CPI DAY!! 8:30 AM ET

Mixed Markets

- Hong Kong: Hang Seng closed down -0.17%

- China CSI 300 +0.07%

- Taiwan KOSPI +1.23%

- India Nifty 50 +0.09%

- Australia ASX -0.44%

- Japan Nikkei FLAT

- European bourses in MIXED territory so far this morning

- USD -0.07%

TOP STORIES OVERNIGHT

China Mulls $137 Billion of New Funds to Aid Housing Market-BBG

China plans to provide at least 1 trillion yuan ($137 billion) of low-cost financing to the nation’s urban village renovation and affordable housing programs in its latest effort to shore up the struggling property market, according to people familiar with the matter.

The People’s Bank of China would inject funds in phases through policy banks with the money ultimately trickling down to households for home purchases, the people said, asking not to be identified discussing a private matter. Officials are considering options including the so-called Pledged Supplemental Lending and special loans, the people said, adding that the government may take the first step as soon as this month.

The plan, part of a new initiative by Vice Premier He Lifeng, would mark a major step-up in authorities’ efforts to put a floor under the biggest property downturn in decades, which has weighed on economic growth and consumer confidence. Market concerns have mounted over the financial health of the nation’s largest surviving developers after record defaults in the industry.

Dubbed by some as “helicopter money,” PSL allows the central bank to provide low-cost funds through policy and commercial lenders to the developers of the shantytown renovation projects. Developers then use the money to buy land from local governments, which in turn give cash subsidies to households whose old homes were demolished so they can purchase newly-built or existing apartments, driving up demand.

COMMENTS: The onshore yuan rebounded on the report, paring all of the day’s declines to 7.288 per dollar. The yield on benchmark 10-year government bond rose 1.75 basis points to 2.6625%, heading for the biggest increase in three weeks.

IEA raises oil demand growth forecasts, despite economic gloom ahead-Reuters

For 2023, the IEA raised its growth forecast to 2.4 million barrels per day (bpd) from 2.3 million bpd and moving closer to OPEC’s forecast of 2.46 million bpd.

For 2024, the IEA raised its growth forecast to 930,000 bpd from 880,000 bpd, still well below OPEC’s forecast of 2.25 million bpd.

“For now, with demand still exceeding available supplies heading into the Northern Hemisphere winter, market balances will remain vulnerable to heightened economic and geopolitical risks – and further volatility ahead.”

COMMENTS: Current prices not matching up with fundamentals..where demand is outstripping supply. This all speculators, as I keep saying.

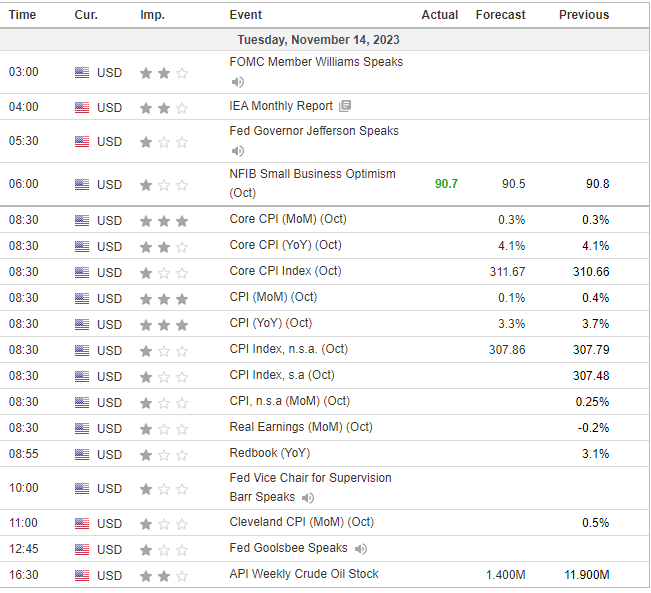

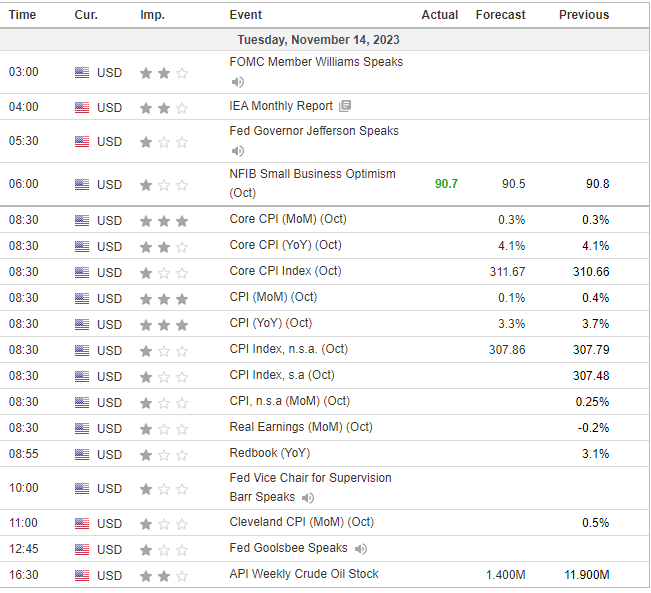

US Inflation Report to Keep Fed Leaning Toward More Rate Hikes-BBG

A monthly US government report on consumer prices due Tuesday is set to show slower progress toward the Federal Reserve’s 2% inflation target, keeping the central bank biased toward more tightening, according to Bloomberg Economics.

The figures are set to show the consumer price index excluding food and energy rose 0.3% for a second straight month in October, leaving the year-over-year rate unchanged at 4.1%, Bloomberg economists Anna Wong and Stuart Paul said Monday in a preview of the report.

“After showing encouraging progress this summer, disinflation in year-over-year core CPI likely stalled, while the monthly pace has been creeping up toward something more consistent with an annualized inflation pace of 3%-4% than 2%,” Wong and Paul said.

“Officials most likely will leave open the possibility of future rate hikes as long as core CPI is running at the current monthly pace.”

COMMENTS: Part of this is due to the metric change for health insurance in the CPI report see here since the market has been forewarned, there MAY be a muted response

Asset Managers Warn of More Failed Trades as US Market Speeds Up-BBG

Global investment houses are bracing for more failed trades as a result of plans to halve the time it takes to settle American stock transactions to just one day.

Around 60% of asset managers fear a higher rate of settlement failures will be the consequence of regulations coming into force in May that will speed up the time it takes to complete a US security trade. That’s according to SIX Group’s Future of Finance report, which polled 343 C-Suite executives at financial institutions from around the world.

The looming shift will put stocks in the largest equity market out of step with not only global peers but also the world of foreign exchange, where trades typically take two days to complete. That threatens to create new risks for firms unprepared for the transition.

“The move is going to impact European market participants that trade in US securities, especially as the risks associated with moving to T+1 include penalties if settlement fails,” said Nicholas Phillips, a market structure researcher at Bloomberg Intelligence. “If you sell a stock in the UK at the same time as buying a stock in the US, the different settlement cycles create a funding and currency risk.”

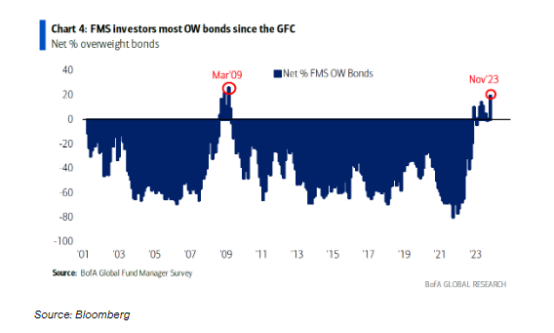

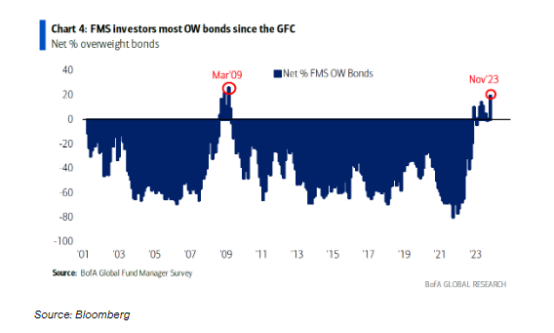

Investors Dump Cash to Chase Bonds, BofA Survey Shows-BBG

Investors turned the most bullish on bonds since the global financial crisis on “big conviction” that rates will move lower in 2024, according to the latest Bank of America Corp. fund manager survey.

The monthly survey showed investors were dumping cash to hold the biggest overweight position in bonds since 2009. BofA’s Michael Hartnett said the “big change” was not the macro outlook, but expectations that inflation and yields will move lower in 2024.

Global stocks and bonds have advanced in November after slumping for the past three months amid concerns that interest rates would move higher and stay elevated for an extended period of time, denting the economy further. The Federal Reserve’s latest meeting somewhat eased these worries, allowing assets to rally.

US DATA TODAY