October 5th 2023

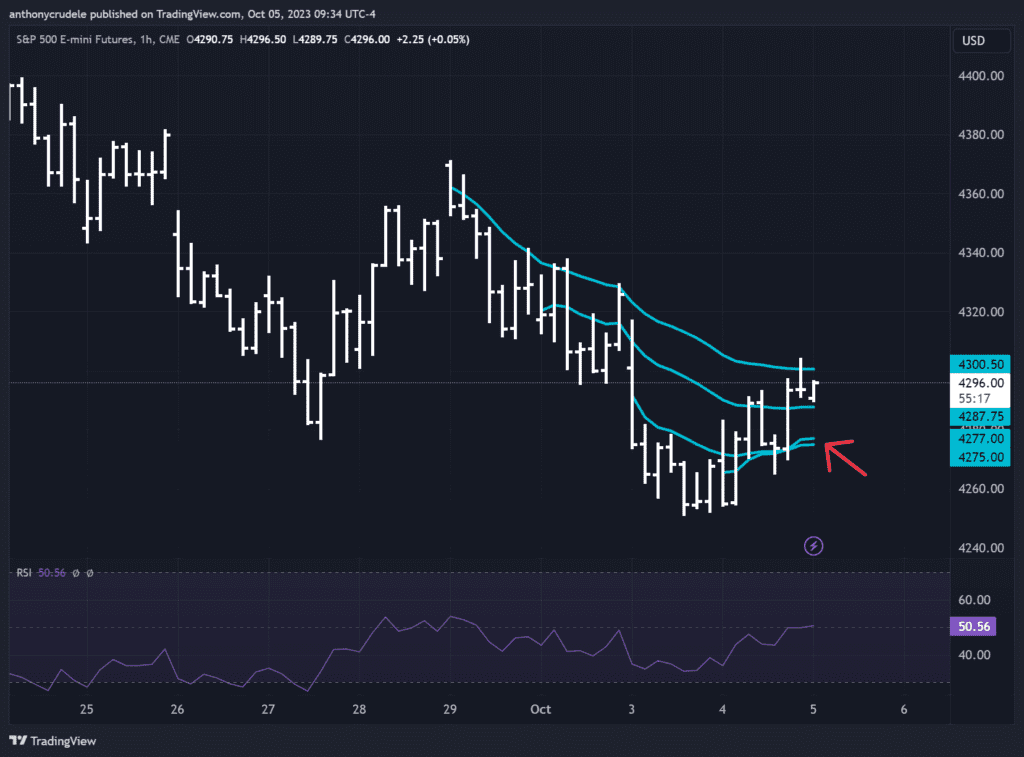

As discussed in my evening note, I anticipated some overnight volatility and a potential pullback to the 4277-74 area – which did happen. The market held this area and rallied up to the 5-day moving average, consistent for several sessions now.

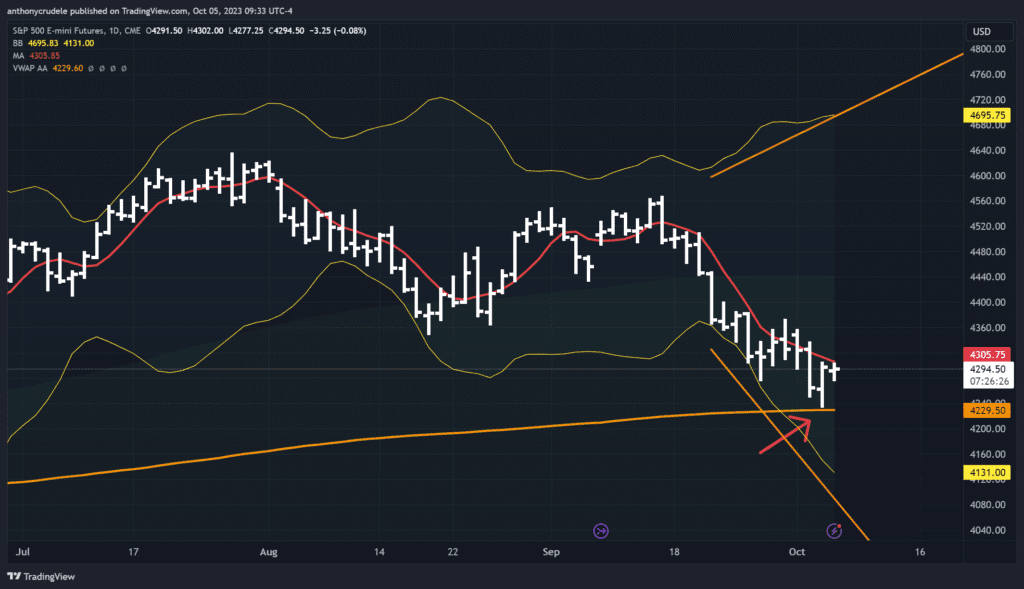

Today might echo yesterday; bears may attempt to push us lower before the bulls find a lever and take us back up. I’m not convinced a substantial rally will occur until the daily Bollinger bands come back in. Meanwhile, we’re likely in a tug-of-war, ideal for day traders to play both sides.

For starters, I plan to wait for a pullback to the overnight lows and test the two VWAPs around 4277-74, eyeing a long. I’ll forgo shorting today, as I believe the bears are currently at a disadvantage. Don’t neglect monitoring the rates – they’re flat this morning, but they might hint at a directional shift based on their movement.

An hourly close above Fridays VWAP 4300.5 would put us above the 5 day moving average as well. That could spark a little boost higher, but I don’t think it would be a sustainable rally.