April 3rd, 2024

Yields higher, Indexes lower. With yields making new highs for the year, the indexes can’t ignore. However, I will say this: the move thus far in the indexes has been lackluster, which gives me pause to think that this sell-off in the indexes has legs. Of course, I will let the technicals guide me, but as of right now, the technicals are not that bad in the indexes. Unless rates continue to rise significantly, I’m not sure the indexes will drop significantly.

Regarding the technicals:

RTY was my focus yesterday for the short side because it is the index most tied to rates. Even with yields at new highs, RTY is still well above YTD VWAP, and the daily chart looks like a typical pullback into the range we’ve been in all year. RTY is currently a range-bound market and may continue to be so for the months ahead. With the CME Fed watch tool still pricing in a cut in June, I believe RTY could remain sideways until that changes or until we see an actual rate cut. It’s a two-way tape for day traders, but watch the ZN… as it moves, RTY likely follows.

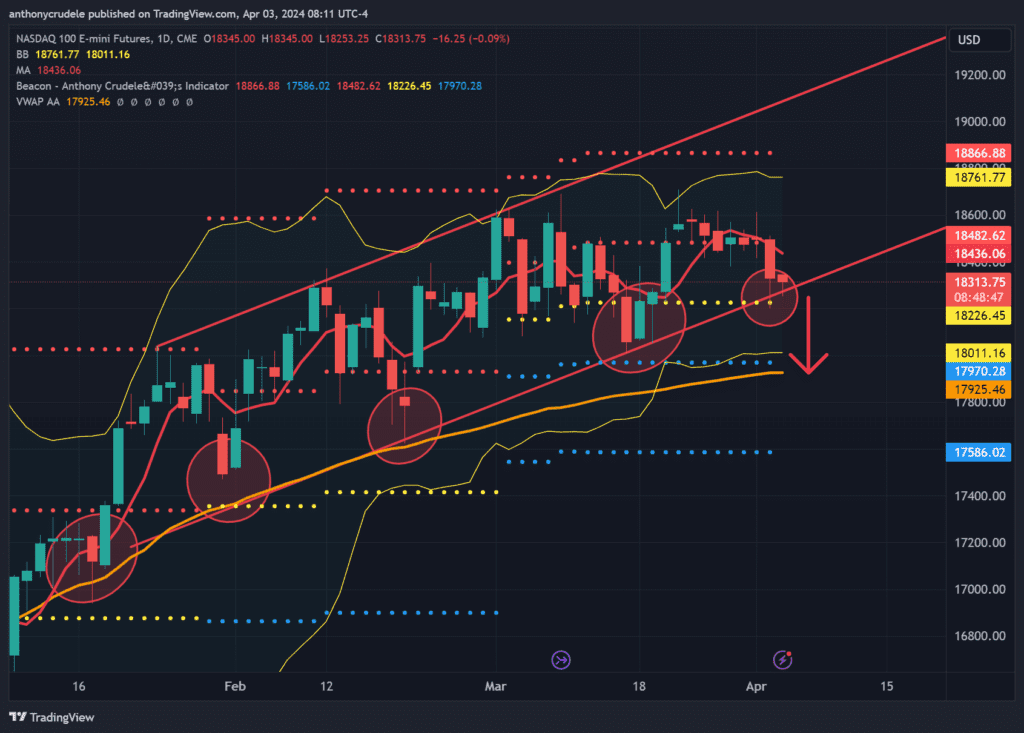

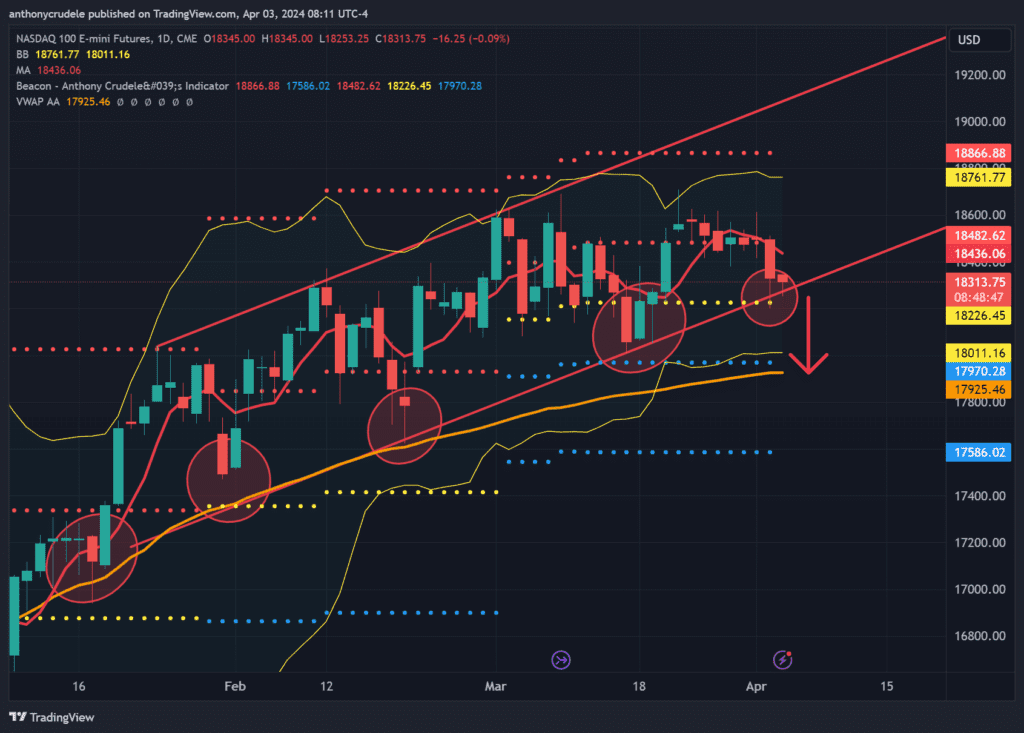

NQ has held its uptrend for the fourth time this year, but the bounce has been lackluster. I foresee a test of the YTD AVWAP at 17,925 in the coming sessions as bulls have lost momentum in NQ. NQ is currently a two-way tape for day traders, but if we break yesterday’s low (18,201), we could see a quick trip down to 17,925.

ES experienced a boost in volatility yesterday but remains overall very quiet. It’s still in a tight uptrend channel, and I expect it to last for some time. This market is not showing signs of explosive volatility in any direction; it’s a two-way tape for day traders. It’s crucial to stay small and keep an eye on the 10 YR Yields to see if they influence ES in one direction or the other. Personally, I prefer NQ and RTY for day trading.

This market environment is not favorable for someone like me who likes a theme and presses hard into one side. It’s more suitable for day traders with two-way strategies but have the discipline to trade small and not force trades. The current environment is what it is; don’t fight it, don’t force anything, and trade smart and small.

If you’d like my daily note sent right to your inbox, here is the link to sign up: https://anthonycrudele.com/newsletter/

Cheers, DELI