HAPPY FOMC DAY!!

Mixed Markets

- Hong Kong: Hang Seng closed down -0.06%

- China CSI 300 -0.04%

- Taiwan KOSPI +1.03%

- India Nifty 50 -0.53%

- Australia ASX +0.10%

- Japan Nikkei +0.47%

- European bourses in mixed territory so far this morning

- USD +0.20%

TOP STORIES OVERNIGHT

Fed’s ‘Hawkish Pause’ to Keep Option to Hike-BBG

The Federal Reserve is poised to hold interest rates steady at a 22-year high for a second meeting, while leaving open the possibility of another hike as soon as December with economic growth staying resilient.

The Federal Open Market Committee will keep rates unchanged at its two-day meeting ending Wednesday in a range of 5.25% to 5.5%, a level first reached in July. The rate decision and an accompanying statement will be released at 2 p.m. in Washington. Chair Jerome Powell will hold a press conference 30 minutes later.

Powell has signaled that Fed leaders would prefer to wait to evaluate the impact of past increases on the economy as they near the end of their rate-hiking campaign. With inflation still well above the committee’s 2% target and the economic growth rate near a two-year high, policymakers want to retain the option to move again.

COMMENTS: All eyes on the presser at 2:30PM ET

BOJ Buys More Bonds to Slow Rising Yields a Day After Tweak-BBG

The Bank of Japan stepped into the bond market unexpectedly Wednesday to curb the pace of gains in sovereign yields, just a day after announcing it was loosening its grip on debt prices.

The central bank’s unscheduled purchase operation statement came as the benchmark 10-year bond yield touched 0.97% — a fresh decade-high but still below the 1% cap it removed in favor of a more flexible policy setting.

There was very little immediate market reaction to the move, with traders trimming one basis point off the 10-year yield before it recovered half of that. Bond futures pared losses and the yen, which is sensitive to shifts in interest rates, shed a fraction of its advance versus the dollar

COMMENTS: They just can’t help themselves

China firm launches stock indices to tap into rush for safe-haven gold-Reuters

China’s biggest index provider launched on Wednesday two gold-linked stock indices to cash in on surging demand for exposure to the safe-haven metal amid a slump in the local real estate market and volatile global markets.

The new indexes (.CSI931493), (.CSI931413), launched by the China Securities Index Co, include shares of global gold miners such as Newmont Corporation and Barrick Gold .

COMMENTS: Keep an eye on gold and miners…this move could be legit

Orsted hit by up to $5.6 billion impairment on halted US projects-Reuters

Renewable energy firm Orsted (ORSTED.CO) on Wednesday halted the development of two U.S. offshore wind projects and said related impairments could spiral to as much as 39.4 billion Danish crowns ($5.58 billion).

The stock, which had dropped about 40% since August, plunged another 22% in early trade.

Orsted, the world’s largest offshore wind developer, said it would stop developing its 2,248-megawatt (MW) Ocean Wind 1 and 2 projects in New Jersey as part of an ongoing review of its U.S. offshore wind portfolio.

COMMENTS: Siemens now Orsted…..wind is a bad place to be

Oil-Merger Mania Threatens Crude’s Liquidity as Hedgers Vanish-BBG

The recent wave of dealmaking by US oil producers — which may not be finished just yet — is hastening a decline in liquidity from the oil market.

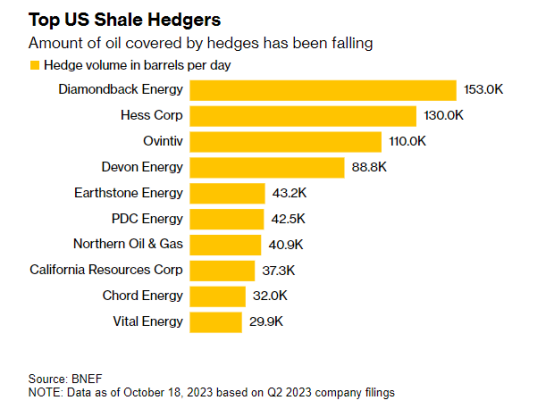

Hess Corp. and Pioneer Natural Resources Co. have in recent years bought large derivatives positions to lock in prices for their future production. Those holdings are set to dry up after the drillers’ takeovers by Chevron Corp. and Exxon Mobil Corp. because supermajors tend not to hedge, instead using their refining and retail operations as natural buffers against price moves. Two other top hedgers — Devon Energy Corp. and Marathon Oil Corp. — are also said to have held merger talks.

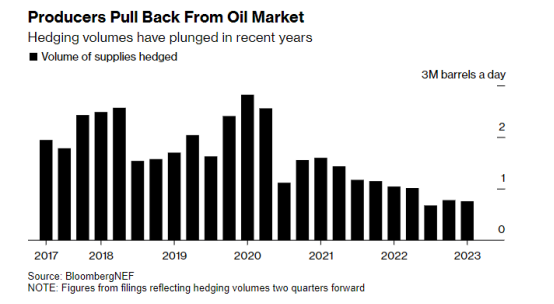

The consolidation threatens to accelerate a decline in listed producers’ activity in the oil derivatives market, potentially increasing volatility and exposing drillers to steeper earnings drops in the event of a price crash. US oil producers had about 750,000 barrels a day of supplies locked in using derivatives contracts in the first quarter, down more than two thirds since before the pandemic, according to data from BloombergNEF. Those are near the lowest levels in data dating back to 2017.

Oil producers typically use derivative contracts such as swaps and options to cover production about 24 months or more into the future, guaranteeing their revenues even if prices slump. The practice provides crucial liquidity for the more distant oil futures contracts and spurs active trading in the instruments, where participation is otherwise thin.

Hedging volumes across US producers have declined by about 1 million barrels a day since 2019, equating to roughly 365,000 contracts over a year. That’s more than 20% of the current open interest on West Texas Intermediate futures, which is already down by about 1 million contracts from a record set in 2018.

COMMENTS: This will lead to more volatility

US DATA TODAY