October 18th, 2023

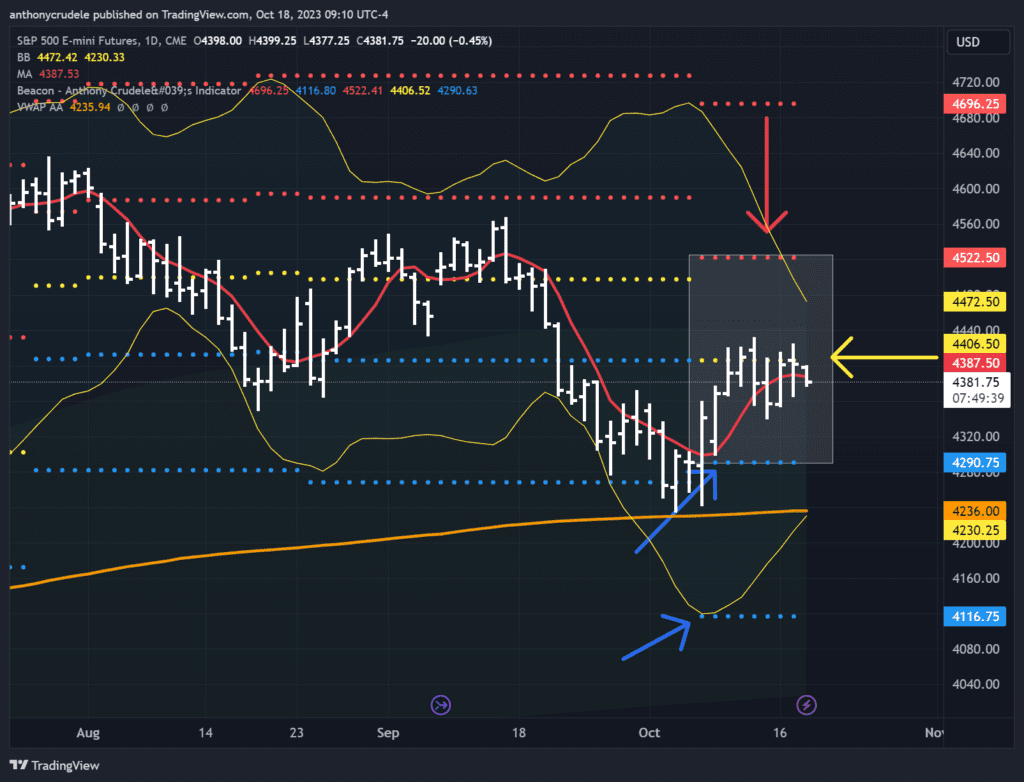

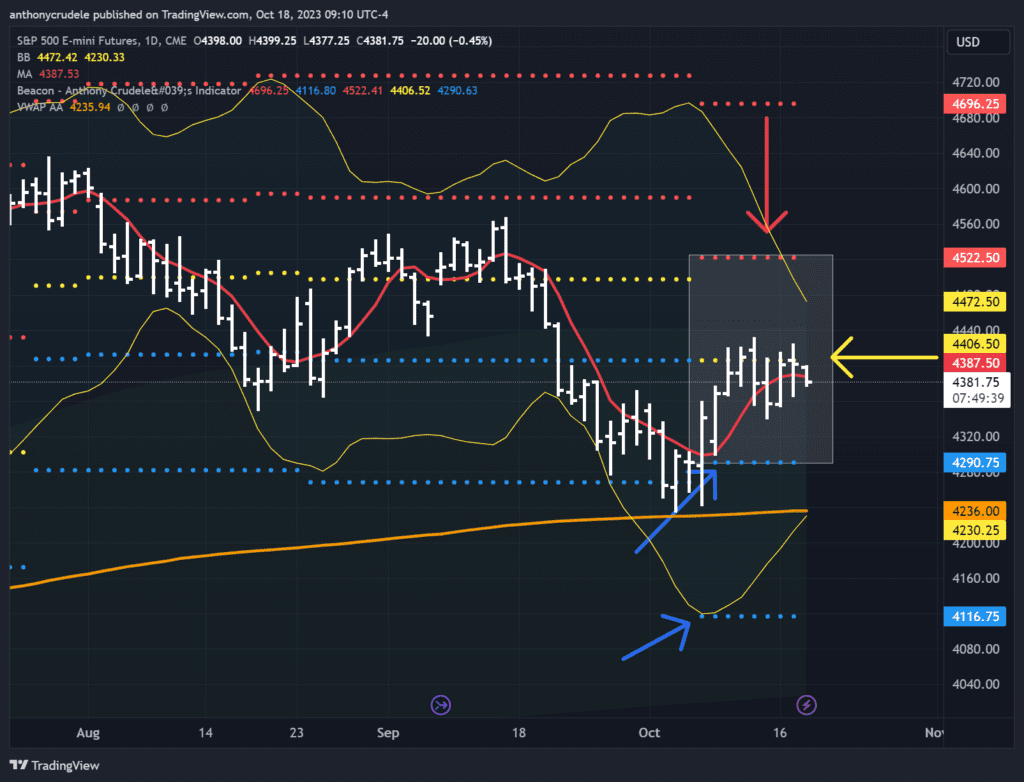

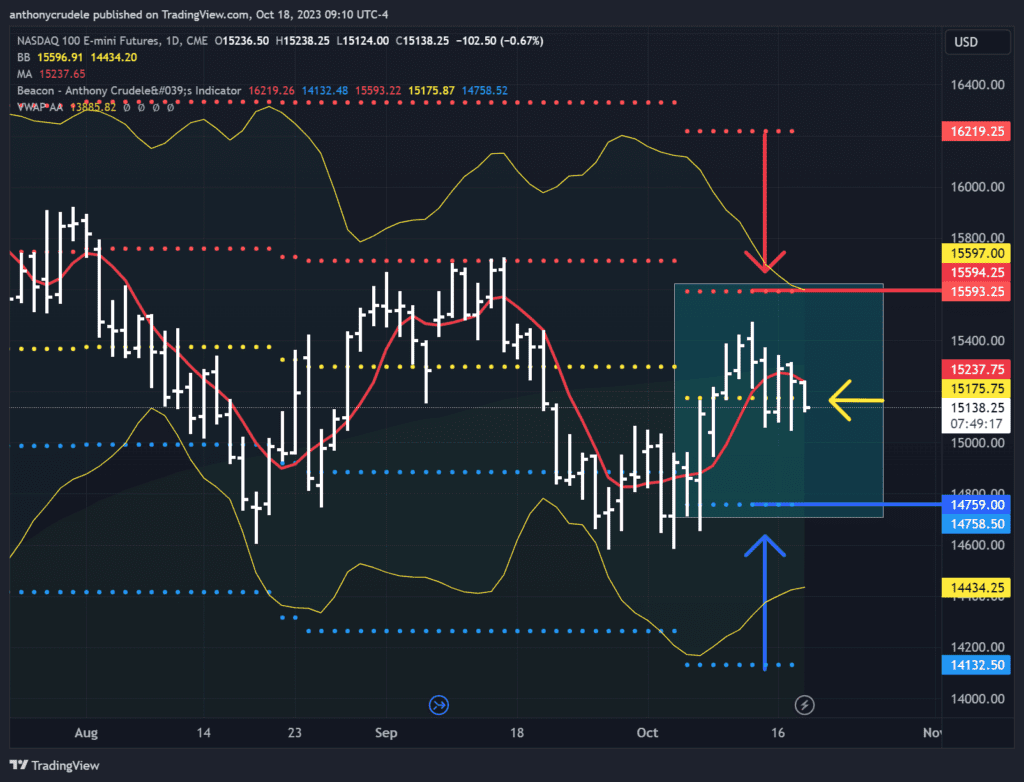

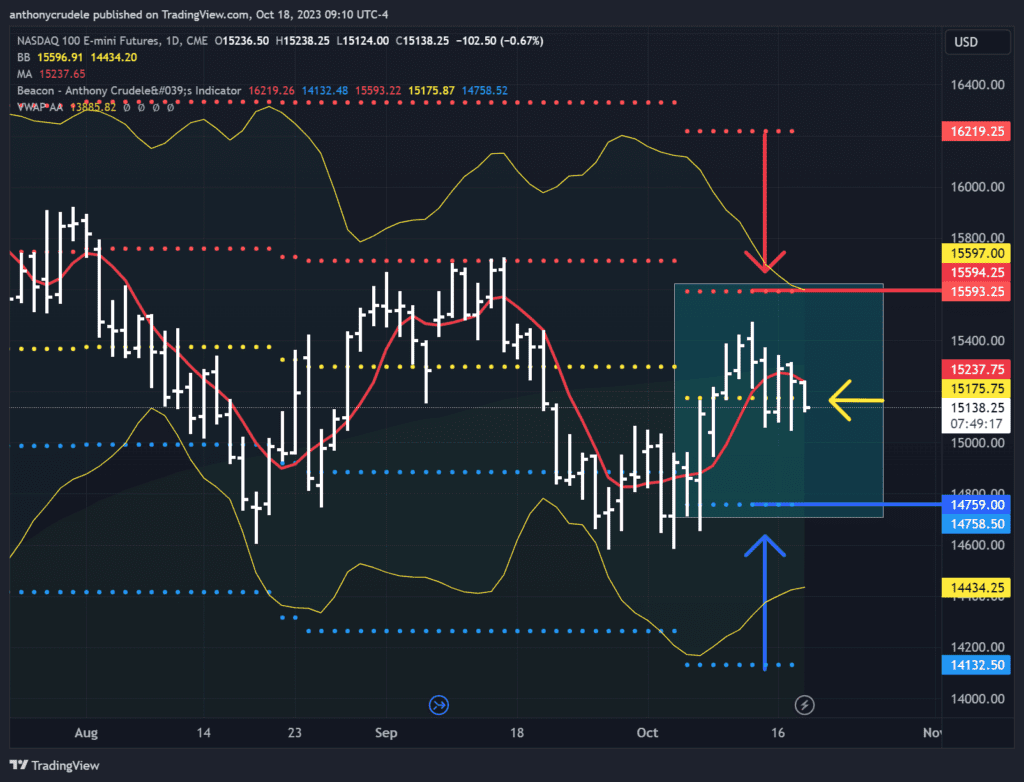

The bears have the momentum. The first thing I noticed this morning is how the 5-day moving average in ES (4387.50) is turning downward, and we had another close below my neutral level of 4006.50. Similar action in the NQ as the 5-day MA (15,237) has turned downward, and this morning we’re below my neutral area of 15,175.

When rallies lose momentum late in the day, they start to lack the confidence of the buyers in the morning. I think that is what we’re seeing today with this gap lower. The bulls aren’t comfortable with being long, and we may need to see a stronger move lower before the bulls can make any headway higher.

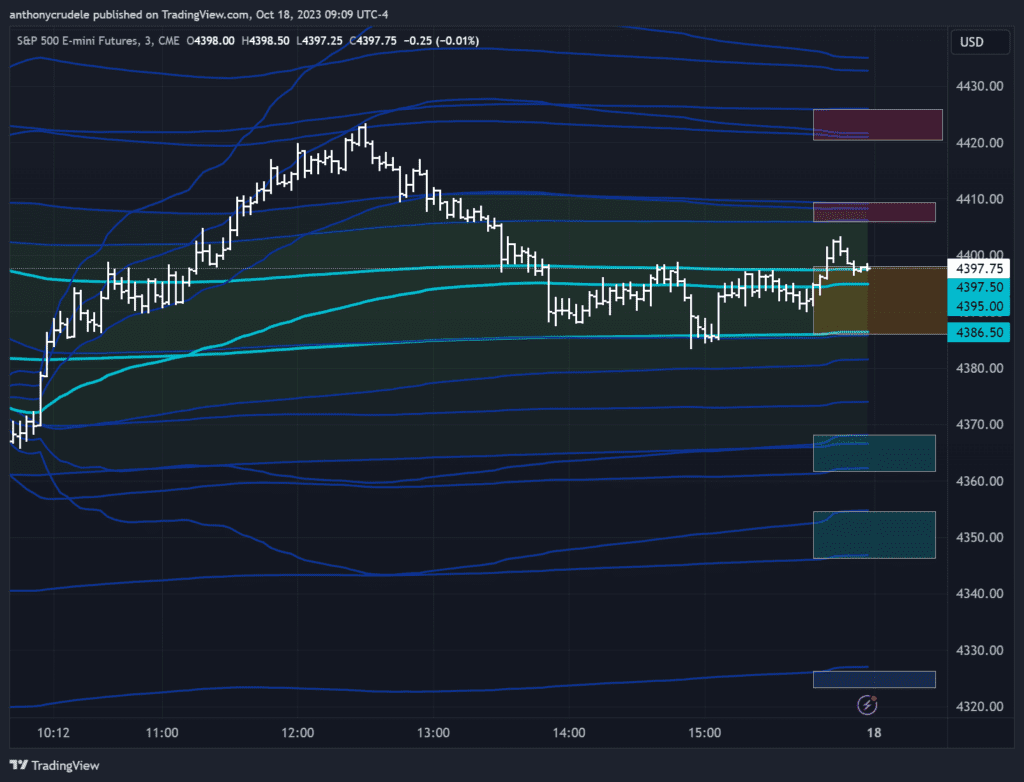

My strategy for today is as follows: Looking at the 3-minute chart I shared, you can see the specific zone I highlighted between last Friday’s and yesterday’s VWAPs (4397.50-4386.50). This area is expected to be a major chop zone today, and it will be a no-trade for me if we are in that range. If the 3-minute opening range can sustain below 4386.50, I will be looking to get short for a test of the 4368-62 area. If that area were to give way, then I think the 4354-47 range can get tested. Below there, it could be timber!!! Down to the 4330-25 area. These levels of support may shift as I use the standard deviation lines as a guide.

The bullish case for today is if we can sustain trade above 4397.50, and then I think we’ll see similar action to what we’ve seen before. A rally up to the 4406-10 area. Above there, we could see yesterday’s high (4423.25) and a test of the 4420-26 area.

Also note that rates are flat this morning, but that can change at anytime. Keep an eye on 10 YR Yields as rates are still the main driver of the markets.

Remember that position sizing is always key. This market is still a two-way tape, and it’s important to stay small enough to withstand the volatility and capitalize on your trades. Stay nimble and no FOMO.