December 13th, 2023

Good Morning everyone PPI, CPI, FOMC… in the tone of Mr. Chow from The Hangover. They are all the focus of Fintwit, with arguments on whether or not we’re ‘higher for longer’, rate cuts are coming, or if there’s a hard or soft landing coming. While many in the market are focusing on that, the market itself is focusing on Rollover, Triple Witching OpEx, and Year End.

As a trader, it is always hard to acknowledge that factors in the market don’t matter until they do matter. Meaning that these data points do matter, what the FOMC meeting does today does matter, but not right now. Until the order flow for Rollover, this week’s Triple Witching Options Expiration, and Year End is behind us, the data isn’t the driving factor of the market in the Indexes.

Observe, learn, and embrace the process. Technicals and fundamentals will matter again, but not yet. I’m not posting charts in my note until I think my charts matter again. If you think you’re smarter than the tape, the tape will prove you wrong. If you allow the tape to be what it is, you can find a way to take advantage of it. Small and smart, everyone. I will be observing again today.

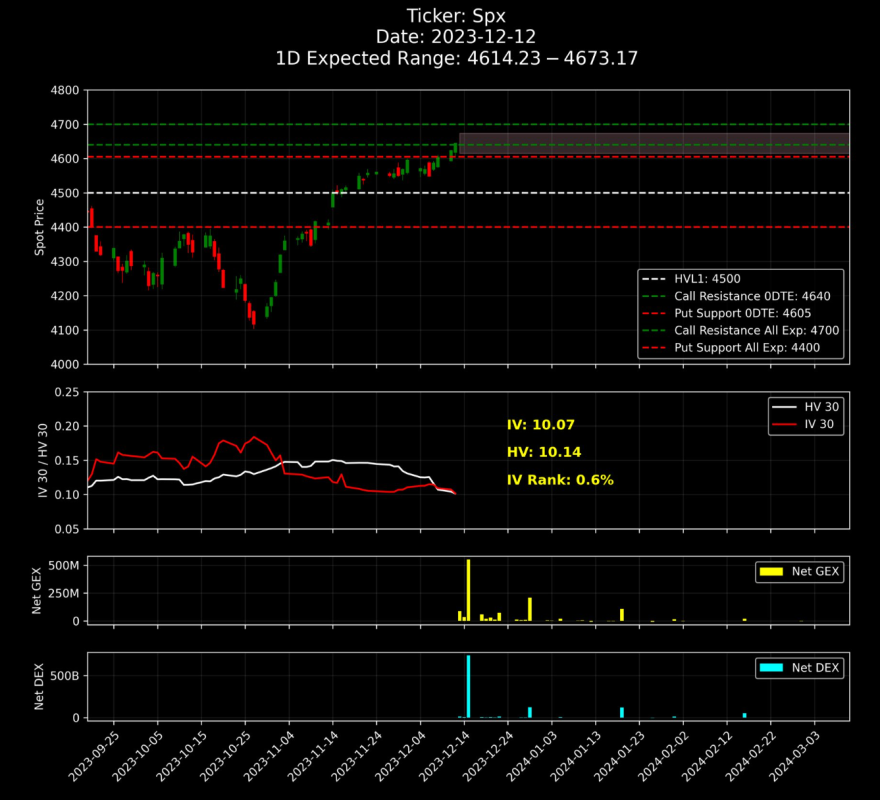

Something to note from my friends at Menthor Q about SPX Options for today’s FOMC:

1/ As we get into today, we have seen the shift on the Call Resistance level to 4700. While that can be interpreted as bullish, it is also important to note that tomorrow’s OpEx will shed a ton of call gamma. After today, we will want to see how flow re-positions.

2/ Tight range from our 1D expected move. But now we wait for Powell.

Cheers, DELI