March 5th, 2024

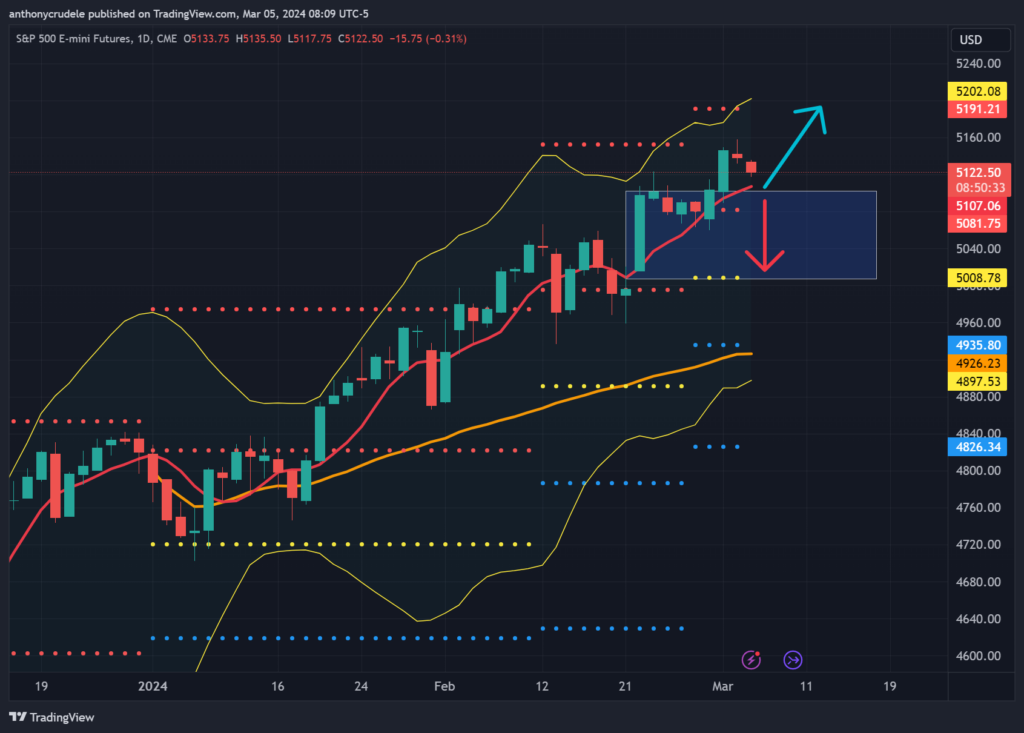

Are the markets getting a bit toppy? There are two types of short-term market corrections to consider: time or price. A time correction involves consolidation at the highs that doesn’t deteriorate the technicals. However, it can lead to frustration among both bulls and bears, causing short-term day traders to overthink and overtrade. Price corrections occur when the market plummets as quickly as it rose, causing a technical breakdown and altering market environments. Currently, it appears we may be entering a time correction as the market digests this rally, leading to what we call a two-way tape. This coincides with our transition into the rollover phase, with the front month of futures moving to June.

Important to note, time corrections may still lead to new highs, but these are likely to be sold off rapidly, pulling us back into the ranges and causing traders to overthink and overtrade in these markets again.

As for today’s plan:

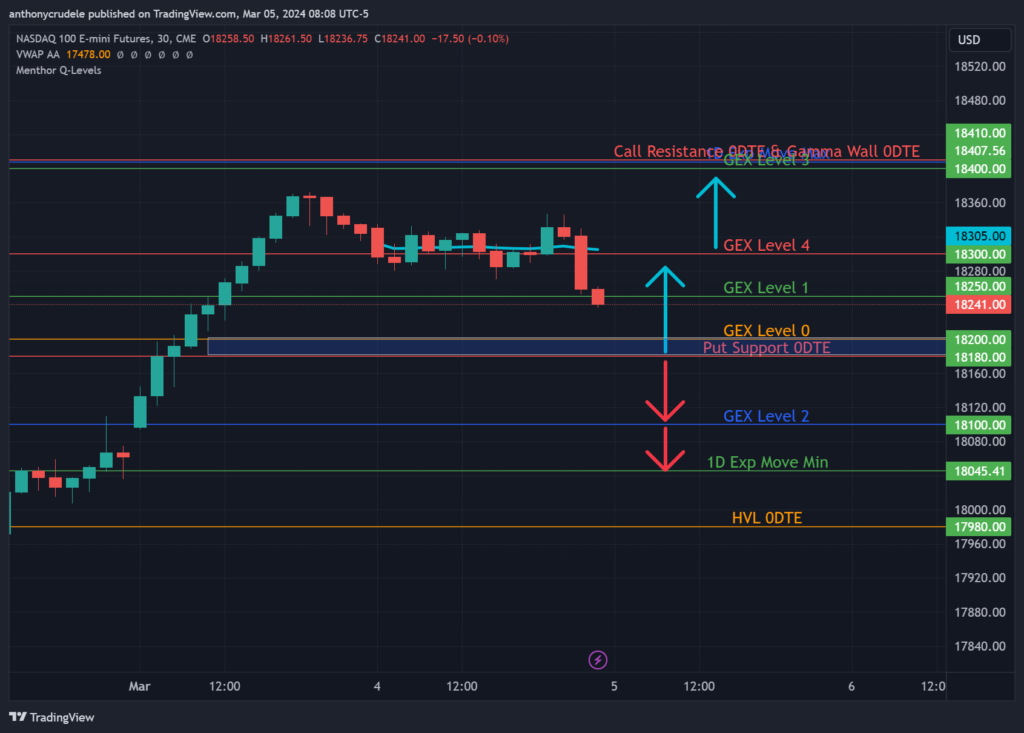

NQ 18,100 is the key point. If the bulls defend it this morning, we could bounce back up to 18,180-200 which is the pivot back to the upward momentum. If the bulls regain 18,200, we might head straight back up to 18,300 where I believe the market will hold today. If we push past there, 18,400-450 comes into consideration. If we fail to reach 18,100 today, 18,045 is likely to come into play rather quickly. While 18,045 is an area I anticipate the bulls will defend, the more crucial region to hold today is 17,980. If we do drop to that level, it’s an area I will consider for long trades. As I mentioned last night, I am currently flat since I covered my calls, but I’ll consider getting back in again long if we drop to 17,980.

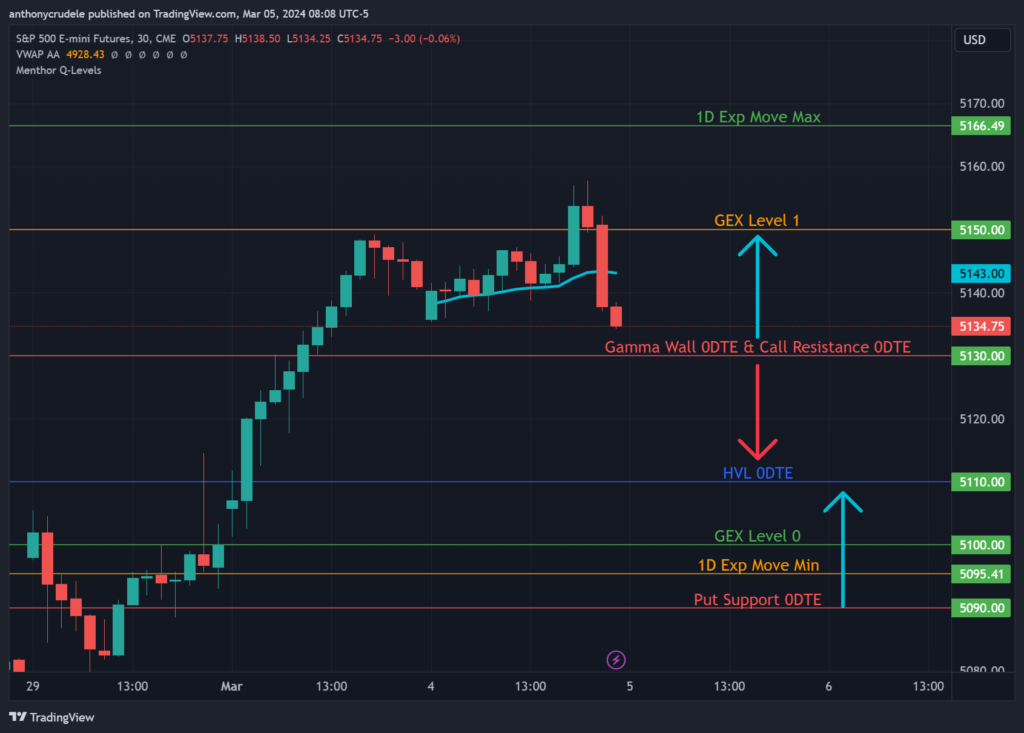

As for ES, the levels are quite tight at the moment. I believe it’ll be a rollercoaster between 5090-5150. I prefer trading at the edges of such volatile periods, which means I’m leaning towards longs around 5100-5090 and shorts around 5150. These are short-term, intra-day trades for me in ES at the moment.

The RTY continues to exhibit vitality, and provided that 2050 remains steady, I predict a trial of 2150 in the forthcoming week(s). Given the minimal movement in rates, it’s a suitable atmosphere for the RTY to build some momentum. However, I am currently not interested in trading it, except for some IWM in my long-term portfolio.

Cheers, DELI