Monday Morning update: Credit Suisse is down 73%, UBS down 13%, European banks RED

It’s all about Credit Suisse

UBS offered to buy Credit Suisse earlier today for $1B and settled on more than $2B hours after

They are rushing to get the deal done before the open tomorrow

UBS agrees to buy Credit Suisse for more than $2bn

Swiss authorities expected to change country’s law to bypass UBS shareholder vote

UBS has agreed to buy Credit Suisse after increasing its offer to more than $2bn, with Swiss authorities poised to change the country’s laws to bypass a shareholder vote on the transaction as they rush to finalise a deal before Monday.

The all-share deal between Switzerland’s two biggest banks is set to be signed as soon as Sunday evening and will be priced at a fraction of Credit Suisse’s closing price on Friday, all but wiping out the target’s shareholders, three people with direct knowledge of the situation said. UBS will now pay more than SFr0.50 a share in its own stock, far below Credit Suisse’s closing price of SFr1.86 on Friday, the people said.

UBS also agreed to a softening of a material adverse change clause that would voids the deal if its credit default spreads jump, they added.

Some of the people criticised the plans to void normal corporate governance rules by preventing a UBS shareholder vote.

The material adverse change clause applies for the period between the signing and closing of the deal, the people said.

There has been limited contact between the two lenders and the terms have been heavily influenced by the Swiss National Bank and regulator Finma, the people said. The US Federal Reserve has given its assent to the deal progressing, they added.

Vincent Kaufmann, chief executive of Ethos Foundation, which represents Swiss pension funds that own between 3 per cent and 5 per cent of Credit Suisse and UBS, told the Financial Times that the move to bypass a shareholder vote on the deal was poor corporate governance.

“I can’t believe our members and UBS shareholders will be happy about this,” he said. “I have never seen such measures taken; it shows how bad the situation is.” – Financial Times

I would like to note that earlier in the day here was talk of nationalizing Credit Suisse, this deal is actually better, at least investors get “something”, though for pennies on the dollar as Credit Suisse market cap was $7B at the end of close on Friday and they are being bought for $2B.

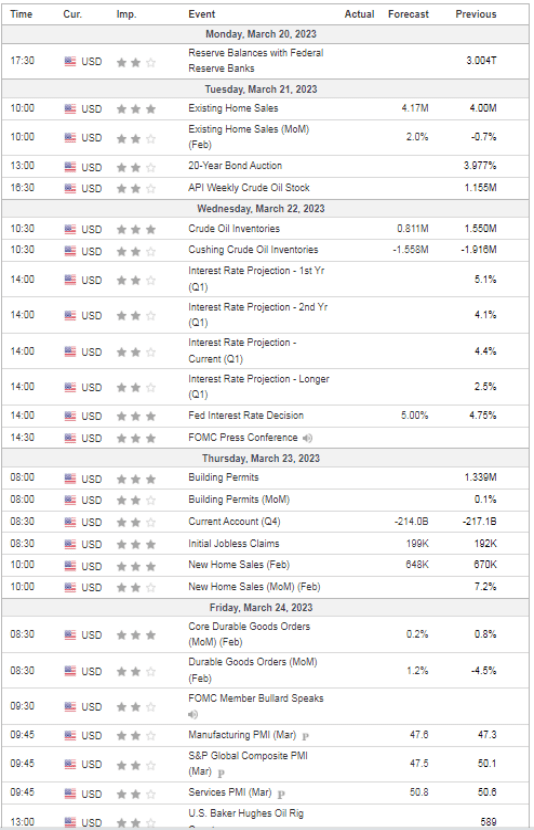

Meanwhile….in Federal Reserve news was this headline this weekend: FED TO CONSIDER A PAUSE AS FALLOUT FROM SVB ROILS MARKETS

It is important to note that broader markets may like this news, leading up to Wednesday’s decision, but an actual pause may have them scared. FOMC will be more important than ever this week.

(Additional note: Even with all the crisis lately it is remarkable that ES is still trading at 3900 and has not completely tanked)

THIS LEADS US TO ENERGY MARKETS

A pause would most definitely excite commodities markets

Why?

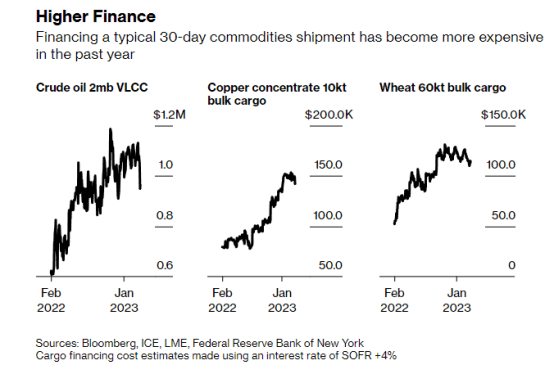

Rising Rates Are Reshaping Once-Lucrative Commodity Trades

Commodity traders rely on bank credit to finance deals

Companies are passing on costs or exiting from some trades

Higher interest rates are forcing commodity traders to rethink some deals and push up prices, in the latest example of how a period of rapid central-bank hiking is reshaping global business.

The companies that buy, sell and transport the world’s natural resources are particularly vulnerable to rising rates, because they rely on banking lines to finance their trades – from shipping a cargo of wheat or oil to holding inventories of aluminum.

As rates rise, the additional costs of a weeks-long journey or extended storage in a warehouse or tanker are making certain trades far less attractive. The financing cost can dictate whether deals are made or not, and some companies are seeking to pass on the expense to their customers, or getting out of some trades completely. -Bloomberg

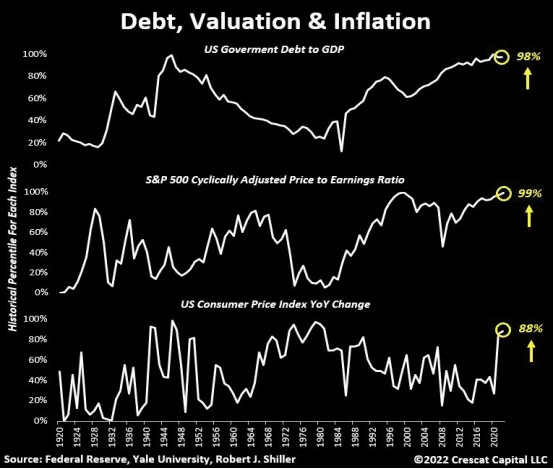

Tavi Costa of Crescat Capital also pointed out earlier today:

The recent banking problems reminded us of how the US economy is facing a trifecta of macro imbalances:

- The debt problem of the 1940s

- Speculative environment of the late 1990s

- Inflationary issues of the 1970s

Never in history have we had all three issues happening at once. When financial problems re-emerge, the Fed must always resort to financial repression, letting inflation run hotter than historical standards.

Thus a pause would likely excite the commodities markets.

TECHNICALS

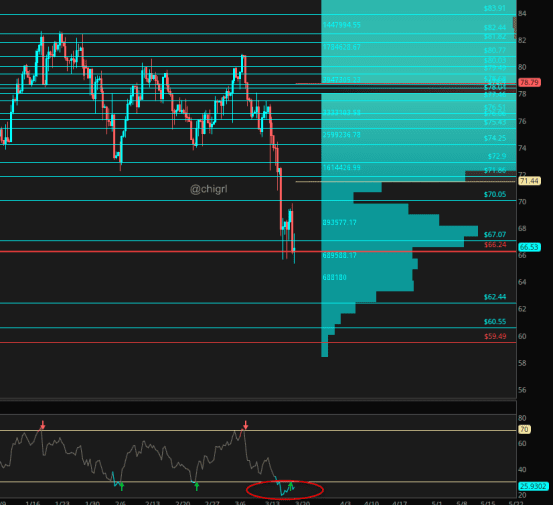

Crude Oil

Crude is obviously very oversold, but my swing chart did finally get a buy signal on Friday …a rebound here soon likely

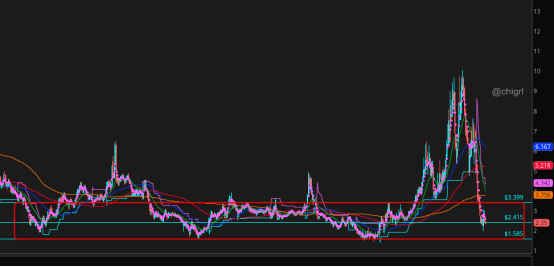

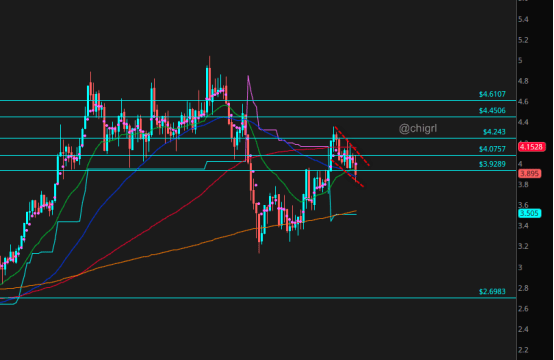

Nat Gas

Nat gas is still waffling in a supply zone, again, really hard for me to get excited about this market.

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish this market over the longer term, we just are not even close yet.

In addition, Baker Hughs report showed an INCREASE in gas rigs this past week. Not really bullish for this market.

MOVING ONTO METALS

Copper

Again, copper is still hanging in there.

Possible bull flag on the weekly

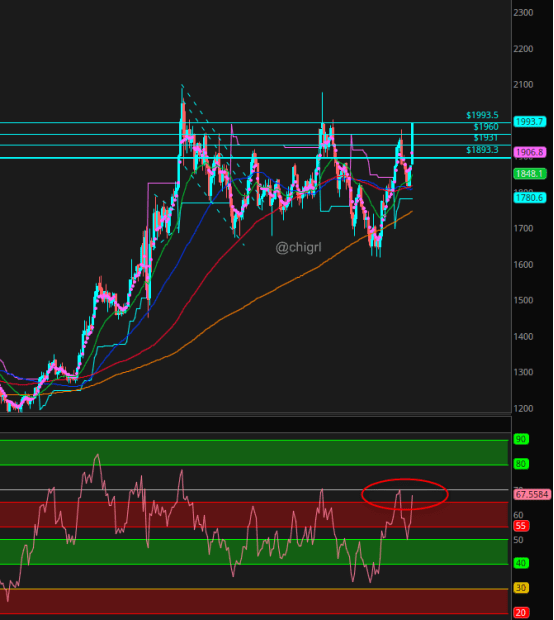

Gold

From last week: Gold stocks (miners, ETF, physical, and paper) are some of the cheapest stocks on the board right now. Most are trading at 20% free cash flow yields and they are talking about the same capital discipline as the oil sector.

We saw a massive liquidation last year in gold ETF’s for almost 24 straight weeks.

Who was on the other side of that trade? The answer is Central Banks. They have been buying gold at a rate three times faster than anything we have seen in the last 20 years.

While the CB’s are telling us “everything is “OK” They are buying gold hand over fist.

I also noted that: We are coming up on overhead resistance ($1890). That said if this makes it over it could fly.

And FLY we did!!

This week we are getting a bit overbought…gold could take a pause here this week, with a resolution to Credit Suisse and a possible FOMC pause. That said this chart still remains bullish.

US DATA THIS WEEK

THINGS TO KEEP AN EYE ON THIS WEEK

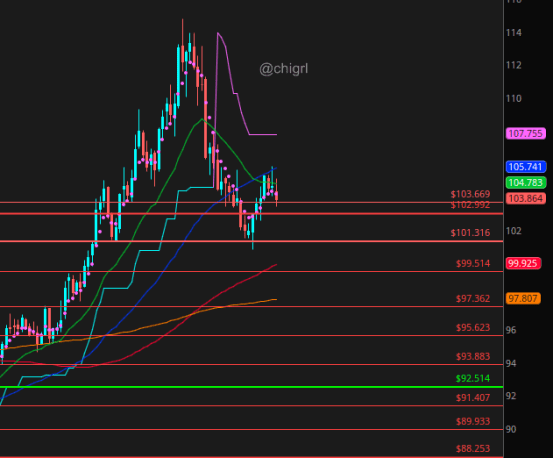

$DXY (USD)

I think a softer dollar has in part helped the equities markets last week. It looks as though we could get a bigger pullback at least in the shorter term, especially with the possible Fed pause news. In addition, the Fed may have to open swap lines with SNB and others due to this banking crisis. Let’s see.

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.