Big event last week was Jerome Powell’s Testimony in the Senate and House

From Edward Jones:

Two key takeaways:

- The Fed is willing to trade some pain on the economy in exchange for achieving its inflation-reduction goals. While no one wants to see a downturn in the economy, robust economic growth and sustained declines in inflation can’t exist in perfect harmony. We think the effort to bring down inflation is the right move for the longer-term health of the economy and financial markets.

- The Fed is shifting to a more data-dependent approach. To this stage, the Fed has been steadfast in aggressive rate hikes to quell 40-year highs in inflation. Chair Powell acknowledged this week that the full effects of the rate hikes to this point have yet to fully work their way through the economy. As a result, we think the Fed will seek to more closely calibrate upcoming hikes to incoming data.

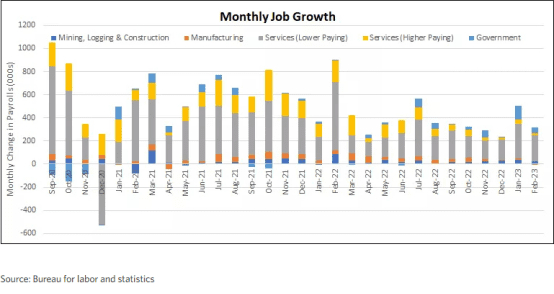

Then came NFP employment data on Friday

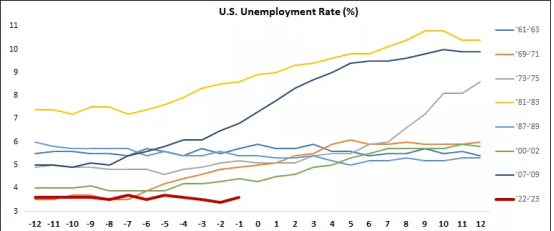

The headline number came in HOT but the unemployment rate ticked up!

February added 311K jobs (255K Bloomberg consensus)

But unemployment ticked up from 3.4% to 3.6%

Also Job growth took a considerable dive

As a result we saw a swift change in the CME group Fed watch tool for the target rate for the March meeting and beyond.

There was a shift from 50 bps to 25 bps.

SVB

Obviously, the biggest news had been the collapse of Silicon Valley Bank since Friday

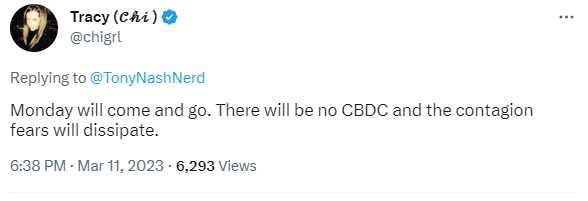

For all the mayhem on Twitter about a systemic collapse ushering in a CBDC …I think most of this has been completely overblown (as Twitter usually does).

There will not be a run on regional banks and Yellen has indicated there will be a solution by this (Sunday) evening.

The best post on all this was from

@INArteCarloDoss

(sorry for the profanity in this Twitter thread)

Fucking fed-up with the clown show around Shit Valley. Here is the fucking maths: – $ 190 b ish of deposits – $ 40 b AFS and cash – most likely already sold entirely – $ 90 b HTM most likely sold to likes of GS/MS at disc and to be liquidated – part sold already by SVB

Assuming 10% haircut on these two (conservative) that’s $ 120 b ish realized already – that’s over 60% of deposits. Then you have the loan book. $ 75 b of it that will take longer but 70% of this is private/fund banking loans, so should realize at decent price.

Say a conservative 30% haircut, that’s $ 50 b in a few weeks. That’s close to 90% total recovery. If these idiots get a 10% on their ill-earned deposits, that’s too light a penalty. That’s the maths. Cut the crap and call out the fearmongers.

In the end, I would not be surprised if we see a bounce in indices come Monday, as I believe fears are overblown.

Energy Markets

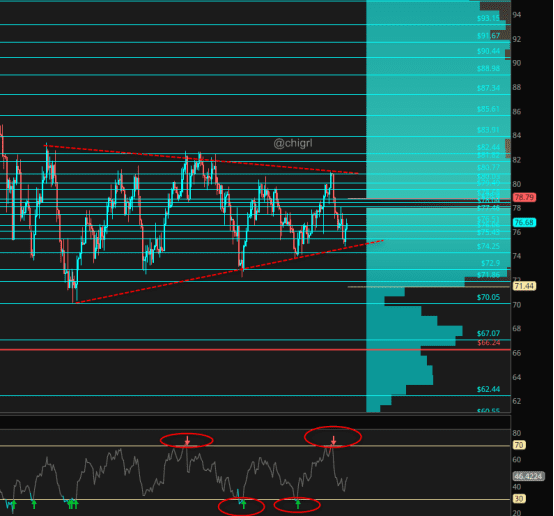

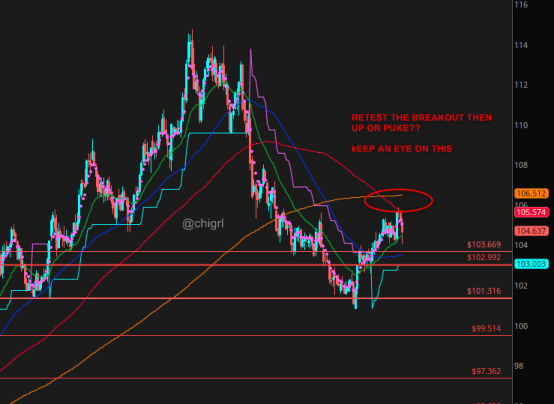

Crude oil continues to consolidate and remains range bound. This is not that surprising, OPEC is perfectly happy with Brent between $80-$90 and there are still a lot of unknowns. Russian production cuts in March and of course China reopening. Play the edges for now.

That said, the consolidation is getting more narrow, I think there will be a few more weeks of this until the market actually breaks out.

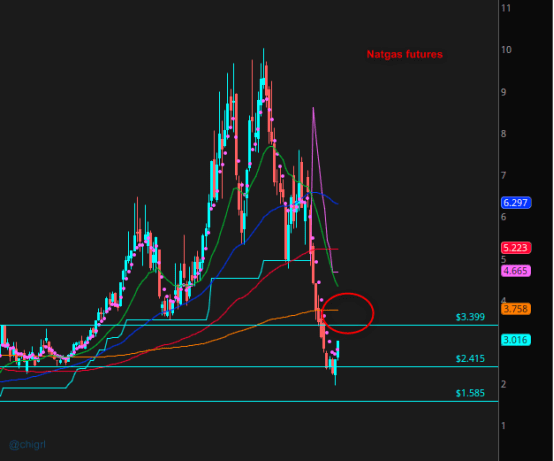

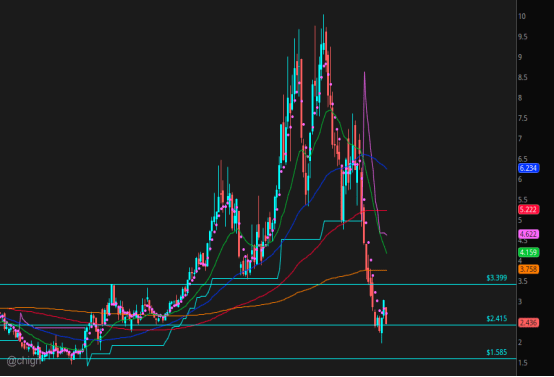

Nat Gas

Last week I noted that Nat gas reached a supply zone and it was hard for me to bet bullish this until we saw a break above

March 5th I noted:

I know a lot will be asking about NatGas. I just do not see a bullish case at this juncture until at least these four items are met:

- Freeport fully re-opens (supposedly may)

- We see a meaningful decline in US production (at $2 nat gas is not feasible for most producers…Cheniere mentioned production cuts in their earnings call…lets see what comes to fruition. As of Friday’s rig count, we did see a decline of rigs)

- We see a meaningful uptick in European consumption (would have to be weather related as industry is fleeing)

- We see a meaningful uptick in Asian demand (primarily from China)

This Week

We opened gap down the last Sunday and never looked back.

That said we are again at the bottom of the range. The good news is we are seeing an uptick in China demand…maybe open gap up tonight for a fade?

Metals

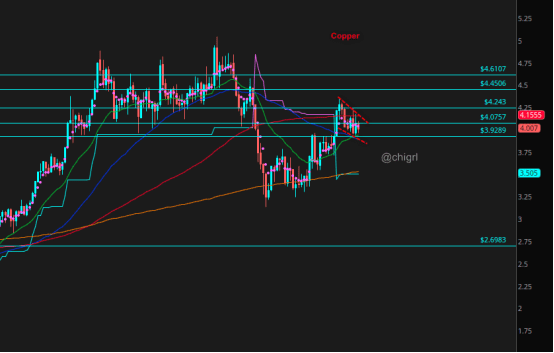

Copper continues to hang in there, holding over $4.

Possible bull flag on the weekly?

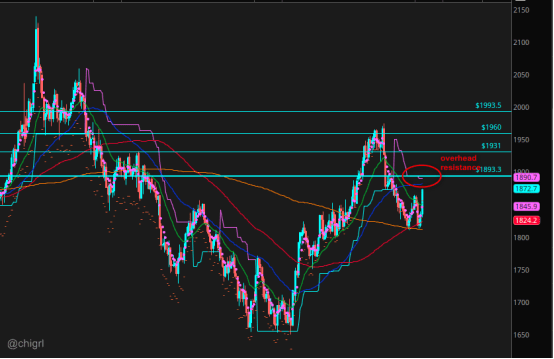

Gold

Gold stocks (miners, ETF, physical and paper) are some of the cheapest stocks on the board right now. Most are trading at 20% free cash flow yields and they are talking about the same capital discipline as the oil sector.

We saw a massive liquidation last year in gold ETF’s for almost 24 straight weeks.

Who was on the other side of that trade? The answer is Central Banks. They have been buying gold at a rate three times faster than anything we have seen in the last 20 years.

While the CB’s are telling us “everything is “OK” They are buying gold hand over fist.

Note: We are coming up on overhead resistance. That said if this makes it over it could fly.

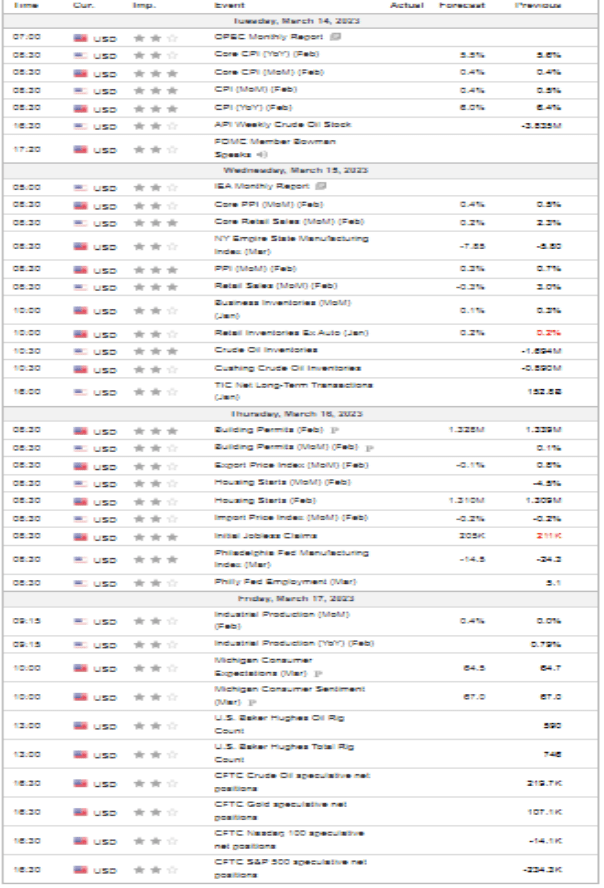

US DATA THIS WEEK

THINGS TO KEEP AN EYE ON THIS WEEK

(yes I am a broken record on this)

$DXY (USD)

$DXY (USD)

$DXY (USD)

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.