March 4th, 2024

Level to Level. I notice a lot of traders mulling over the past rather than focusing on the present. Getting too caught up in where the markets have been can cause you to lose sight of where they’re heading. As a trader, the past should be used as context, not as a source of a hidden bias. The focus should be on executing the market from one level to the next, not on what’s already happened.

So, what’s the plan for today?

For NQ, I’m still anticipating a test of 18,450. Therefore, intraday I’ll be relying on Friday’s RTH VWAP, which coincides with MenthorQ gamma level of 18,250-200 area. As long as that area holds, I’m an intraday buyer, and I’ll keep holding my calls until I see an 18,450 test. We might see some turbulence around 18,300 this morning, but if the bulls can maintain control from the get-go, a swift leap to 18,400-450 wouldn’t surprise me. There, I’d be evaluating any long positions. The market could easily head higher, but that’s been my daily target for two weeks, and I’ll be out if we get there.

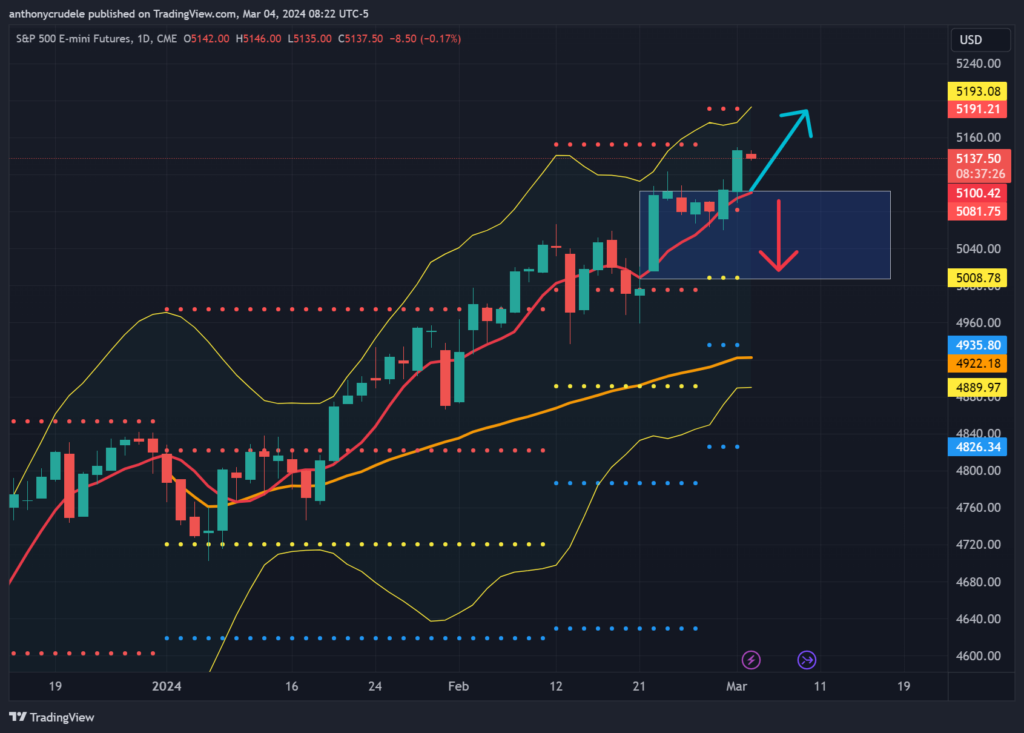

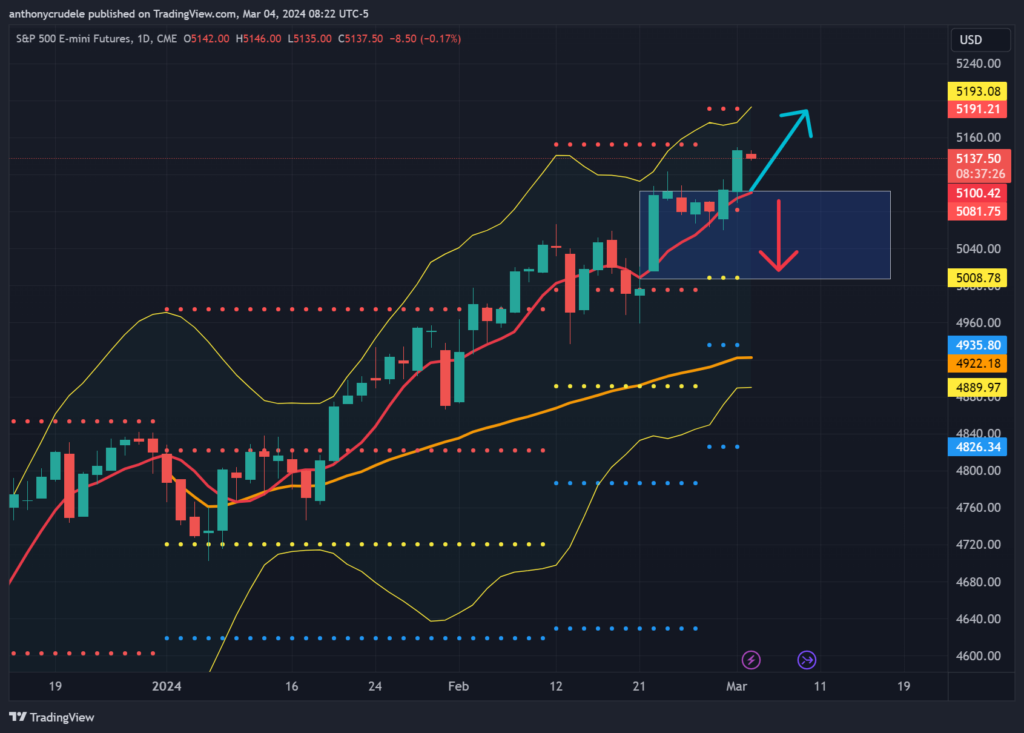

For ES, I anticipate most of the trading this morning to occur in the 5130-5150 zone. As long as 5130 holds, the bulls maintain momentum, and 5150 is the crucial test. If we get past that, 5190 becomes a possibility. But let’s not forget 5170, which might provoke a bearish response.

RTY is showing signs of life, and as long as 2050 holds, I foresee a test of 2150 in the upcoming week(s). With rates barely moving, it’s a conducive environment for RTY to gain some momentum.

Ease into the week. Be patient and let the market come to you. Don’t force your way in.

Cheers, DELI