Pretty GREEN out there

- Hong Kong: Hang Seng closed up +1.58%

- China CSI 300 market closed for holiday

- Taiwan KOSPI +0.21%

- India Nifty 50 +0.54%

- Australia ASX +0.50%

- Japan Nikkei +0.54%

- European bourses in positive territory so far this morning

- USD -0.03%

TOP STORIES OVERNIGHT

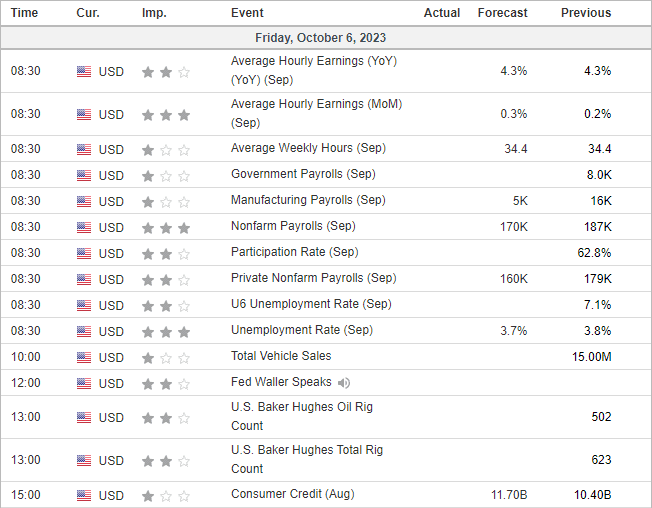

September Jobs Report May Be Last Good One Before Sharp Slowdown-BBG

A monthly US jobs report due Friday may be the last to show solid hiring before a sharp slowdown, according to Bloomberg Economics.

The report will probably show employers added 173,000 workers to payrolls in September, though figures due a month from now could show hiring plummeted to 100,000 in October, Bloomberg economists Anna Wong, Stuart Paul and Eliza Winger wrote Thursday in a preview of the release.

“The September payrolls report is backward looking. Since the September survey week, financial conditions have tightened sharply and auto strikes have escalated,” Wong, Paul and Winger said.

“Rather than layoffs, a slowdown in hiring usually precedes a higher unemployment rate. That dynamic is about to pick up.”

Weekly initial filings for unemployment insurance have returned to near the lowest levels of the expansion so far after an uptick earlier in the year, and the latest numbers from Challenger, Gray & Christmas suggest companies are scaling back downsizing plans amid a ramp-up in holiday hiring plans.

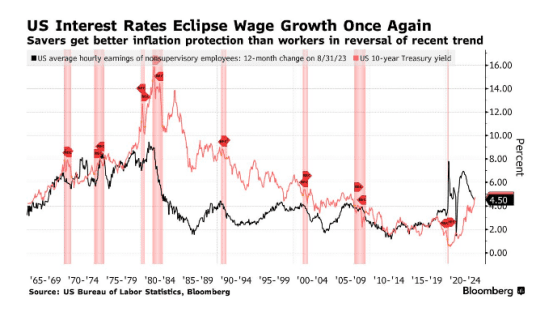

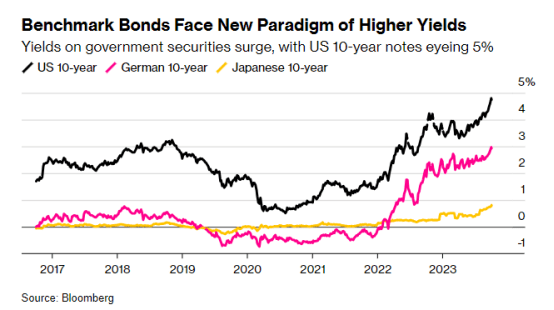

The 5% Bond Market Means Pain Is Heading Everyone’s Way-BBG

Not so long ago, families, businesses and governments were effectively living in a world of free money.

The US Federal Reserve’s benchmark interest rate was zero, while central banks in Europe and Asia even ran negative rates to stimulate economic growth after the financial crisis and through the pandemic.

Those days now look to be over and everything from housing to mergers and acquisitions are being upended, especially after 30-year US Treasury bond yields this week punched through 5% for the first time since 2007.

“I struggle to see how the recent yield moves don’t increase the risk of an accident somewhere in the financial system given the relatively abrupt end over recent quarters of a near decade and a half where the authorities did everything they could to control yields,” said Jim Reid, a strategist at Deutsche Bank AG. “So, risky times.”

The mortgage-cost squeeze is a story playing out everywhere. In the US, the 30-year fixed rate has surpassed 7.5%, compared with about 3% in 2021. That more-than-doubling in rates means that, for a $500,000 mortgage, monthly payments are roughly $1,400 extra.

COMMENTS: Seems the Federal Reserve is bound to break something soon

Russia diesel ban jolts crude premiums ahead of winter-Reuters

Premiums for the type of crude oil best suited to producing diesel, heating oil and jet fuel have risen sharply as the Northern hemisphere heads into winter amid a global supply crunch, several traders told Reuters.

Oil markets are tight as OPEC and its allies restrict supplies. Saudi Arabia and Russia have curbed output by an additional 1.3. million barrels per day (bpd) in addition to agreed OPEC+ cuts.

Russia, the world’s top seaborne diesel exporter, imposed a ban on fuel exports in late September. However, on Friday, Moscow lifted the ban on pipeline diesel exports via ports, removing the bulk of restrictions, although curbs on gasoline exports remain.

The recent ban has left diesel supplies short, encouraging refiners to make more. For that, they are seeking to buy the medium-sweet crude that yields more of the fuel group known as distillates when it is refined.

Differentials for such Nigerian grades are at their highest levels since August 2022, after the Russian invasion of Ukraine in February 2022 sent crude prices soaring, according to LSEG data.

Bonga, for instance, is being offered at dated Brent plus $9 a barrel, while Escravos and Forcados are in excess of dated Brent plus $8, said a trader of West African crude.

Differentials for Angolan grades of crude, which are lighter than those from Nigeria, have also gone up, another trader of West African crude said.

“Sellers are betting on a market deficit,” a third trader of West African crude said.

COMMENTS: This is putting pressure on lighter crude grades, globally and US which produces very light crude grades is not immune.

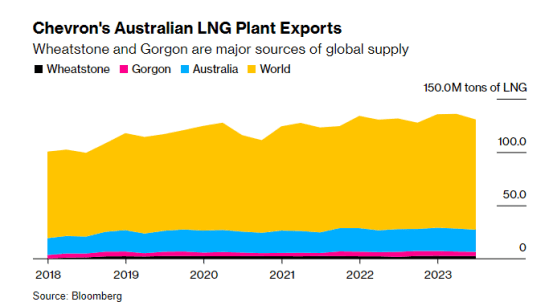

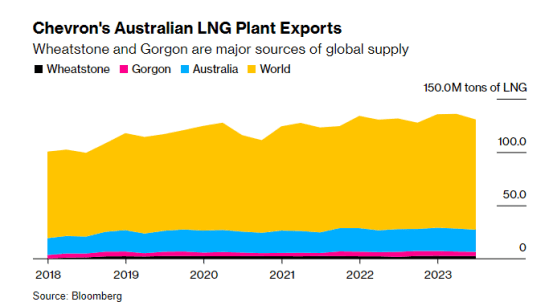

Australia LNG Workers to Resume Strikes, Fueling Price Gain-BBG

Workers at Chevron Corp. liquefied natural gas facilities in Australia plan to resume strikes, threatening global supplies just as Europe and Asia approach their winter heating season and pushing prices higher.

Union members at Chevron’s Gorgon and Wheatstone plants voted to return to walkouts, after suspending stoppages last month, according to Offshore Alliance, which represents the labor groups. The decision comes after the unions criticized the company’s efforts to finalize an agreement on pay and conditions.

The unions will give Chevron a notice of seven working days on Monday, a union representative said, asking not to be identified.

Renewed strikes again raise the risk disruptions to gas supplies from Australia, one of the world’s biggest exporters of the fuel, as seasonal demand increases in the Northern Hemisphere. Prices in Europe and Asia jumped several times during the third quarter amid concern over the effects of potential strikes.

COMMENTS: Nat gas futures up globally on this news, given how short the market is in the US, we could see a further squeeze

Buy the Dip in Global Stocks as Rates Peak, Citi Strategists Say-BBG

It’s the right time to buy global equities after a pullback that brought them to the brink of a correction, according to Citigroup Inc. strategists.

The team led by Beata Manthey said they forecast a 15% advance in the MSCI All-Country World Local Index by mid-2024 given “more balanced macroeconomic risks.” The strategists favor sectors exposed to the economic cycle, so-called cyclical stocks, as they expect a peak in interest rates, a mild slowdown in growth and a gradual cooling in inflation.

“Until recently, our year-end targets implied down markets and increased volatility,” Manthey wrote in a note. “After the last selloff, we see a more attractive entry point. We would buy dips, as advised by our Bear Market Checklist.” That Citi tool measures metrics such as stock valuations, the yield curve, investor sentiment and profitability.

A surge in US bond yields has shaken financial markets in the past few weeks as investors worry central banks will remain hawkish for longer. The MSCI all-country index deepened its slump from a peak reached on July 31 to as much as 9% this week, coming close to the 10% threshold of a technical correction, before trimming some of the declines.

COMMENTS: Always interesting to see what the banks are recommending to their clients

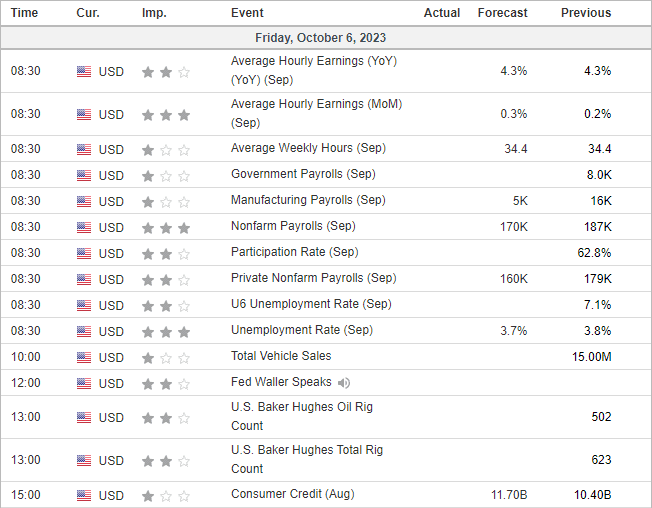

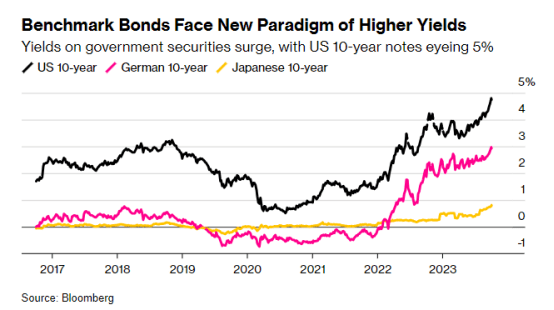

US DATA TODAY