December 7th, 2023

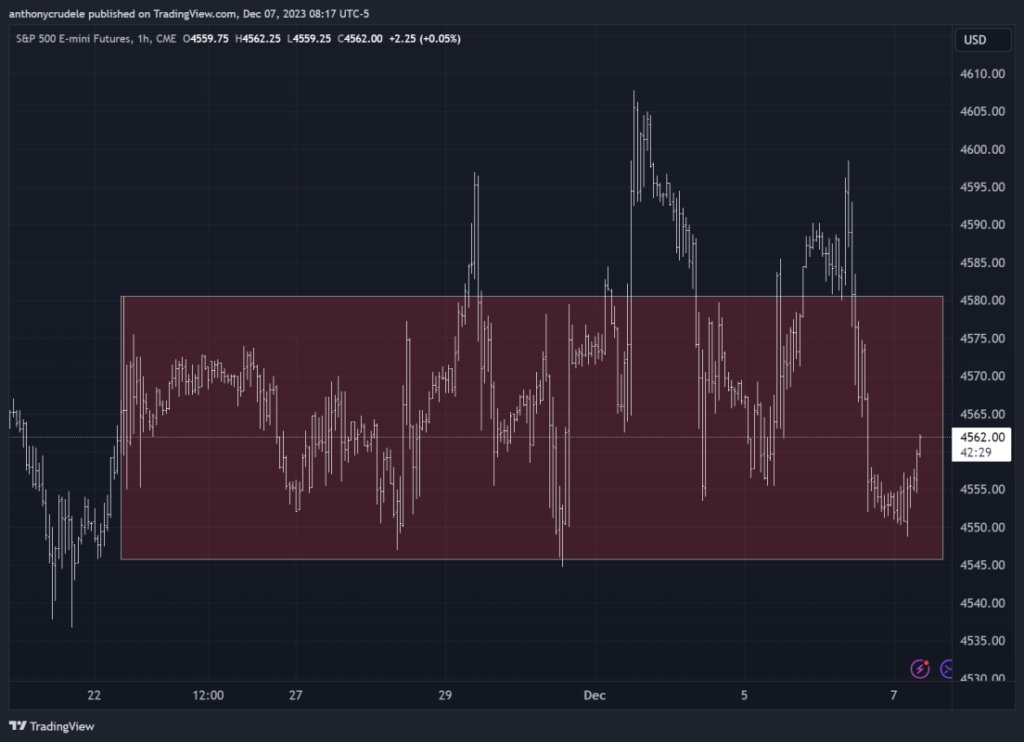

Bear Victory? Yesterday’s triumph for the Bears mirrored a typical Chicago Bear win, however, they remain 4-8 and at the bottom of their division. Reviewing the tape, our standing mirrors the range I’ve consistently outlined in ES for quite some time. The RTY and YM continue to trend upwards, while the NQ is gradually edging downwards. These factors complicate the tape, making it a non-trading situation for me. Mixed signals and diverging spreads between RTY and NQ still significantly influence intra-day activity.

So, how do we navigate this if it persists? Stay SMALL AND SMART.

Years ago, I resolved that when the Indexes diverge, I either play small or not at all. I don’t claim to have the foresight to predict when the spread will change, when the tape will shift, when a breakout will stand, and frankly, I’d rather avoid additional grey hairs from wrestling with a divergent tape 🙂

I believe it’s critical to closely monitor Treasuries at the moment, specifically the 10 YR. Over the past month, the 10’s have rallied considerably, acting as if rate cuts are just around the corner, which is fueling Index Bulls to maintain this rally. If the 10’s begin to drop slightly, it could affect all the Indexes, potentially resulting in a day where they all work in tandem. The same principle applies to a rally in the 10’s from here; it could trigger a trend-up day across all Indexes.

If you tuned into my Spaces discussion with Cem and Andy yesterday, you’ll have heard two master traders discussing topics that are beyond my pay grade. However, after listening to their ‘why’s’, I’ve gained a deeper understanding of the current environment and how I’m observing something very similar in the tape, even without knowledge of the Macro and Options Flow. We’re dealing with Macro Headwinds and Options Flow Tailwinds. The tape is currently being pushed and pulled, and even those two gents understand the importance of not forcing the issue. The key is to choose a side, manage your risk to a level that can handle the push and pull, and let the cards fall as they may. You don’t have to be a Macro or Options master like these guys to grasp market environments. You simply can’t ignore what you see.

Keep it light and tight everyone, I’ll be observing from the sidelines again today. Cheers, DELI.