October 20th, 2023

I won’t be around for the open today, but here are my thoughts. Yesterday, the bears had multiple opportunities for a capitulation-type move into the close, but they just couldn’t get it done. It would’ve provided a clearer picture for today. The fact that we’re gradually moving lower in a controlled manner makes it challenging to determine if we’ve reached a short-term low. This suggests that today’s action will likely be as volatile as yesterday.

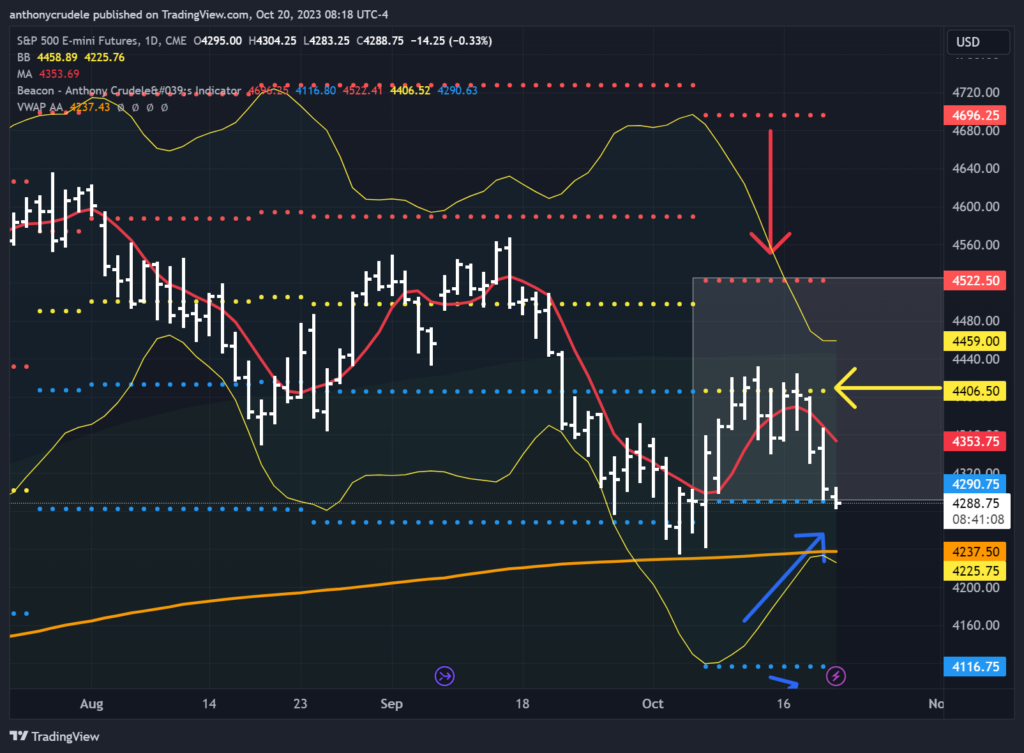

Technically, rates are slightly lower this morning and the ES & NQ have returned to my daily support levels: 4290.75 in ES and 14,759 in NQ. This slightly favors the bulls at the open.

Looking at the RTH VWAPs and standard deviation lines for the week, they are all sloping downwards, indicating that any rallies at the open will likely encounter selling pressure. 3 standard deviations often mark short-term bottoms, which for ES falls between 4280-70. If we were to drop lower this morning, that area could act as a blow-off bottom, but it’s not a buying opportunity. When the lines are heading south, it’s best to wait and see if it holds before considering any trades.

The key resistance areas where I would consider short positions are 4330-35. This is where sellers are likely to defend. If the bulls manage to break above that level, we have a wide range of VWAPs from 4345-66. Trading around this region can be messy, so it’s important to watch how price behaves in that area before initiating short positions. Overall, I anticipate a tricky day today. Stay nimble and trade wisely, everyone.