October 26th, 2023

Traders are on the hunt for a low, but the market seems to be in no rush to find one. When the market grinds in a trend, it indicates a stronger trend. It may sound odd, but just look at bull markets. When they grind higher, they can do so for months or even years. When it comes to lows, everyone wants a V-shaped bottom and for it to be over, but sometimes it just doesn’t work that way.

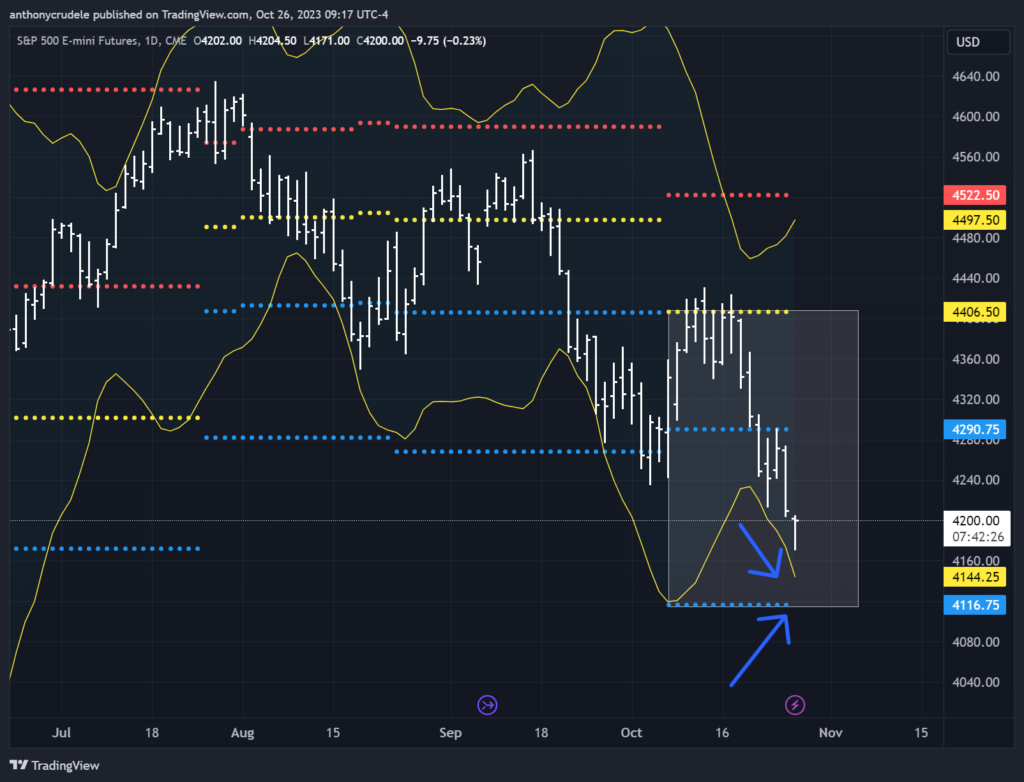

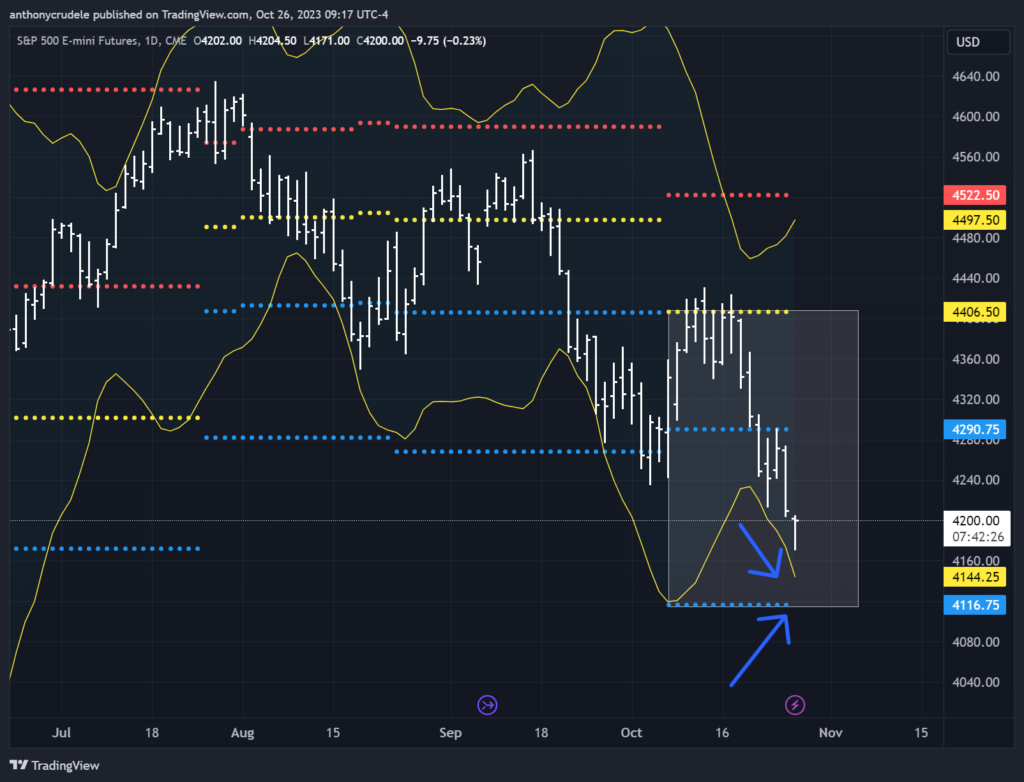

Right now, Bollinger Bands are crucial for me. They help me determine if we’re in a trend or if we’re setting up for mean reversion.

The daily Bollinger Bands suggest that we’re in a downtrend and there’s a possibility that we could test 4120 (bottom Bollinger Band peak). As long as the bottom BB continues to point downward, I’ll be looking to sell rallies.

Today’s plan: keep an eye on the 3-minute opening range and cumulative delta. I’ll mark the opening range high and low and if the RTH VWAP goes above or below it with cumulative delta support, that will be the direction I trade towards. Key support levels are at 4170, and if that fails, we could reach as low as 4120-16 where I’ll be an aggressive buyer. The first test for the bears will be at 4225-20. If I’m long in that area, I’ll look to exit and observe how the market trades around it. If we fail to break above that area, I’ll consider going short. If we push above, I believe we’ll head towards the 4244-53 range, which will be a major test for the market.

Stay cautious and smart today. Don’t rush into trading this action.