Sea of RED

- Hong Kong: Hang Seng closed down -0.72%

- China CSI 300 -0.65%

- Taiwan KOSPI -1.96%

- India Nifty 50 -0.42%

- Australia ASX -1.28%

- Japan Nikkei -0.14%

- European bourses all in negative territory so far this morning

- USD -0.05%

TOP STORIES OVERNIGHT

China Stocks Erase All Reopening Gains as Property Woes Persist-BBG

Chinese stocks erased all the gains seen during their massive reopening rally that took off late last year, as persistent concerns about the health of the property sector help drive an unprecedented foreign outflow from the onshore market.

The CSI 300 Index fell 0.7% to end at 3,510.59 on Friday. The gauge at one point fell below its closing level on Oct. 31 last year, the day before frenzied speculation over Beijing’s abandoning of its stringent Covid curbs sparked an epic surge that lasted about three months. Investor pessimism over an uneven economic recovery and a weaker-than-expected rebound in consumption has since kept equities in a downtrend

The benchmark’s 16% slide from a Jan. 30 peak has come amid relentless selling by global funds, many of whom cite China’s ongoing housing crisis and tensions with the West as the biggest worries. Recent figures show that property investment — a key driver of China’s economic activity — has continued to slump, offsetting optimism spurred by other data that suggest government stimulus efforts have taken root.

Weakness in global equities spurred by geopolitical tensions in the Middle East has worsened the pain for China’s market, with foreigners offloading 24 billion yuan ($3.3 billion) of onshore stocks on a net basis this week. That’s the most since the week ended Aug. 18.

BOJ’s Ueda vows to ‘patiently’ maintain ultra-loose policy-Reuters

Bank of Japan Governor Kazuo Ueda said on Friday the central bank will “patiently” maintain ultra-loose monetary policy to achieve its 2% inflation target in a stable manner.

He also said the BOJ will stand ready to “respond nimbly” to changes in economic, price and financial developments.

India Pushes Back Against Russia Demands to Pay for Oil in Yuan-BBG

India is rejecting pressure from Russian oil suppliers to pay for crude imports in the Chinese currency as tensions between New Delhi and Beijing continue to simmer.

Some Russian oil suppliers are demanding payment in yuan, according to a senior Indian official directly involved in the negotiations and another senior person at a state-owned oil refiner. The two people asked not to be identified as the discussions are private.

Prime Minister Narendra Modi’s government won’t agree to those requests, according to the two people and two other Indian government officials. Almost 70% of India’s refiners are government-owned, which means they would need to follow orders on payment instructions from the Ministry of Finance.

Indian Oil Corp., the biggest state refiner, had made a yuan payment for Russian crude in the past, although the government has since clamped down on that. Private refiners could also settle payment in yuan, although there are no official or industry figures to show the magnitude.

Indian refiners mostly pay for Russian oil imports in dirhams — the currency of the United Arab Emirates — US dollars, and a small amount of rupees, if oil prices are above the $60 a barrel cap imposed by the US and its allies on Russian oil. While the yuan is sometimes used in smaller transactions, Russian oil suppliers are requesting that the Chinese currency be the main unit of transaction for oil trade, according to the senior Indian government official.

COMMENTS: Going to be had to get a BRICS currency together with too many political tensions between the group. Reason # 45676 why Yuan will not be a reserve currency.

Offshore wind developers likely to cancel some contracts after NY decision-Reuters

Developers in the U.S. offshore wind industry will likely cancel some power sales contracts in New York after the state last week denied passing on more of the costs to consumers, but major projects off Massachusetts and Rhode Island are set to start up later this year.

Last week, New York utility regulators dealt the industry a severe blow by denying requests to increase the amount of money New Yorkers would have to pay under existing contracts for power to be produced at four offshore wind projects under development.

The wind developers, including units of European energy companies Orsted (ORSTED.CO), Equinor (EQNR.OL) and BP (BP.L), requested those increases to cover rising labor and equipment costs due to soaring inflation and higher financing costs from interest rate hikes.

COMMENTS: These projects are becoming less economical in a raising rate environment, I expect this trend to continue. I expect wind stocks to continue to perform poorly.

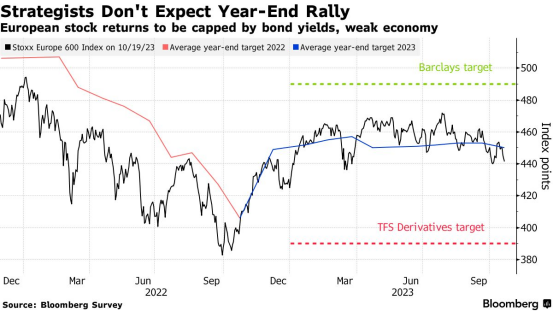

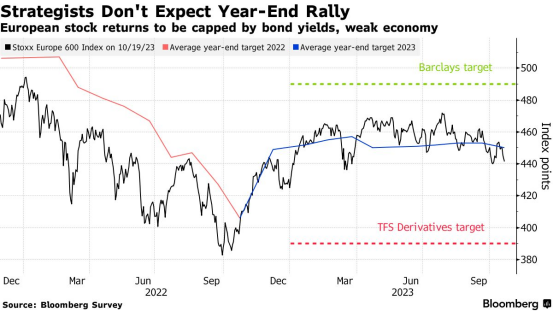

Expecting a Year-End European Stock Rally? Strategists Say No-BBG

Soaring bond yields, a conflict in the Middle East and a tricky earnings season to navigate have cemented market strategists’ view that a year-end rally in European stocks isn’t on the cards.

The Stoxx Europe 600 index is expected to end the year at 450 points, according to the average forecast of 16 strategists in a Bloomberg survey — just 1% above Wednesday’s close. Britain’s FTSE 100 is forecast to end 2023 pretty much where it is now, while the Euro Stoxx 50 and Germany’s DAX are seen rising by less than 3%.

With the global economy expected to slow, and with so many moving parts in the market, the average target hasn’t changed much from predictions made a month ago. Among those surveyed, the two most bearish firms — Bank of America Corp. and TFS — raised their targets by as much as 5%, while four firms cut their forecasts by a similar magnitude.

“With the relative valuation of equities to bonds at levels not seen since the great financial crisis, and earnings momentum in negative territory, we expect European equities to remain under pressure from any further increase in bond yields,” said Societe Generale SA’s head of European equity strategy, Roland Kaloyan. He reiterated his Stoxx 600 year-end target of 440 points, but expects further downside in the first half of 2024 as the economy weakens.

COMMENTS: US could be a beneficiary of an exodus of European stocks

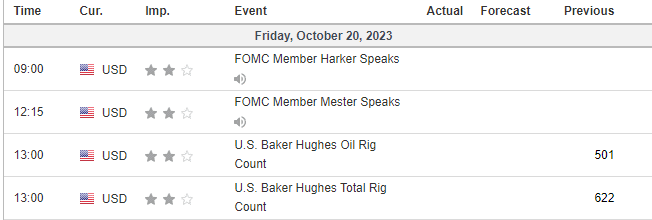

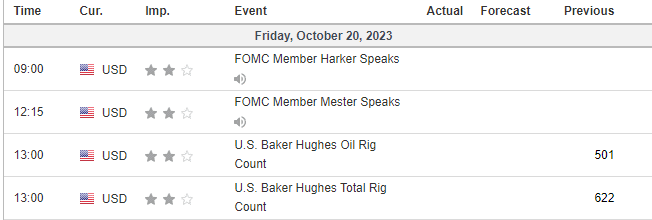

US DATA TODAY