March 18th, 2024

Widen your perspective. Identifying market environments is key no matter what timeframe you are trading. As day traders, one of the most difficult things for us to do is widen our perspective but still focus on our short-term execution. When we step back and look at this year thus far, the ES and NQ are simply channeling higher, while the RTY is in a holding pattern, consolidation. That is important to understand because where we are in those higher timeframes will have a significant impact on how we trade in the lower time frames.

So how do we trade it, and what is the plan for today?

As of today, the NQ opened up Sunday night at the bottom of their channel and once again stayed a small distance above their YTD VWAP and the bulls chased it higher. We now sit on the 5-day SMA inside yesterday’s range, but the bulls have the momentum telling me to buy dips on the short-term strategy today. 18,180-400 is gonna be a whippy area and my expected range for most of today’s action. Below 18,180 puts some pressure back on the bulls, and we could see selling down to 18,090-076. Below there puts 18,010 into play.

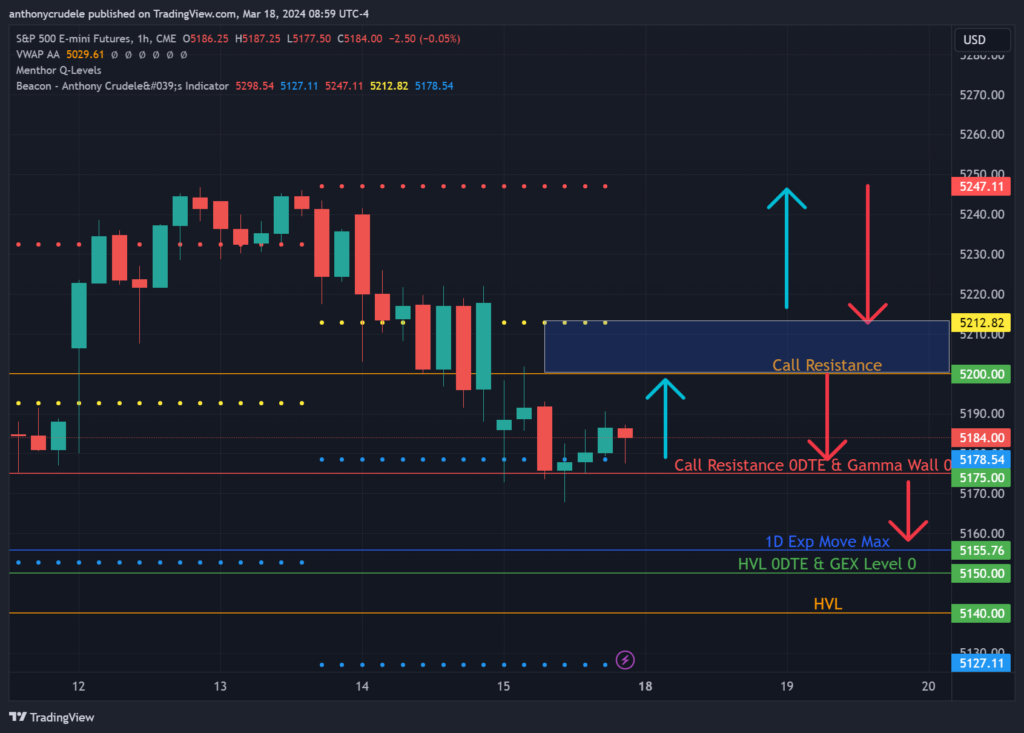

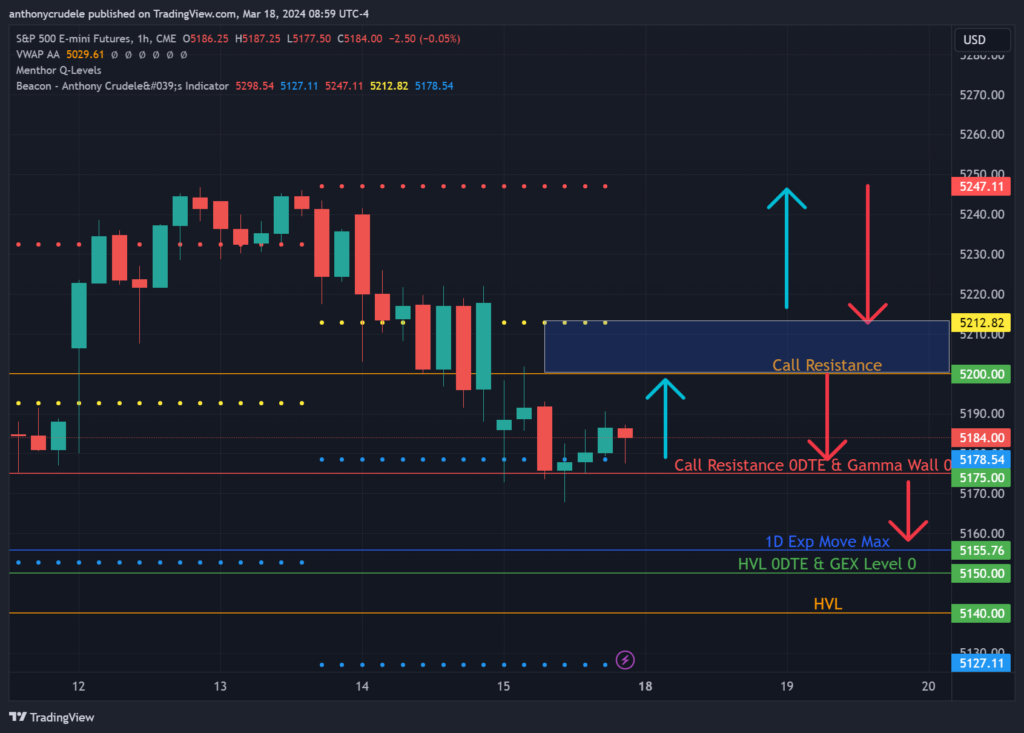

ES is stuck in between their channel for the year, so I expect a two-way tape, but I still favor thelong side because the primary trend is up. For today, 5200-5212 is the pivot. If we hold above it, we could head to 5247, below it we could be back down to 5175. Below 5175 puts 5155-5150 into play. Once again, expect a two-way tape today that I think for short-term traders they can play both sides.

RTY remains in a massive consolidation for the year and will be closely watched by the 10 YR (ZN), which is on the verge of breaking out to the downside. I am currently long some 110 and 109 puts in ZN expiring in April. If ZN starts to push below the YTD low, 109’25.5, it could be a decent selloff down to 109 in the coming sessions. This puts 10 YR yields higher and most likely, RTY lower. This move in ZN could also be a catalyst to bring down the entire market with the fear the Fed is pushing off rate cuts in the upcoming FOMC meeting. ZN is the key market to watch this morning.

It’s Fed week, ease your way into the market on this Monday morning. Small and smart.