November 14th, 2023

The bulls are consistently winning the battles. Yesterday, the bears had an opportunity to push the market downwards, but they couldn’t accomplish the task. Currently, the shorter-term charts show compression, while the daily chart indicates range expansion. To me, this indicates that the bulls are ready for another significant rally. Today, we have the CPI data, and unless it triggers algorithmic selling, I believe the market will find a way to grind higher. In the words of the band Creed, ‘CPI, Can you take me higher? To a place with golden streets.’

My plan for today: Watch the action in CPI and see how the market reacts to the numbers. Don’t worry about the numbers themselves, watch the market’s reaction.

In ES, we have daily Bollinger Bands expanding outward, 5-day moving average sloping upward, and we’re holding above all key AVWAP’s… all signs of range expansion to the upside. When I go down to the 60-minute chart, it has range compression, which means we’re building up steam for a move. Yesterday, I played the move to the short side and took a loss, but it was a good loss because I followed my plan. Today, I won’t look short unless we push down below 4412.25. If that happens, I will look for a small short position and a test of 4390.75. Aside from that happening, I am only looking at longs. If we can sustain trade above 4321.50 post CPI, then I think the rally continues, and we’re headed up to 4468 in the coming sessions. I think that rally will be a tough trade, so I will be taking my position sizing down so I can withstand the potential chop.

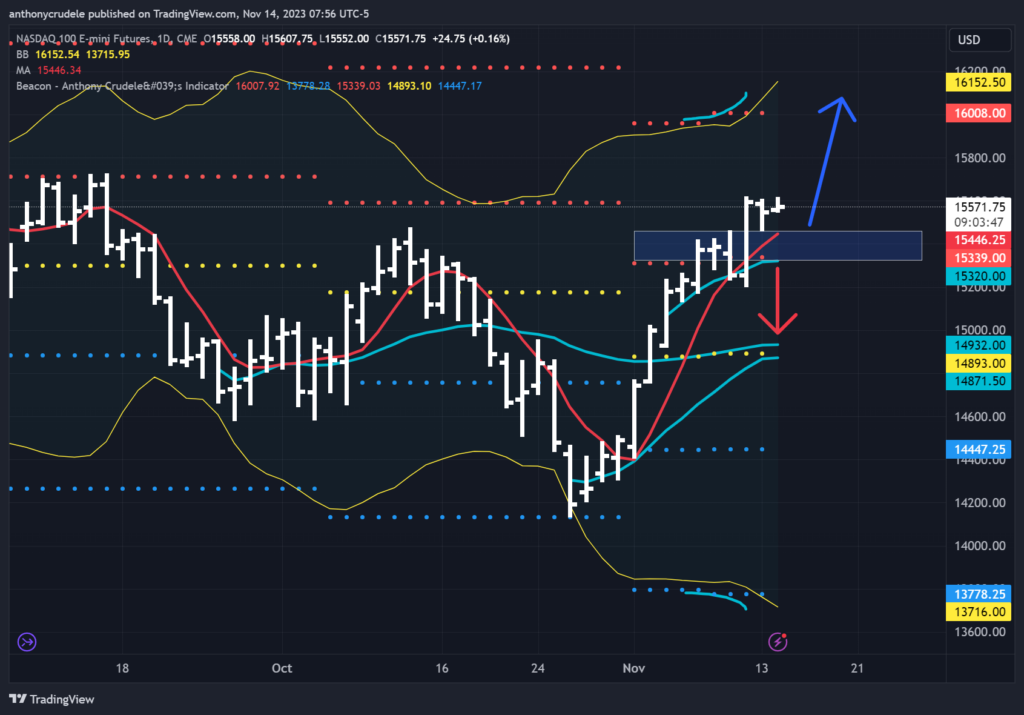

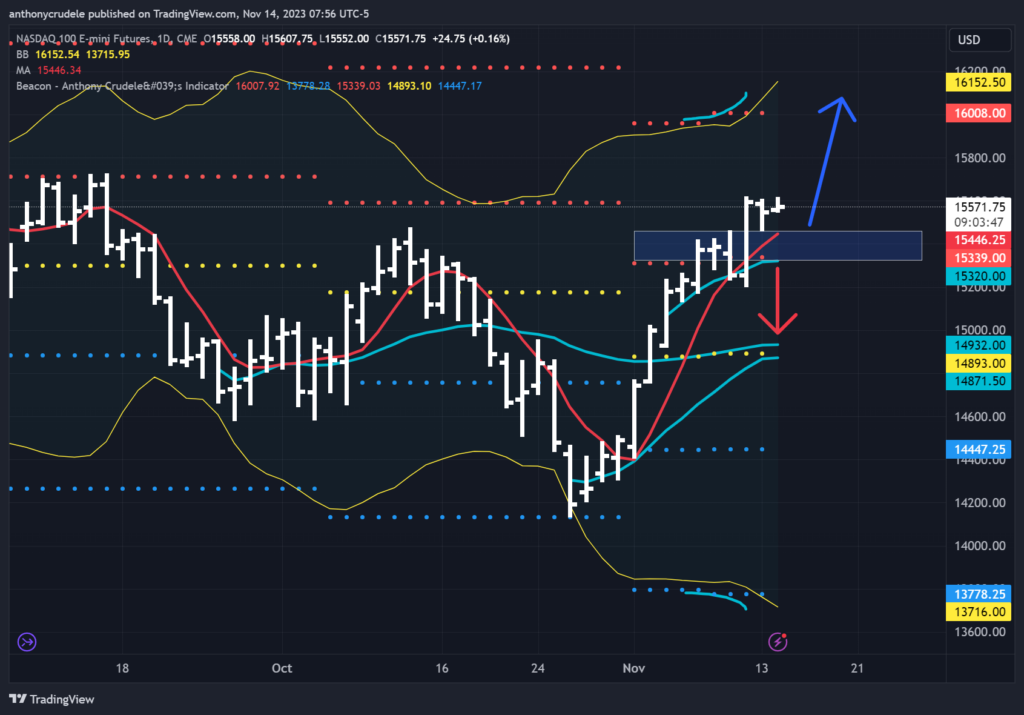

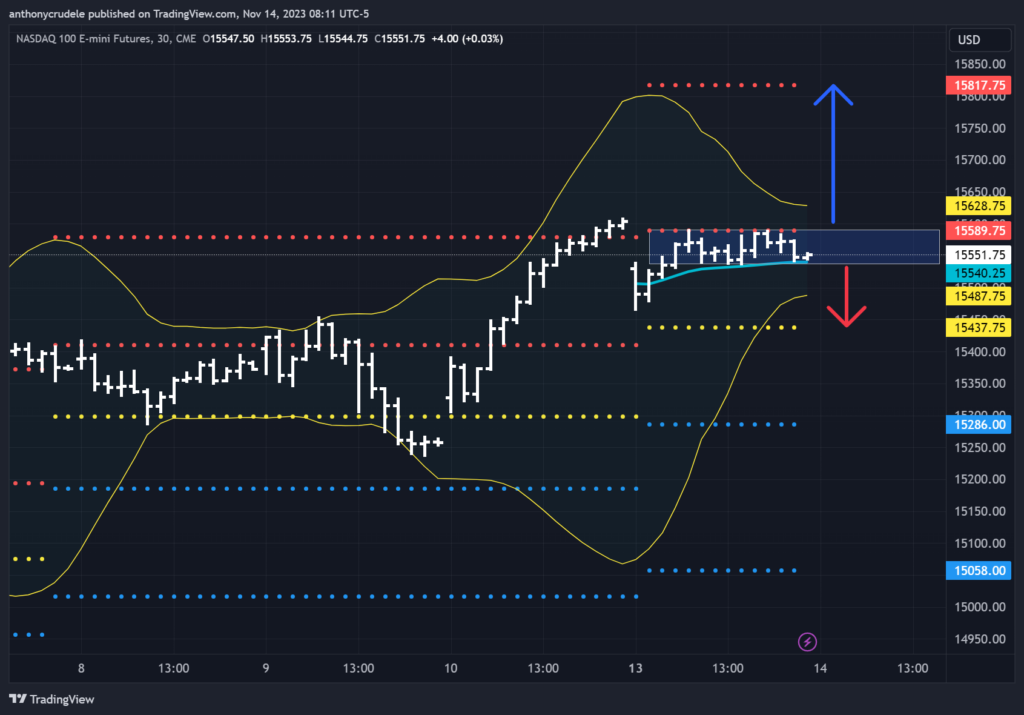

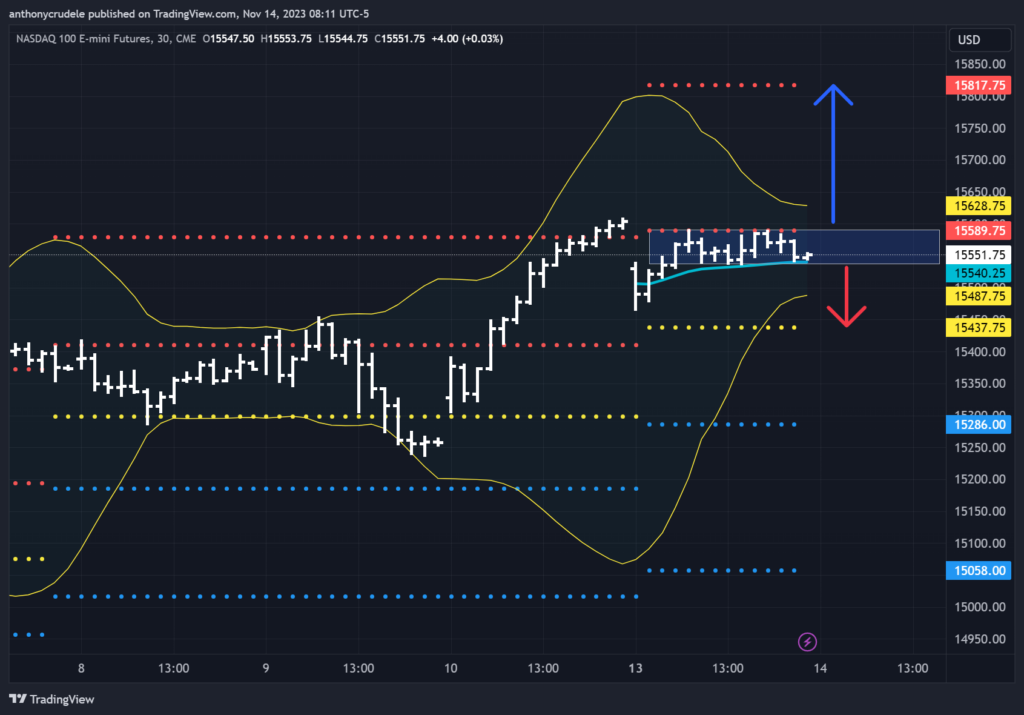

NQ 16,000 remains in my sights, but for today I will be watching the 15,590-540 range. Sustaining trade above it indicates a test of 15800, and I will be looking for longs in NQ. If we cannot hold above 15540, then I think the NQ is headed for a test of 15430 today.

RTY remains a no-trade for me. They are the forgotten index right now, and until they get out of the range between 1719-1694, I think it is a chop zone. I’ve said this before: I don’t love the divergence between RTY and NQ, but I don’t think the ES bulls care about it right now. Until they do, neither do I. To be continued…

Small and smart today. This is not the easiest tape to trade right now. Cheers, DELI