3 April morning note: Crude opened up over $4!

First note: Short week as Good Friday is this Friday. NYSE is closed, CME group is on a shortened holiday schedule

HUGE NEWS!

Some of the OPEC and plus nation announced a oil voluntary oil production cut beginning in May and lasting through December.

This is completely outside of the current OPEC+ deal, in fact the OPEC+ meeting is not until April 3-4. These cuts are not mandated, again these are voluntary.

Here is the break down:

Saudi Arabia 500k bpd

UAE 144k

Oman 40k

Kazakhstan 78k

Kuwait 128k

Iraq 211k

Algeria 48k

For a total of 1.149M bpd

*also note that Russia also extended their 500K bpd cut from just March out to June. So for the months of May-June that is 1.649M bpd.

**Side note: If energy prices spike due to this cut, likely this will take grains up as well (energy costs are a huge input for agriculture), in particular soybean oil and corn.

Pretty quiet week last week

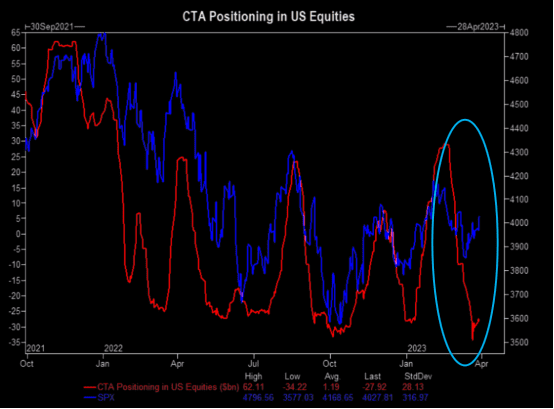

One very notable chart was posted by @AlessioUrban

*IF* CTA’s start chasing this, we could get an eye-watering rally.

Amazing market resilience in light of the banking crisis..why?

Per Edward Jones:

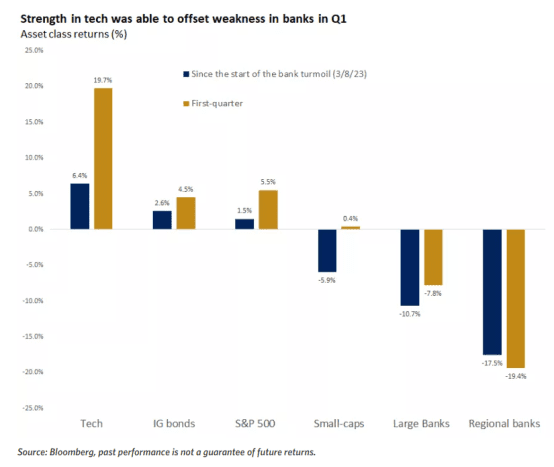

- Markets wrapped up a volatile but positive first quarter as strength in tech was able to offset weakness in banks.

- Confidence has increased that the cyclical peak in bond yields is behind us. The bank turmoil likely pulled forward the end of the Fed’s tightening campaign.

- History is mixed on whether a Fed pause can be enough to end bear markets. But similarities of the current bear with the one from the 1970s suggest that equities might not require aggressive rate cuts to bottom.

- While the bank turmoil led to a sharp pullback in shares of regional banks, large banks, and value-style investments more broadly, it was also a catalyst for the tech sector and other growth segments of the market to reassume stock-market leadership.

- The drop in short- and long-term yields partly reversed the valuation pressures that high-growth companies experienced last year. This in turn helped prop up the S&P 500, which managed to eke out a small gain in March, even after a 15% drop in large banks and a 22% drop in regional banks. Showcasing the tug-of-war, the tech-heavy Nasdaq 100 logged its best quarter since 2020, up now 22% from its December lows1.

- Small-cap stocks, which are more economically sensitive and carry a higher weight in financials, lagged. But balanced portfolios benefited from better fixed-income returns as bonds rose, regaining their diversification benefit against equity volatility.

Confidence has increased that the cyclical peak in bond yields is behind us

- The silver lining from the recent bank troubles is that financial-stability concerns will likely end up pulling forward the end of the Fed’s tightening campaign. It was less than a month ago that Chair Powell in his testimony to Congress entertained the possibility of reaccelerating the pace of rate hikes and opened the door to a higher peak than previously projected. But the bank failures that followed led Fed officials to largely maintain the same path for rate hikes as they were penciling in back in December, despite ongoing tightness in the labor market and lingering inflationary pressures.

- Historically, 10-year Treasury yields have peaked about two months before the last Fed hike2. If market and Fed expectations for one final rate hike in May come to fruition, that would suggest that 4% for the 10-year yield and 5% for the 2-year will likely act as ceilings.

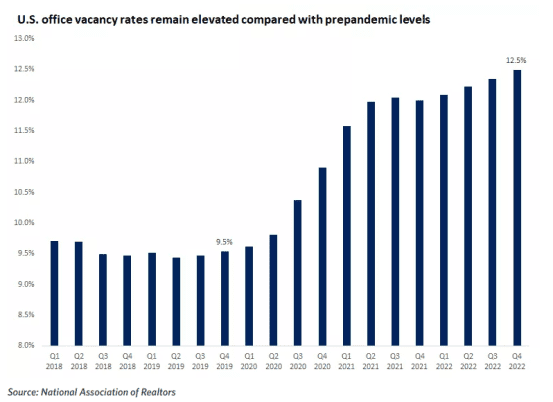

That said commercial real estate may become a potential headwind for the market – the next shoe to drop????

An area of potential concern is commercial real estate. A wave of upcoming refinancing of loans at much higher interest rates is coming at a time when vacancy rates in offices are significantly above their pre-pandemic rates. And tied to the recent stress in regional banks, these smaller banks account for about 70% of all commercial real estate loans and are the ones that are likely to tighten financing the most. While it is worth paying close attention to this sector as the next potential vulnerability, the impact of commercial real estate is relatively small relative to the size of the U.S. economy, accounting for about 5% of GDP, according to the Commercial Real Estate Development Association.

This seems to be a consensus view among many analysts…so just keep your eye commercial real estate space!!

TECHNICALS

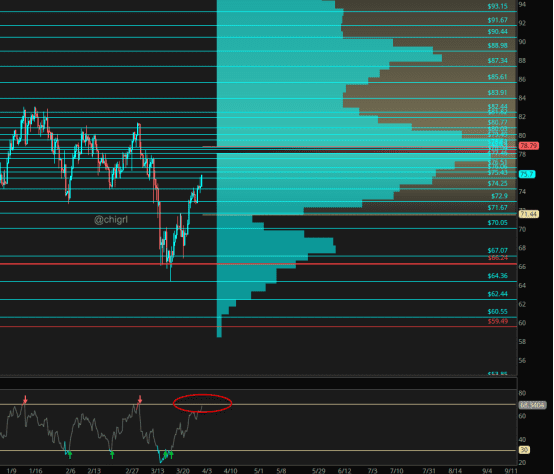

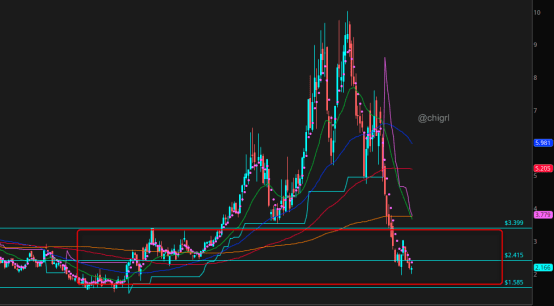

Crude oil

Last week I noted: Possible we see more upside this week as we bounce in that HVN..if the market can make it over in its second attempt, that would be a very positive sign. BUT keep an eye on the banking crisis. That said, with all the turmoil this week, the broader markets are still hanging in there quite well.

More upside indeed!

I think likely we open gap up tonight on the OPEC cut news, that said we are getting close to being overbought …so if we gap up, we may see a fade by tomorrow (as I suspect the Biden administration with attempt to damper this news) Overall the market is still constructively bullish (the recent lows may be in for at least the next few months as we head into high demand season and China recovers).

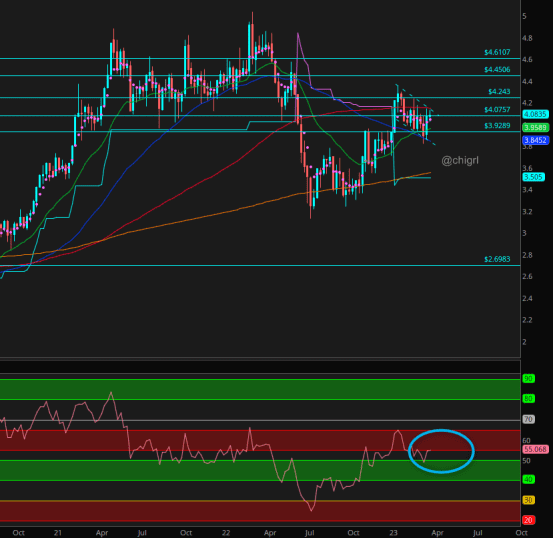

Nat Gas

No change to my view from last week:

Nat gas is still waffling in a supply zone, again, really hard for me to get excited about this market.

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish this market over the longer term, we just are not even close yet.

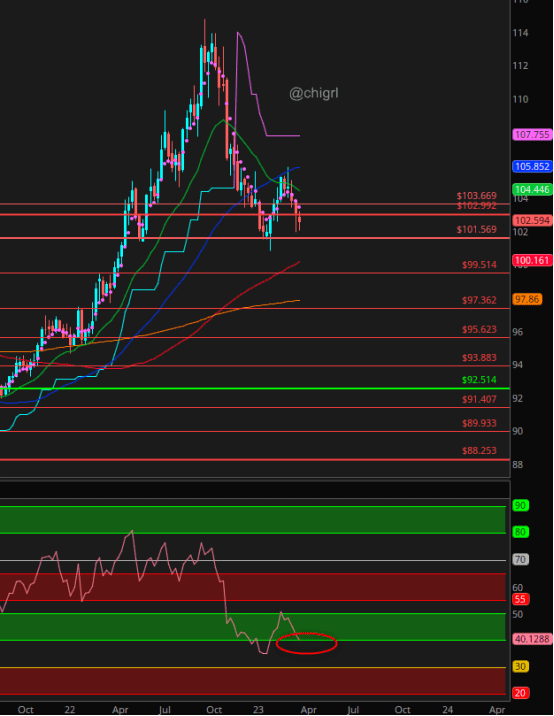

Copper

Copper ended the week flat, weekly bull flag in tact. Still not oversold.

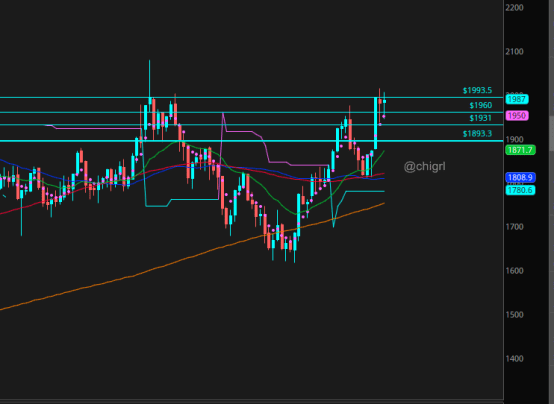

Gold

Last week I noted: It would not surprise me if we consolidated some more to work off this overbought territory

Again it was a consolidation week. This actually speaks to gold’s strength as it did not tank with markets rallying and sentiment that the banking crisis has passed.

It may be another sideways market this week, but overall …chart is still bullish.

THINGS TO KEEP AN EYE ON THIS WEEK

As always USD

Last week I noted: I suspect this week we may be sideways/slightly up, but it still looks as though we have a bigger pull back in store.

Same thoughts this week.

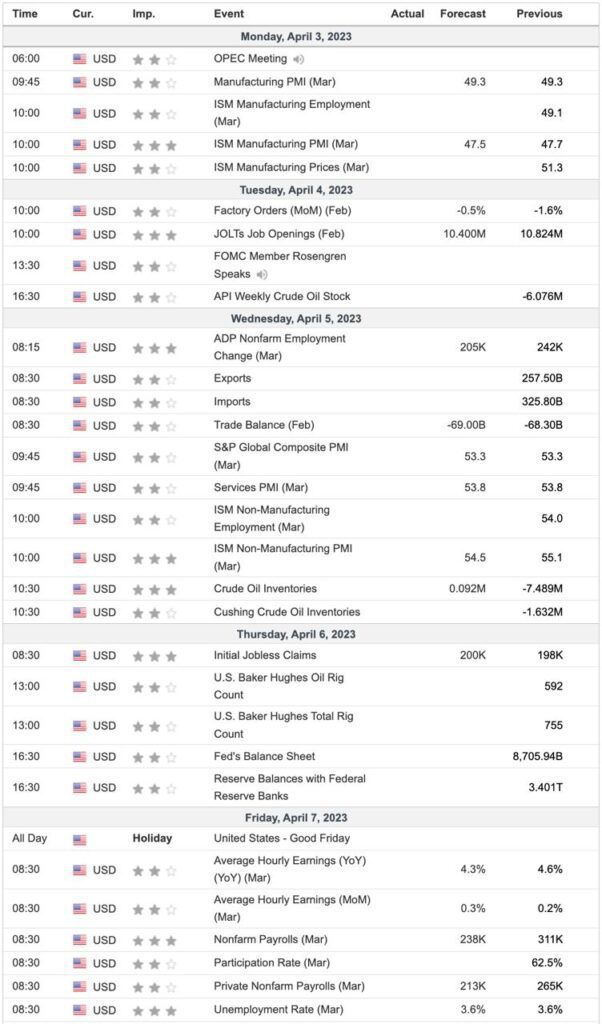

US DATA THIS WEEK

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.