Pretty GREEN out there

- Hong Kong: Hang Seng closed UP +0.83%

- China CSI 300 +0.16%

- Taiwan KOSPI +0.04%

- India Nifty 50 +0.40%

- Australia ASX -0.90%

- Japan Nikkei +1.55

- European bourses in POSITIVE territory so far this morning

- USD -0.05%

TOP STORIES OVERNIGHT

PBOC Steps Up Yuan Support Via Fixing After Moody’s Outlook Cut-BBG

The PBOC set the daily reference rate for the managed currency at 7.1140 per dollar, versus an average estimate at 7.1486 in a Bloomberg survey. The gap between the two was the largest in more than two weeks, a sign that Beijing is boosting its efforts to prevent declines in the Chinese currency.

“Policymakers just want to keep up with the same messaging of wanting a steady yuan and not let Moody’s derail the policymakers’ efforts,” said Christopher Wong, strategist at Oversea Chinese Banking Corp. The market “can’t rule out policymakers stepping in if there is excessive volatility in yuan.”

COMMENTS: This helped stabilize China markets after yesterday disaster

Putin Arrives in UAE to Start Gulf Visit With Oil in Focus-BBG

Russian President Vladimir Putin arrived in the United Arab Emirates to start a rare foreign trip that will also include a visit to Saudi Arabia, with bolstering cooperation among strategic oil producers a top priority.

At the center of discussions in Riyadh will be Russia’s role in OPEC+, the Saudi-led alliance between the Organization of Petroleum Exporting Countries and other major oil producers, which last week agreed to extend and deepen production cuts to bolster prices.

Saudi Arabia, meanwhile, is looking to the Russian leader to cement OPEC+ coordination, he said, after the agreement to cut production by 2.2 million barrels a day in the first quarter.

COMMENTS: Oil traders be on alert for a rash of headlines…stay nimble

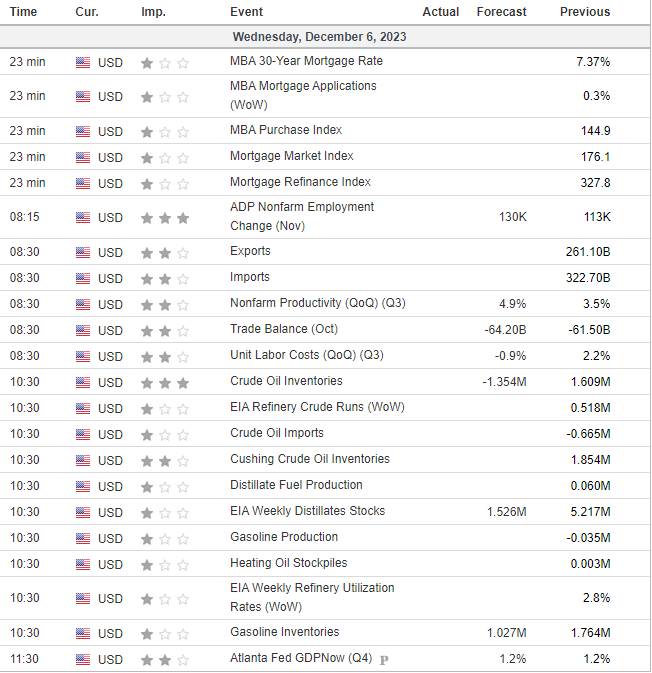

Bitcoin Trades Near $44,000 After Longest Win Streak Since May-BBG

Bitcoin traded close to $44,000 after notching its longest winning streak since May, a rally driven in part by expectations of looser monetary policy.

The largest digital asset climbed for six days through Tuesday, advancing roughly 16% to as high as $44,491 before giving up some gains. Its 2023 rebound from last year’s crypto rout now stands at 163%.

Bitcoin is up almost 80% since mid-September, a rally that saw it take out the $30,000 and $40,000 levels in quick succession. Along with wagers that the Federal Reserve may start cutting interest rates next year, its rise has also been fueled by speculation that the the US may be close to allowing its first spot Bitcoin exchange-traded funds.

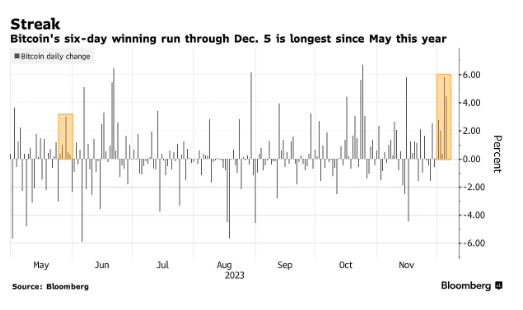

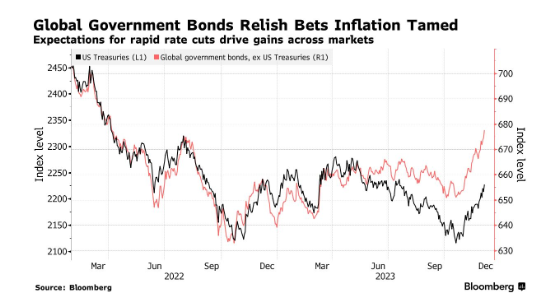

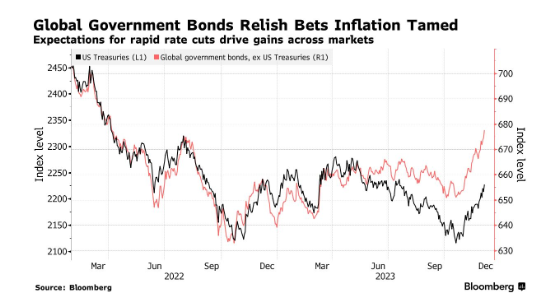

Global Bond Rally Powers on as Rate Cut Bets Appear Everywhere-BBG

Bonds around the world are extending gains on expectations that a wave of easier monetary policy will break out next year as inflation fears evaporate.

An index of sovereign debt that excludes Treasuries surged to the highest since April 2022, as rates traders switched to betting the European Central Bank will cut interest rates even before the Federal Reserve does. US government notes are also set for their first annual gain in three years, as bond investors position for an end to the economic resilience that made 2023 so challenging.

COMMENTS: Hedge Funds are short this market, the 20 year is now over the 100 day, we could see a further squeeze to the 200 day just above ~122

Apple told component suppliers to source iPhone 16 batteries from India- FT

Apple has informed component suppliers of its preference to source batteries for the forthcoming iPhone 16 from Indian factories, the Financial Times reported on Wednesday in a shift away from China

COMMENTS: The market will probably like this…watch Apple today…could set the tone for Nasdaq

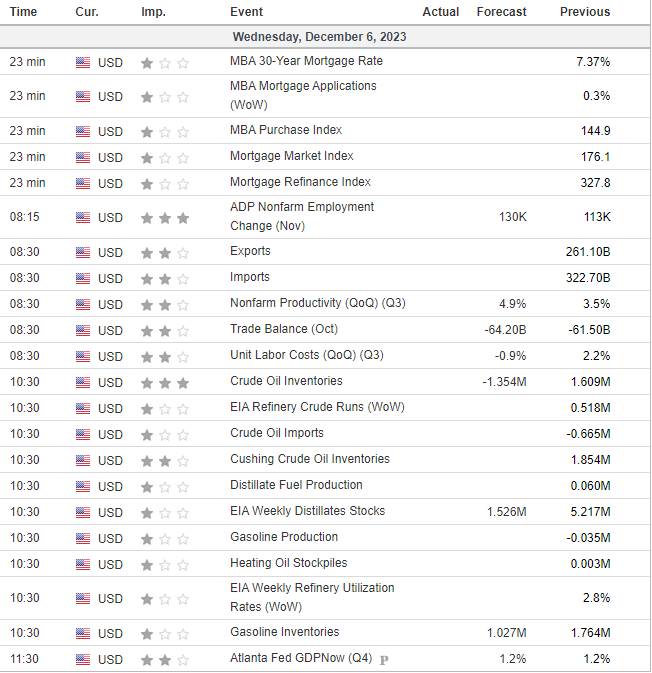

US DATA TODAY