June 5th, 2024

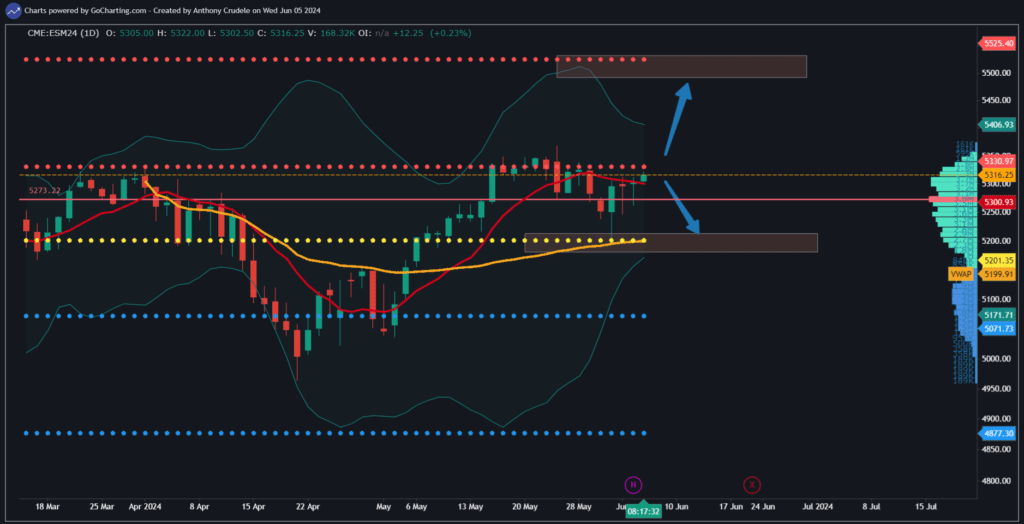

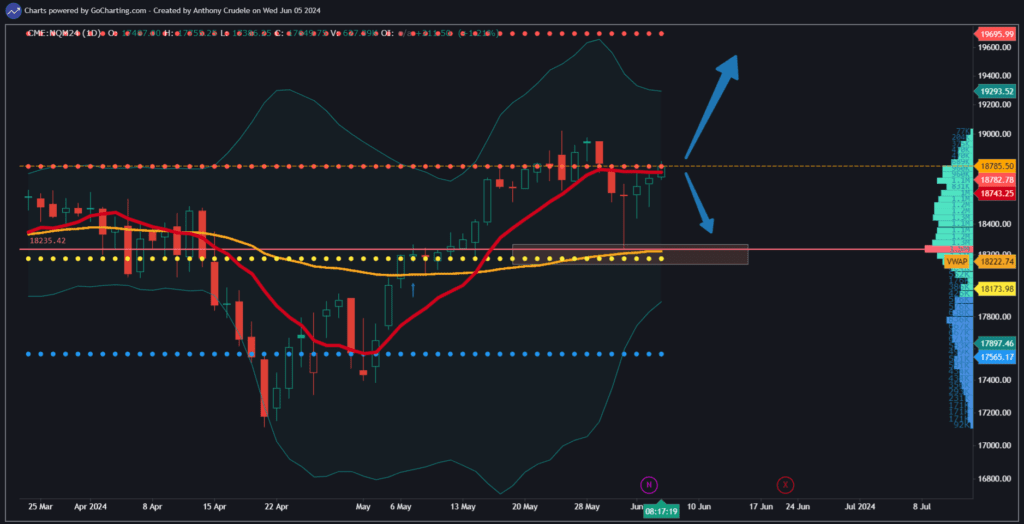

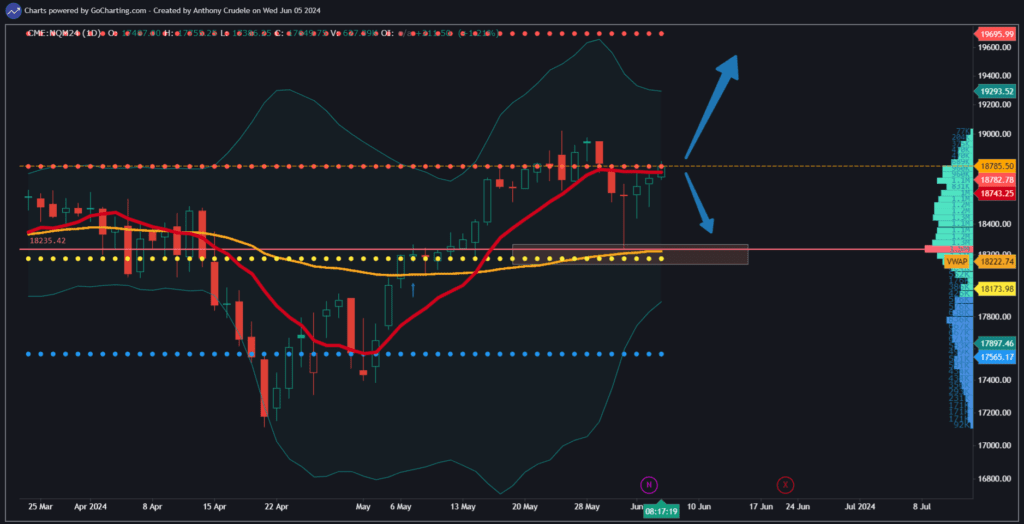

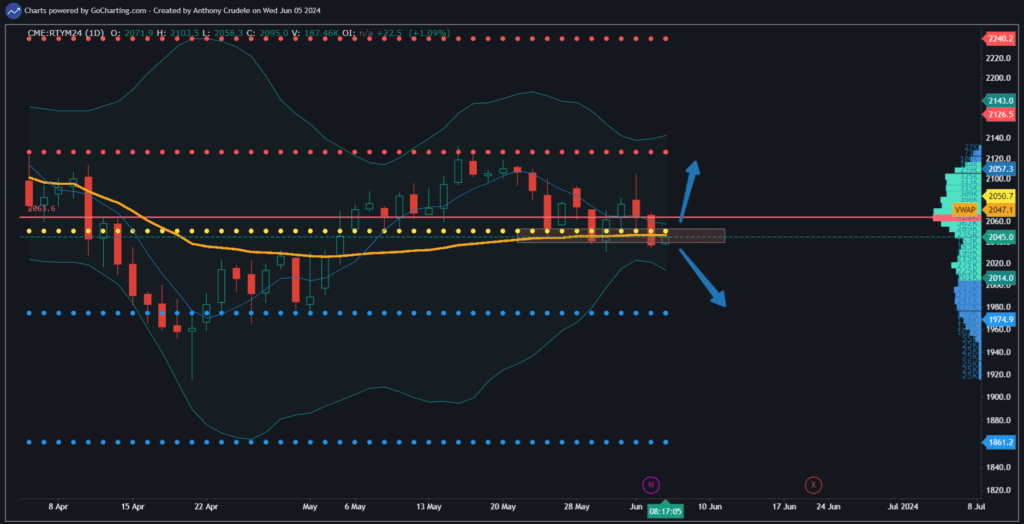

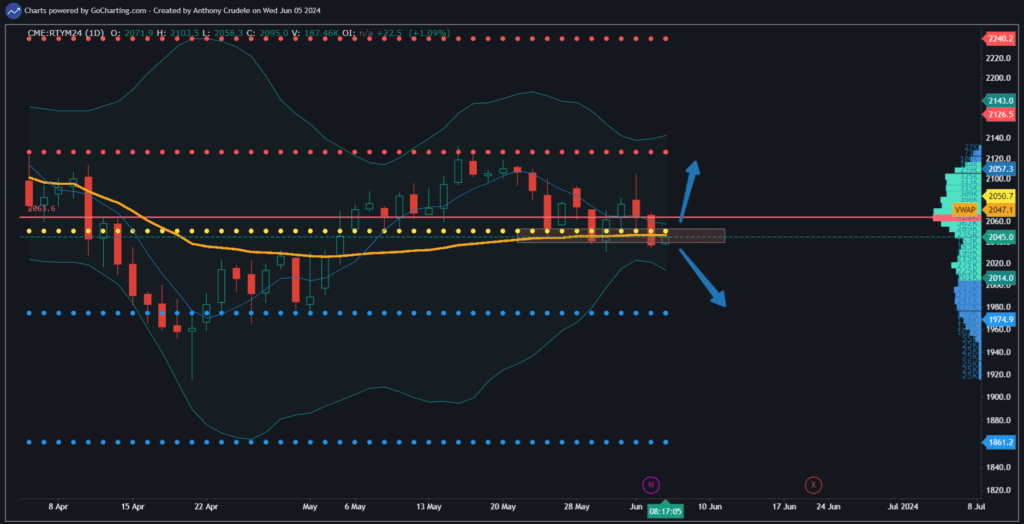

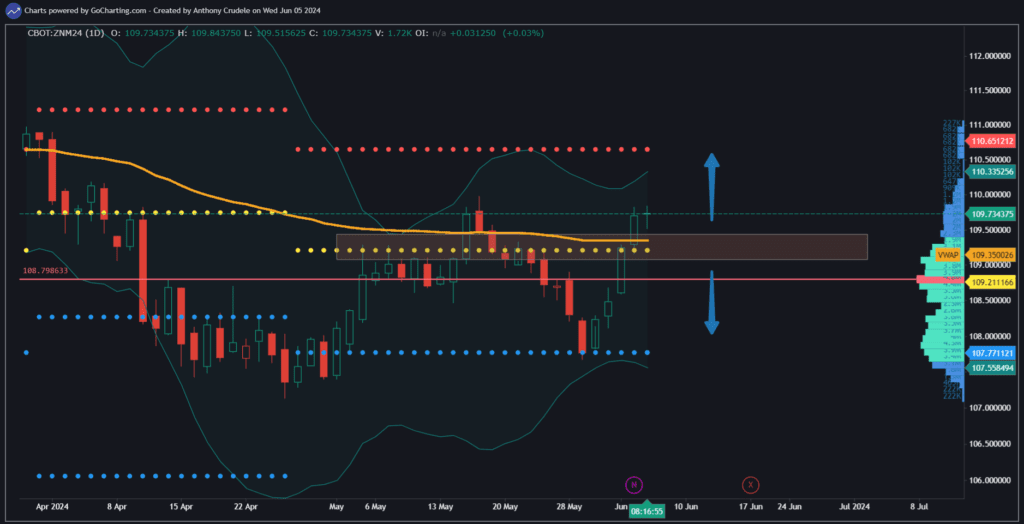

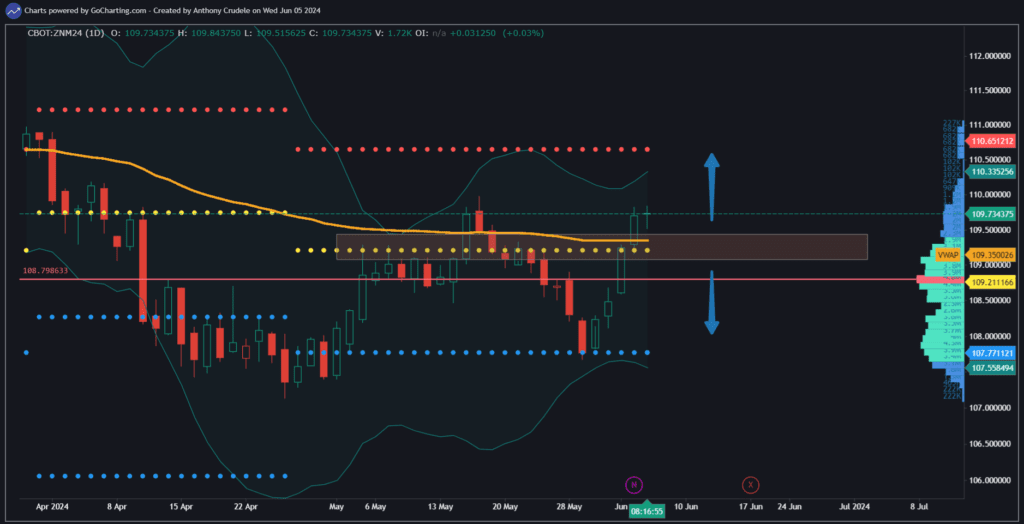

The stage is set for the bulls to push back up to all-time highs. In the past few sessions, we’ve had pullbacks that have held key support. The daily Bollinger bands have stopped moving inward, we’re back up on the 5-day SM, rates are coming down, and volatility is decreasing. We’re back to grind mode.

This is really an environment where the bulls should take the market to new highs. We have technicals aligning with macro trends right now, and either the bulls step in and take advantage of it, or, as I mentioned yesterday, the counter-argument is that market positioning has already accounted for this, leaving no buyers willing to step in at these prices.

Keep an eye on the rates. If they continue to decline, it serves as fuel for the bulls to keep going. Also, watch the RTY. If it starts to rise, how will it affect the rest of the indexes? Will it boost the ES and NQ, or is there divergence, causing the RTY to play catch up?

The market’s closing today is crucial; can we continue seeing strength at the close, or does the market fade? If the market can sustain the rally today and grind higher, then I believe this market will continue its run to all-time highs in the upcoming sessions.

Even though I maintain a bullish perspective, I predict the markets will be volatile while we grind higher. This is not a ‘hold your nose’ rally to buy as I foresee further chop during our upward grind. As usual, the key is to be cautious and stick to your strategy. Presently, I’m only interested in long setups. Don’t fall into the trap of overthinking or over-trading this tape. Remain small and smart.

Cheers, DELI