November 9th, 2023

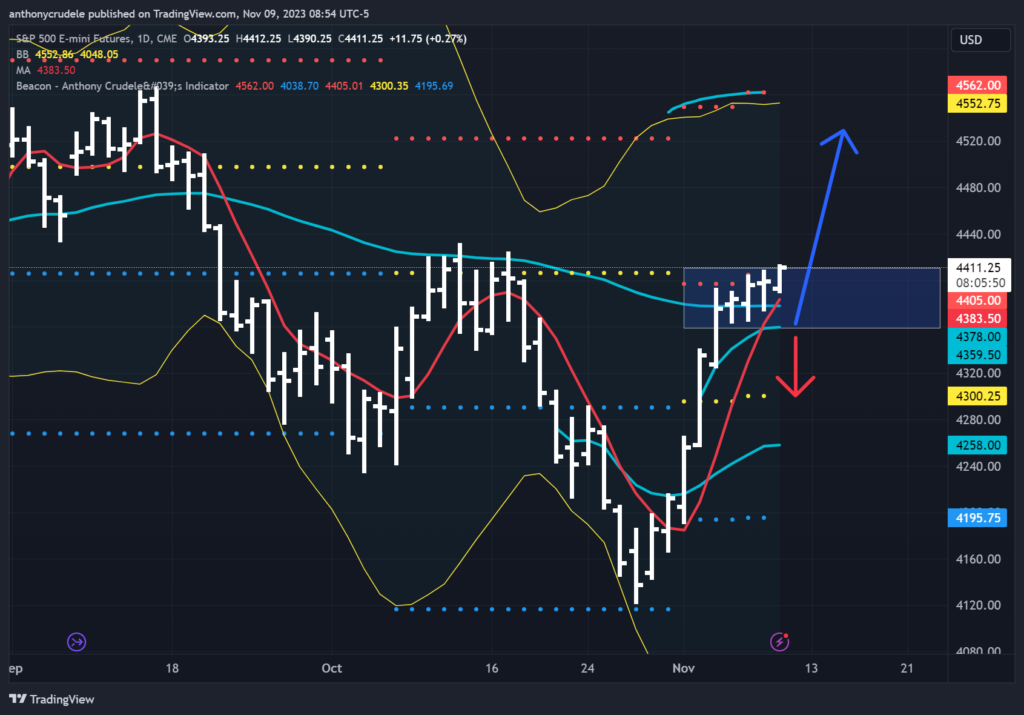

In the words of Frank Abagnale Sr.: Two little mice fell into a bucket of cream, one named Bull and one named Bear. The first mouse, Bear, quickly gave up and drowned. The second mouse, Bull, wouldn’t quit. He struggled so hard that eventually he churned that cream into butter and crawled out. This is what the Bulls are trying to do right now in the ES zone from 4404-4385.

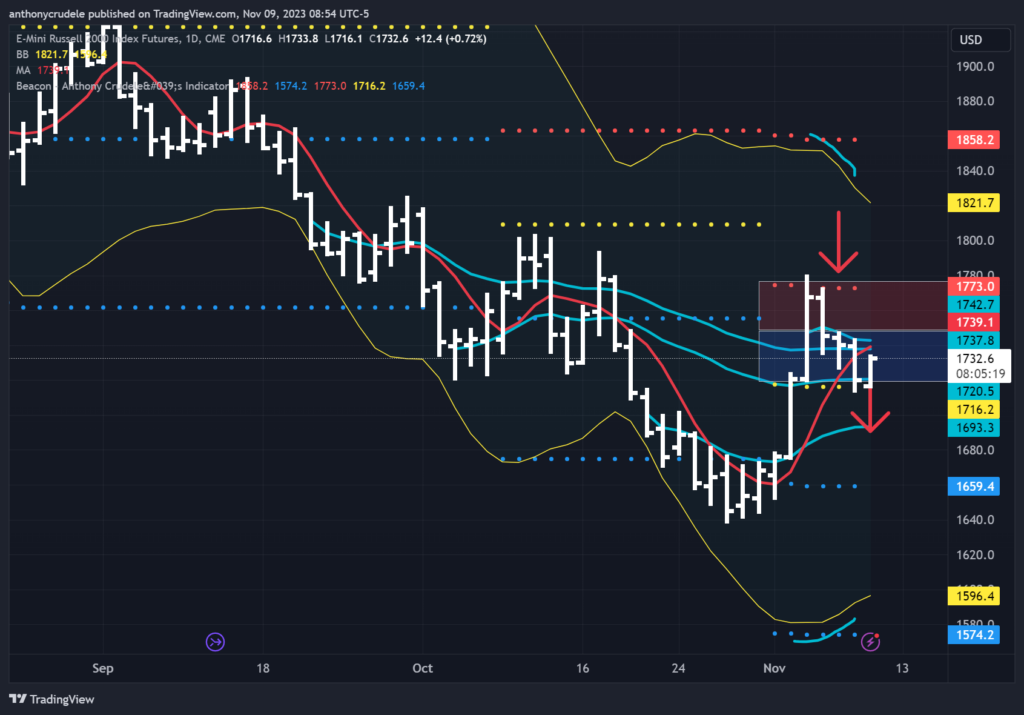

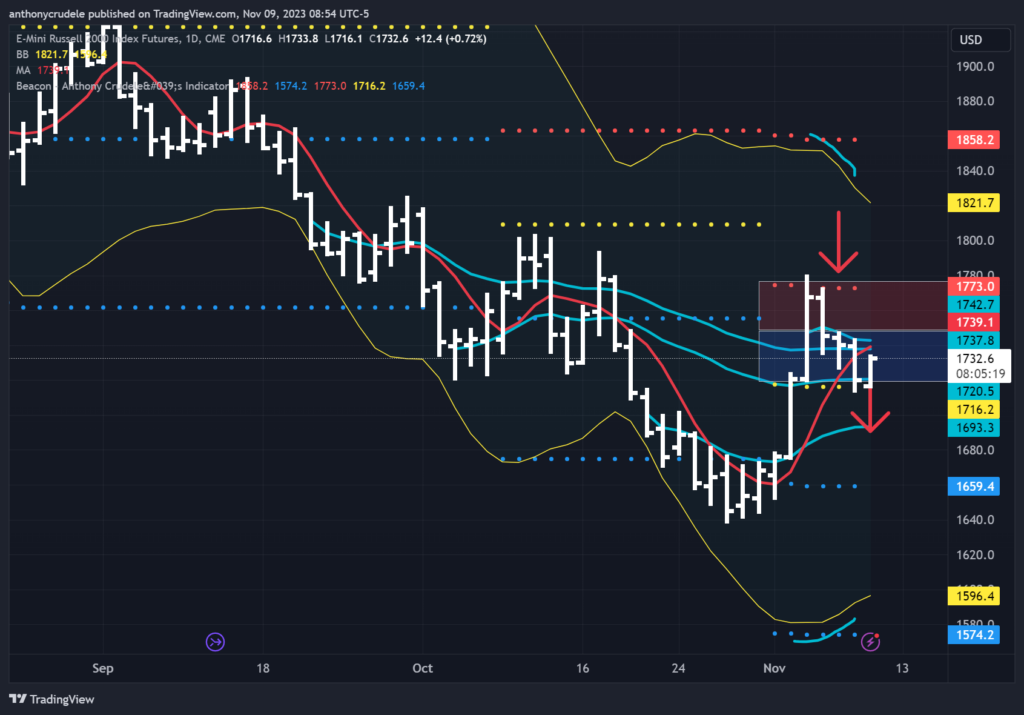

The divergence in the tape continues, with NQ being the strong upside leader and RTY remaining weak. I don’t love this for the bull case in ES, but as long as the RTY doesn’t fall out of bed, I think the strength in the NQ supersedes the weakness in the RTY.

My plan for today: I’m watching 4,404 support as the key pivot to the upside. If we can hold above it, that could potentially bring 4,430 into play today, which I believe will act as resistance. If we can’t surpass 4,430, then it could be off to the races to the upside. Failure to hold 4404 then it’s right back down to 4,393-4,385 for a key test for the bulls. Failure to hold that area puts 4,355-4,350 in play, and then I shift to bearish and I’ll start looking for shorts. My 3-minute opening range strategy with RTH VWAP and 3 standard deviations is key today. If we set up for a trend up day, then I look to be a little aggressive to the buy side.

NQ: As long as it sustains trade above 15,310-15,260, I look for small long positions to ride the wave higher. If we can’t hold 15,260, then 14,900 comes into play, where I can be a more aggressive buyer. Daily upside targets are at 15,900-16,000, but I’ll use my 3-minute opening range strategy with RTH VWAP and 3 standard deviations to guide position trimming and risk management.

RTY is currently a no-trade for me. I’m waiting to see how it trades within the 1,747-1,737 zone. A breakout above or below this range will provide clarity on the direction. Above 1,747, we might see a move towards 1,773. On the other hand, if it drops below 1,737, we could witness a decline towards 1,719. Just a word of caution: be careful of false breakouts in RTY and avoid chasing it.

Gold and oil are also on my radar. Intraday, I’m looking for short positions in gold, with a target of possibly testing 1926 in the upcoming sessions. The key resistance level for gold is at 1986-2003. If there are any rallies into that area, I’ll be a short seller.

As for oil, it could be on its way to testing 72 in the upcoming sessions. I consider 72 as unfinished business in CL, so if we reach that level, I’ll be a buyer on a swing basis. However, it’s important to not rush in at that level; let’s wait and see how it trades. Once we have a better idea, I’ll enter from there. When markets are trending, it’s best to let them test the price before jumping in.

Keep it light and tight. Cheers, DELI