HAPPY NFP Day!!

Asia Mixed…Europe GREEN

- Hong Kong: Hang Seng closed DOWN -0.07%

- China CSI 300 +0.24%

- Taiwan KOSPI +1.03%

- India Nifty 50 +0.34%

- Australia ASX -0.03%

- Japan Nikkei -0.08%

- European bourses in POSITIVE territory so far this morning

- USD +0.23%

TOP STORIES OVERNIGHT

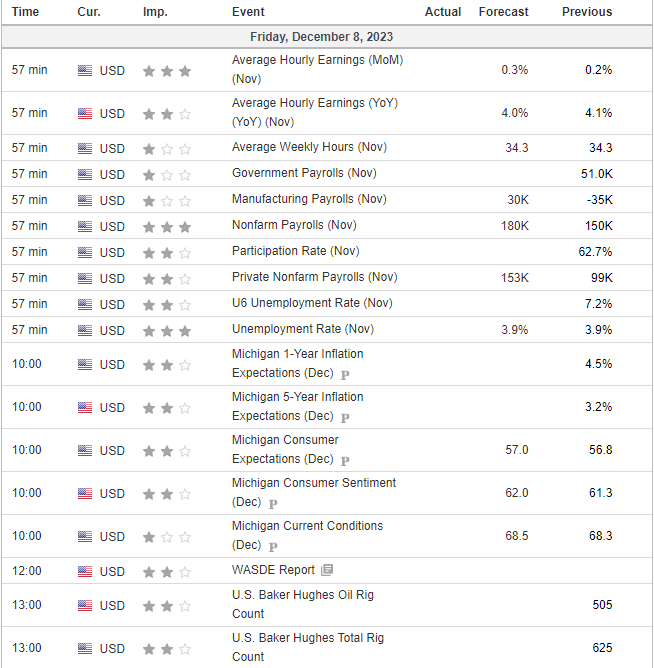

Yen Watchers Brace for Even Wilder Swings-BBG

The foundations for the yen’s biggest surge in nearly a year were laid in Asia after Bank of Japan Governor Kazuo Ueda and one of his deputies made comments that traders took as hints of a looming interest-rate hike.

A weak Japan bond auction added fuel to fire. Traders needed little encouragement to abandon bearish yen bets, sending Japan’s currency soaring nearly 4% at one point during the New York session Thursday.

The frantic trading — exacerbated by thin liquidity, computer algorithms and furious covering of short positions in the yen — forced some investors to the sidelines. Yen watchers expect a lot more market swings, with US payrolls data due later on Friday the next likely catalyst.

The dollar-yen pair started the trading day at just above the 147 level in Asia Thursday before plunging as low as 141.71 in New York. It extended the advance on Friday, rising as much as 1.1% against the greenback. Underscoring the challenge for traders, it had given up Friday’s gain at 4:22 p.m. in Tokyo and was at 144.35.

COMMENTS: Everyone has been short the YEN …we could see a massive squeeze, which could upend the carry trade (one example of the carry trade: look at the carry trade between the yen and the Mexican peso. Borrow in yen at negative rates and then park in Mexico, one of the countries that started hiking rates to fight inflation back in 2021, and pocket the difference, and you would have made equity-like returns this year)

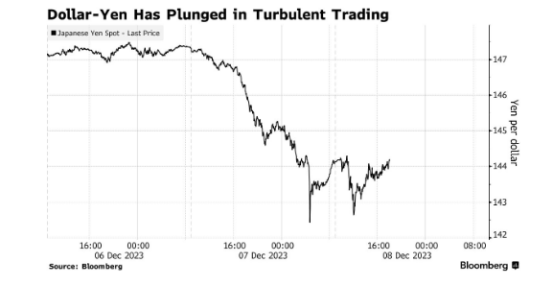

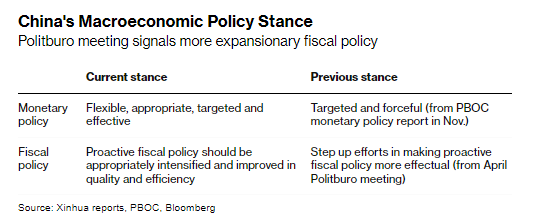

China to Step Up Fiscal Support to Strengthen Economic Recovery-BBG

China’s Politburo, comprising the top 24 leaders of the Communist Party, pledged to strengthen the government’s fiscal measures and make monetary policy more effective, bolstering efforts to stabilize growth.

The meeting, chaired by President Xi Jinping, said the fiscal policy will be stepped up “appropriately,” the official Xinhua News Agency reported Friday. Meanwhile, the monetary policy should be flexible, appropriate, targeted and effective, with the previous wording “forceful” dropped from the statement.

The overall tone reaffirmed economists’ expectations that policymakers in the world’s second-largest economy will become more aggressive with their growth goal for 2024. While numeric annual targets are traditionally released in March, the Politburo meeting and an anticipated upcoming Central Economic Work Conference help set the tone for policy in the coming year.

COMMENTS: They keep promising..lets see, watch commodities for clues.

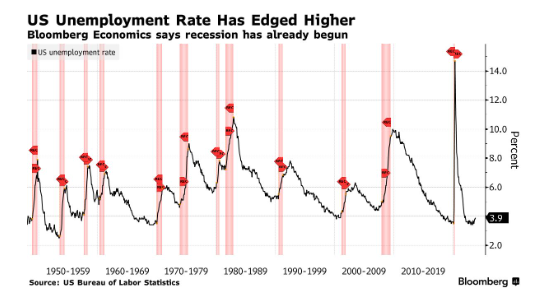

US Unemployment Rate to Tick Up Amid Early Signs of Recession-BBG

A monthly Bureau of Labor Statistics report due Friday is set to show the US unemployment rate edged higher in November as the economy began to slip into a recession, according to Bloomberg Economics.

Alongside a rise in the unemployment rate, to 4% from 3.9%, the figures will probably also reveal a temporary rebound in employment growth thanks to the resolution of two major strikes, Bloomberg economists Anna Wong and Stuart Paul said Thursday in a preview of the report.

“It’s harder for job seekers to find work, and longer stints of unemployment usually lead to persistent increases in the unemployment rate,” Wong and Paul said. “Our view is that a recession likely began in October.”

COMMENTS: Could be a wild ride today in stocks and bonds, stay nimble

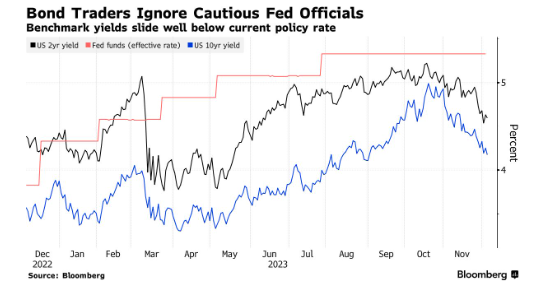

Bond Traders to Face a Reality Check With Friday’s Jobs Report-BBG

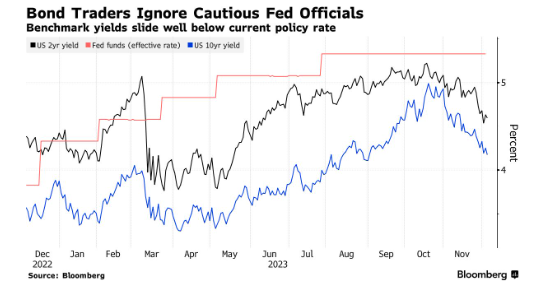

Bond traders who powered a ferocious rally in the $26 trillion US Treasury market are about to find out if they’ve gotten ahead of themselves.

Softening inflation and employment data in the past month have convinced investors that the Federal Reserve is done raising interest rates and ignited bets that cuts of at least 1.25 percentage points are in store over the next 12 months. Treasury yields, which touched highs of 5% as recently as October, have declined sharply, with the US 10-year benchmark sliding more than three-quarters of a percentage point.

Now into the mix comes a key report Friday on the US labor market, which bulls hope will provide fresh evidence of a cooling economy. The bond market is already pricing in more than twice as much monetary easing in 2024 as Fed officials themselves, who while signaling they’re likely done raising rates have also been quick to caution that any talk of cuts is premature for now.

Traders remain unfazed: A JPMorgan Chase & Co. survey released earlier this week showed clients maintaining their largest net long positions since Nov. 13.

Friday’s report is expected to show moderating employment and wage growth in November but no major deterioration in hiring. Given the recent run-up in bonds, there’s a risk of a market reversal — at least initially — on any surprises that challenge traders’ bullish narrative.

COMMENTS: All eyes on NFP today

BofA’s Hartnett Says Rising Bonds Will Drag on Stocks Early 2024-BBG

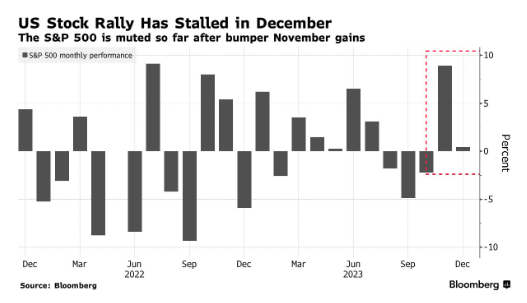

Stock markets will suffer in the first quarter of 2024 as a rally in bonds would signal sputtering economic growth, according to Bank of America Corp.’s Michael Hartnett.

The strategist — who has remained bearish even as the S&P 500 rallied about 19% this year — said lower yields were one of the main catalysts of equity gains in the current quarter. However, a further drop toward 3% would mean a “hard landing” for the economy.

The narrative of “lower yields = higher stocks” would flip to “lower yields = lower stocks,” Hartnett wrote in a note dated Dec. 7.

A rally in US stocks has just about stalled this month after one of the best November gains in a century, as investors consider when the Federal Reserve is likely to start cutting interest rates. The US 10-year bond yield has retreated to about 4.2% after hitting 5% in late October, the highest since 2007.

COMMENTS: Lets keep BofA in the bearish camp I suppose

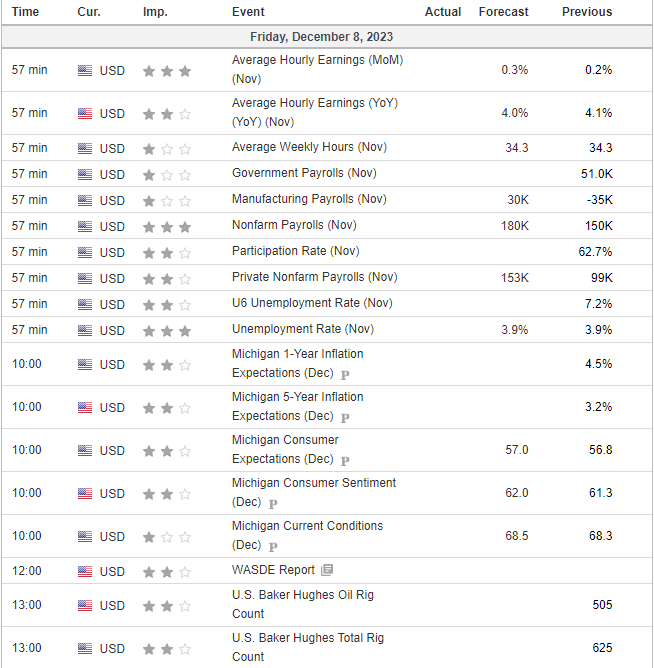

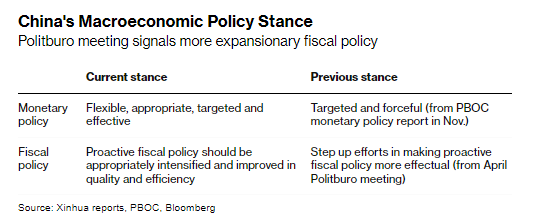

US DATA TODAY