Mixed Markets

- Hong Kong: Hang Seng closed up +0.10%

- China CSI 300 market closed for holiday

- Taiwan KOSPI -0.09%

- India Nifty 50 +0.56%

- Australia ASX -0.82%

- Japan Nikkei +1.27%

- European bourses in positive territory so far this morning

- USD -0.11%

TOP STORIES OVERNIGHT

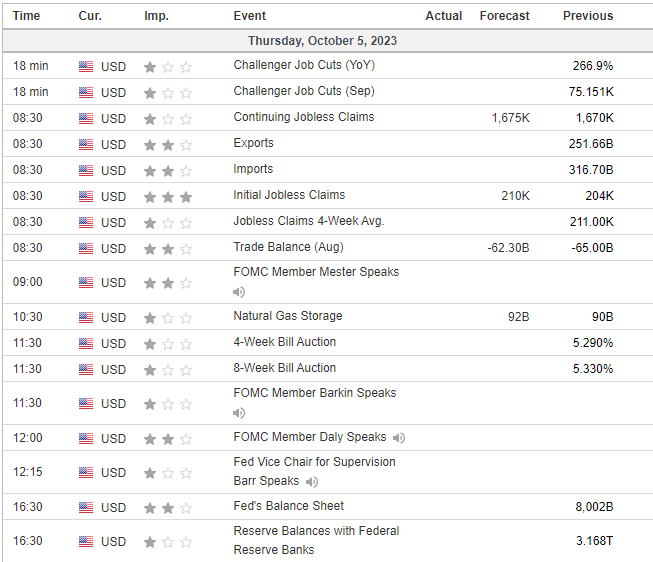

Only an Equities Crash Can Rescue the Bond Market, Barclays Says-BBG

Global bonds are doomed to keep falling unless a sustained slump in equities revives the appeal of fixed-income assets, according to Barclays Plc.

“There is no magic level of yields that, when reached, will automatically draw in enough buyers to spark a sustained bond rally,” analysts led by Ajay Rajadhyaksha wrote in a note. “In the short term, we can think of one scenario where bonds rally materially. If risk assets fall sharply in the coming weeks.”

The rout in Treasuries has sent shockwaves through the global bond market in recent months as investors position for borrowing costs to stay higher for longer. While the selloff abated on Wednesday, traders are on high alert for a resurgence in volatility — especially if US non-farm payrolls data on Friday come in stronger than expected.

COMMENTS: WELP!

German exports disappoint in August-ING

There is no end to the German macro disappointments. Exports dropped again in August and there’s a growing risk that the entire economy has fallen back into recession in the third quarter

And another German macro morning to forget. German exports disappointed again and dropped by 1.2% month-on-month in August. Even worse, the July drop was revised downwards to -1.9% MoM, from an initial -0.9% MoM. August imports decreased by 0.4%, from -1.3% MoM in July. As a consequence, the trade balance widened to €16.6bn from €16.0bn in July. Don’t forget that this is in nominal terms and not corrected for high inflation.

COMMENTS: Odds of a recession have increased, though I would argue they are already in one

Citi Raises China GDP Forecast, Saying Economy Has Bottomed Out-BBG

Citigroup Inc. raised its growth forecast for China to 5% this year, as promising data helps build consensus around the nation’s ability to achieve its official government target.

Retail sales and industrial production may improve, the economists wrote Wednesday, adding that the nation’s export contraction could also narrow after official manufacturing surveys expanded for the first time in six months.

“The cyclical bottom is here, with all eyes on whether organic demand will pick up amid gathering policy momentum,” wrote economists led by Yu Xiangrong. The bank’s previous forecast was 4.7%, making it among the more bearish investment banks on China.

COMMENTS: If so this is good for the global economy

Chevron, Australian unions hit snag in deal, workers to meet for possible strike vote-Reuters

Efforts to finalise a pact to end strikes at Chevron’s two Australian liquefied natural gas (LNG) plants hit a snag on Thursday, with unions accusing the U.S. energy major of reneging on commitments and potentially gearing up to resume stoppages.

Workers called off strikes less than two weeks ago after unions and Chevron accepted proposals on pay and conditions proposed by the country’s industrial arbitrator, the Fair Work Commission (FWC).

COMMENTS: This could cause a spike in European gas markets again is strike resumes

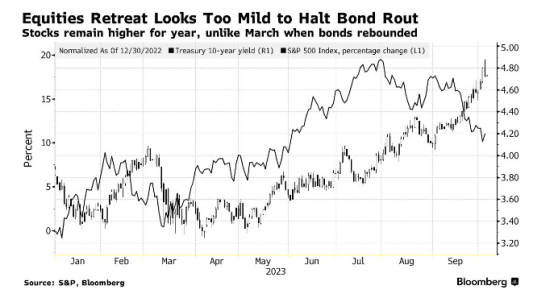

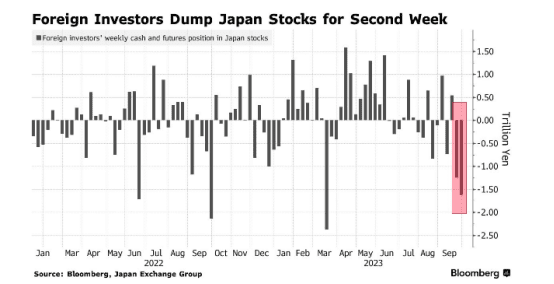

Foreign Investors Dump Japanese Stocks for Second Week-BBG

Japanese stocks are facing selling pressure from foreign investors who took profit from one of world’s best-performing markets for a second week.

They offloaded a net ¥1.62 trillion ($10.9 billion) of stocks and futures in the five days that ended Sept. 29, figures from Japan Exchange Group Inc. show. That took their two-week selling to ¥2.88 trillion, the most since March 2020. The Topix index slid 2.2% last week.

The fall in Japanese shares continued into this week, as fears of a Federal Reserve interest rate hike next month triggered a global selloff in equities and bonds. The Topix has dropped 2.6% this week through Thursday, while the Nikkei 225 Stock Average is down 2.5%, closing at 31,075.36.

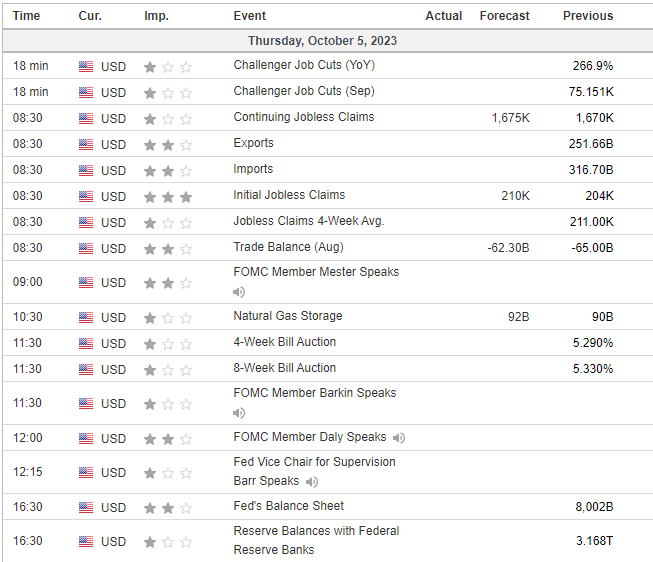

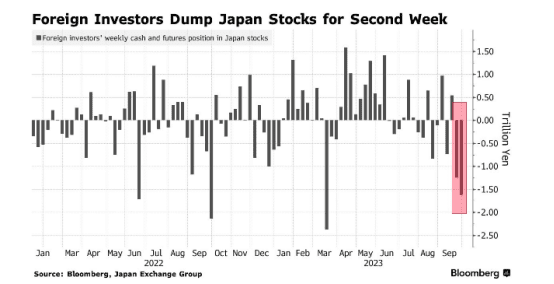

US DATA TODAY