Green Friday

- Hong Kong: Hang Seng closes up +0.68%

- China CSI 300 +0.31%

- Taiwan KOSPI +0.17%

- India Nifty 50 +1.57%

- Australia ASX +0.05%

- Japan Nikkei+0.71%

- All European bourses broadly in in positive territory so far today

- US indices also in positive territory this morning in pre-market, USD -0.36%

Overnight Data/News–Ton of data

- PBoC Sets Yuan Mid-Point At 6.9117 / Dlr VS Last Close 6.9193

- China Central Bank Governor Yi: China To Step Up Support For Tech Innovation, Green Sector

- Caixin China PMI Services Feb: 55 (est 54.5, prev 52.9) – Caixin China PMI Composite Feb: 54.2 (prev 51.1)

- China Swap Traders Flip To Bet On Higher Rates On Growth Rebound

- Japan’s 10-Year Yield Rises Above BoJ’s 0.5% Ceiling Again

- Morgan Stanley: Now Expect ECB’s Terminal Rate At 4%

- Turkish CPI (Y/Y) Feb: 55.18% (exp 55.70%; prev 57.68%) – Turkish CPI (M/M) Feb: 3.15% (exp 3.49%; prev 6.65%)

- Turkish PPI (Y/Y) Feb: 76.61% (prev 86.46%) – Turkish PPI (M/M) Feb: 1.56% (prev 4.15%)

- Swedish Swedbank/Silf Services PMI Feb: 45.7 (prev 51.0) – Swedish Swedbank/Silf Composite PMI Feb: 46.1 (prev 49.9)

- French Industrial Production (M/M) Jan: -1.9% (exp -0.2%; prev 1.1%) – French Industrial Production (Y/Y) Jan: -2.2% (exp 0.2%; prev 1.4%) – French Manufacturing Production (M/M) Jan: -1.8% (exp -0.3%; prev 0.3%) – French Manufacturing Production (Y/Y) Jan: -0.7% (prev 3.6%)

- French S&P Global Service PMI Feb F: 53.1 (exp 52.8; prev 52.8) – French S&P Global Composite PMI Feb F: 51.7 (exp 51.6; prev 51.6)

- Spanish S&P Global Services PMI Feb: 56.7 (exp 53.7; prev 52.7) – Spanish S&P Global Composite PMI Feb: 55.7 (exp 53.5; prev 51.6)

- Italian S&P Global Services PMI Feb: 51.6 (exp 52.3; prev 51.2) – Italian S&P Global Composite PMI Feb: 52.2 (exp 52.0; prev 51.2)

- German S&P Global Services PMI Feb F: 50.9 (exp 51.3; prev 51.3) – German S&P Global Composite PMI Feb F: 50.7 (exp 51.1; prev 51.1)

- Eurozone S&P Global Service PMI Feb F: 52.7 (exp 53.0; prev 53.0) – Eurozone S&P Global Composite PMI Feb F: 52.0 (exp 52.3; prev 52.3)

- Eurozone PPI (Y/Y) Jan: 15.0% (exp 17.8%; prevR 24.5%) – Eurozone PPI (M/M) Jan: -2.8% (exp -0.4%; prev 1.1%)

- UK S&P Global Services PMI Feb F: 53.5 (exp 53.3; prev 53.3) – UK S&P Global Composite PMI Feb F: 53.1 (exp 53.0; prev 53.0)

- ECB’s De Guindos: Believe Headline Inflation Will Continue To Decline – Around Mid-Year It Could Fall Below 6% – Core Inflation Could However Have A More Stable Performance

- ECB’s Muller: Most Likely March Hike Not The Last – Rates Will Have To Stay High For Some Time

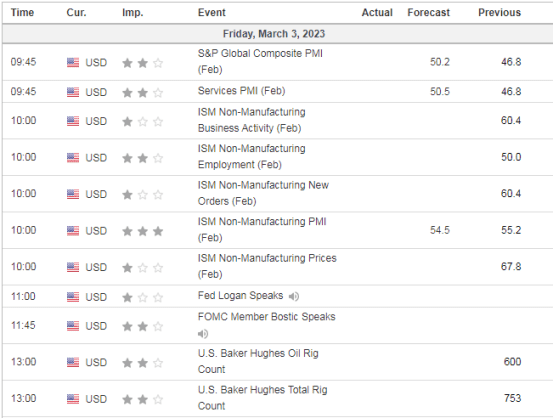

US DATA TODAY

OVERNIGHT COMMODITIES HEADLINES

Metals

India: Gold jumps Rs 160; silver climbs Rs 220

Gold Stronger as Treasury Yield Dip Weighs on Dollar

Gold could be getting support from the notion that the Fed will end its interest rate hikes before the ECB does

METALS-Copper set for weekly gains, investors eye China demand

Energy

Uzbekistan making final adjustments to accommodate Russian gas imports- This is the first time Uzbekistan will import natural gas from Russia

Shell reviewing oil and gas output reduction targets, CEO tells the Times “I am of a firm view that the world will need oil and gas for a long time to come. As such, cutting oil and gas production is not healthy.”

Russia Oil Resilience May Fade on Lack of Technology, Yakov Says Production seen 5% to 20% lower in 2030 by Yakov & Partners Departure of some global companies affects high-tech services

Abu Dhabi’s Adnoc Gas Raises $2.5 Billion in Year’s Biggest IPO

US looks to tighten oil sanctions enforcement on Iran, de-escalate nuclear progress

China 2023 gas demand likely to grow, but LNG outlook cloudy – PetroChina Intl exec