Pretty GREEN out there

- Hong Kong: Hang Seng closed down -0.33%

- China CSI 300 +0.05%

- Taiwan KOSPI +0.23%

- India Nifty 50 -0.22%

- Australia ASX +0.30%

- Japan Nikkei +1.05%

- European bourses in POSITIVE territory so far this morning

- USD +0.12%

TOP STORIES OVERNIGHT

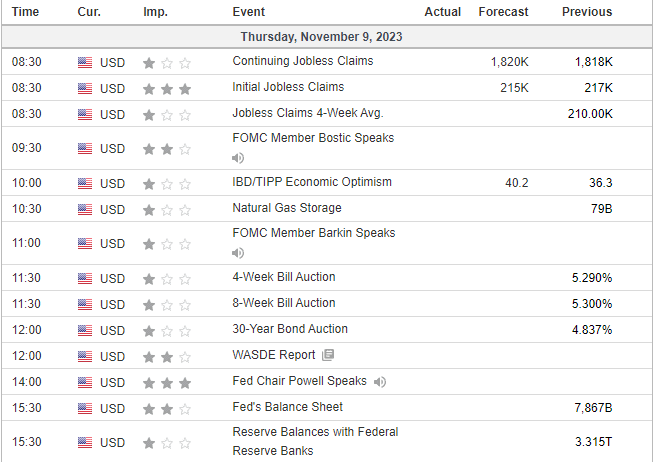

Markets Price an End to Interest-Rate Hikes Across the World-BBG

Rates traders are betting that the steepest global tightening cycle in a generation is over and that monetary easing will begin from mid-2024.

Swaps signal the average cash rate for developed economies will be steady over the coming six months, the first time in two years that they’re not pricing in a hike over that time frame, according to data compiled by Bloomberg. They also show a 50-basis point reduction in the aggregated rate within a year, the biggest bet on easing since the pandemic.

From Europe to the US and Australia, bonds have bounced back this month as traders speculate that central banks may soon call a halt to monetary tightening as price pressures recede. To be sure, it’s a risky bet as previous wagers to that effect backfired after inflation proved to be stickier than anticipated and expectations of a recession failed to materialize.

China’s Consumer Deflation Returns as Recovery Remains Fragile-BBG

China’s deflation pressures worsened in October as consumer prices dipped back below zero and producer cost declines deepened, adding to expectations the economy needs more stimulus to shore up growth.

Consumer prices fell 0.2% last month after hovering near zero in the previous two months, according to data from the National Bureau of Statistics Thursday, lower than the median forecast in a Bloomberg survey of economists. Producer prices fell for a 13th straight month, dropping 2.6%.

China has battled stubbornly weak prices for much of this year. Consumer prices slipped below zero in July and have been teetering on and off the edge of negative year-on-year growth, undermining an August assessment by the People’s Bank of China that prices would rebound from the summer’s rough patch. Coupled with the ongoing declines in factory-gate costs, that’s led to calls for more support to counter deflationary pressures.

COMMENTS: Low inflation has been one of the main reasons cited by economists who argue that China’s economy is growing below its potential and needs more monetary and fiscal stimulus

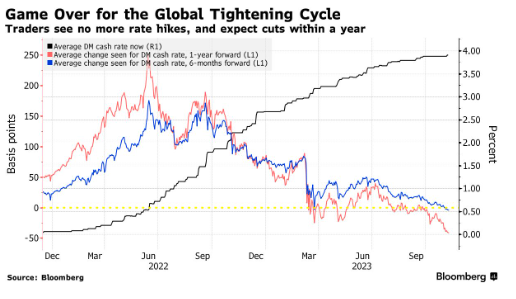

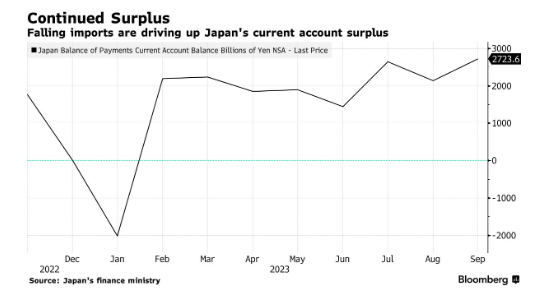

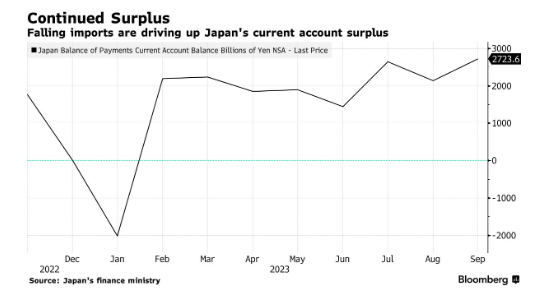

Japan Current Account Surplus Hits Record in Support for Economy-BBG

Japan’s current-account surplus hit a record high in the first half of this fiscal year, marking a potentially positive development for the country’s economic recovery and weakened currency.

Japan’s current-account surplus reached a record of ¥12.7 trillion ($84.2 billion) for the six months through September, driven by a drop in imports, according to the Finance Ministry on Thursday. The surplus also rose from a year earlier to ¥2.72 trillion in September, the highest level in 18 months, although it fell short of economists’ consensus forecast of ¥2.98 trillion. The country extended its surplus streak to eight months.

COMMENTS: Nikkei up nicely today on this

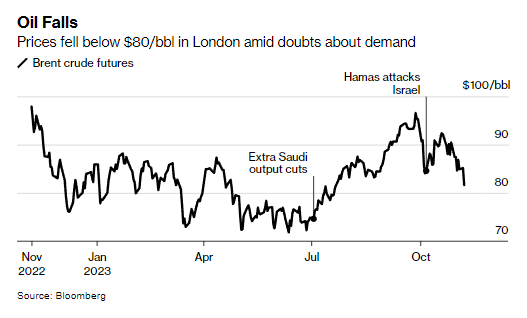

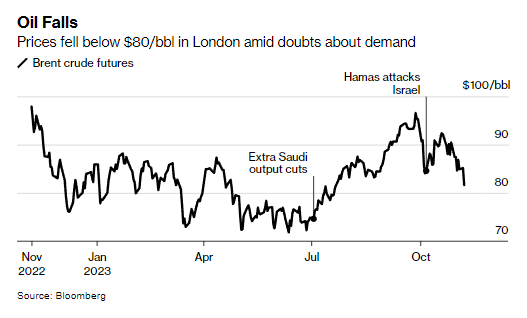

Oil at $100 a Barrel is Looking Less Likely After All-BBG

The big bang expected for oil prices this year is turning into a whimper.

Just weeks ago, Brent crude was on the cusp of finally fulfilling industry forecasts of a return to $100 a barrel as record fuel demand and Saudi Arabia’s supply cuts depleted global oil inventories. The eruption of conflict in the Middle East shortly after heightened the risk of a price spike.

But on Wednesday the benchmark retreated to a three-month low under $80 a barrel. Concerns about supply are giving way to doubts about plunging refinery profits in China and Europe, lackluster physical cargo trading and an uncertain economic outlook for the US.

“The market seems to be shifting its focus from fear-driven geopolitics to hard-fact fundamentals,” said Norbert Ruecker, an analyst at Julius Baer & Co. Ltd. “Ample supplies, incremental production growth, and stagnating demand create an overall soft fundamental backdrop.”

Still, forecasters such as Goldman Sachs, Standard Chartered Plc and Barclays Plc see scope for crude to pick up again as further increases in demand whittle away stockpiles.

COMMENTS: Almost time to get long again!

Also note in response to this recent sell-off: Saudi Energy Minister Prince Abdulaziz bin Salman said on Thursday that oil demand is healthy and speculators are to blame for the recent drop in prices.

“It’s not weak,” he told reporters in Riyadh. “People are pretending it’s weak. It’s all a ploy.”

(we all know what happened the last two times he warned/blamed speculators…..)

ArcelorMittal reports higher-than-expected Q3 profit-Reuters

ArcelorMittal, the world’s second-largest steelmaker, “continued to demonstrate structurally improved profitability,” it said on Thursday after reporting higher-than-expected third-quarter earnings.

The group said it still expected global steel demand excluding China to grow by between 1% and 2% this year, but sees demand in Europe below previous guidance of -0.5% due to weak construction activity there.

COMMENTS: Interesting to note as everyone is talking global slowdown…apparently not…or not everywhere

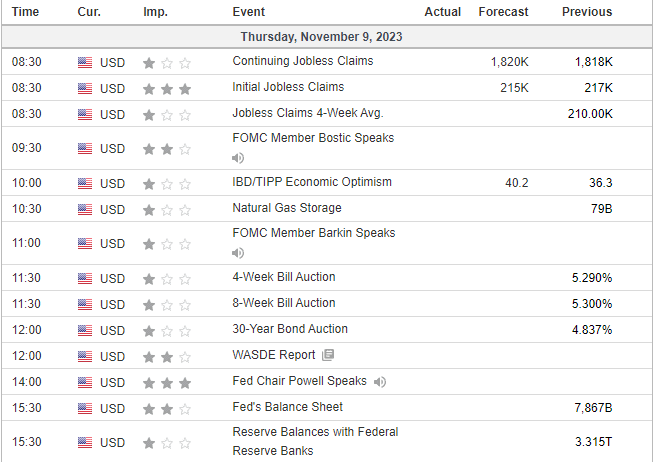

US DATA TODAY