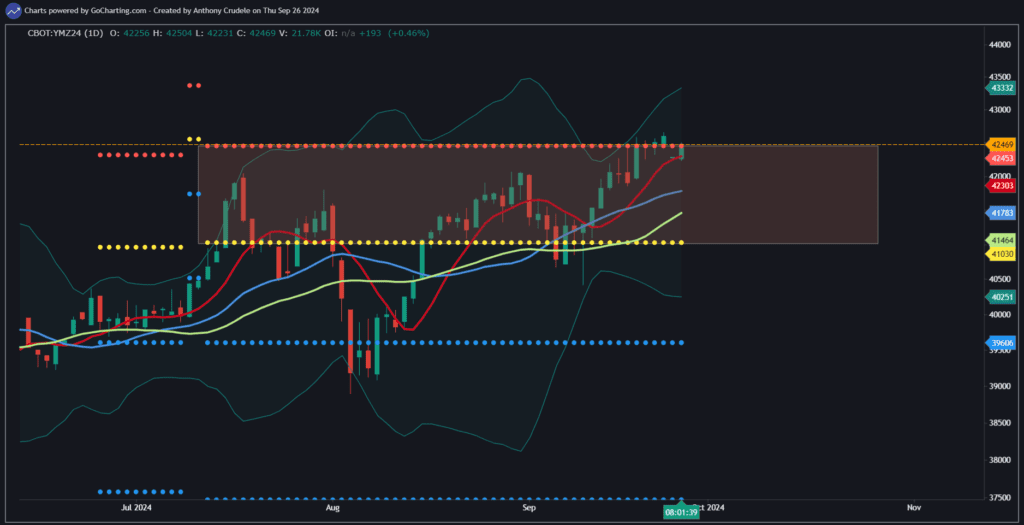

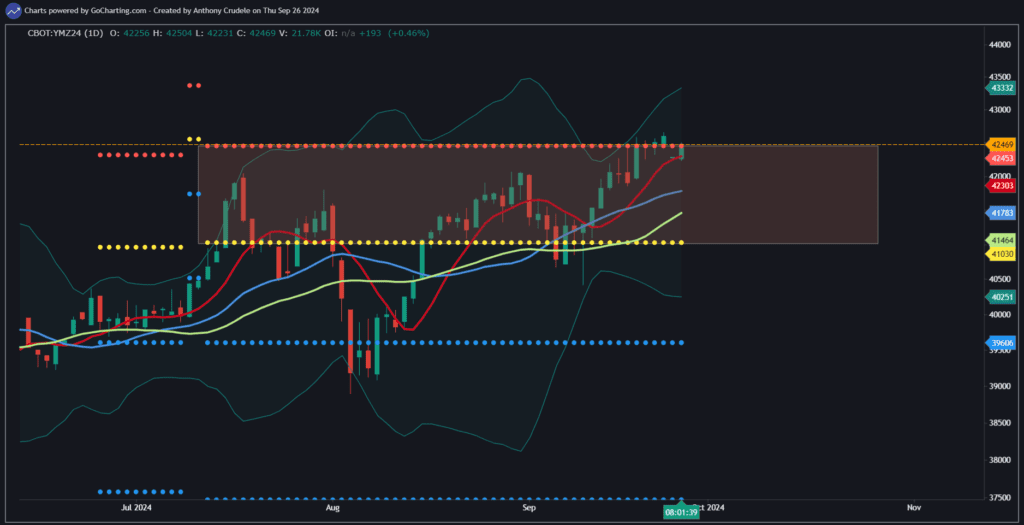

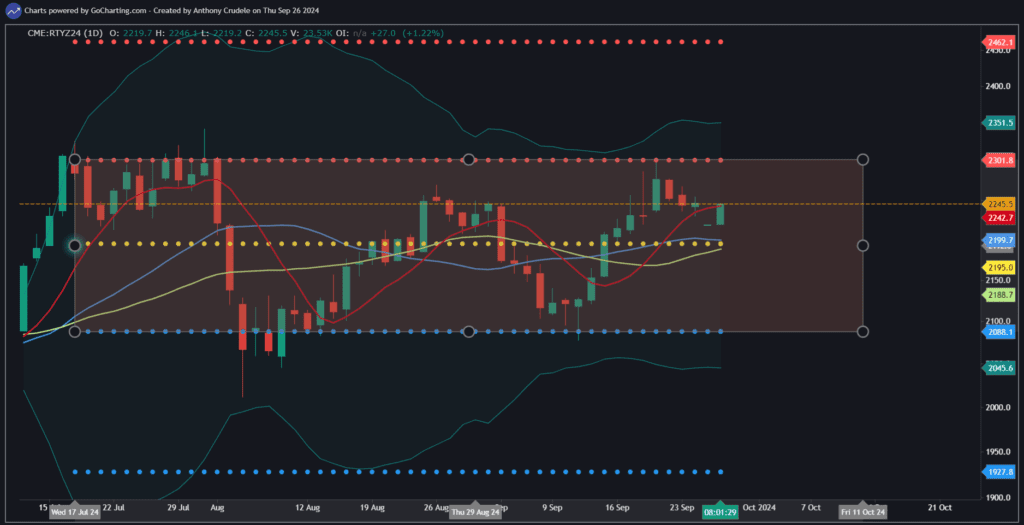

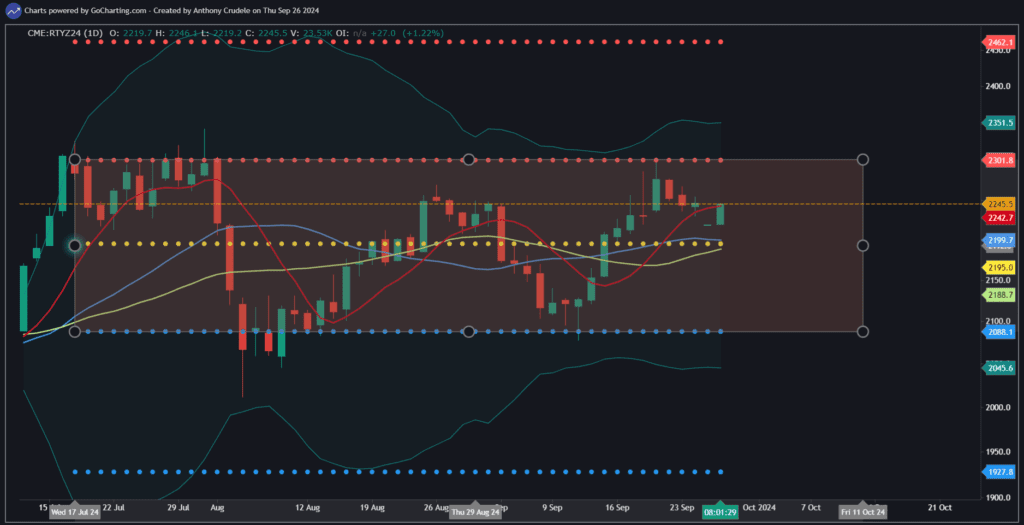

Gap and go. Bulls had a hiccup yesterday and ran it back up overnight, giving them the momentum they needed to take the market to the next level. This rally overnight in ES looks like it has legs to run this morning. In the other indexes, YM, RTY, and NQ, they look bullish, just not as convincing that this rally keeps going.

The reason the ES looks the most bullish is that the daily Bollinger Bands are opening up as we’re breaking out of highs and we’re in range expansion. Not a look you want to fade.

What does this mean for day traders today?

Focus your energy on buying dips in ES. The other markets may be choppier because their charts aren’t as clean. Keep an eye on NQ, RTY, and YM. If one starts to falter today, it could create a domino effect, and that selloff would be an opportunity to buy the dip in ES.

Keep it small and have a strong hand in your positions. Don’t force trades; let them come to you.

Cheers, DELI