March 1st, 2024

Bulls continue to win the battles they need to win. One of the hardest things for day traders to accept in bull markets is they look where we came from in price instead of where we are now in price action. The price action right now supports higher prices as every break is very short-lived, and the follow-through continues to the upside, not the downside. As we enter the first day of the month, I expect the bulls to add to this rally across all of the indexes today, and then we start to look at how the rollover in the coming weeks will start to impact price as we move from March (H) to June (M) in the Equity Indexes.

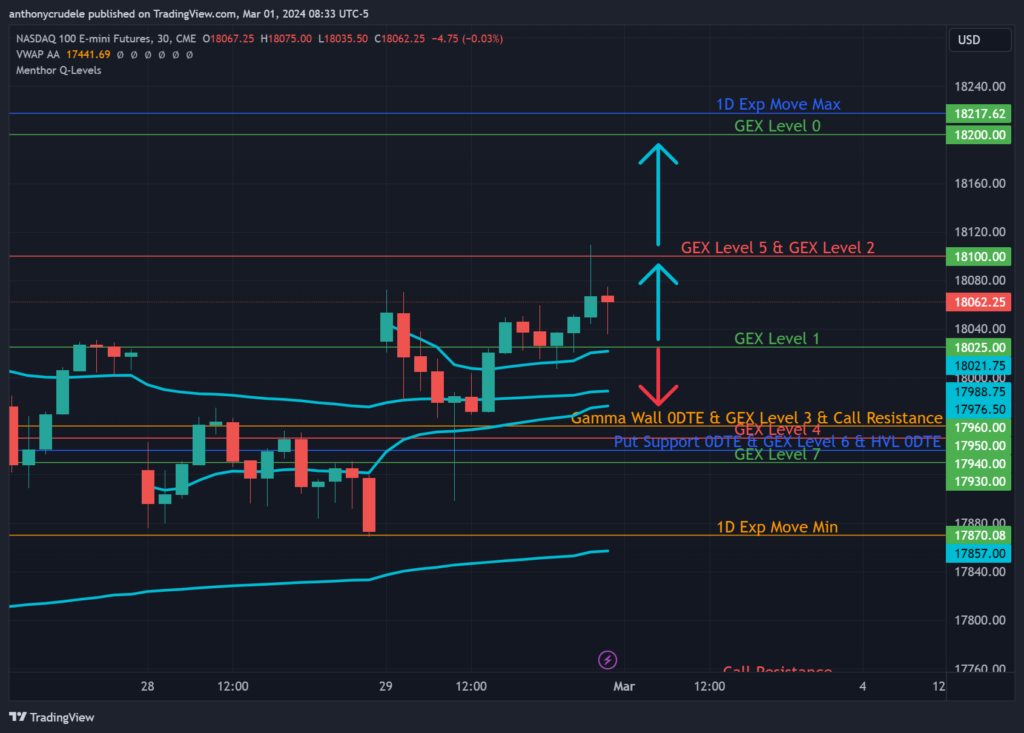

The plan for today is the same plan I’ve had for the entire week. Look for weakness near support and get long. For NQ, 18,100 is the pivot I will be watching on the open. Holding above it, we head to 18,200; below, we head back down to 18,025. 18,025 is the key for bulls to keep their momentum. Failure to hold that today could start to shift the balance towards the bears, and we could look to test 17,900 and this week’s lows. If we push above 18,200, I don’t see much stopping the market from heading up to my daily target of 18,450 in the coming sessions.

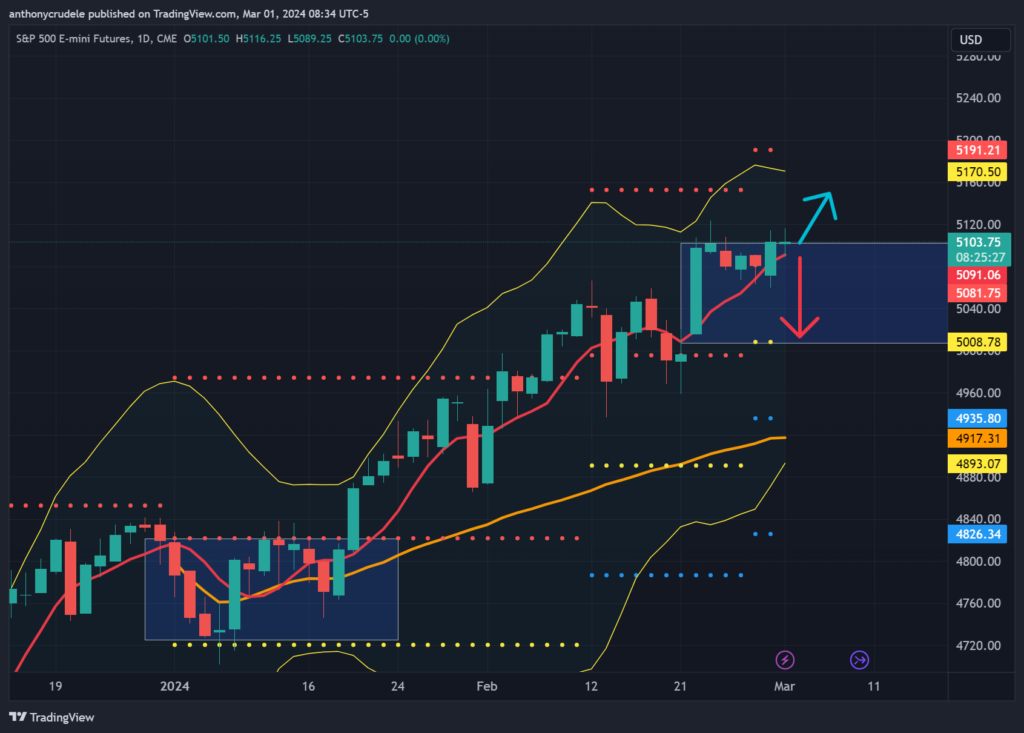

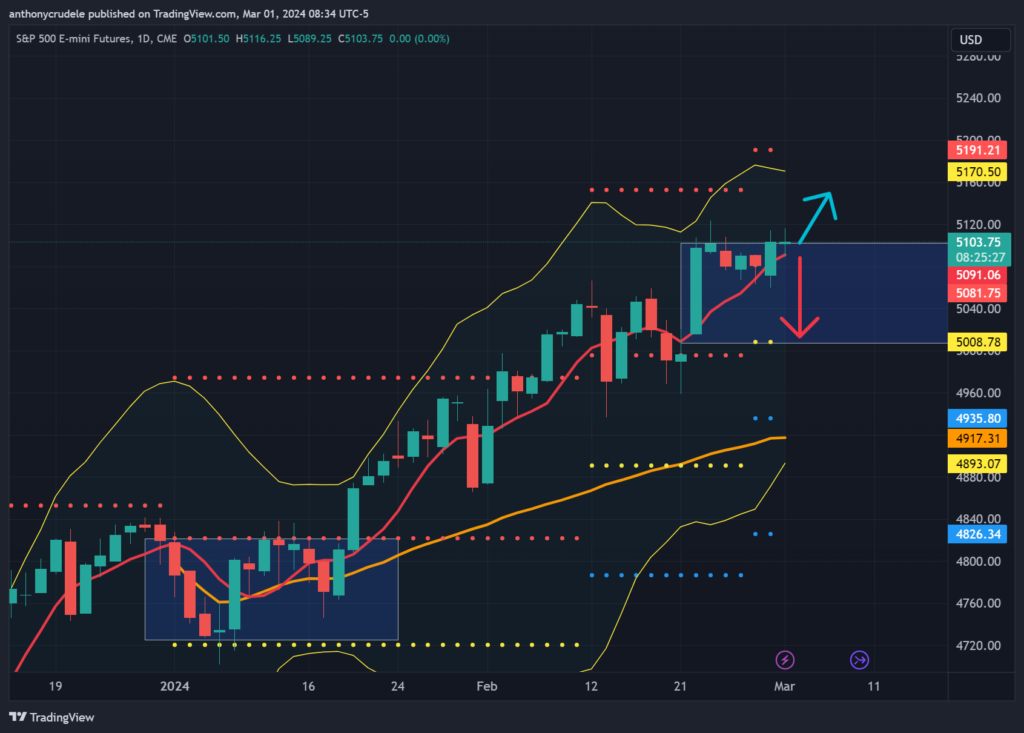

ES remains glued to 5,100 and is my pivot this morning. Above it, we see 5,130, then 5,152. Below 5,100 puts 5,070 in play. Overall, the ES is choppy around this area, so be cautious with position sizing. (Note, all GEX levels in charts are from MenthorQ)

RTY is back on my bull radar. If it can hold above 2,050, I see 2,150 in the coming sessions. There are not a lot of day trader levels I have for RTY at the moment, but 2,050 is a pivotal area to keep an eye on.

As my brother Pax always says, it’s capital preservation Friday. Small and smart. Have a fabulous weekend!

Cheers, DELI