January 3rd, 2024

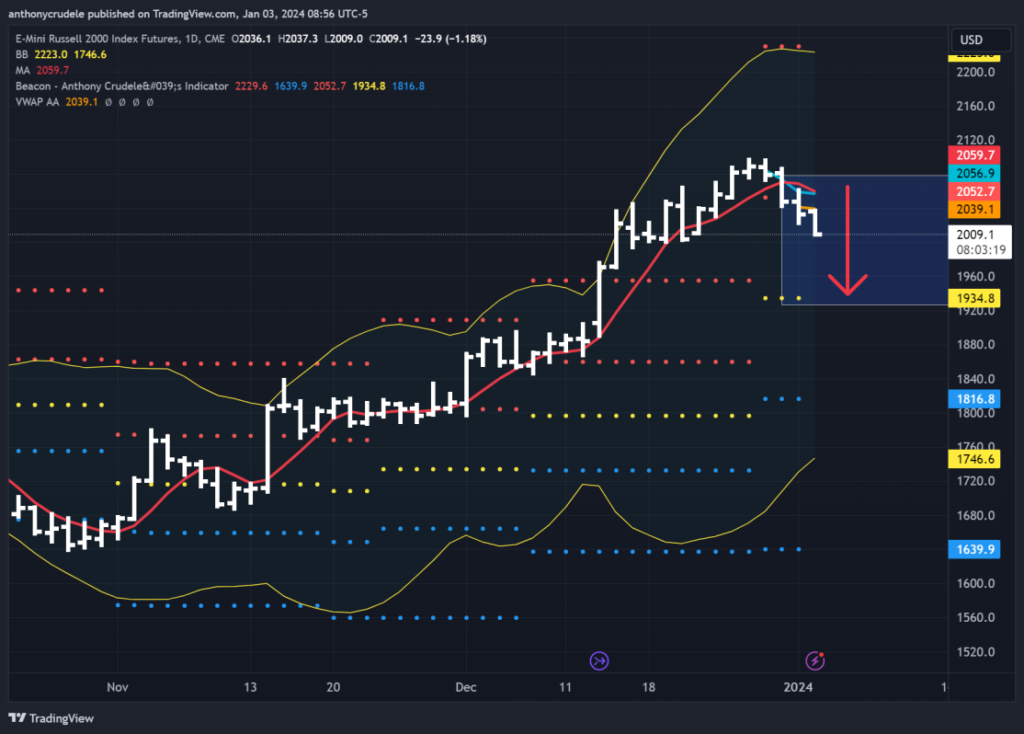

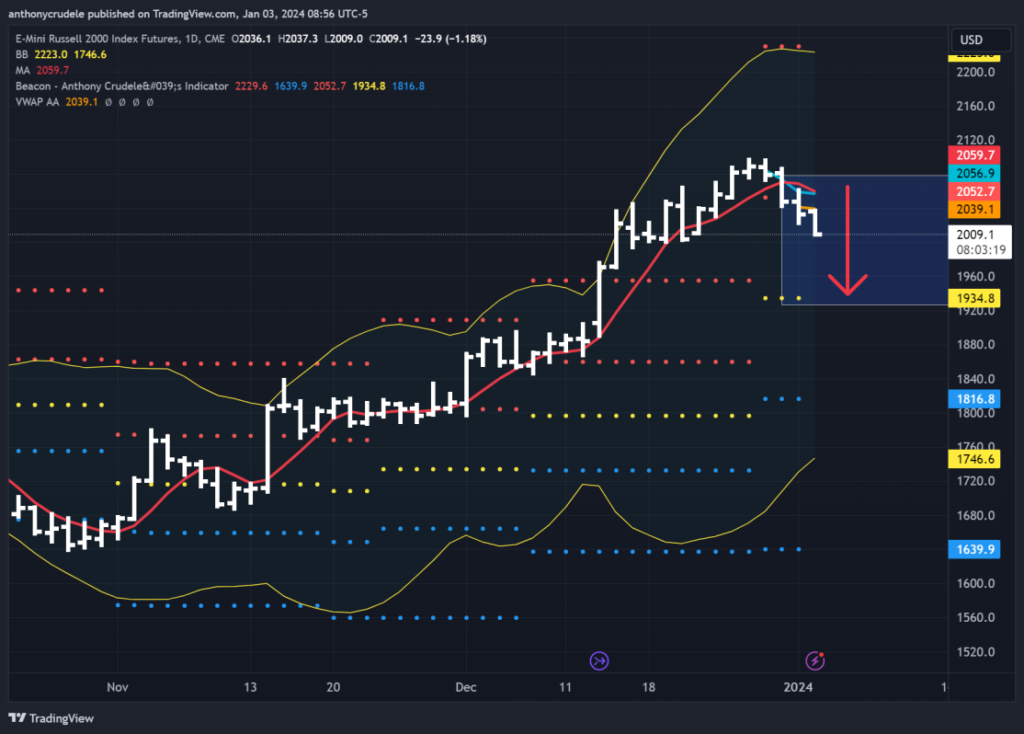

Bears are winning the short-term battle. After a very volatile day 1, now that it’s in the books, the market has confirmed my short-term bearish bias. Nothing is changing for me with my bias or my plan as we enter day 2 of 2024. The bears are winning the short-term battle and they have the momentum. With all of the major indexes still in a short zone for me, the plan remains the same as yesterday: sell the rallies. Currently, I’m short some ES on a swing basis and will continue to short ES on a swing basis until I see a daily close above 4820 or above the 5-day moving average or VWAP anchored to yesterday. So, for now, in my day trading, I will sell the rallies using my 3-minute opening range strategy with VWAP and standard deviation lines.

Things to note: The NQ is leading the charge lower, just like it led the charge higher last year. On a daily basis, the NQ is almost at my first target of 16,533. If it gets through there today, that could put additional pressure on ES. The 10 YR continues to decline, which is key for the bears in equities to maintain momentum, as a lower ZN indicates higher rates. With 6-7 rate cuts potentially priced into the market for 2024, that was one of the driving forces behind the Q4 rally. If rate cut predictions start to come back to reality, which I believe is around 3 cuts according to the Fed’s Dot plot, then ES, NQ, and especially RTY will struggle to hold rallies.

Ease your way into the trading year. Small and smart.

Cheers, DELI