May 17th, 2024

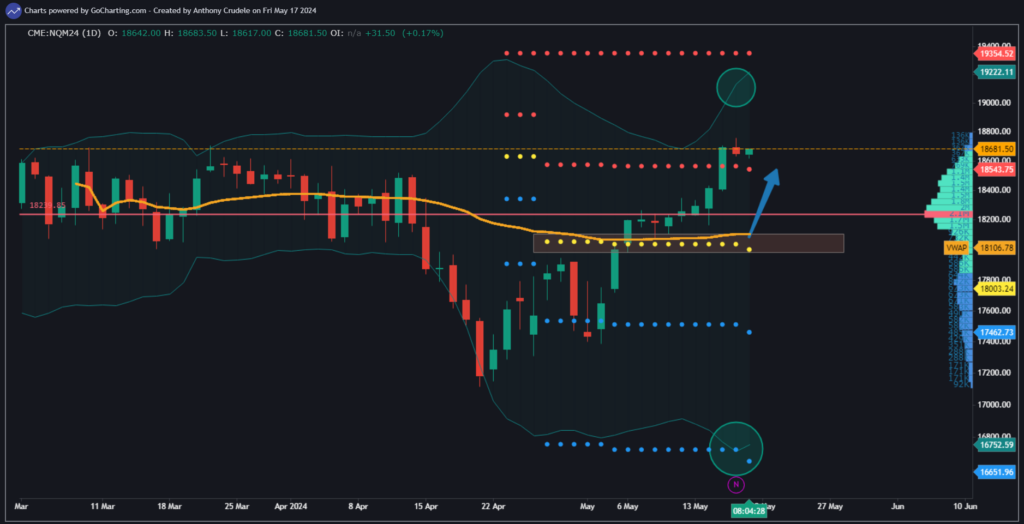

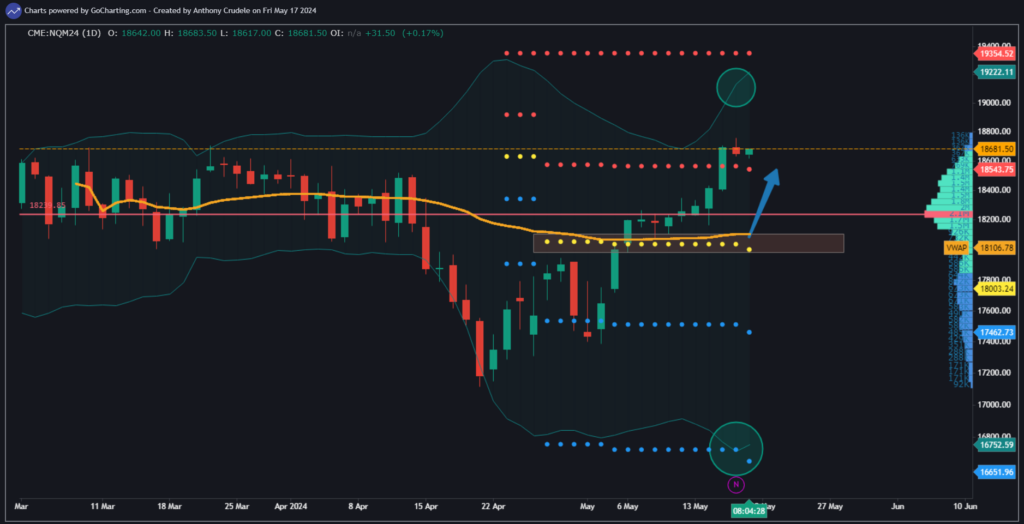

The choppy rally. This market has been grinding its way higher, and the light volume chop will most likely continue to be how this tape moves. With the bond market struggling to hold any rallies, the longs in equities continue to be uneasy with staying too long… especially in RTY. This uncertainty is keeping the tape jittery.

With a tape that has little confidence in the future of rates, you have to recognize as day traders that it’s not going to be clean in Equities, and you have to be extremely patient. Don’t let the tape frustrate you; embrace the fact that it may take hours for your favorite setup to come in or the fact that you may not get a clean look.

The Indexes are starting to look more like a two-way tape, where I can see day traders trading both sides but still heavily favoring the long side. For shorting this market, I just think you have to be really small and really tight with your stops. This rally has not yet made a good high, and the market is still searching for one.

The RTY is the one market I can see traders playing the short side because the ZN looks like it may be headed lower again. This will pull on the RTY and keep them in what they’ve been in… a two-way tape. ES and NQ still have momentum on their side, and shorting them you need to have strong confirmations.

It’s easy to complicate a tape like this, but don’t put that much pressure on yourself. If your looks aren’t clean, just trade it small and smart and don’t get married to any positions. Wishing you a wonderful weekend!

Cheers, DELI