May 28th, 2024

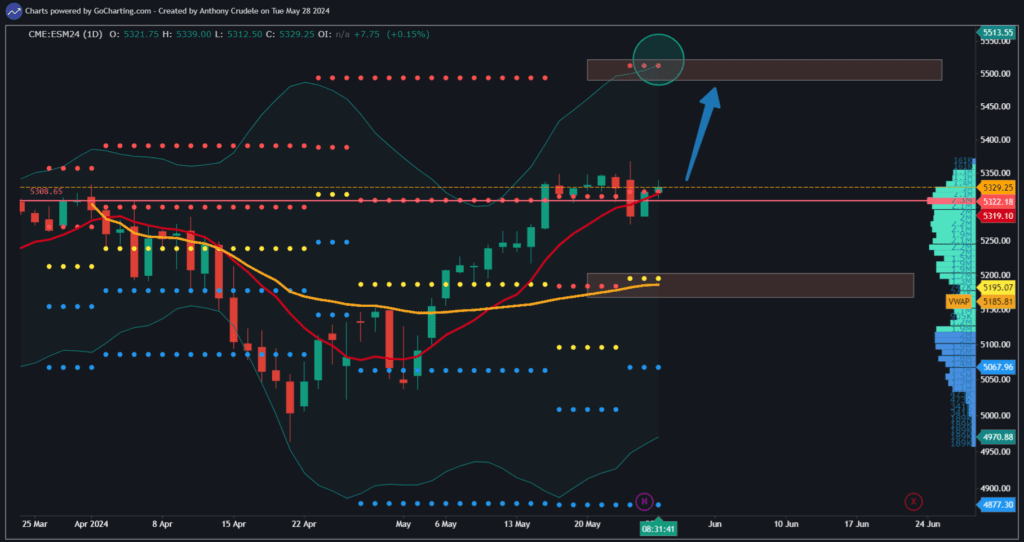

The market has yet to hit a high that bears can trade off of. You can analyze all the macro or technical factors you want to determine when a high is being made, but it boils down to risk versus reward. When the market is setting all-time highs like it is now, it’s tough for shorts to manage risk. We could stay overbought and overvalued for much longer than anticipated, leading to this gradual climb as shorts get squeezed and longs swiftly cover their positions only to re-enter.

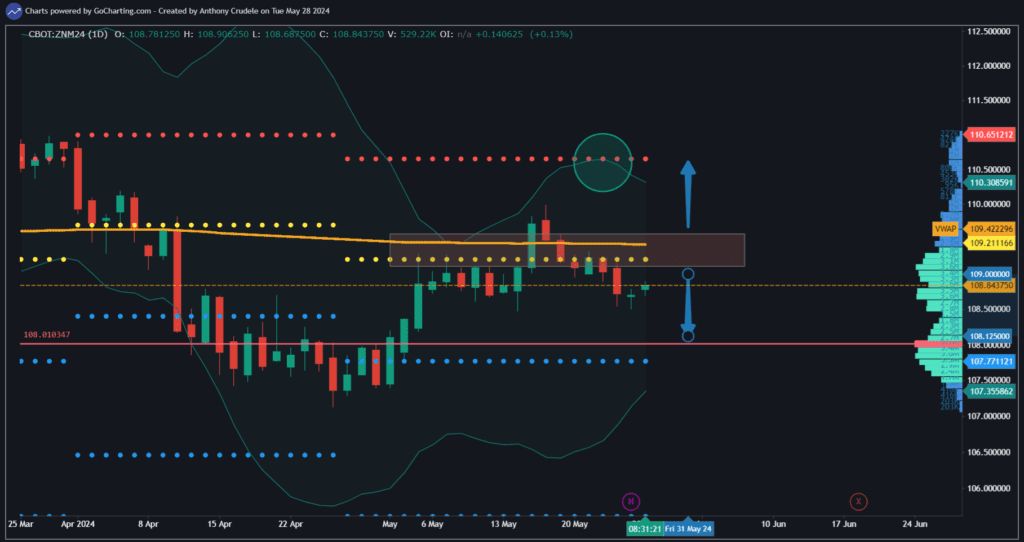

Typically, ‘good highs’ occur after some form of sharp upward move, prompting both longs and shorts to identify the peak as a prime trading point before we start descending. Technically, I’ve noted that we may be nearing a peak as the daily Bollinger Bands are still expanding upward, but the lower Bands are starting to contract, RSI’s show overbought conditions, and short-term moving averages are sharply ascending. This suggests a bullish trend for now, with a possible continued upward surge followed by a decisive move signaling a short-term peak.

Potential targets for ES and NQ in the upcoming weeks: ES 5450-5490, NQ 19,350.

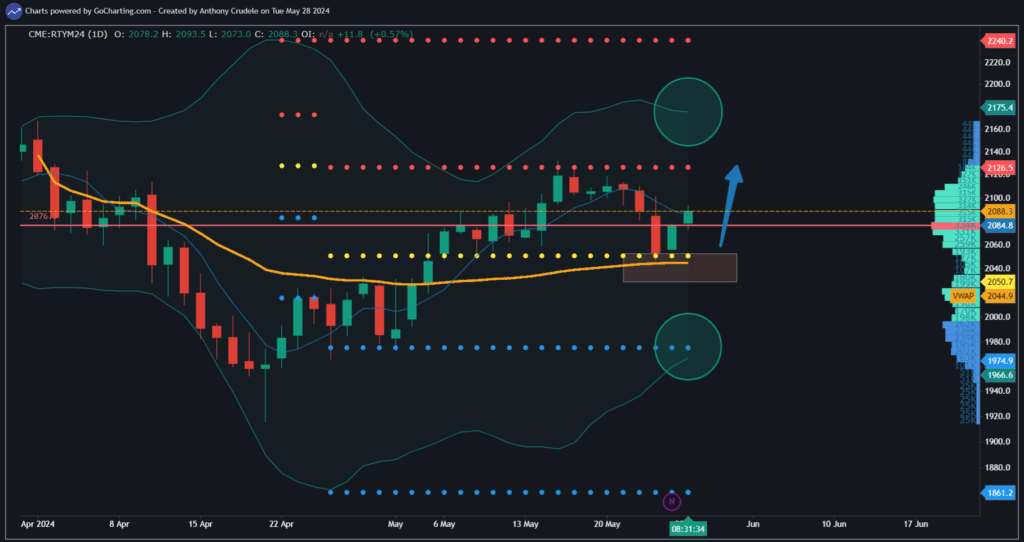

I didn’t mention RTY targets due to lingering rate challenges for small caps. Unless there are clear signs of declining rates, small caps may face difficulties.

I strongly lean towards long positions for my day trades in ES and NQ, while RTY offers opportunities in both directions. Set your levels, define your risk, and trade accordingly. Approach the markets cautiously post a three-day weekend.

Cheers, DELI