December 6th, 2023

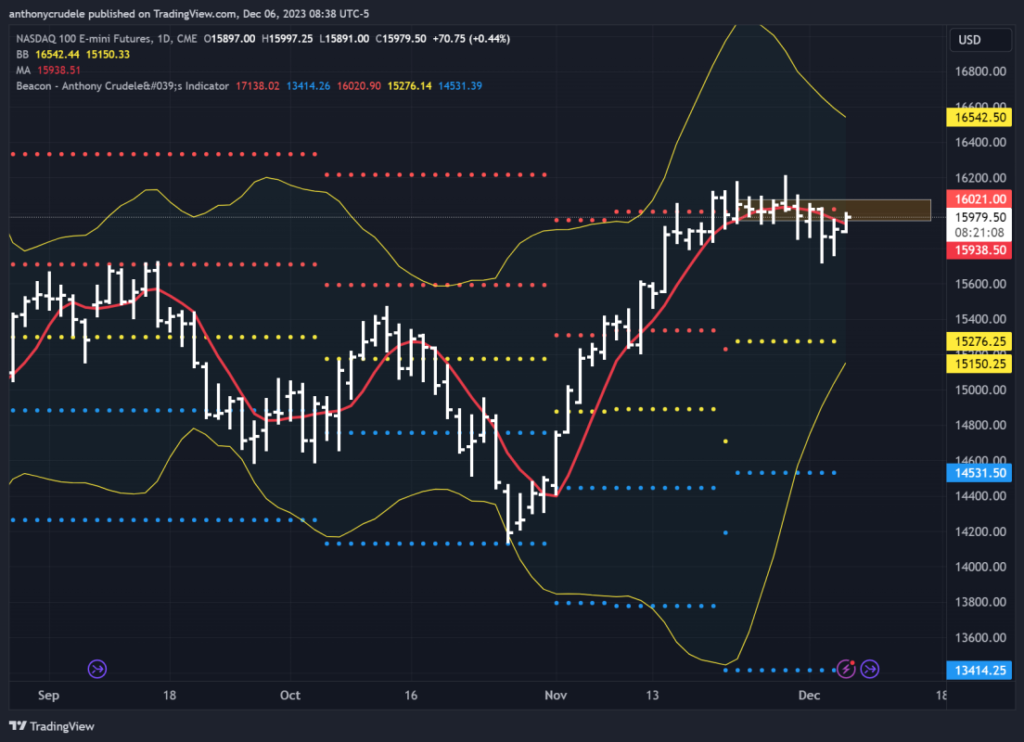

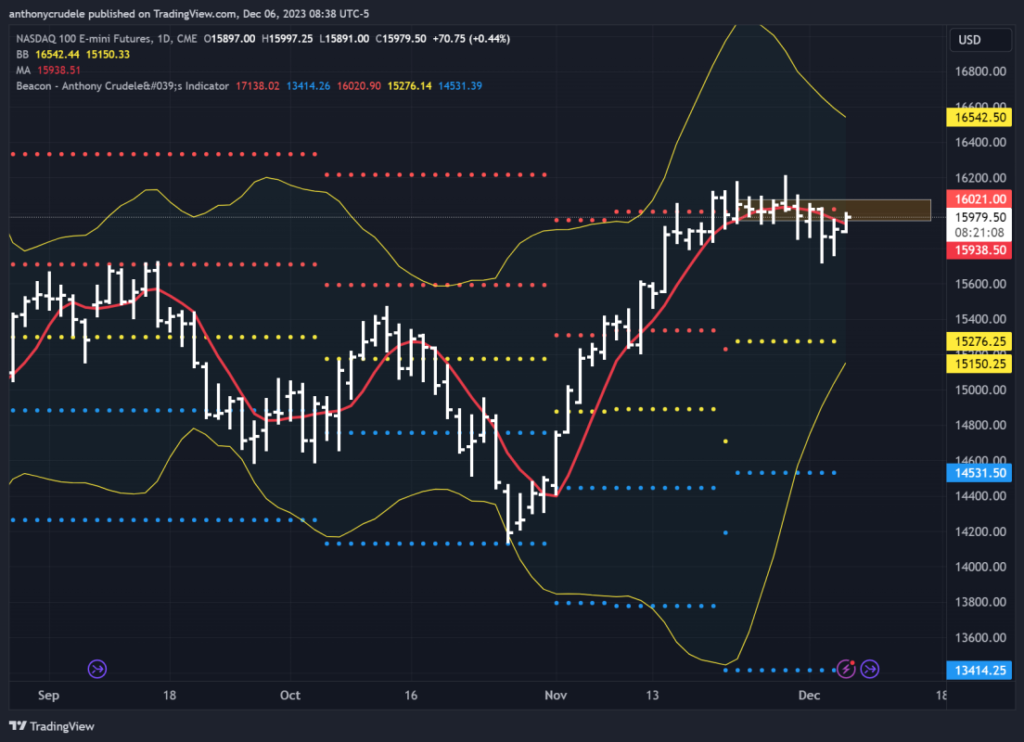

HOLD, HOLD, HOLD! As Mel Gibson shouted in the iconic movie, Braveheart. The bears are attempting to gain momentum, but the bulls consistently hold the line. The tape becomes erratic, causing traders to be unsure about maintaining their long positions while in the grand scheme of things, the bulls are faring quite well. The main draw for me continues to be the spread between the Russell 2000 and the Nasdaq 100. Yesterday, the RTY took a hit while the NQ rallied, tightening the spread. Yet, the bears did no significant damage to the technicals in the RTY, as they failed to even revert them to the 5-day moving average. This intra-day divergence is what resulted in the ES trading pattern we saw yesterday. A classic push and pull dynamics.

I too am holding my ground, patiently observing the market. I hold long positions in some stocks and IWM in my long-term portfolio, but I’m refraining from making any day trade moves currently. Let’s not overlook the Futures rollover happening right now, adding a layer of complexity to the tape. Remember, the long-term charts still lean towards bullish, and unless we see a significant downgrade to the technicals or headlines that provide ammunition for the bears, we’re navigating a sideways to upward tape. The current strategy is to trade small and smart.

Join me today at 12 ET as I host a spaces event with Cem Karsan and Andy Constan, two of the most brilliant minds in the trading world. You can check it out at this link: https://twitter.com/i/spaces/1vAxRvPMnjYxl?s=20

Enjoy your day, cheers, DELI.