Powell Speaking today at 2:00 PM ET

Asia Mixed…Europe GREEN

- Hong Kong: Hang Seng closed DOWN -1.25%

- China CSI 300 -0.38%

- Taiwan KOSPI -1.19%

- India Nifty 50 +0.58%

- Australia ASX +0.72%

- Japan Nikkei -0.39%

- European bourses in POSITIVE territory so far this morning

- USD -0.09%

TOP STORIES OVERNIGHT

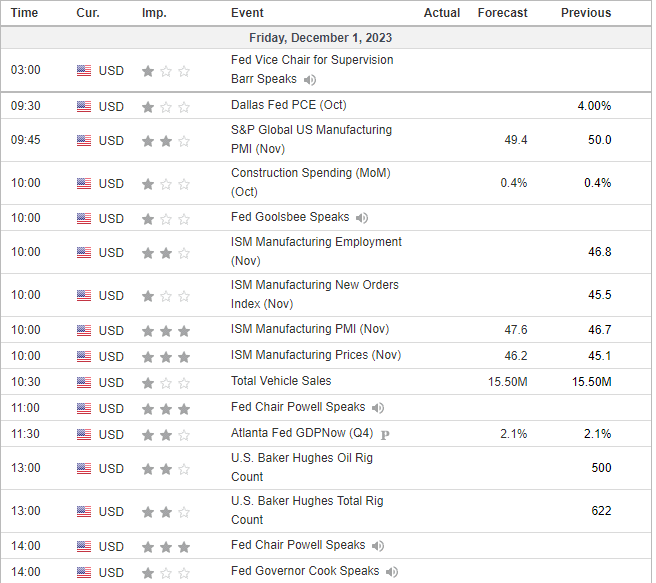

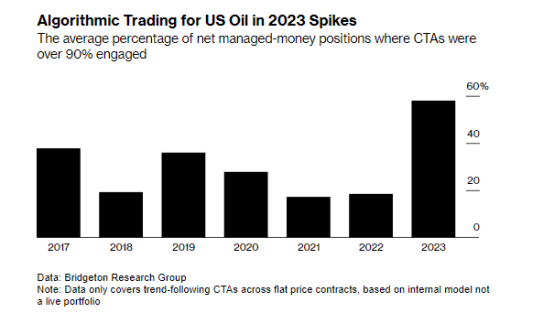

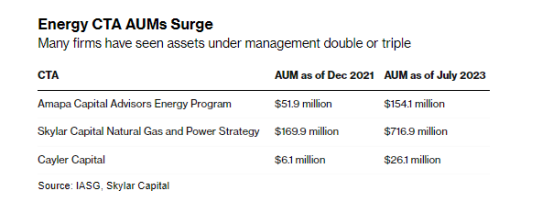

Oil’s Wild Ride Is Driven by a Disruptive Band of Bot Traders-BBG

While it’s hard to quantify how much of total trading volumes are controlled by CTAs, algos more broadly are responsible for as much as 70% of crude trades on an average day, according to data from TD Bank and JPMorgan.

“You would be absolutely shocked how large their positions are,” said Ilia Bouchouev, a former trader and managing partner at Pentathlon Investments who teaches at New York University. “They are probably bigger than BP, Shell and Koch combined.”

This year’s volatile price swings are being intensified by these bots, according to interviews with more than a dozen traders, analysts and money managers who work in the oil market. They’ve roiled commodities from gasoline to gold, sidelined traditional investors, drawn the ire of OPEC and even raised eyebrows at the White House.

What makes algorithmic CTAs so destabilizing is that they’re typically trend followers — and trend exaggerators. When prices go down, they sell, driving them even lower. And, more troubling for consumers, the same is true on the upside.

COMMENTS: What we all suspected, but this accounts for those rather large intraday moves and high volatility

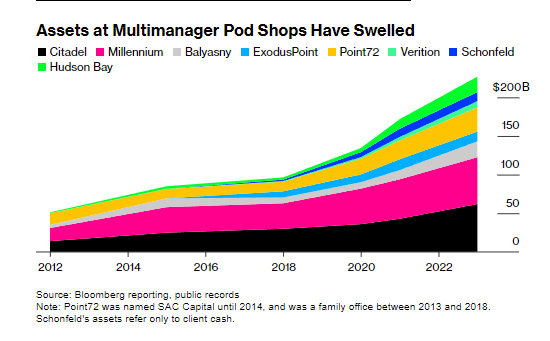

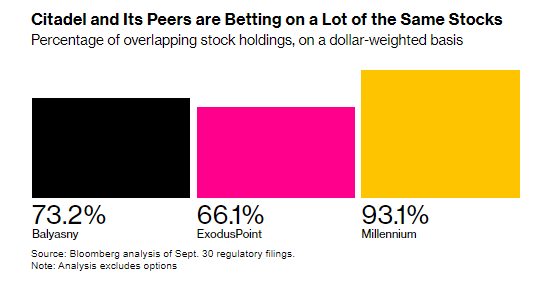

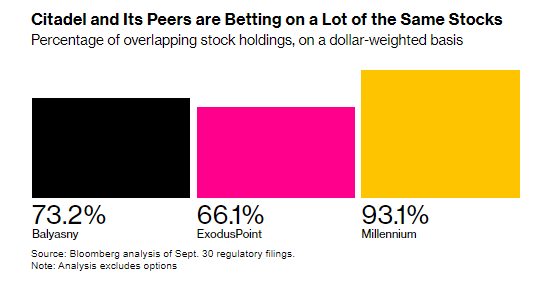

Citadel and Its Peers Are Piling Into the Same Trades. Regulators Are Taking Notice-BBG

Multimanager funds like Griffin’s Citadel have come to dominate the hedge fund industry, riding a steady run of outperformance to oversee more than $1 trillion, including a healthy dose of leverage. But the explosive growth has led the industry giants to pile into many of the same trades.

That has built unease among regulators, investors and traders over these so-called pod shops. And while Citadel’s billionaire founder has vocally opposed any notion that his firm and rivals pose systemic risks and need more regulation, even he acknowledges that crowded trades could lead to widespread losses if all of them head for the exits at once.

Officials at the Securities and Exchange Commission and US Treasury Department have warned that the firms’ favored basis trade could destabilize Treasury markets. At least one large bank is approaching the limit of how much it’s willing to lend to them, and some investors are growing more wary.

“There’s some overcrowding and concern about the amount of leverage at individual firms and collectively,” John Jackson, head of hedge fund research at investment consultant Mercer, said during a recent Capital Allocators podcast. And because they typically cut risk very quickly “we are worried about the potential snowball effect.”

Some investors are capping the amount of money they allocate to these funds, fearing blowups. Others are avoiding newer entrants, saying they could be hurt the most by a big unwinding. Smaller hedge funds, meanwhile, are looking for ways to profit from the market dislocations these larger competitors create.

With $62 billion of assets under management, Citadel is so big that its trades “could at times represent a high multiple of average daily trading volumes,” potentially limiting its ability to sell quickly without sending prices tumbling, S&P analyst Thierry Grunspan wrote in an April report.

“Everyone says ‘We are going to be the one that is able to run out of the crowded theater,”’ said New Holland Chief Executive Officer Scott Radke, whose firm manages about $6 billion. “But it works less well as the theater gets more crowded, and maybe you are less nimble than you thought.”

COMMENTS: This is worrying

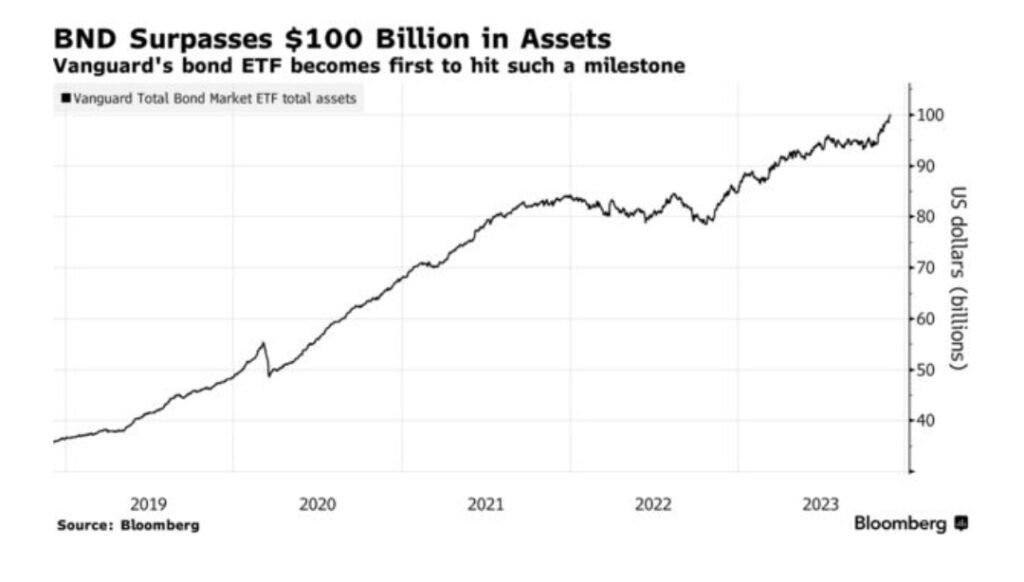

Vanguard’s Biggest Bond ETF Becomes First to Break $100 Billion-BBG

A bond exchange-traded fund crossed $100 billion for the first time since such products launched over two decades ago.

A $14 million inflow Wednesday pushed assets in the Vanguard Total Bond Market ETF (ticker BND) above $100 billion for the first time ever, data compiled by Bloomberg show. BND has absorbed $15.6 billion so far this year.

The milestone marries two of 2023’s biggest trends: The highest yields in years have made fixed-income more appealing, while relatively low-cost, tax-efficient ETFs have consistently stolen market share from their more expensive mutual fund brethren.

“There’s likely a large portion of flows coming from mutual funds too, as a source of growth,” said Todd Sohn, ETF and technical strategist at Strategas Securities, adding that since the interest-rate liftoff in March 2022 through last month, fixed-income mutual funds have lost $500 billion.

“It’s not surprising when you offer up 18,000 bonds for three basis points that’s going to get weatherproof flows,” said Bloomberg Intelligence senior ETF analyst Eric Balchunas. “That’s money coming in rain or shine, because it’s that good of a deal.”

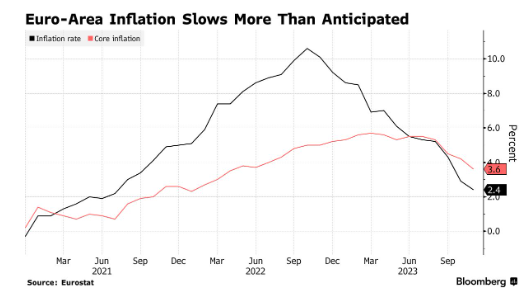

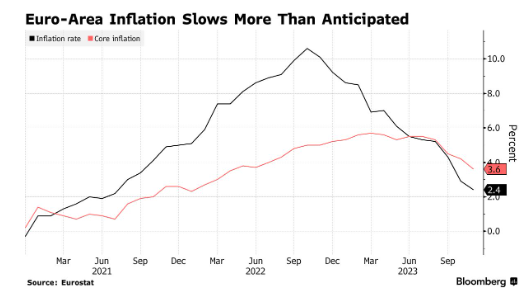

Goldman Says ECB to Cut Interest Rates Sooner Than Expected-BBG

The European Central Bank won’t wait as long as previously forecast to cut its interest rate, with the first reduction now anticipated in the second quarter, Goldman Sachs economists said.

The US investment bank changed its prediction in a report on Thursday, hours after data showed that inflation in the region weakened markedly toward the 2% goal targeted by policymakers. Economists including Jari Stehn previously expected a move in the third quarter.

“While we see a significant hurdle for rate cuts before Q2, the risks around our baseline are clearly skewed towards a faster cutting cycle if inflation continues to slow more quickly than expected or if growth fails to improve next year,” the analysts wrote.

COMMENTS: European markets loving this today

China’s Xi Seen Delaying Key Economic Plenum, Defying Norms-BBG

President Xi Jinping appears set to postpone a party meeting held every five years to chart his nation’s long-term reform agenda, the latest example of the Chinese leader disregarding decades-old norms.

The ruling Communist Party’s Politburo skipped setting a date for the third plenum at its meeting this week, according to the official read out. That leaves little time for the conclave that normally focuses on economic issues to assemble this year.

Delaying the meeting to 2024 would mark the first time it’s been held in an off-schedule year in over three decades. The third plenum normally comes in October or November, one year after China’s new leadership team is set, according to a Bloomberg analysis of meeting readouts.

COMMENTS: This has China markets spooked today

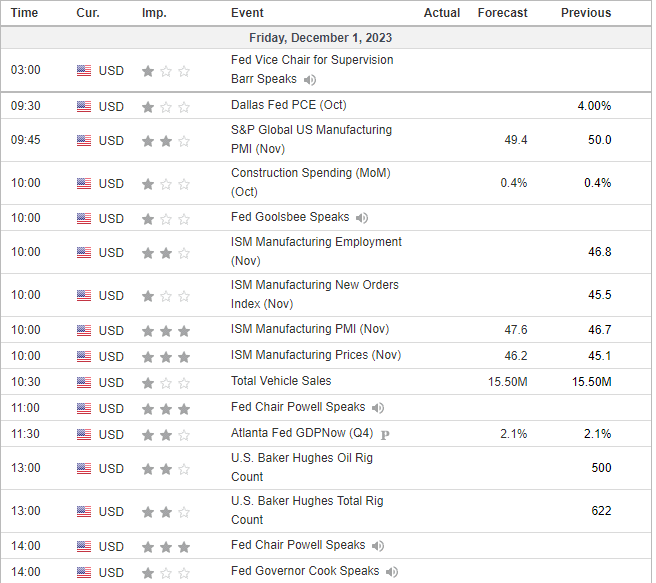

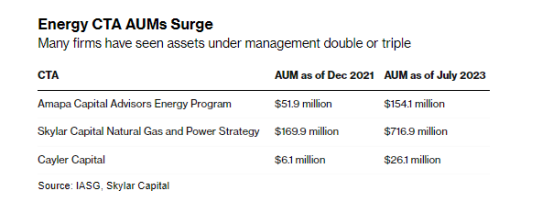

US DATA TODAY