February 29th, 2024

The PCE data was released this morning, showing a 0.4% increase in the PCE index for January, in line with consensus expectations. The year-over-year increase was 2.8%, a slight decrease from the previous reading. Overall, rates are relatively stable, and equities rallied on the news. Ultimately, what matters most is the market’s reaction.

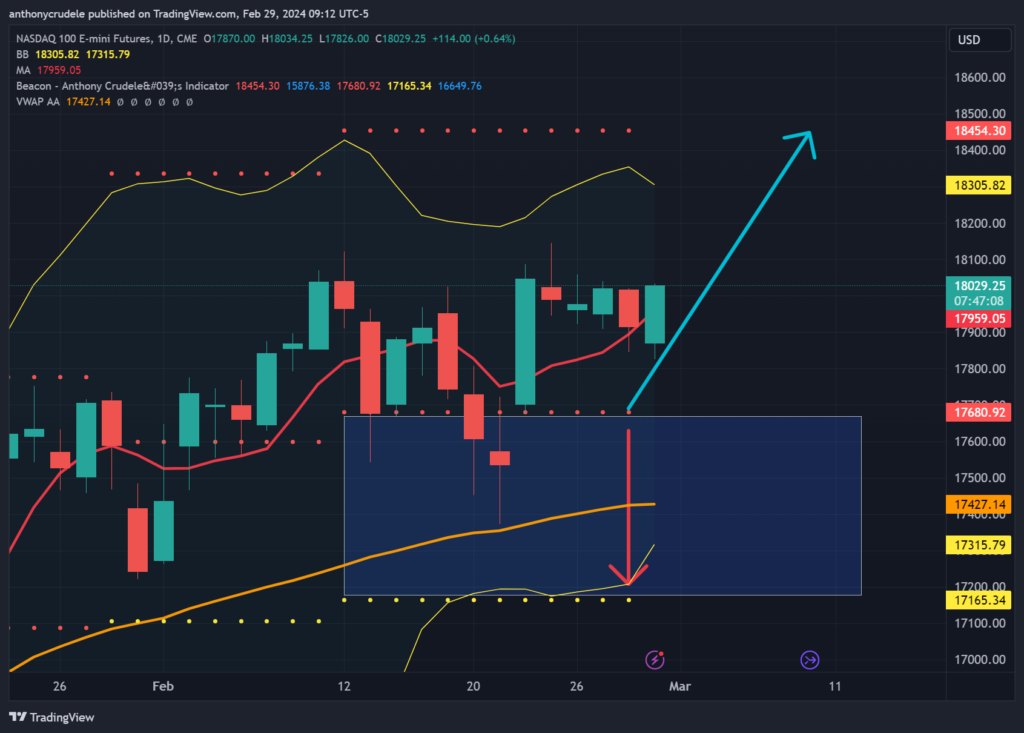

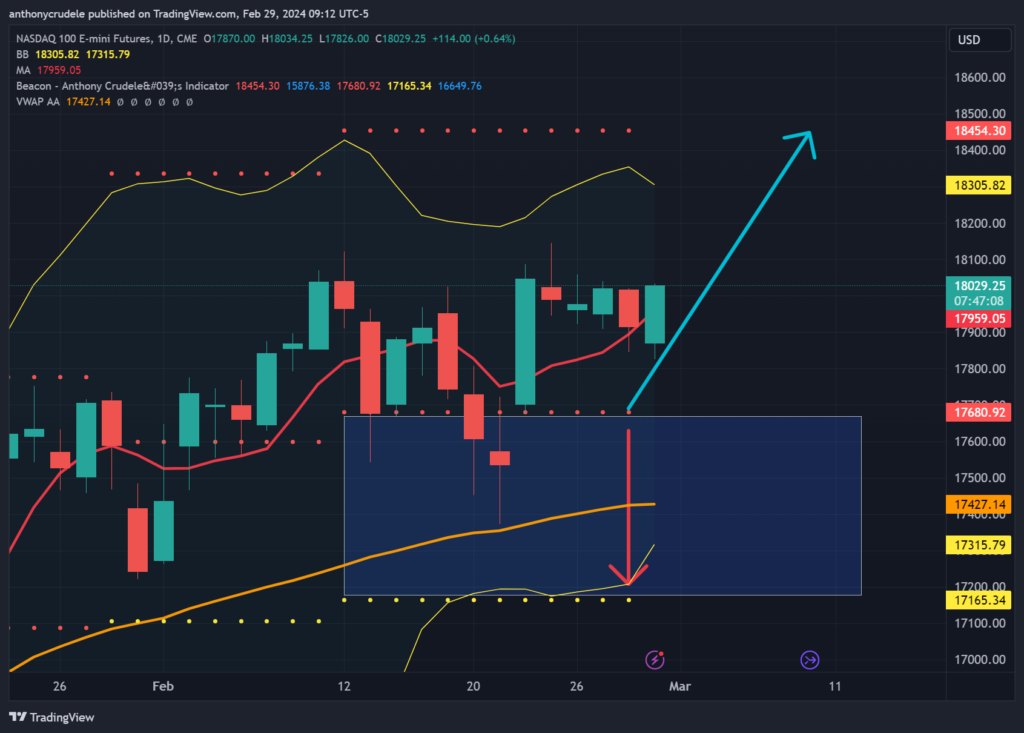

For those holding NQ long positions like myself, the reaction aligns with my bullish technical outlook. The market trend continues to lure in short-term sellers during selloffs, only to see them buying back in on rallies, as seen this morning. Despite my bullish stance, the bulls must maintain trade levels above 18025-50 in NQ to prevent the bears from gaining control. The ongoing volatility and churning are in line with my market expectations, but it’s crucial for the market bulls to drive us to new highs.

Today’s plan:

For NQ, I’m scouting long setups for day trades, aiming to sustain levels above 18025-50 with a potential test of 18,100. If we break above 18,100, we could see a sharp rally to 18,450 in the next day or two. Failing to hold above 18,025-50 would lead us back to the cluster of levels between 17,950-900, with a further drop to 17,750-680 on a breach of 17,900, and 17,800 posing as a potential support level.

ES’s critical zone is 5105-100. Above this range, a move to 5152 is possible within a day or two, while dropping below could send us back to 5065. I’m not keen on ES trades in this area.

RTY is showing signs of life, with potential for significant upward movement in the upcoming sessions. I’m long IWM in my long-term portfolio and considering swing longs in RTY futures. While there are no specific levels for now, I’m looking for short-term strategies to go long intraday.

Keep your trades nimble and focused.

Cheers, DELI