May 29th, 2024

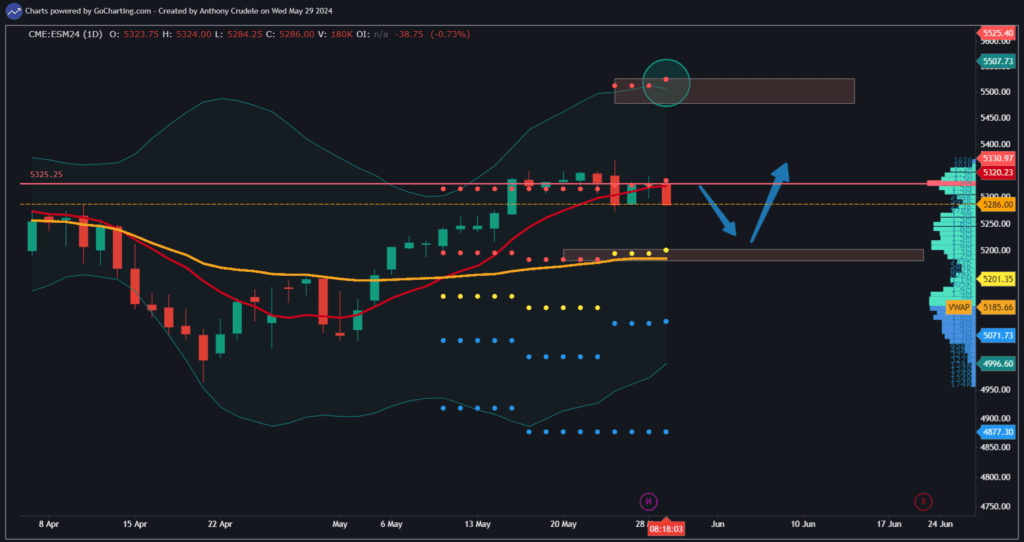

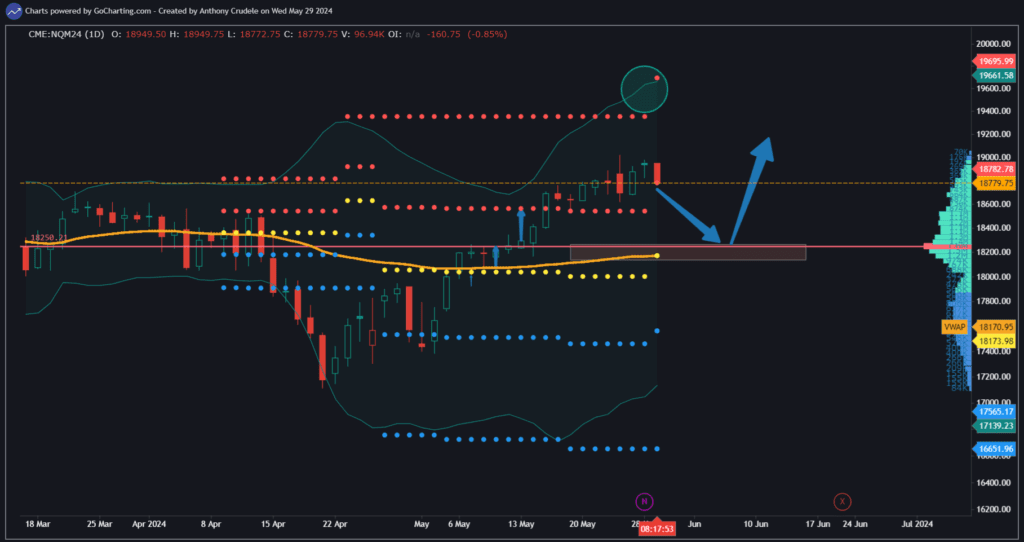

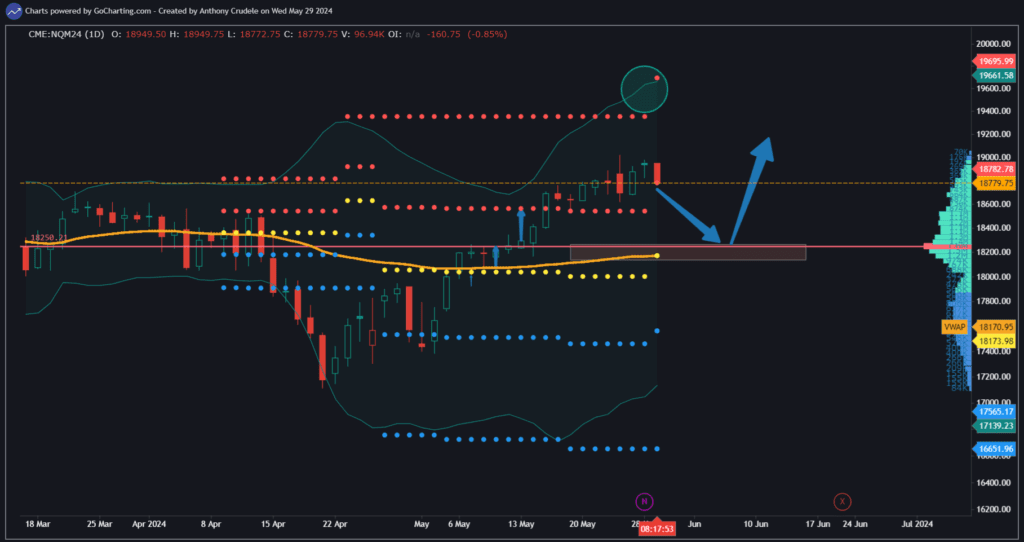

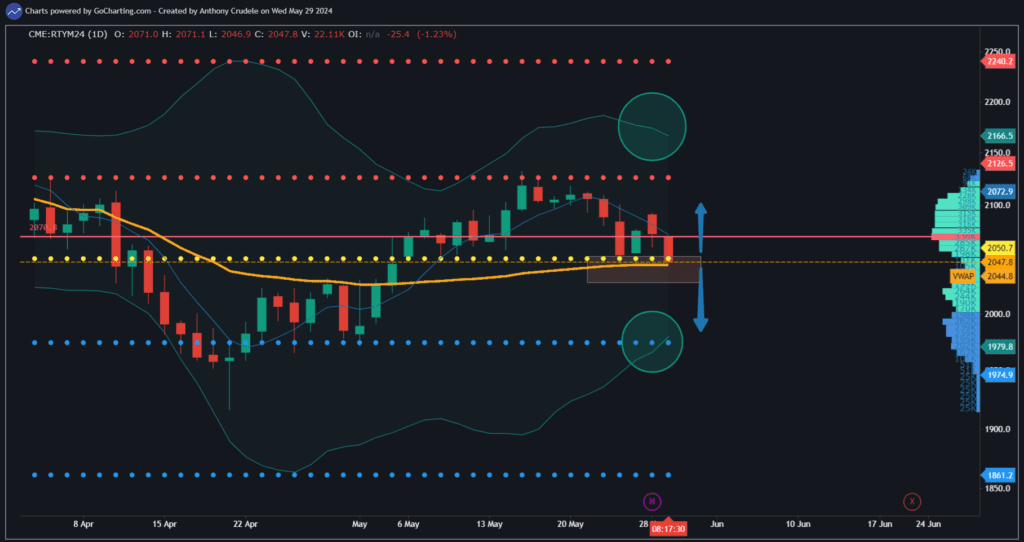

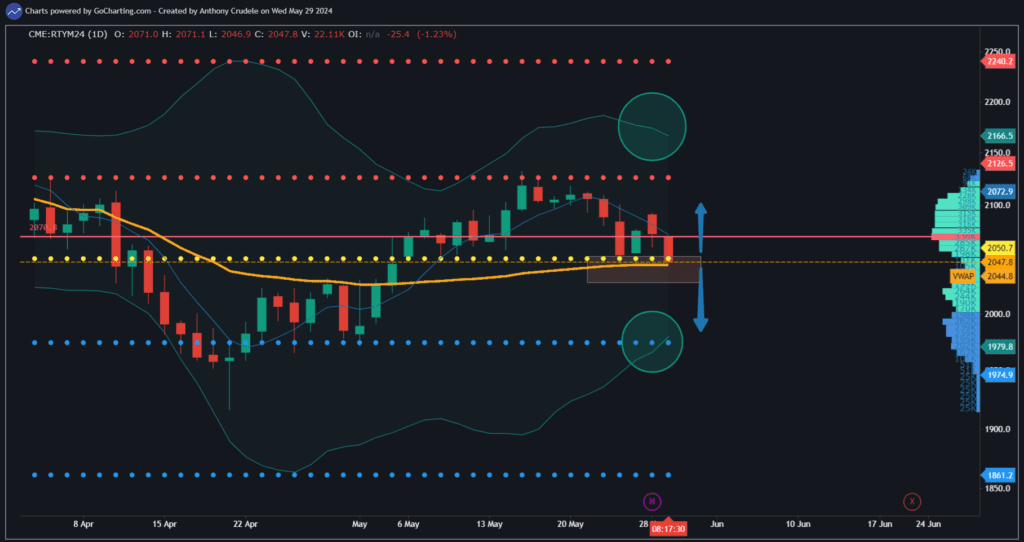

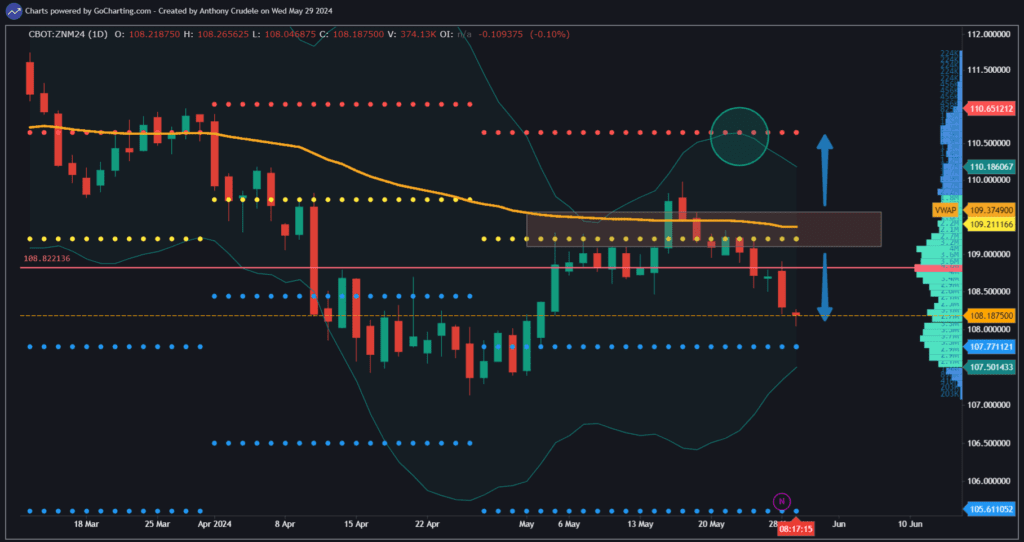

Time for a rotation? Daily Bollinger Bands have now started tightening as the markets have seemingly lost momentum. Volume, Volatility, and Momentum are currently lacking, with rates inching up, not ideal for equity bulls. NQ remains the lead to the upside, while ES, YM, and RTY are losing steam, hinting at a possible rotation ahead.

I believe this high isn’t a ‘good high,’ but that doesn’t rule out it being the peak for now. In my view, a ‘good high’ involves a sharp move up, little time near the highs, while this high has been slow and gradual. Such highs often lead to rotations before another push upward, which could be the current scenario.

Trading strategy? Stay cautious and flexible. With the market in a range, a potential descent might precede an ascent. Shorting in this setting is challenging, especially for day traders. In low-volume, low-volatility markets, rallies tend to emerge unexpectedly. I am waiting for support confirmation before buying, rather than impulsively selling into short-term downward movements.

If shorting, RTY stands out due to ZN’s downward trend, indicating small caps’ vulnerability alongside a weak macro backdrop. On a broader scale, 5320 marks resistance, potentially pulling ES to 5210-5185. NQ’s crucial level at 18,780 could trigger a drop to 18,270-170. These support zones could offer opportunities for swing long positions.

Although momentum has slowed, bulls retain dominance. Maintain a cautious approach, focusing on precision and minimal exposure.

Cheers, DELI