OPEC MEETING IN PROGRESS (3 meetings today, final meeting is at 9:30AM ET…lots of rumors until then)

GREEN as far as the eye can see

- Hong Kong: Hang Seng closed UP +0.29%

- China CSI 300 +0.23%

- Taiwan KOSPI +0.61%

- India Nifty 50 +0.19%

- Australia ASX +0.31%

- Japan Nikkei +0.74%

- European bourses in POSITIVE territory so far this morning

- USD +0.54%

TOP STORIES OVERNIGHT

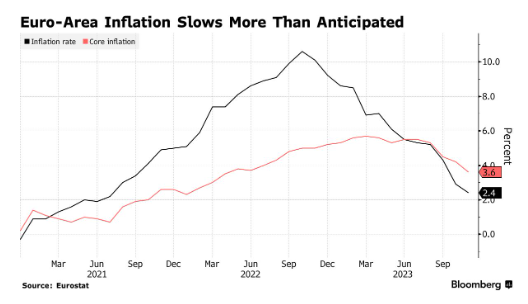

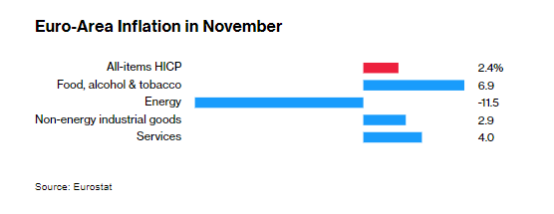

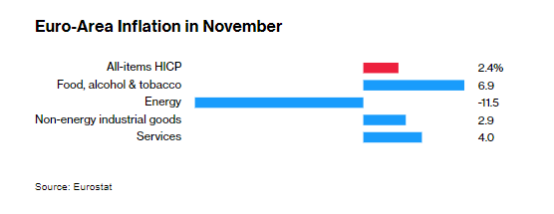

Euro-Area Inflation Slows More Than Expected With 2% in View-BBG

Euro-zone inflation cooled more than expected, putting the 2% target in sight as investors step up bets that the European Central Bank will cut interest rates sooner than officials suggest.

Consumer prices rose 2.4% from a year ago in November — down from 2.9% the previous month and less than the estimates of all economists in a Bloomberg poll. Price pressures continued easing across almost all categories and remained at a two-year low.

A core measure that excludes volatile components including fuel and food moderated for a fourth month, to 3.6%.

COMMENTS: European stocks loving this as market prices in ECB pause/cuts

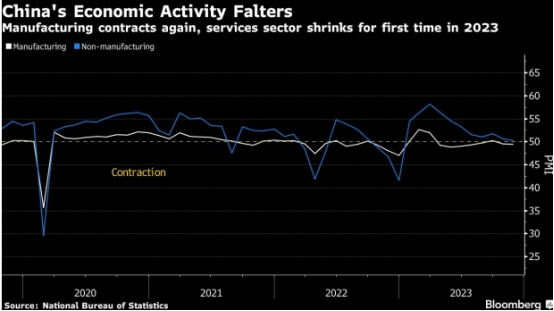

China’s Factory Activity Shrinks Again in Sign of Recovery Woes-BBG

Activity in China’s manufacturing and services sectors shrank in November, adding to expectations for additional government support for the economic recovery as it struggles to regain steam.

The official manufacturing purchasing managers index fell to 49.4, the second straight month of contraction, according to a Thursday statement from the National Bureau of Statistics. While economists expected a decline in the index, the number was lower than estimates.

A gauge of non-manufacturing activity — which measures the construction and services sectors — unexpectedly eased to 50.2, barely clearing the 50 mark above which indicates expansion. An underlying measure of services activity fell to 49.3, the first contraction for that gauge this year.

“Today’s PMI reading will further raise the expectations toward policy support,” said Zhou Hao, chief economist at Guotai Junan International in Hong Kong. “Fiscal policy will be under the spotlight and takes the center stage over the coming year.”

COMMENTS: China markets rallied on this as expectation is government will have to intervene with more stimulus.

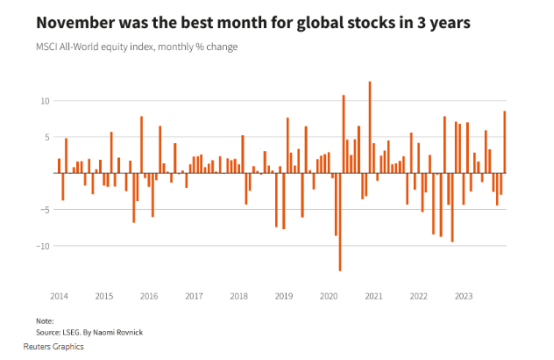

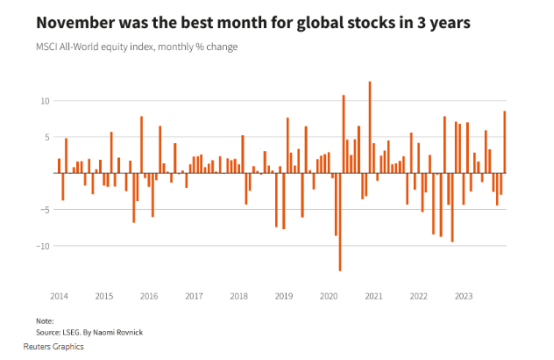

Goldilocks meets Santa as global stocks power to best month in three years-Reuters

November has shaped up to be a fairytale month for equities, with the festive Santa rally investors traditionally hope for coming early as traders bet on a Goldilocks scenario of inflation falling and central banks lowering interest rates.

MSCI’s world stock index is set to close the month up almost 9%, its best performance since November 2020, when markets cheered the arrival of COVID-19 vaccines.

Easing inflation has boosted talk that the U.S. Federal Reserve, the European Central Bank and others are done with aggressive rate hikes, lifting bond and stocks while hurting the dollar.

Global bond prices have soared, with an ICE BofA index of global investment-grade bonds in major markets set to return almost 4% in November, the best month on record going back to 1997.

Yields on U.S. Treasuries, which move in the opposite direction to prices, are set for the biggest monthly drop since 2008.

That’s taken the sting out of a summer bond rout, while major stock markets are on track to reverse 2023 sharp falls

November’s equity rally has been broad based, with Wall Street’s S&P 500 (.SPX) 8.5% higher on the month and Europe’s Stoxx 600 index (.STOXX) adding 6%. Global growth stocks in high-tech sectors are up 11% while value stocks, which are mainly in cyclical industries and offer high dividends, have gained around 6.7%

Major central banks have jacked up rates by a hefty 3,965 bps since late 2021 and investors sense a peak has been reached.

Traders are already pricing over 100 bps of Fed and ECB rate cuts next year while most big economies have paused rate rises to see how much the tightening bites.

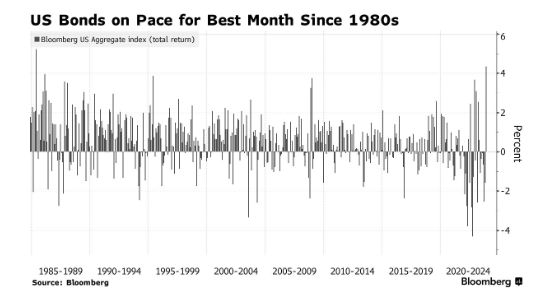

Biggest Blowout in Bonds Since the 1980s Sparks Everything Rally-BBG

In a year in which little has gone right in the US bond market, November turned out to be a month for the record books.

Investors frantically bid up the price of Treasuries, agency and mortgage debt, sparking the best month since the 1980s and igniting a powerful pan-markets rally in everything from stocks to credit to emerging markets. Even obscure cryptocurrencies, the sort of speculative, uber-risky assets that struggled when yields were soaring, posted big gains.

For those bond investors bracing for a possible third straight year of losses — an unprecedented streak in the Treasuries market — the rally was desperately needed. The Bloomberg US Aggregate Index has returned 4.9% this month through Wednesday as the yield on the 10-year bond, the benchmark for everything from home loans to corporate debt, sank close to 0.65 percentage points to 4.29%.

Whether the rally extends into December and then 2024 depends on if the principal forces behind it — signs that the economy and inflation are slowing and that the Federal Reserve is done hiking interest rates — keep building. Cooling jobs data and soft consumer inflation figures proved a boon for bonds in November, while dovish comments from Fed Chair Jerome Powell to Governor Christopher Waller added fuel to the advance.

COMMENTS: Big question now…is will it last?

London copper set to post first monthly gain since July-Reuters

London copper prices rose on Thursday, on track for their first monthly gain in four months, on a weaker dollar and hopes of demand growth in the last quarter.

Three-month copper on the London Metal Exchange CMCU3was up 0.7% at $8,477.50 per metric ton by 0640 GMT. The contract is up 4.6% month-on-month.

The most-traded January copper contract on the Shanghai Futures Exchange SCFcv1 edged up 0.2% to 68,280 yuan ($9,586.25) a ton. It is up 1.5% on a monthly basis.

“While disappointing economic activity limits the upside for industrial metals prices, demand from the new energy sector remains a sweet spot,” ANZ analysts said in a note.

Meanwhile, Panama’s president directed Canadian miner First Quantum to shut down the Cobre Panama copper mine after the Supreme Court declared its contract unconstitutional.

“This dashed hopes by the company that it might be able to reach a new deal to keep it operating,” ANZ analysts said.

COMMENTS: I have been waiting for this market to brush off China data as green transition push marches on

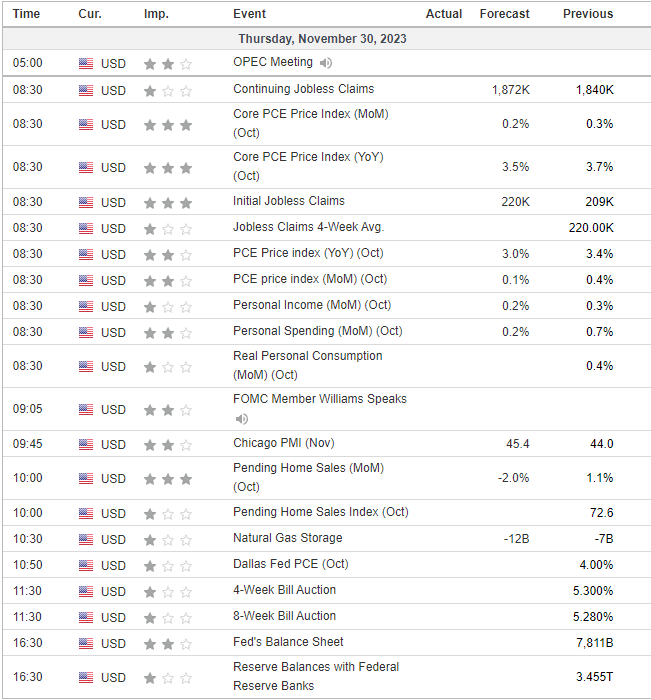

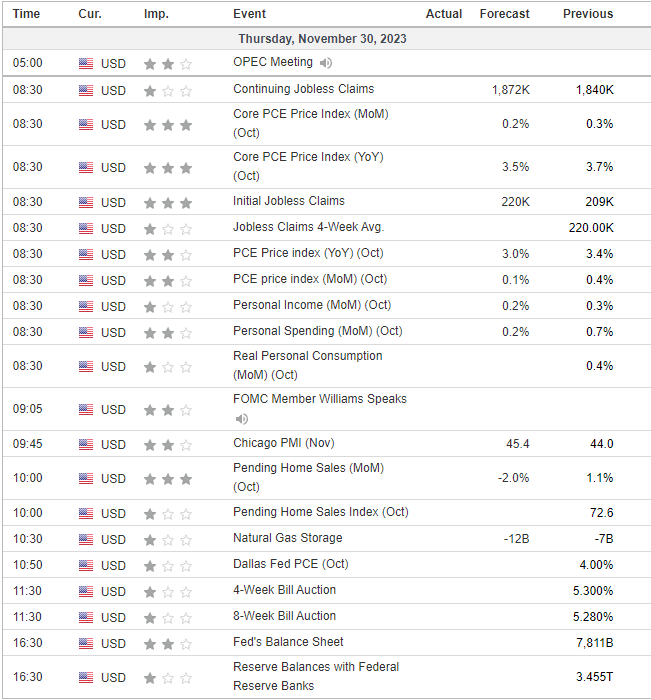

US DATA TODAY