March 19th, 2024

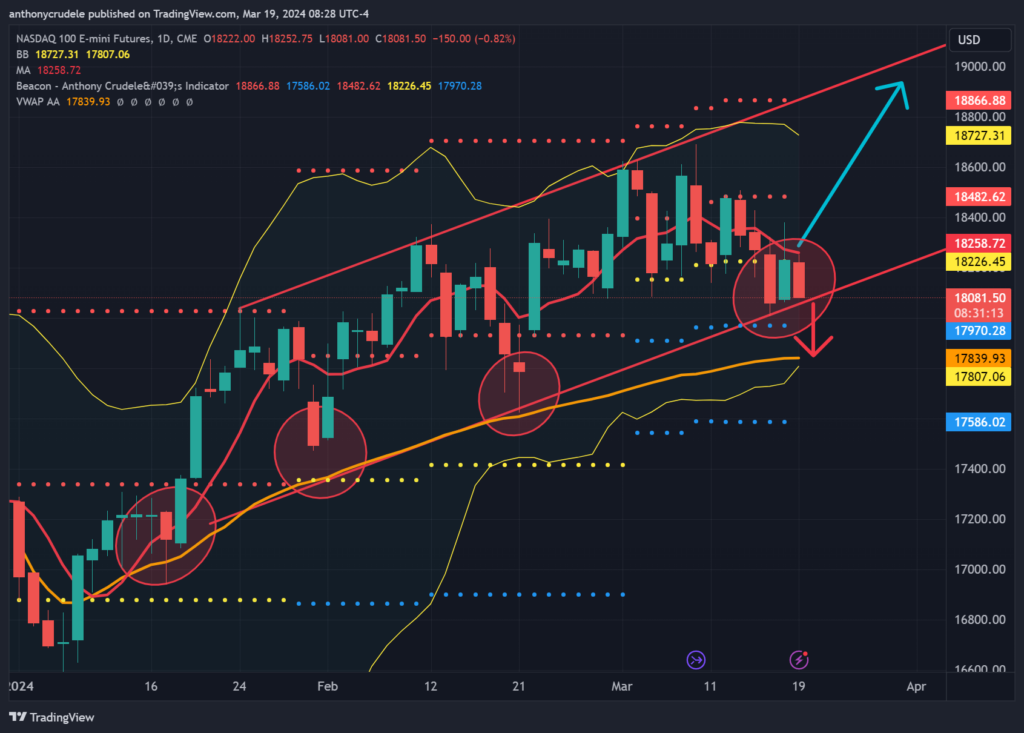

Nuance: The most overlooked aspect of becoming a successful trader is finding nuance in market situations. Not all looks are the same; sometimes, there is a bit of nuance in the situation that you have to recognize to better execute your trades. Right now, the NQ is showing a minor difference in reaction off the trend channel and retest of the YTD VWAP. In almost every situation so far this year when the NQ has tested the YTD VWAP and the channel, it has had a V-shaped move and regained the 5-day SMA the day after. This time, we saw a failure at the 5-day SMA, and we do not have a V-shaped low anymore.

What does that mean, and how do we trade it?

If you’re long, you should wait to see us regain the 5-day SMA. If you’re short or want to be short, you can now lean on the 5-day SMA for a stop, and there is the possibility of a decent selloff in the coming sessions. I took the latter and got short via getting long puts last night. I will watch today’s action and either add to it or cover it, depending on the action.

The technicals for today:

18,075-175 is an area where I see the market chopping around. I will look to sell rallies in this range. If we push above 18,175, I would turn slightly bullish and cover my shorts. Failure to hold 18,075, I think we head down to 17,900, where I think the bulls have to defend, or else selling begins to escalate. I will be looking at reactions in that area to see if I should trim shorts or if the market is looking for an extended move lower. If we push below 17,900, it could be off to the races down to the 17,788 area. I believe that area holds today for a bounce, and I will cover my shorts. If the bears push through there, then that changes the character of this year’s market, and we could see selling escalate again. (Today is a good day to look at Event Contracts on the rallies. I like out of the money NQ, NO contracts 18,100 strike)

ES 5189-5200 is the pivotal area this morning. Below there, I am bearish and look for us to trade down to 5175 and then possibly 5150. The ES does not look as bearish to me as NQ, but if NQ starts to push below 17900, then that will add selling pressure to ES and likely put ES below 5150. 5127, 5110-100 become the support areas to watch.

RTY is still stuck in range-bound territory, keeping an eye on ZN. I covered my ZN puts this morning for a small profit as I am now focusing on selling rallies in NQ. This doesn’t mean I’m not bearish ZN anymore, but I banked a small profit with my puts and will be focusing on what I think has the greater opportunity for the next day or two, which is short NQ.

It’s FED week, and many people tend to wait for the meeting for the action to begin, but that’s not always the case. Don’t think that we can’t have a big move prior to the meeting. Always manage risk and expect the unexpected. Small and smart.

Cheers, DELI