October 13th 2023

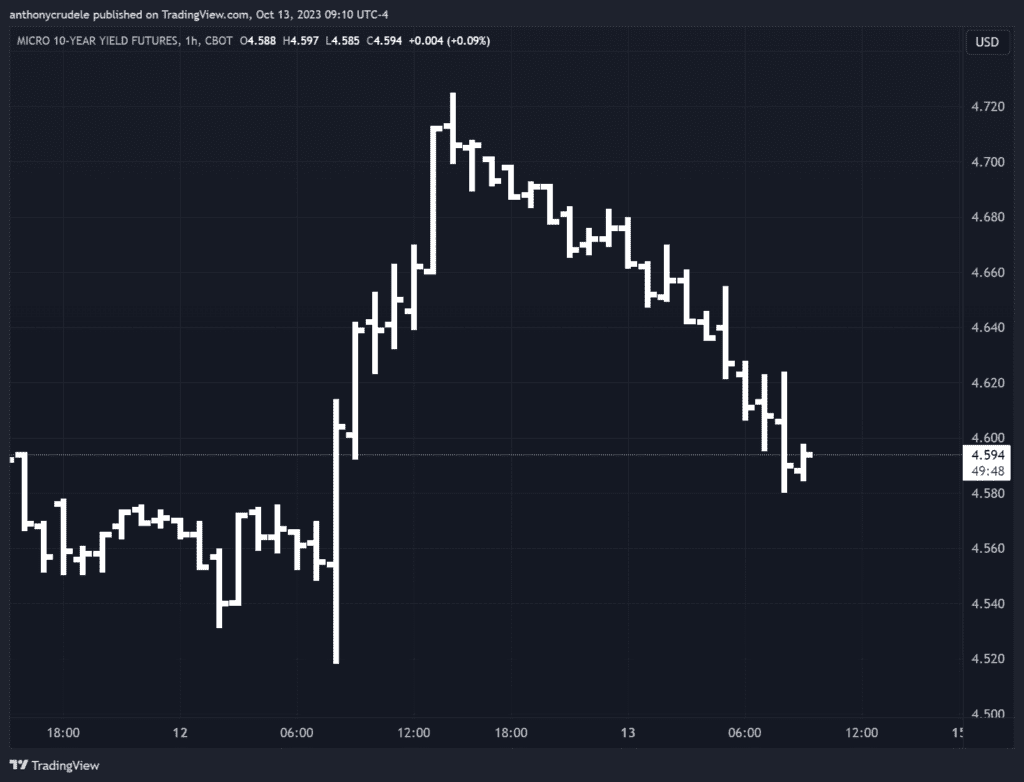

As the week comes to an end, we have a tricky day ahead. Yesterday, there was a midday rally in 10-year yields, causing a decent selloff in ES. This morning, the 10-year yield has almost returned to its starting point, which is why we’re seeing ES rise again. I’ve been emphasizing the importance of keeping an eye on bond charts, even if you’re not trading them. Bonds are currently leading the market.

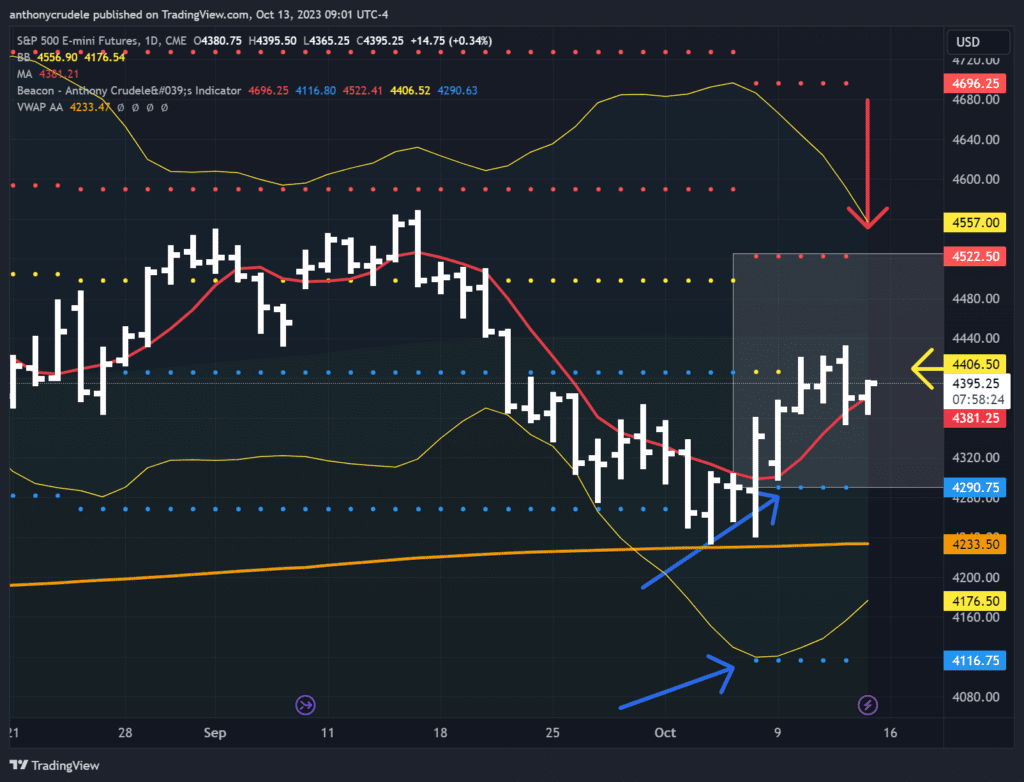

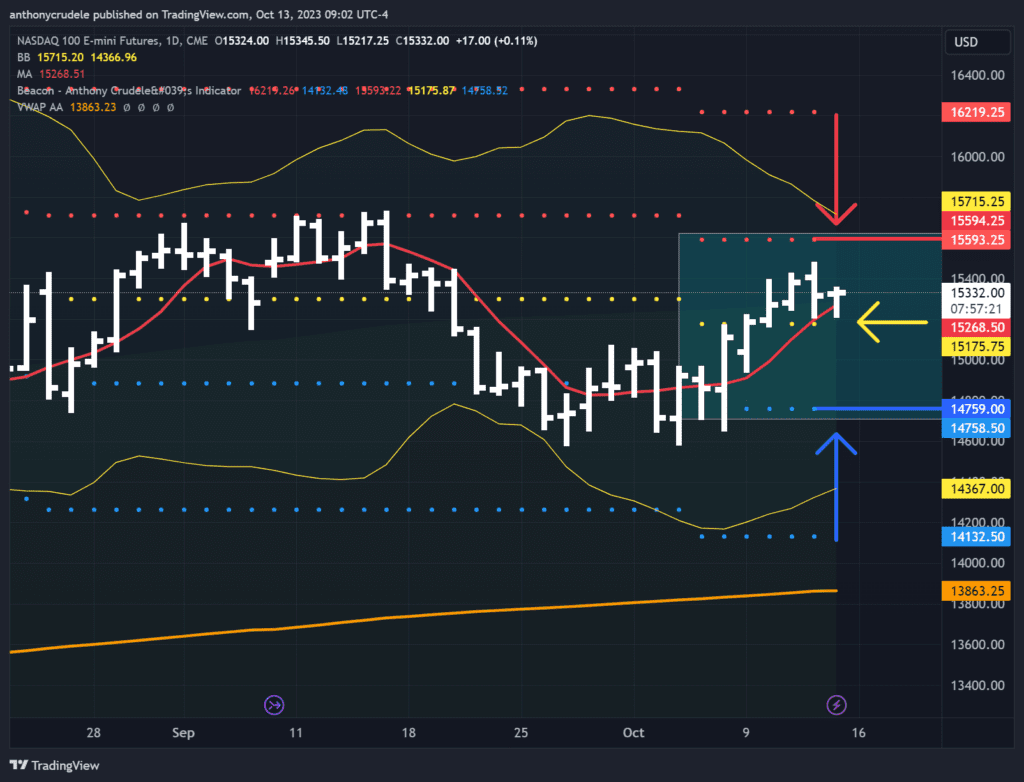

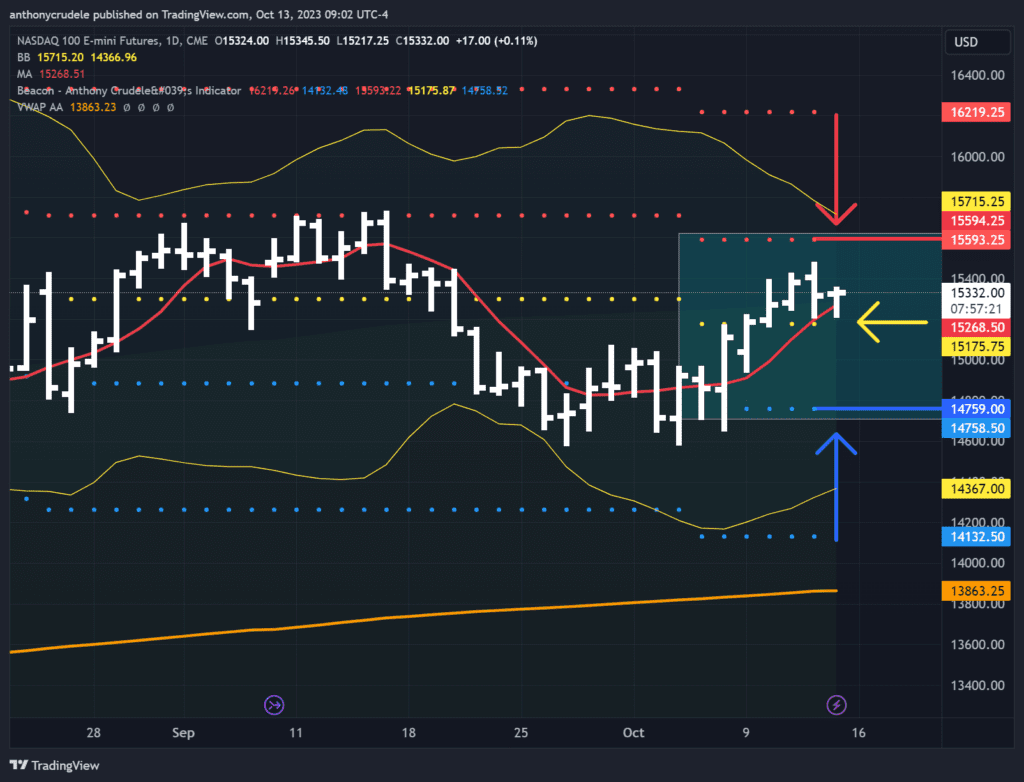

The daily chart remains bullish, as we continue to hold above the 5-day moving average. Although we didn’t close above the neutral area of 4406.50, the NQ remains above its neutral area of 15,175. This is significant because the NQ is the upside leader, giving us more confidence in the bullish case for ES.

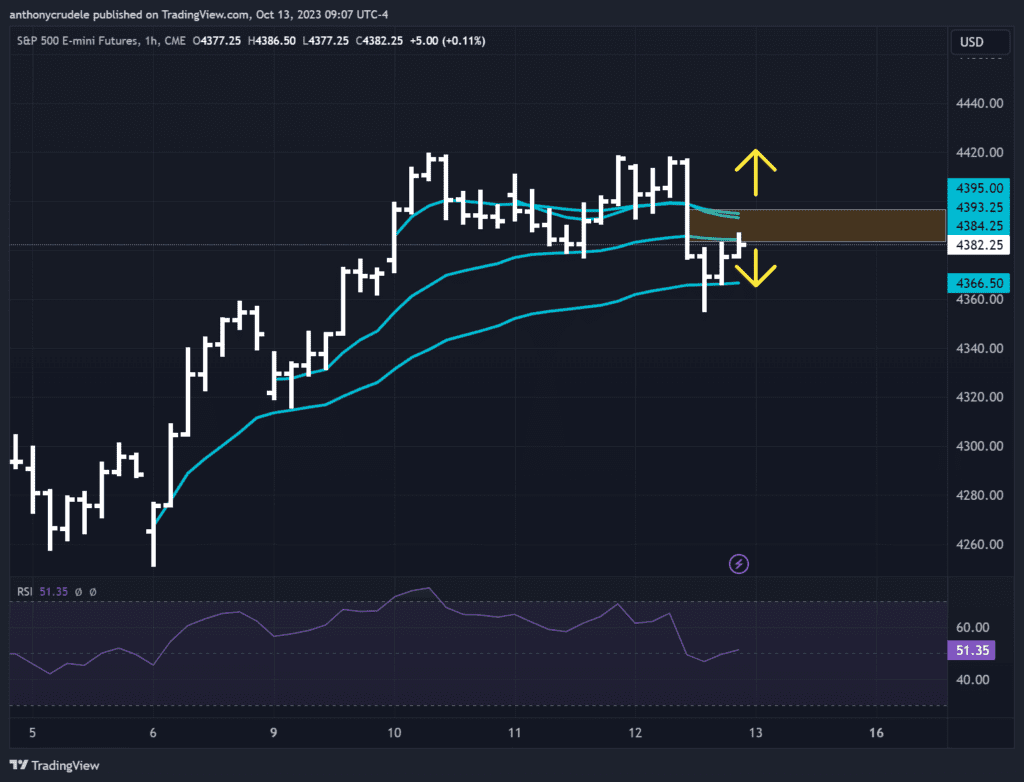

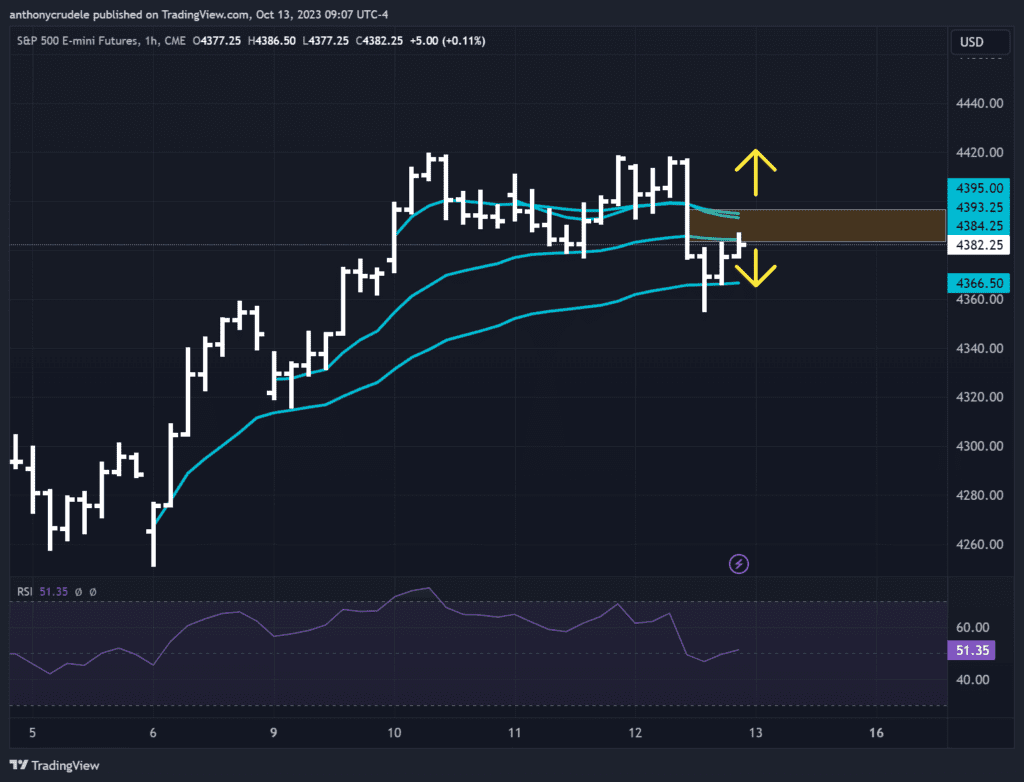

Here’s the trading plan for today: I set VWAPs (Volume Weighted Average Price) based on the opening bar from Monday to Friday, giving us 4 VWAPs for the week. These VWAPs serve as a guide for the week’s trends and provide a good directional play if we’re above or below them. The range from 4395 to 4384 is a no-trade zone for me as it tends to be choppy.

If the opening range holds above 4395, I consider long positions, targeting the 4404-4410 area. This is similar to what I did yesterday morning. On the other hand, if we fail to hold above 4384, I consider a small short position with a tight stop, targeting the 4366-4368 area. However, for me to consider a short position, rates need to be rising. Since the daily chart remains bullish, I prefer long positions over short positions.