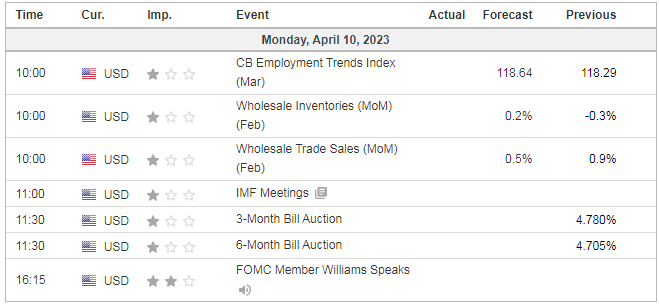

UPDATE: US DATA TODAY 10 APRIL

DEATH OF USD?

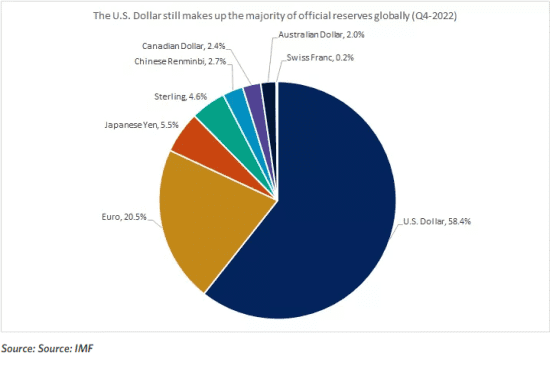

Lots of talk of the death of the dollar over the last few weeks, as TotalEnergies purchased a cargo of LNG in yuan from China, China making deals to trade in Yuan, and Russia exploring other currencies to trade oil in due to sanctions.

I believe these calls are VERY premature.

To be a reserve currency you need these 5 things:

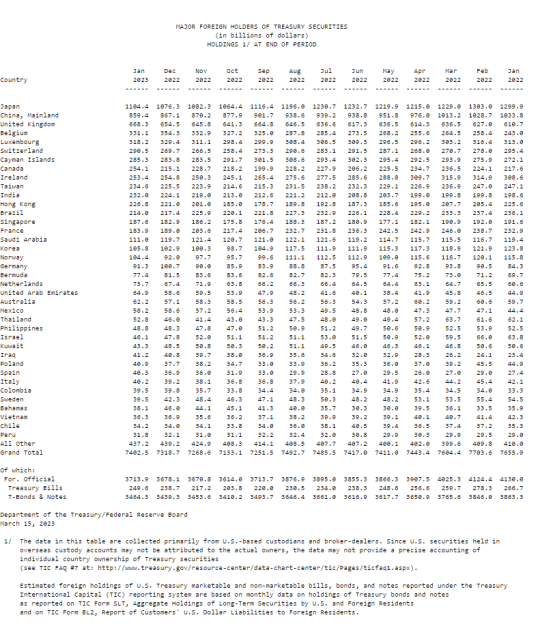

1. Trust in the central bank. The U.S. Federal Reserve is one of the most powerful central banks in the world. With the U.S. dollar used for approximately 90% of all of the world’s currency transactions, the Fed’s sway has a sweeping effect on the valuation of many currencies. In addition, The bulk of official dollar reserves are held in the form of U.S. Treasury securities, which are in high demand by both official and private foreign investors. As of the end of the first quarter of 2021, $7.0 trillion or 33 percent of marketable Treasury securities outstanding were held by foreign investors, both official and private while 42 percent were held by private domestic investors, and 25 percent by the Federal Reserve System. (Federal Reserve)

Current foreign holders of US debt

2. Liquid Markets. U.S. dollar has been the dominant currency globally is the strength and stability of the U.S. economy, as well as the deep and liquid financial markets that the U.S. offers. The U.S. has by far the largest bond markets and stock markets globally, and, importantly, the financial markets are highly regulated and offer borrowers and lenders access to a large set of counterparties. These advantages have allowed the U.S. dollar to maintain its dominant position in international trade and finance.

3. Wide Acceptance. Most of the global trade is still conducted in U.S. dollars. The Federal Reserve estimates that between 1999 to 2019, the dollar accounted for 96% of trades in North America, 74% in the Asia-Pacific region, and 79% for the rest of the world. The only region where trade was not dominated by the U.S. dollar was Europe, where the euro remained the preferred trade currency. Global oil trade, which accounts for about 6% of overall trade, is still largely conducted in U.S. dollars. (Federal Reserve)

4. Convertibility. Currency convertibility is the ease with which a country’s currency can be converted into gold or another currency. Currency convertibility is important for international commerce as globally sourced goods must be paid for in an agreed-upon currency that may not be the buyer’s domestic currency. When a country has poor currency convertibility, meaning it is difficult to swap it for another currency or store of value, it poses a risk and barrier to trade with foreign countries that have no need for the domestic currency. A convertible currency is any nation’s legal tender that can be easily bought or sold on the foreign exchange market with little to no restrictions. A convertible currency is a highly liquid instrument as compared with currencies that are tightly controlled by a government’s central bank or other regulating authority. (Investopedia)

Chinese Yuan is non-convertible as it is traded in low volumes in the global foreign exchange market and tightly controlled by the government via capital controls that limit the amount of currency that can exit or enter the country.

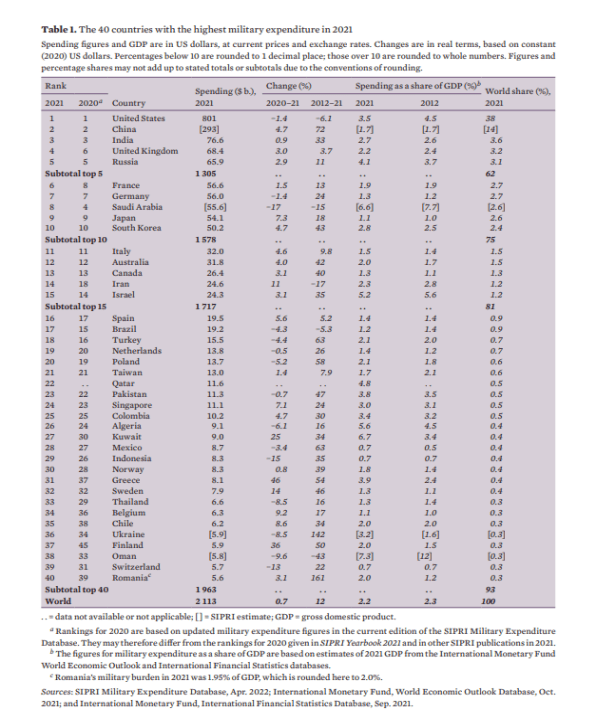

5. Strong Military. Over the past 300 years, there have been three major empires – the Dutch Empire, British Empire, and American Empire, each characterized by having a reserve currency and a dominant military.

According to Statista, the most powerful military in the world is the United States military. (Statista uses an index with 50 different factors such as military might to budget to give each country a score.)

The top eight most powerful militaries as of January 2022:

United States

Russia

China

India

Japan

South Korea

France

United Kingdom

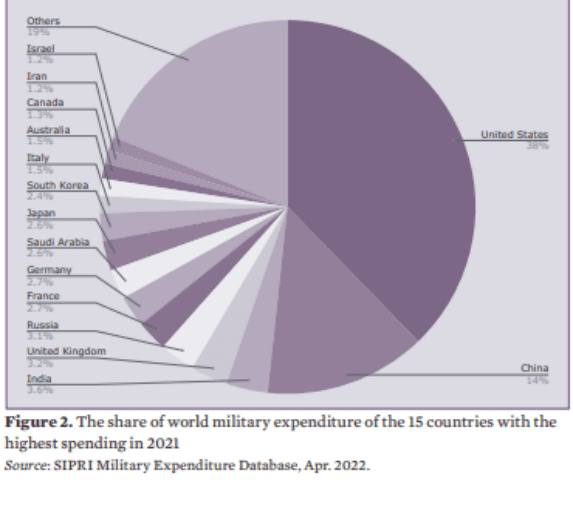

The 40 countries with the highest military expenditure in 2021

The share of world military expenditure of the 15 countries with the highest spending in 2021

EURODOLLAR MARKET

Not a requirement of a reserve currency,but we have to factor in Eurodollars as it is one of the world’s primary international capital markets.

The term eurodollar refers to U.S. dollar-denominated deposits at foreign banks or at the overseas branches of American banks. Because they are held outside the United States, eurodollars are not subject to regulation by the Federal Reserve Board, including reserve requirements. Dollar-denominated deposits not subject to U.S. banking regulations were originally held almost exclusively in Europe (hence, the name eurodollar). Now, they are also widely held in branches located in the Bahamas and the Cayman Islands.

The fact that the eurodollar market is relatively free of regulation means such deposits can pay higher interest. Their offshore location makes them subject to political and economic risk in the country of their domicile; however, most branches where the deposits are housed are in very stable locations.

To say this market is HUGE is an understatement. In 2016, the Eurodollar market size was estimated at around 13.833 trillion., and since grown.

IN SUM

Right now there just is no other viable country with the ability to supplant the US dollar as the global reserve currency taking all these factors into account.

DATA LAST WEEK

Data last week showed some signs of the economy slowing

1. Labor market. The ADP private-payrolls report for the month of March showed an increase of 145,000 jobs, well below the expected 250,000 increase. The report also noted that the pace of wage growth decelerated from the February report. In addition, the job openings data last week (JOLTS) showed that openings in February fell below 10 million for the first time in nearly two years, another signal that the labor market may be cooling.

2. Manufacturing and services activity. Last week’s data for U.S. manufacturing activity and services activity for the month of March came in well below expectations. The ISM manufacturing index, a gauge of manufacturing health, fell to a near three-year low of 46.3, below expectations of 47.5. Readings below 50 indicate a contraction in activity. Similarly, the ISM services index came in at 51.2, below expectations of 54.4, although still slightly in expansion territory. The manufacturing and services indexes are considered leading indicators of broader economic growth and are showing clear signs of slowing, which could indicate a slowdown ahead in the economy.

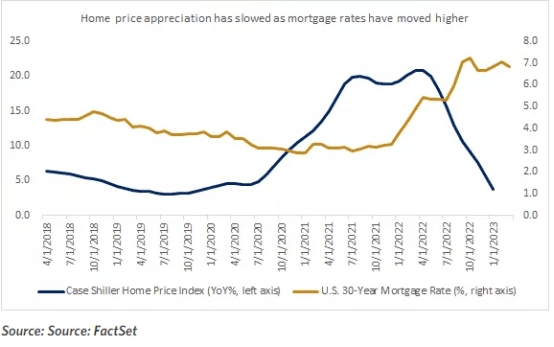

3. Housing. Over the past couple of weeks, we have seen housing data come in softer than expected. The housing and rental components of inflation have remained elevated, although the real-time data indicate a housing market that has started to soften. Last week’s Case-Shiller national home price index saw moderating gains for seven straight months, coming in at 3.8% year-over-year, which has not been seen since the pre-pandemic period1. Higher mortgage rates and cooling housing demand have weighed on the sector, which could also see a further downside if mortgage-lending standards tighten. (Edward Jones)

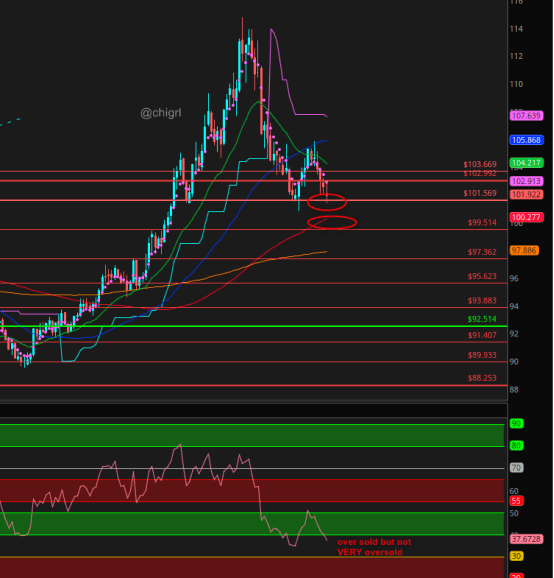

TECHNICALS

Last week I noted: I think likely we open gap up tonight on the OPEC cut news, that said we are getting close to being overbought. Overall the market is still constructively bullish (the recent lows may be in for at least the next few months as we head into high demand season and China recovers).

Gap up indeed!!

That said we are well overbought, I would like to see some of this bullishness worked off to continue higher. So far the Biden administration has been fairly quiet about these new cuts. We my hear some announcement this week. It could be they bring up NOPEC (bad idea) again, another SPR release (help us all), export controls (another terrible decision), or perhaps nothing, but just be on the look out for news that may drive this down a bit.

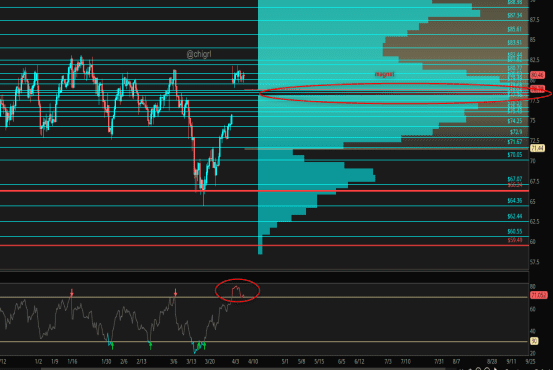

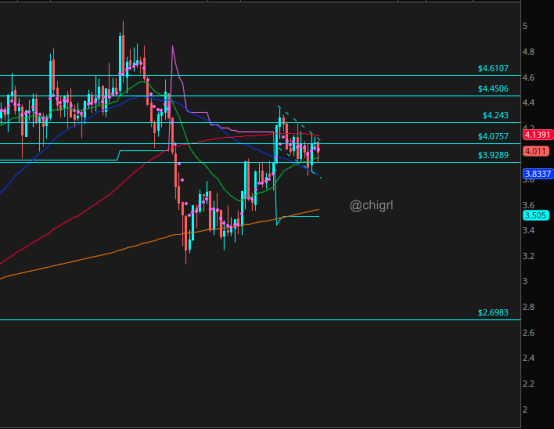

Nat Gas

No change to my view from last week: This market still looks terrible. Honestly, I do not think we see much movement until summer (weather depending).

Nat gas is still waffling in a supply zone, again, really hard for me to get excited about this market.

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish on this market over the longer term, we just are not even close yet.

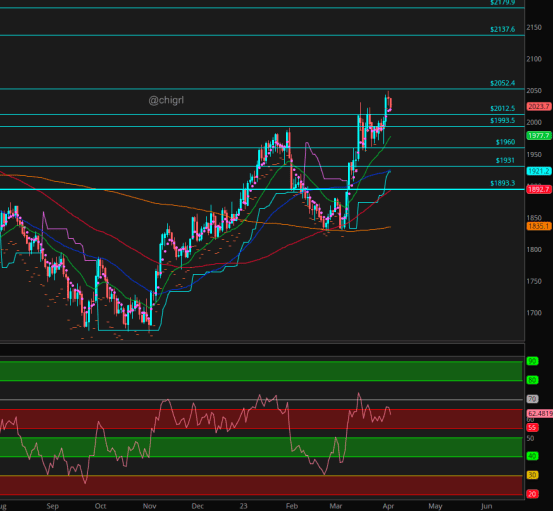

Gold

Last week I noted: Again it was a consolidation week. This actually speaks to gold’s strength as it did not tank with markets rallying and sentiment that the banking crisis has passed.

It may be another sideways market this week, but overall …chart is still bullish.

Well, we actually broke out to the upside last week after two weeks of consolidation. A bit overbought but overall still bullish.

Copper

Copper is still waffling in that weekly bull flag. Bull thesis is still intact.

LAST BUT NOT LEAST

USD as always

Last week I noted: It still looks as though we have a bigger pullback in store.

Same thoughts this week

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.