June 4th, 2024

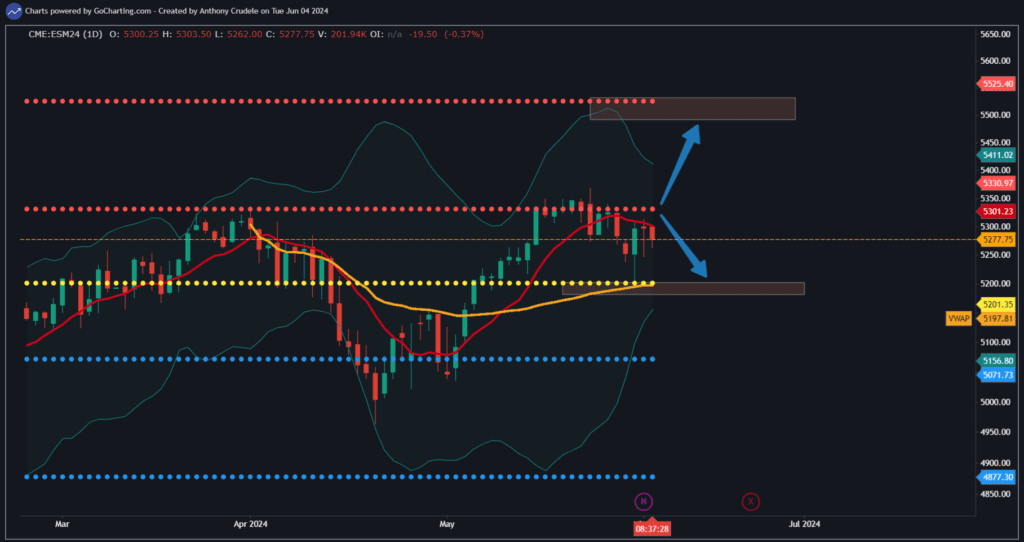

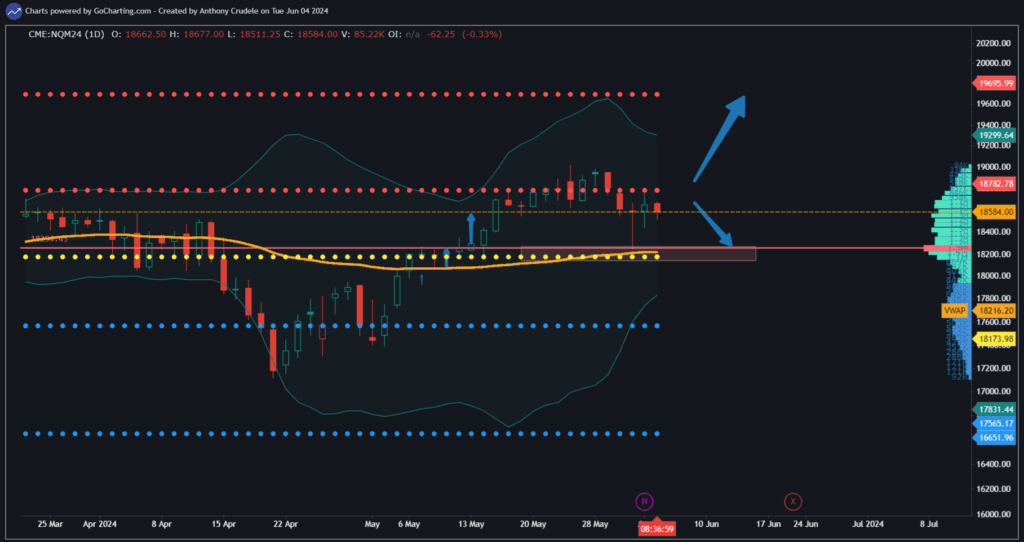

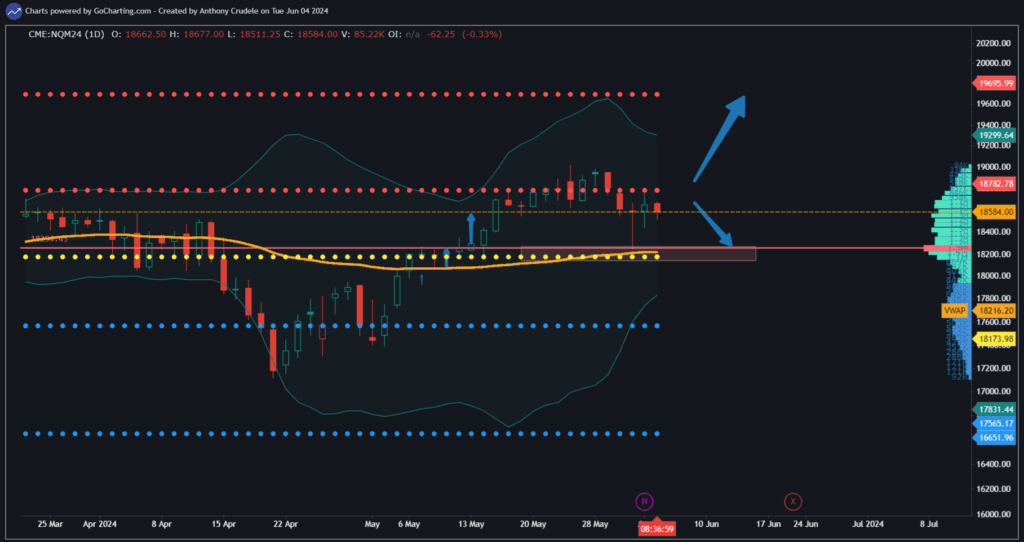

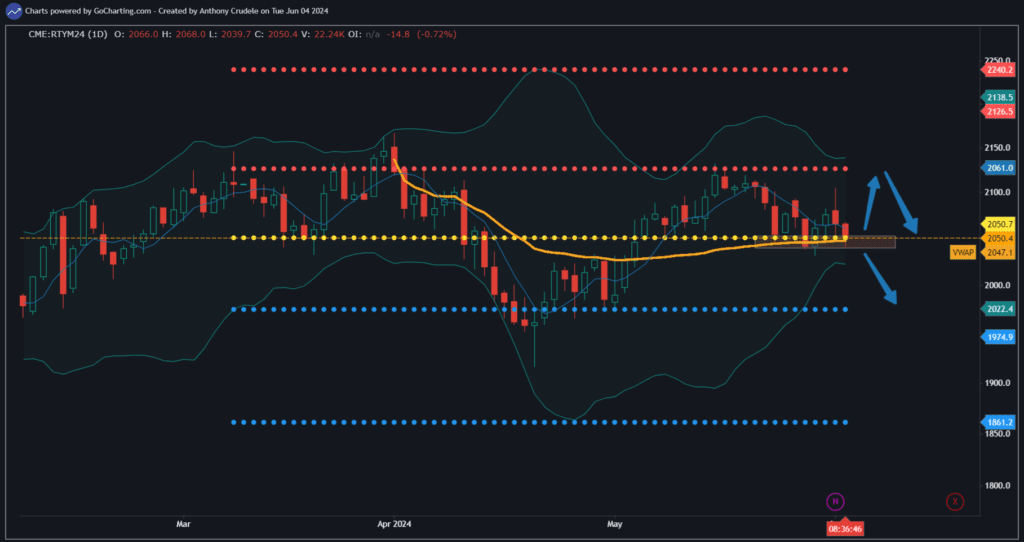

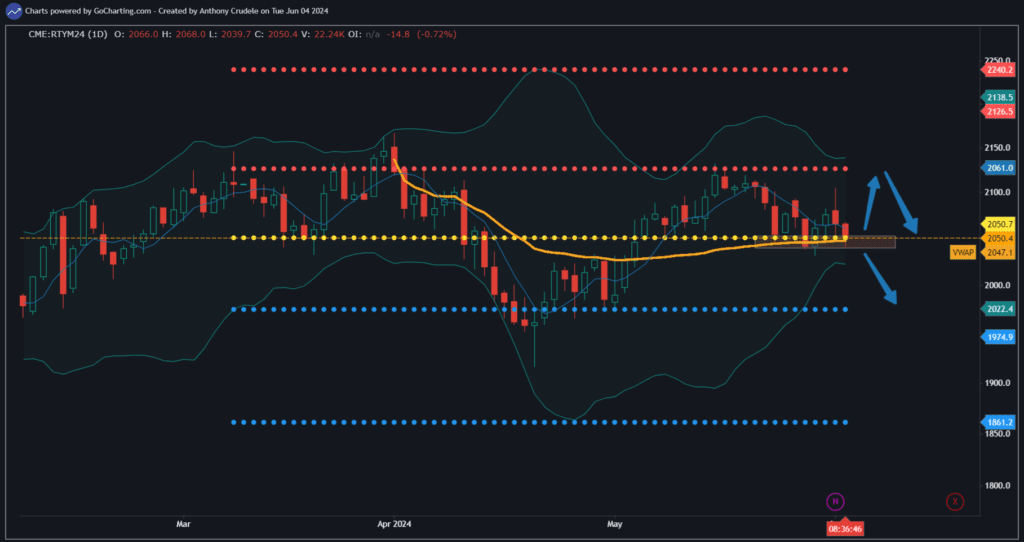

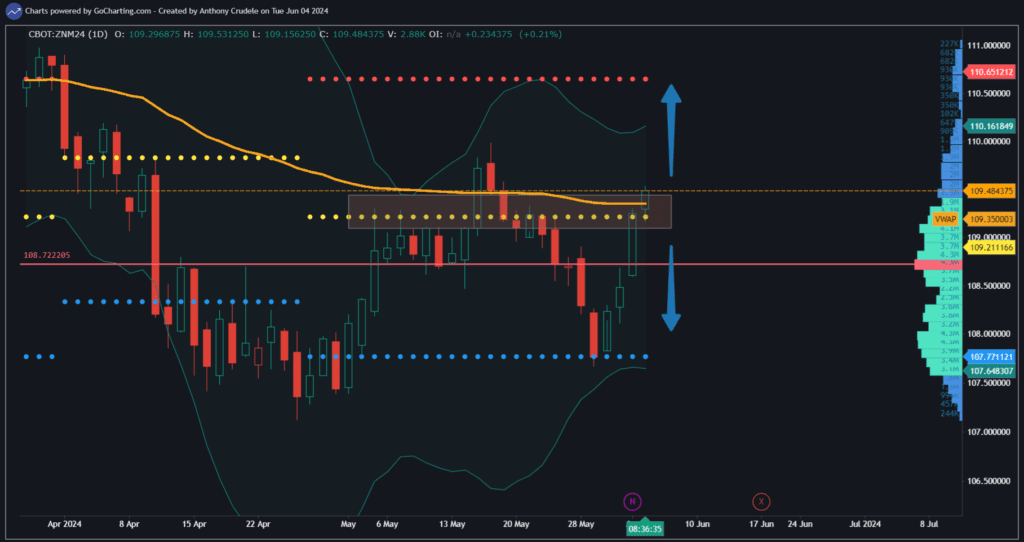

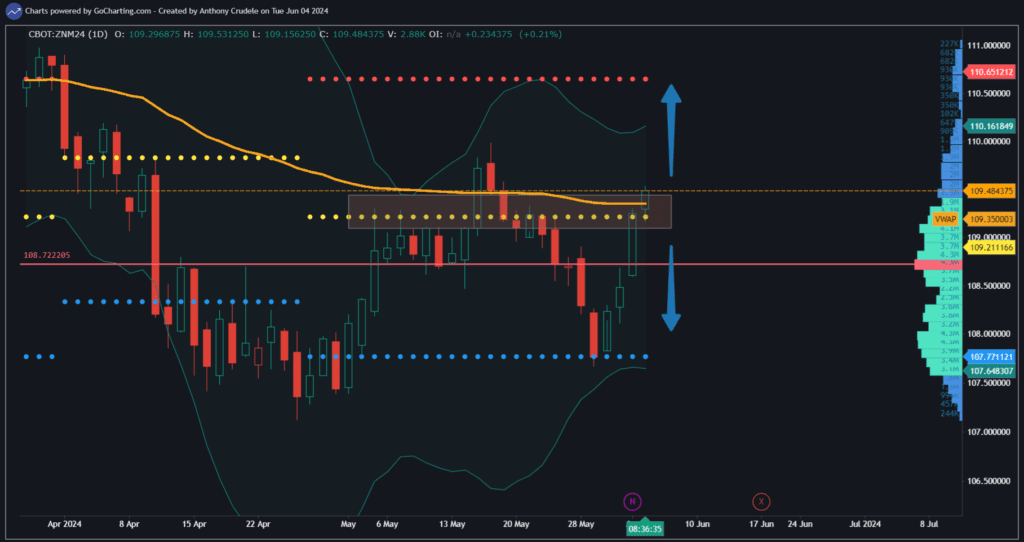

As 10-year yields approach monthly lows and are on the brink of testing support at 4.3%, stocks are pulling back. This is a pivotal moment for the market as stocks potentially retain their bullish momentum while rates diminish. This environment presents all the indexes (including the RTY) with a chance to rally.

The critical factor for stocks hasn’t been the number of cuts the Fed will commit to this year; it’s that rate hikes are no longer being considered. If inflation begins to ease in conjunction with a job market that’s cooling rather than crashing, this is a point where technicals and fundamentals can align, providing indexes with a path of least resistance on the upside.

The counter-argument is that market positioning is already accounting for this, leaving no buyers willing to step in at these prices.

This situation could initiate a period of heightened volatility as the market attempts to shake off some longs. Yet, the bullish case remains. The pattern observed over the past two sessions – early weakness and late-day strength – may persist. This shakes out the faint-hearted longs, triggering a scramble to re-enter before the close.

The rationale behind this is that key technical support from my viewpoint is significantly lower. I’ve identified key support levels at 5201, 5120, and 5074 at which the market can gain momentum. Between the range of 5200-5300, there can be substantial churn, but it can still maintain bullishness. It’s not often that volatility increases alongside bullishness, but this could be one such rare instance.

As ever, the key lies in adopting a small and smart approach. Choose your levels, implement your strategy, and avoid overcomplicating things.

Cheers, DELI