November 1st, 2023

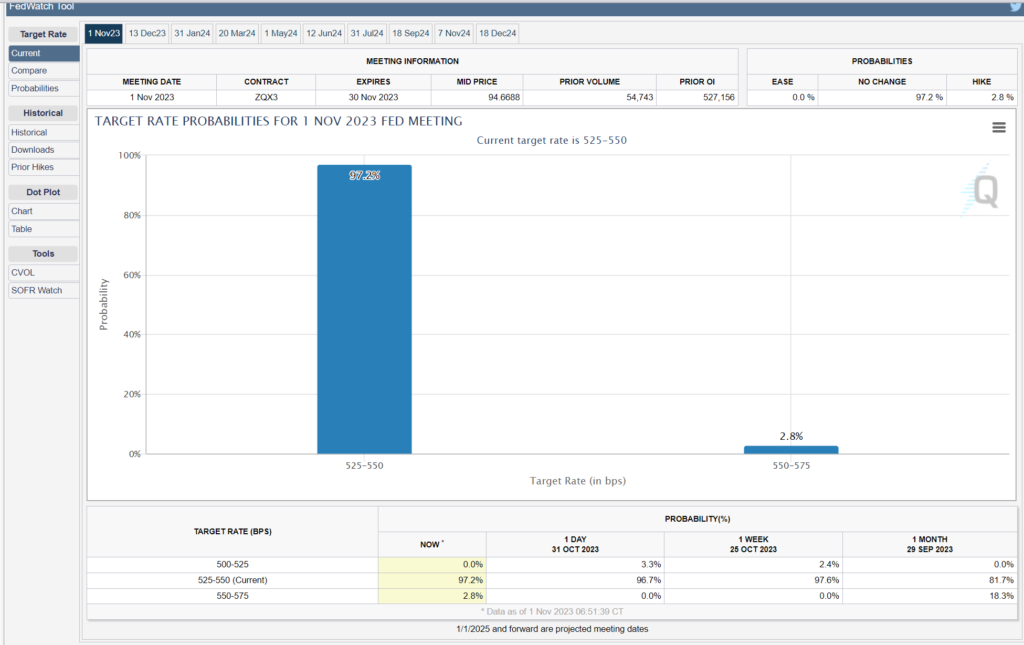

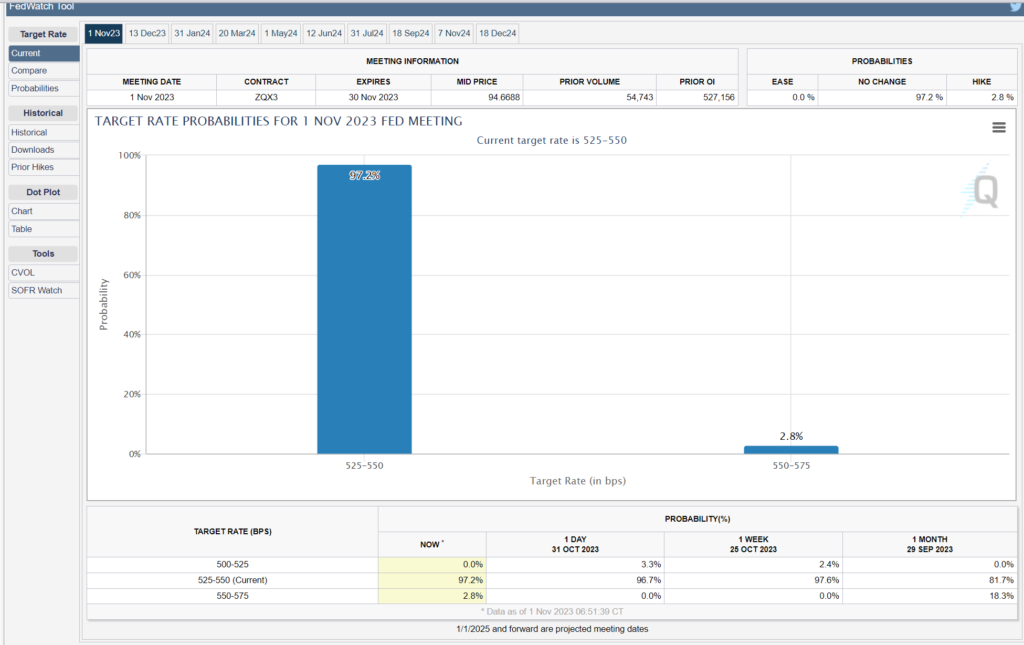

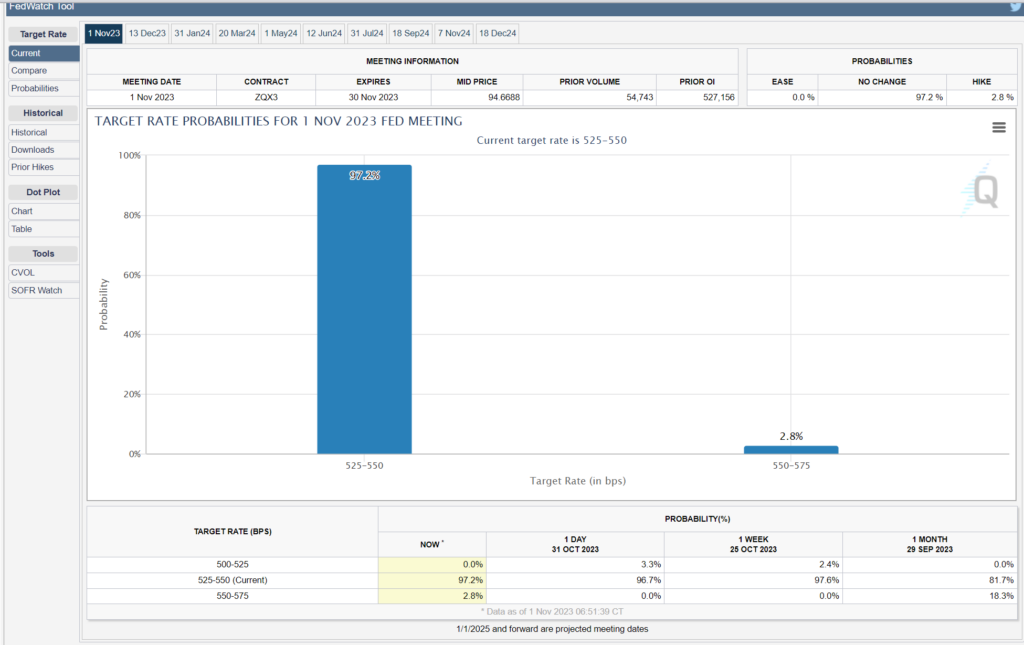

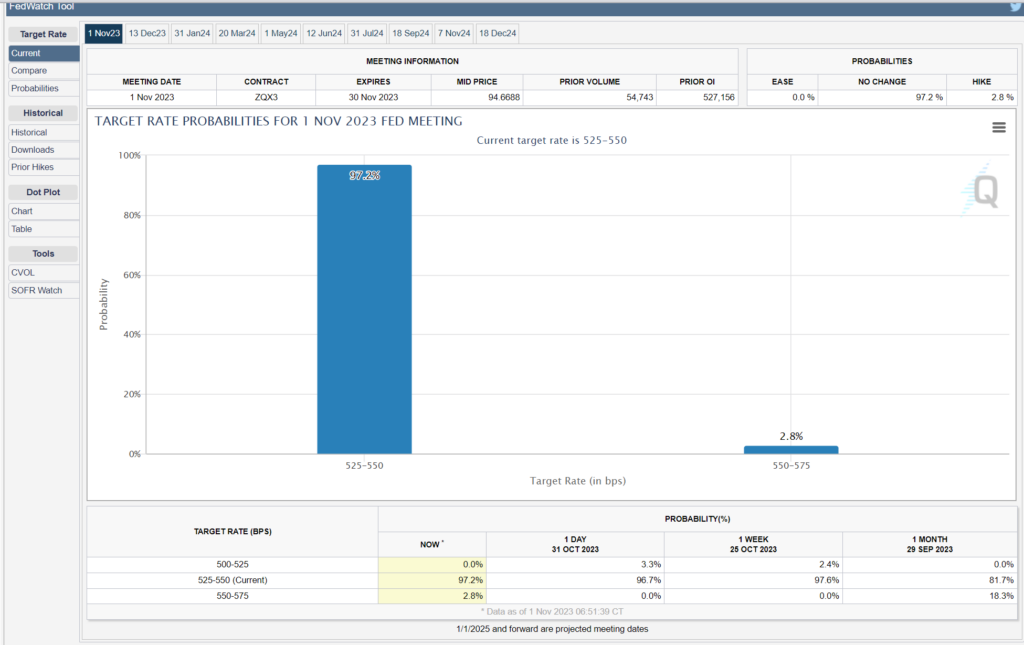

It’s FOMC day, and CME Group’s FED Watch Tool indicates a 97.2% chance that the Fed will leave rates unchanged. The market has already factored this in. The real action will happen during the conference after the announcement. In the December meeting, there’s a 73.1% chance of the Fed keeping rates unchanged. So, the market will be looking for any hawkish talk. If that happens, don’t expect a market sell-off. Instead, observe the price action to gauge the market sentiment. I’ve seen many people lose their shirts trying to predict the market’s moves instead of reacting to them.

No trading for me today. I’m not too keen on this current environment and will be watching from the sidelines. However, there are a few key technical areas to note in ES right now:

I recently made a video discussing how to identify trend reversals (watch here https://anthonycrudele.com/show/10-minute-technical-4/ ), and those concepts are crucial for me at the moment. Yesterday, the bulls had a good day, but the bears actually won. The Anchored VWAP on the daily chart held precisely to the tick. Additionally, we still have a downward sloping 5-day moving average, and the Bollinger Bands are expanding, indicating a range expansion.

The bears still have the upper hand, and today’s action will be important for evaluating the closing. If we manage to close above the AVWAP and the Bollinger Bands start to contract, we might have a low to work off towards the end of the year. Until then, expect a two-way tape with a slight bias towards the bears.

I’ll be live today at 12 ET with the Order Flow Labs crew, set your reminder and join us on my YouTube channel: https://www.youtube.com/live/DhgfNuorvfo?si=ZXYzin12HLAdqu4n Keep it light and tight. Cheers, DELI