A Sea of Red

- Hong Kong: Hang Seng closes down -1.28$

- China CSI 300 -1.44%

- Taiwan KOSPI -0.98%

- India Nifty 50 -0.51%

- Australia ASX +0.81%

- Japan Nikkei -0.31%

- European bourses broadly down morning with the exception of Spain and Austria

- US indices all down this morning in pre-market, USD up +0.70%

Overnight News/Data

- UK Retail Sales Inc Auto Fuel (M/M) Jan: 0.5% (est -0.3%; prev -1.0%) Retail Sales Inc Auto Fuel (Y/Y) Jan: -5.1% (est -5.6%; prev -5.8%) Retail Sales Ex Auto Fuel (M/M) Jan: 0.4% (est -0.2%; prev -1.1%) Retail Sales Ex Auto Fuel (Y/Y) Jan: -5.3% (est -5.4%; prev -6.1%)

- Germany PPI (M/M) Jan: -1.0% (prev -0.4%) -German PPI (Y/Y) Jan: 17.8% (prev 21.6%)

- French CPI (M/M) Jan F: 0.4% (est 0.4%; prev 0.4%) – French CPI (Y/Y) Jan F: 6.0% (est 6.0%; prev 6.0%) -French CPI EU Harmonised (Y/Y) Jan F: 7.0% (est 7.0%; prev 7.0%)4%) – French CPI EU Harmonised (Y/Y) Jan F: 7.0% (est 7.0%; prev 7.0%)

- Thailand – Q4 GDP unexpectedly falls, 2023 outlook trimmed

Q4 GDP -1.5% q/q 1.4% y/y vs. expected 0.6%/3.6%

2022 Annual GDP 2.6% y/y vs. expected 3.2%

2023 GDP growth seen at 2.7-3.7% vs 3.0-4.0% seen earlier - Singapore – Jan Non-oil Domestic Exports 0.9% m/m -25.0% y/y vs.

expected -0.7%/-22.0%

Jan Electronics Exports -26.8% y/y

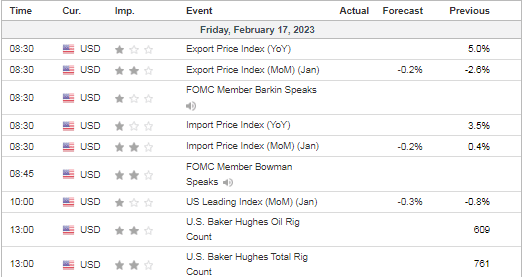

US DATA TODAY

Little data today aside from Fed speakers

OVERNIGHT COMMODITIES HEADLINES

Metals

Gold faces third weekly drop on Fed rate-hike bets

Copper heads for weekly gain as market fundamentals outweigh Fed fears

Energy

Oil prices on track to finish week 2.5% lower on U.S. rate hike worries

US natgas falls 3% to 25-mth low on small storage withdrawal, mild weather

Oil-rich Guyana expects annual economic growth of over 25% in coming years

ADNOC to float 4% of its gas business in IPO – statement

Russia to keep current level of oil exports in March -Vedomosti (this is weighing on the market more than the hawkish Fed last night imho)

US LNG producers poised to leapfrog rivals with three new projects