Q3 Earnings Kick Off With Banks Today (see post below)

SEA OF RED

- Hong Kong: Hang Seng closed DOWN -2.33%

- China CSI 300 -1.05%

- Taiwan KOSPI -0.95%

- India Nifty 50 -0.30%

- Australia ASX +0.09%

- Japan Nikkei -0.63%

- European bourses in negative territory so far this morning

- USD -0.08%

TOP STORIES OVERNIGHT

US imposes first sanctions under Russian price cap on tanker owners-Reuters

The U.S. on Thursday imposed the first sanctions on owners of tankers carrying Russian oil priced above the G7’s price cap of $60 a barrel, one in Turkey and one in the United Arab Emirates, in an effort to close loopholes in the mechanism designed to punish Moscow for its war in Ukraine.

The cap bans Western companies from providing maritime services, including insurance, finance and shipping, for Russian seaborne oil exports sold above $60 a barrel, while seeking to keep oil flowing to markets. Caps also were imposed on Russian fuel exports.

U.S. President Joe Biden’s administration placed sanctions on Turkey-based Ice Pearl Navigation SA, owner of the Yasa Golden Bosphorus, which the Treasury said carried Russian ESPO crude priced above $80 a barrel after the cap took effect in December last year.

The U.S. also imposed them on UAE-based Lumber Marine SA, owner of the SCF Primorye, which the Treasury said was carrying Novy Port Russian crude above $75 per barrel.

“Because of the actions we’re announcing today, and the further actions we will take in the coming weeks and months, these costs will continue to rise and Russia’s ability to sustain its barbaric war will continue to weaken,” a senior Treasury official, speaking on condition of anonymity, told reporters in a call.

COMMENTS: This plus tensions escalating in the Middle East/Asia is why crude is ripping as it could crimp global supply. In addition, Hamas has called for a global Jihad today, cities are on watch across the globe. (stay safe out there today)

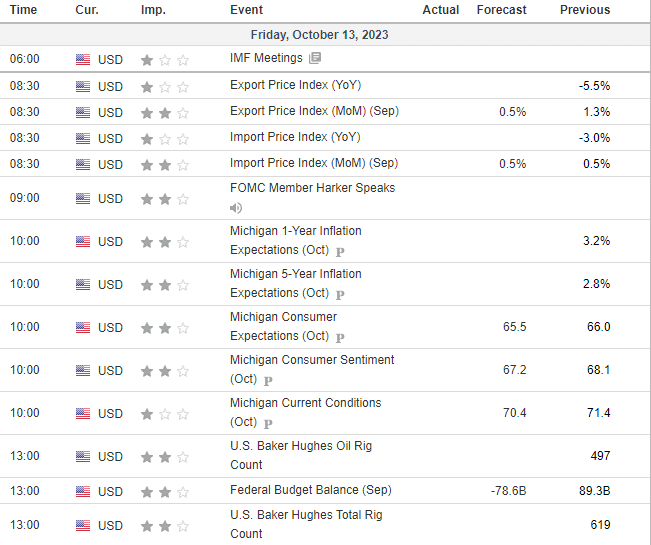

Bank earnings today

The third-quarter earnings season is starting on Friday with reports from JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co. Some of the biggest US banks are poised to write off more bad loans than since the early days of the pandemic as higher-for-longer interest rates and a potential economic downturn put borrowers in a bind. – Bloomberg

COMMENTS: This could set the tone for US markets today

IMF Warns of Spillover Risks From China’s Property Sector Slump-BBG

International Monetary Fund economists warned that China’s real estate sector downturn could erode growth prospects in the Asia Pacific region, which is already seeing signs of its recovery losing steam.

“In the near term, the sharp adjustment in China’s heavily indebted property sector and the resulting slowdown in economic activity will likely spill over to the region, particularly to commodity exporters with close trade links to China,” IMF economists Yan Carrière-Swallow and Krishna Srinivasan wrote in a report published Friday.

The region is also facing growing geopolitical headwinds as some nations pursue supply chain diversification and shift demand to domestic sources.

“In a downside scenario where “de-risking” and “re-shoring” strategies take hold, output could decline by up to 10 percent over five years in the Asian economies most closely linked to China’s economy,” they wrote.

The IMF earlier lowered its growth forecast for the region to 4.2% for next year, down 0.2 percentage points from an April projection. The estimate for 2023 remains at 4.6%, up from 3.9% last year.

“Our less-optimistic assessment is based on signs of slowing growth and investment in the third quarter, in part reflecting weaker external demand as the global economy slows, such as in Southeast Asia and Japan, and faltering real estate investment in China,” they said.

COMMENTS: This is weighing on global markets today

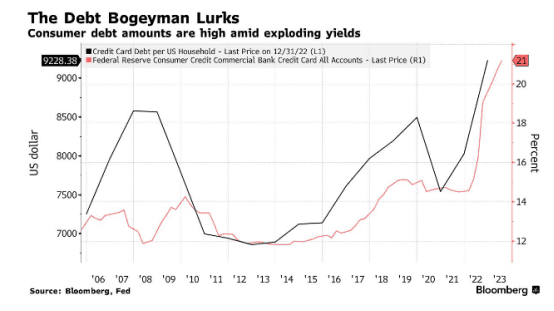

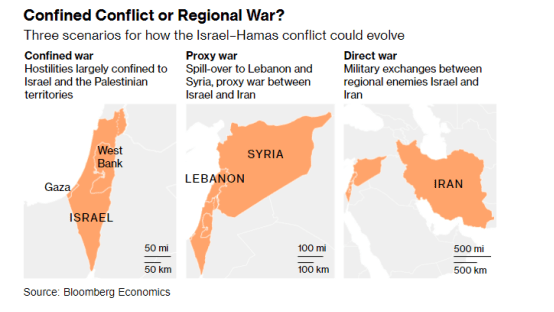

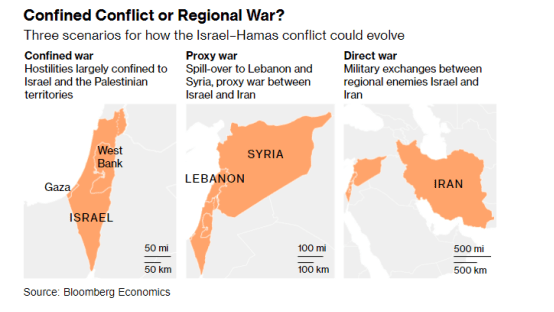

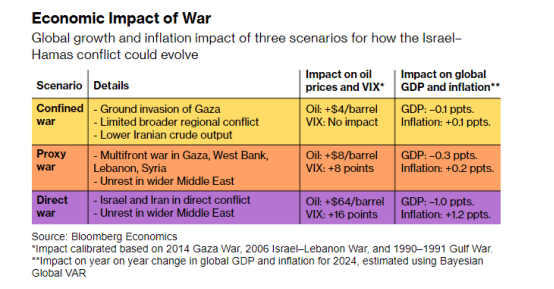

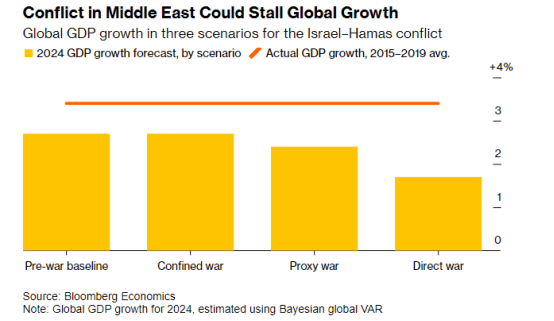

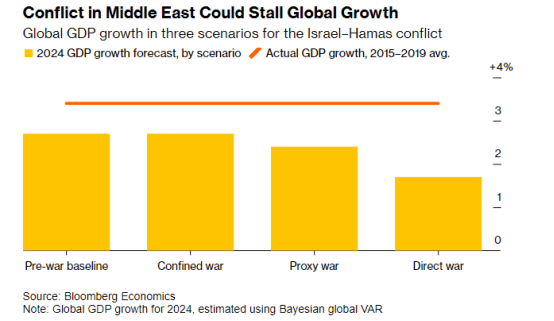

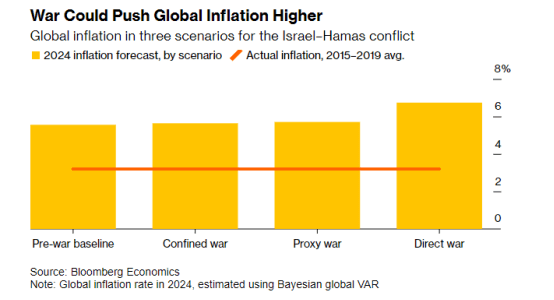

Wider War in Middle East Could Tip the World Economy Into Recession-BBG

Bloomberg Economics has examined the likely impact on global growth and inflation under three scenarios.

Treasuries Jump on Israel-Hamas Conflict-BBG

Treasuries rallied as investors turned to havens on signs Israel is preparing for a ground invasion of Gaza.

The 10-year Treasury yield dropped eight basis points, paring some of Thursday’s sharp rise in the wake of hotter-than-expected US consumer price data. European bonds also gained, with the German 10-year yield falling seven basis points.

“Bonds are rallying ahead of the weekend as traders likely want to hedge geopolitical risk,” said Christophe Barraud, chief economist and strategist at Market Securities LLP.

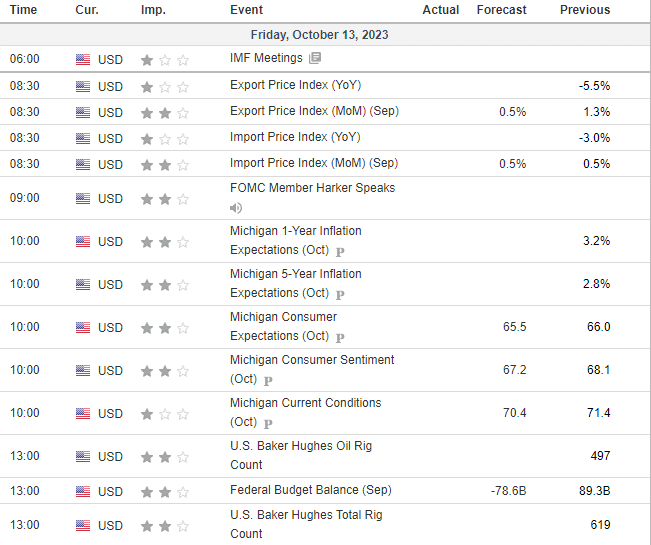

US DATA TODAY