April 8th, 2024

Interest rates are up, but stocks seem dismissive. Perhaps the eclipse has temporarily blinded stocks to today’s interest rates, as the 10 YR hits a new high yield for the year. Unlike last week, when new high rates resulted in stocks being sold off, today’s activity suggests the markets are somewhat indifferent. This is the typical push-and-pull situation where certain factors matter one day and are negligible the next. Some days, headlines may suggest a reason for market movement, yet the same event may occur the next day and the market reacts differently. As traders, our job is to assess the environment each morning and make decisions based on what we observe, not what we presuppose.

Surveying the indexes this morning, markets appear rangebound in the short term. However, medium to long-term trends still heavily favor the bullish side. Let’s go to the charts…

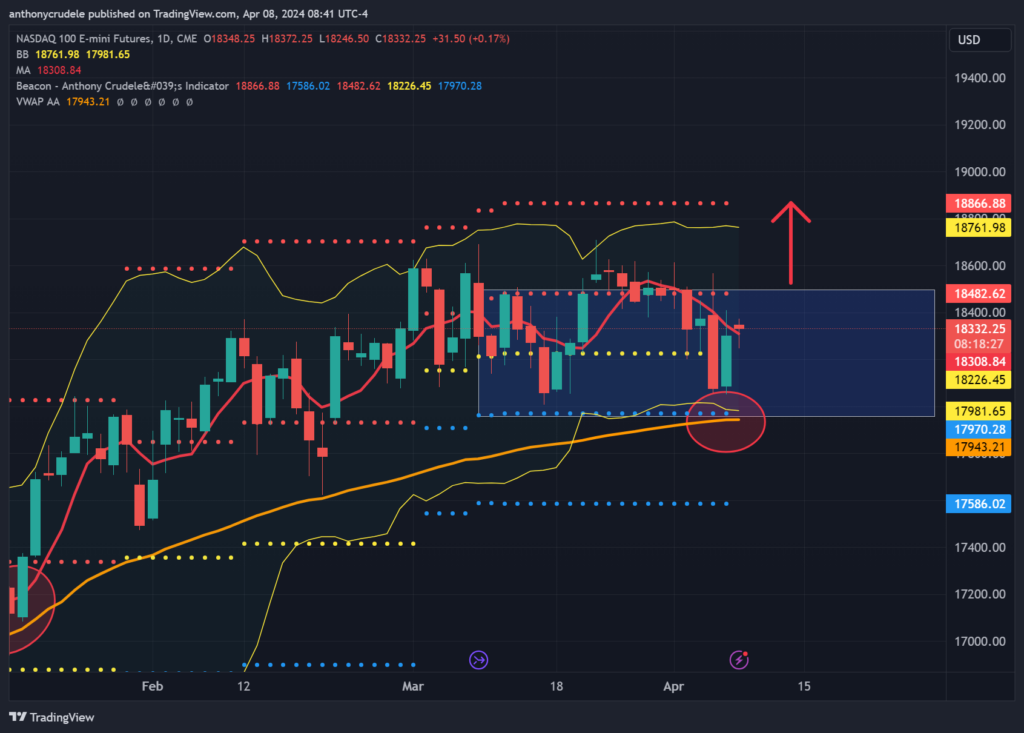

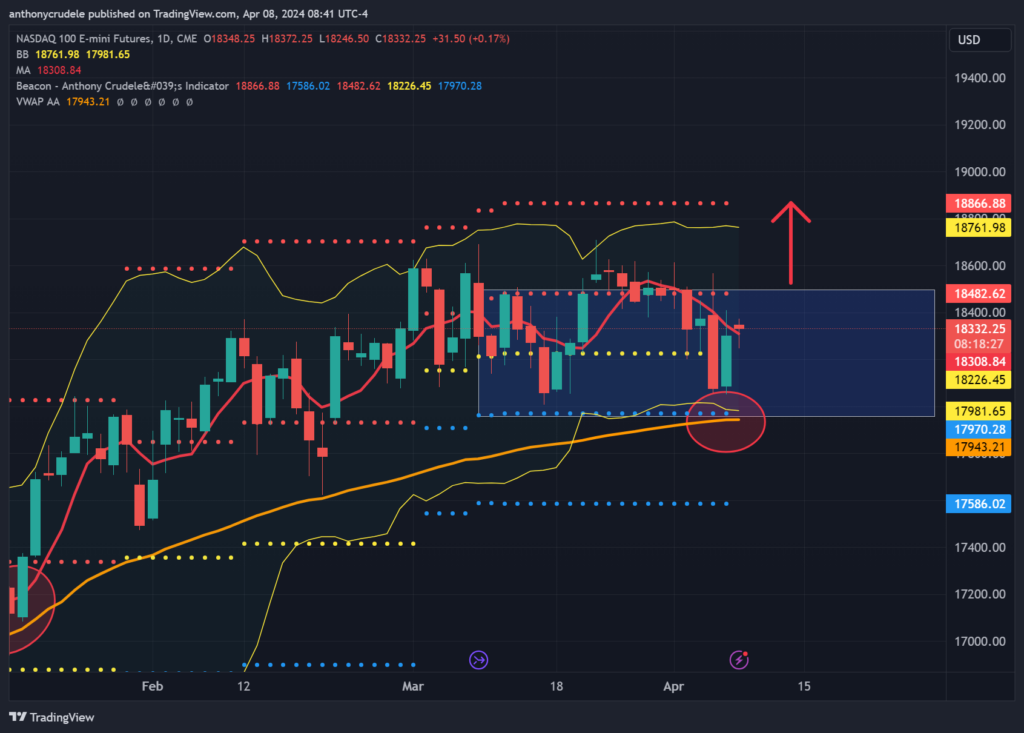

The NQ came within striking distance of its YTD AVWAP and rebounded, yet again. This persistent defense is a positive sign for the bulls, as they refuse to dwell on the lows of any given move. I’ll be keeping a close eye on the key NQ levels of 18,432, 18,226, and 17,970. If we exceed 18,432, it reinstates new highs for the year and hands momentum back to the bulls. 18,226 serves as my short-term pivot. Any upward movement from here maintains pressure on shorts and we will look to test 18,432. However, a drop below 18,226 brings recent lows and the YTD AVWAP support into play around the 17,970 area.

The ES has broken out of its upward channel, only to plunge right back in. The ES maintains a tight upward trend which, in my opinion, is a grind and less favorable for day trader rotations. Look out for the key levels of 5290, 5226, 5162. As long as the bulls can maintain above 5226, I anticipate a gradual climb back up, with momentum returning to the bulls’ side with daily closes above 5290. Expect a slow, choppy tape in ES.

The performance of RTY is largely influenced by ZN. If ZN continues to underperform, I don’t predict a surge of buyers for RTY. While this doesn’t eliminate the possibility of a RTY rally, it does hint at potential limitations on the upside. Therefore, be cautious about setting overly ambitious targets. The critical level for bulls to maintain in RTY is 2089, failing which we might see a retest of the YTD AVWAP at 2044. If it stays above 2089, I anticipate a rough, disorganized rally.

Overall, the current environment is far from ideal, so it’s all about carefully selecting your positions and minimizing stakes. Be drawn into trades, don’t force them.

Cheers, DELI