November 15th, 2023

Well, CPI took the market higher (I may have sang that in a Creed voice) and made it a no-trading day for me. One of the hardest things to accept as a day trader is knowing when to walk away. Yesterday I wrote my morning plan, took my time with developing scenarios, and then in a flash, the day was over. What I thought could happen actually happened, but I didn’t make a penny from it. We just have to say, ‘That’s okay,’ and move on.

Now, let’s talk about today. When I look at the tape now, I see a tough market. The bulls are obviously in control (well, maybe not to everyone ), but they are so extended that there aren’t many places to lean on for long positions. This market can pull back significantly and still maintain a very bullish tone.

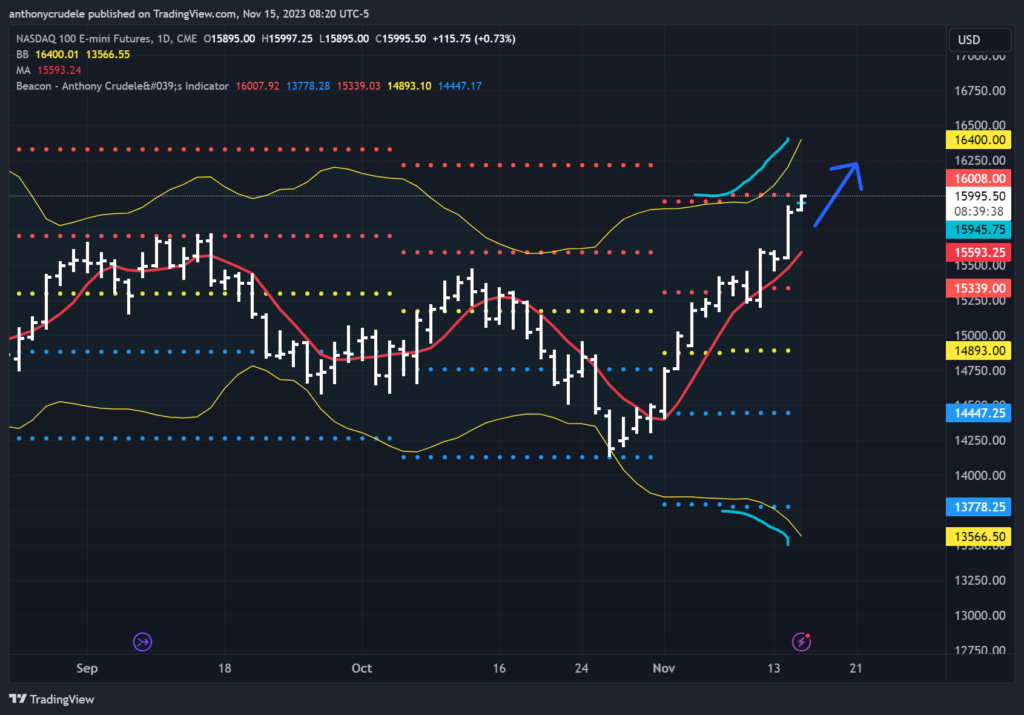

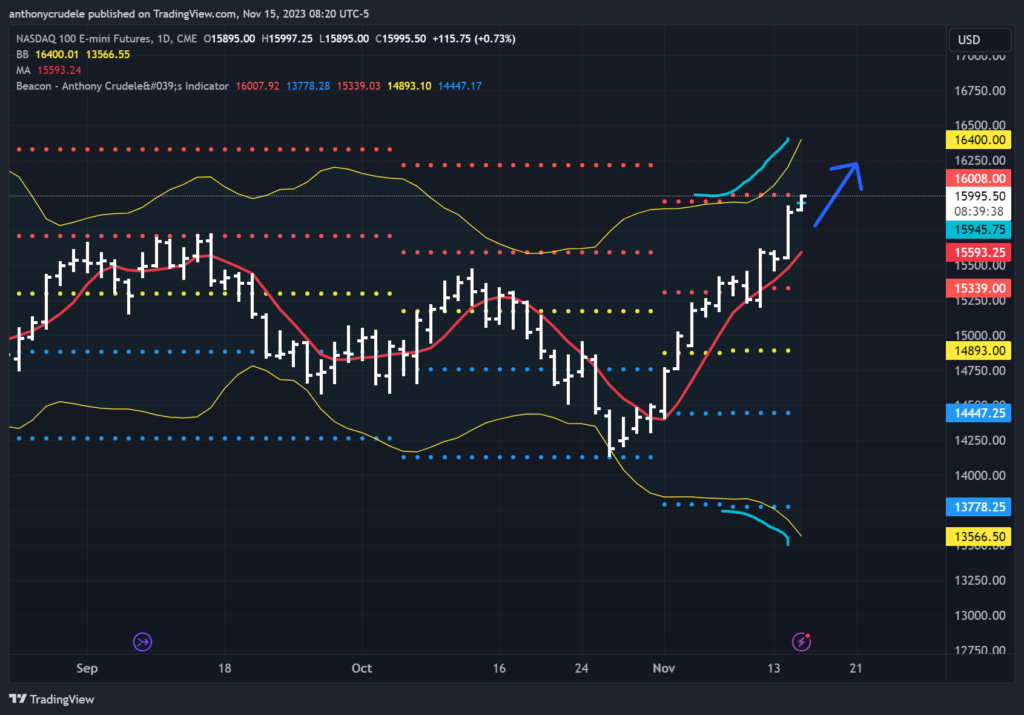

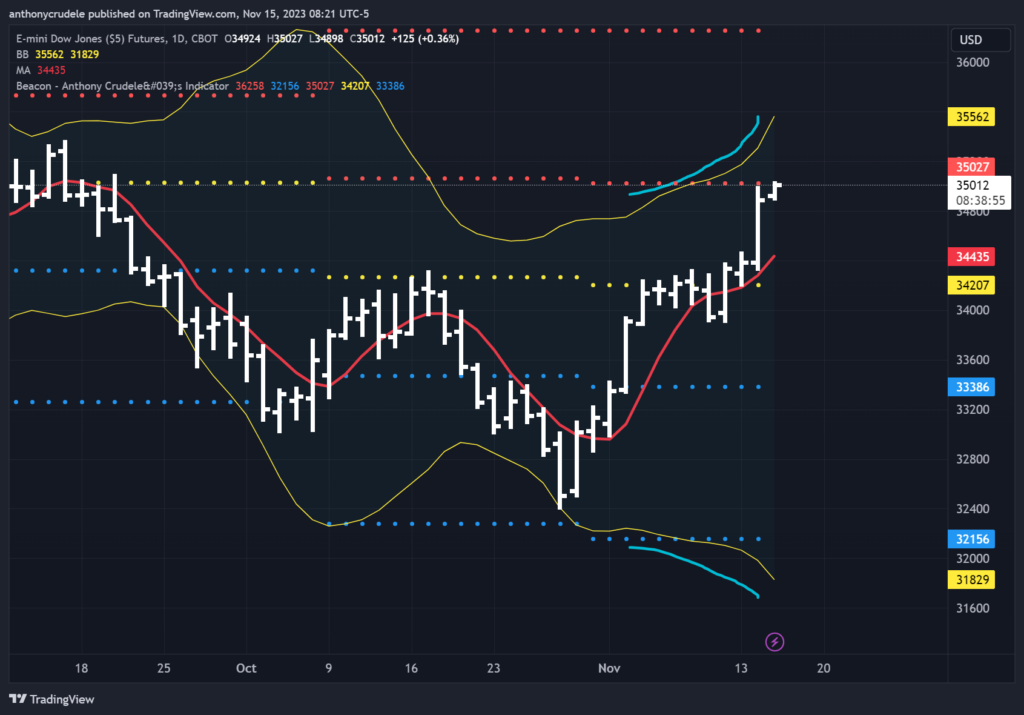

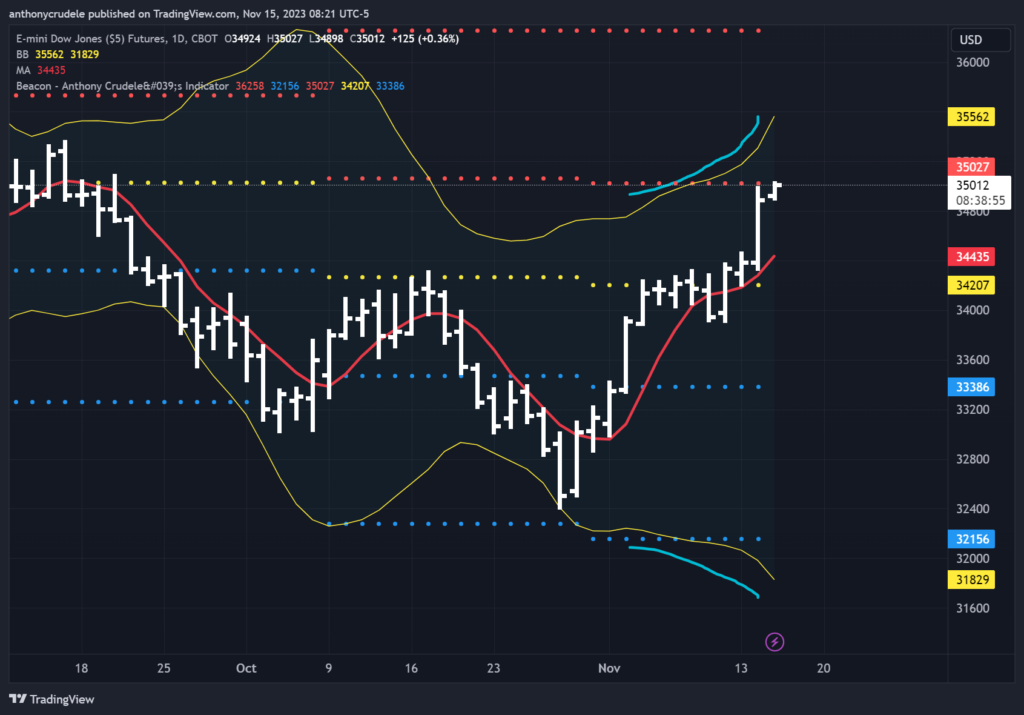

What continues to make this market very bullish for me is the fact that all of the major indexes look similar. On the daily chart, all of the Bollinger Bands are opening up, and we are in what I call a ‘crease’ in the BBs. This means range expansion. It’s hard to imagine that we still have range expansion after a massive rally, but that’s what I see.

My plan for today:

ES: I’ll be reviewing the 60-minute chart to assess the current situation. It appears similar to what I observed previously, with potential for a pullback. However, the bulls are persistently pushing higher, disregarding my signal. The critical zone for me today is 4523-4509. If the bulls can maintain trade above this area, expect an upward grind. On the other hand, if they fail to hold, it may lead to a pullback to the 4475-72 range.

NQ: We’ve hit the target of 16000 that I previously mentioned, and it seems like the NQ doesn’t want to stop there. We’re currently in the daily Bollinger Bands crease I mentioned, indicating that 16,220 might come into play in the upcoming sessions.

RTY: The bulls have finally broken through the range that I’ve been monitoring, prompting a surge in market activity. Interestingly, I noticed several tweets mentioning that 25% of the Russell 2k companies haven’t generated any profits in the last two years. I should have taken advantage of that information and maxed out with a long position (j/k;) For today, RTY remains my preferred market. The daily target of 1858 has yet to be reached, and I believe there’s a good chance it will be hit before the weekend. As the daily and 60-minute charts are already extended, managing risk for a swing position is challenging. Therefore, I’ll be employing my 3-minute opening range strategy, using AVWAP and standard deviation lines as my guide.

Considering the current market conditions, I’m not very active in trading because this is when my stock portfolio performs well, and my day trader accounts remain relatively inactive. It’s crucial to be highly selective in your trades at the moment and understand that this isn’t the easiest market for day trading. Stay patient, wait for favorable opportunities to present themselves, and avoid forcing trades. Cheers, DELI