HAPPY FOMC DAY!!

Asia Mixed…Europe GREEN

- Hong Kong: Hang Seng closed DOWN -0.89%

- China CSI 300 -1.67%

- Taiwan KOSPI -0.97%

- India Nifty 50 +0.12%

- Australia ASX +0.49%

- Japan Nikkei -0.14%

- European bourses in POSITIVE territory so far this morning

- USD +0.09%

TOP STORIES OVERNIGHT

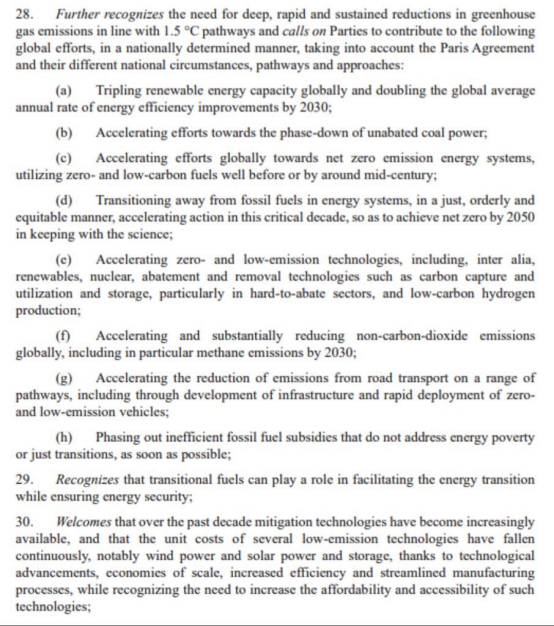

COP28 Reaches a Final Resolution

The COP28 finally reaches a resolution on the wording.

The agreement reads 28(d) to transition from fossil fuels in a “just and orderly manner” by 2050. (the words phase-out were left off)

28 (b) Accelerating efforts toward the phase-down of unabated coal power (this is watered down from rapidly phasing down in prior versions)

29. Recognizes transitional fuels can play a role” meaning gas

COMMENTS: This is a win for the oil and gas industry as the language is vague and there is a lot of “wiggle room) …oil seems to like it this morning. Also in 28 (e) nuclear is mentioned for the first time, also a win for that industry. Uranium stocks should like that.

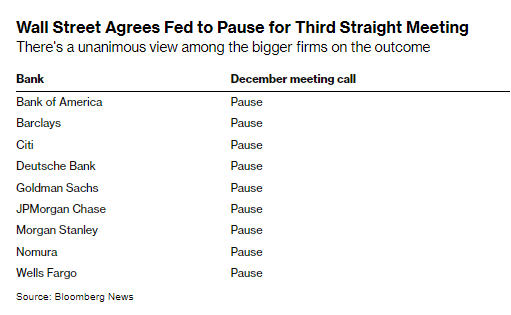

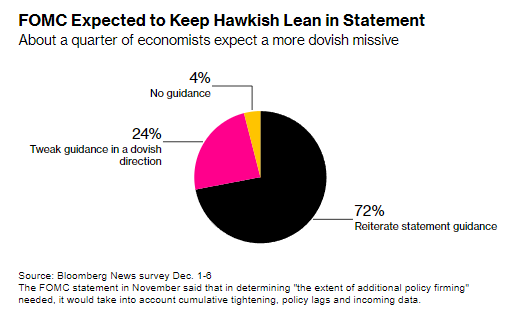

The Fed Isn’t Ready to Speculate on Rate Cuts — Yet-BBG

The Federal Reserve will likely hold interest rates steady for a third straight meeting, while pushing back against market expectations of rate cuts as soon as March.

The Federal Open Market Committee is poised to keep rates in a range of 5.25% to 5.5% at its two-day policy meeting ending Wednesday, a 22-year high first reached in July. The rate decision and an accompanying statement will be released at 2 p.m. in Washington. Chair Jerome Powell will hold a press conference 30 minutes later.

Powell has said it’s too early to speculate on when the central bank will start reducing interest rates. Instead, policymakers have emphasized their desire to pause and evaluate the impact of higher borrowing costs on the economy.

Wall Street will be focused on Fed officials’ forecasts for interest rates — the so-called dot plot — which will show how much the committee expects to cut interest rates in 2024 and 2025.

Economists surveyed by Bloomberg expect the median projection will show two rate cuts next year and five more in 2025, but there’s a high degree of uncertainty. Some Fed watchers see the FOMC penciling in a full percentage point of cuts in 2024 while others see no cuts at all.

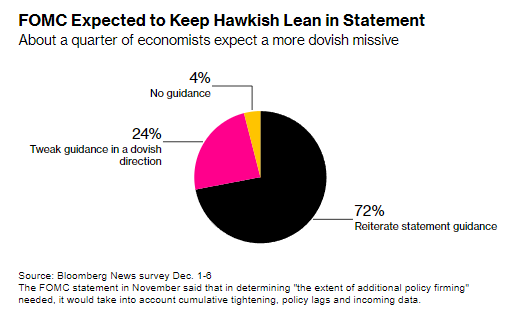

Nearly three out of four economists expect the Fed to retain its current guidance on interest rates, which would leave open the possibility of an additional rate hike. One quarter think it’s time that the committee adjust its statement to reflect the likelihood that rates peaked in July.

COMMENTS: The presser will be most important as pause is all but factored in.

Missiles from rebel-held Yemen miss a ship loaded with jet fuel near the key Bab el-Mandeb Strait-AP

Two missiles fired from territory held by Yemen’s Houthi rebels missed a commercial tanker loaded with Indian-manufactured jet fuel near the key Bab el-Mandeb Strait on Wednesday, a U.S. official said. It is the first time they target an energy shipment heading to the Suez Canal.

An American warship also shot down a suspected Houthi drone flying in its direction during the incident, said the official, who spoke on condition of anonymity to discuss intelligence matters. No one was hurt in the attack, the official said.

The assault on the tanker Ardmore Encounter further escalates a campaign by the Iranian-backed rebels targeting ships close to the Bab el-Mandeb Strait, and also widens the international impact of the Israel-Hamas war raging in the Gaza Strip.

The Marshall Islands-flagged tanker was traveling north toward the Suez Canal in the Red Sea, satellite tracking data analyzed by The Associated Press showed. The vessel was on its way from Mangalore, India, and had an armed security crew aboard it, according to data transmitted by the ship. Those guards apparently opened fire to drive off skiffs loaded with men trying to board the vessel, the private intelligence firm Ambrey said.

Ardmore Shipping Corp., which owns and operates the ship, issued a statement to the AP acknowledging the attack.

“No one boarded the vessel and all crew members are safe and accounted for,” the statement said. “The vessel remains fully operational with no loss of cargo or damage on board.”

COMMENTS: Again, keep and eye in shippers and insurers

Fuel tankers face long slog as Panama Canal drought reroutes flows-Reuters

The change will mean less U.S. gasoline heading to the West Coast of South America, particularly Chile, said Matt Smith, an analyst at ship tracking service Kpler. Chile will instead likely pull gasoline from Asia, he added.

Cururo headed for the Panama Canal last month and, unable to secure a slot for passage, changed its route. Two other refined products vessels, Green Sky and High Loyalty, also have taken longer routes to or from Chile that avoid the Panama Canal.

Taking longer routes or opting for bidding in Panama’s daily slot auctions has made transportation more expensive for tankers and other vessel types with no priority in the canal.

U.S. diesel flows increasingly are heading to Europe as South America buys less due to Panama Canal logjams, Kpler data also showed. About 45% of U.S. diesel exports headed to Europe so far in December, compared with about 21% last month.

The redirection of refined product flows will also lead to higher shipping activity measured by tonne-miles and higher freight rates as U.S. tankers that typically go to South America now cross the Atlantic to Europe, or as ships from Asia travel to South America, analysts said.

COMMENTS: Again, this impacts shippers, keep an eye on rates if you are trading this industry, particularly product tankers.

Gold creeps higher on weaker yields, traders brace for Fed verdict-Reuters

Gold prices edged up on Wednesday, buoyed by weaker Treasury yields, but bullion was still near its lowest in over three weeks as the dollar inched higher ahead of the U.S. Federal Reserve’s interest rate decision and policy outlook.

Spot gold gained 0.1% at $1,981.29 per ounce, as of 0941 GMT. U.S. gold futures rose 0.2% to $1,996.30.

The dollar index rose 0.1%, making gold more expensive for other currency holders, but falling U.S. 10-year Treasury yields lent some support to prices. USD/US/

“Gold is repricing with what’s happening in the yields market, because investors have been extremely confident that the Federal Reserve is going to cut rates quickly in the first part of 2024, now market is a less sure about it,” said Carlo Alberto De Casa, market analyst at Kinesis Money.

Silver slipped 0.4% to $22.65 per ounce, while platinum fell 0.1% to $928.08 and palladium skidded 1% to $970.31.

US DATA TODAY