November 30th, 2023

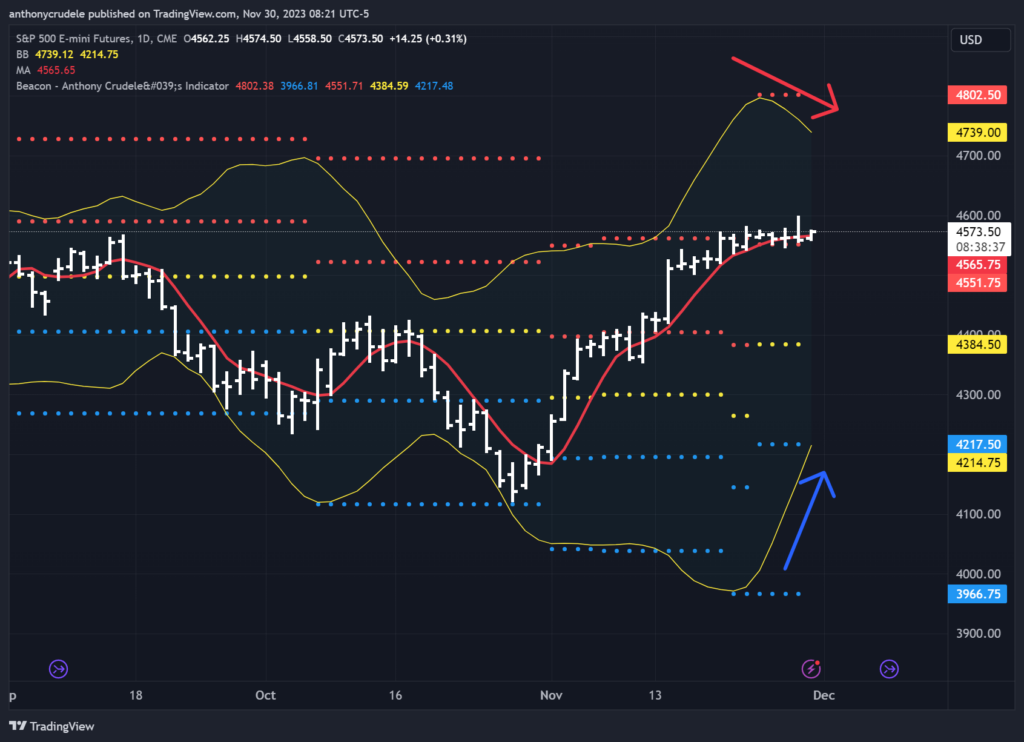

Seasonal Tape. I mentioned the other day that when a market starts to stall in a trend, it will almost always start to show signs of mean reversion, and that’s what we continue to see in the ES. The 5-day moving average sits within the daily ranges, and the daily Bollinger Bands continue to move inward. But as a trader, I understand that there are environments where signals don’t work as well. We’re seasonally bullish right now. We have rollover coming up in futures, big OpEx in December, and the VIX is sitting at lows we haven’t seen in some time. I’ve battled the markets many times in this type of push/pull environment, and it’s a tough trade.

How do we trade it then? Once again, small and smart. Sell rallies if you want to be short, don’t sell into breaks. Buy dips if you want to be long, don’t buy into rallies. Understand that because the VIX is so low, rates continue to slide lower across the curve, and we’re seasonally bullish; the market is going to have tight ranges that most likely favor the bulls. This is not an environment where bears flourish in.

My plan for today. Overnight, in the 60-minute ES chart, we got a buy signal at 4559.50 with a target of 4571.50. Then, that 4571.50 is now a pivot up to 4583.25 or back down to 4559.50. If we can sustain trade above 4559.50 this morning, I like longs to test, 4571.50 and then possibly 4583.25. I would be covering most or all of my position on a test of 4583.25. Wait to see how the market reacts there, and if the bulls can push through it, then we’re most likely headed to 4600. If we fail to hold 4583.25, then I think we’re boxed in today between there and 4559.50 by way of today’s pivot of 4571.50. Keep an eye on the VIX Futures and 10 YR Yields. If they start to revert higher, that could be a short-term bear case for a pullback. If not, it’s a grind up for ES.

End of the month trade. Many of you know that I love the end of the month. Throughout my career, the last day of the month has always been my most profitable. I typically avoid intraday trading on month-end and instead focus on the last 5 minutes of the day. It’s a strategy I’ve employed for nearly 25 years. Today, I believe we will see sellers enter the market during the final 5 minutes of the day. We’ve had a strong rally this month and while there may be some intraday continuation, it’s common to see sellers in the last 5 minutes of the day, who become buyers again the next morning in bullish markets. This is more of an observation than a science, but it’s a trade I’ve done extremely well with over time. At 3:55 PM ET today, I’ll be short selling. Cheers, DELI