Long-anticipated China GDP data was out overnight

Mixed Asian Markets …Europe Green (so far)

- Hong Kong: Hang Seng closed down -0.63%

- China CSI 300 +0.30%

- Taiwan KOSPI -0.19%

- India Nifty 50 -0.26%

- Australia ASX +0.23%

- Japan Nikkei +0.47%

- All European bourses broadly in positive territory so far this morning

- US indices in positive territory so far this morning in pre-market, USD -0.40%

Overnight Data/News (China)

China-mixed data GDP, retail sales, unemployment strong

Property sector is still horrific, slightly weaker than expected industrial production but still improving

- Chinese GDP (Y/Y) Q1: 4.5% (exp 4.0%; prev 2.9%) – GDP SA (Q/Q) Q1: 2.2% (exp 2.0%; prev 0.0%) – GDP YTD (Y/Y) Q1: 4.5% (exp 4.0%; prev 3.0%)

- Chinese Industrial Production (Y/Y) Mar: 3.9% (exp 4.4%; prev 2.4%) -Industrial Production YTD (Y/Y) Mar: 3.0% (exp 3.5%; prev 2.4%)

- Chinese Retail Sales (Y/Y) Mar: 10.6% (exp 7.5%; prev 3.5%) -Retail Sales YTD (Y/Y) Mar: 5.8% (exp 3.7%; prev 3.5%)

- Chinese Surveyed Jobless Rate Mar: 5.3% (exp 5.5%; prev 5.6%)

- Chinese Property Sales YTD (Y/Y) Mar: -5.8% (exp -4.7%; prev -5.7%) -Residential Property Sales YTD (Y/Y) Mar: 7.1% (prev 3.5%)

- PBoC Fixes USDCNY Reference Rate At 6.8814 (prev fix 6.8679 prev close 6.8817)

- China air travel demand has recovered rapidly, domestic air passenger volume has reached to 90% of pre-pandemic levels – official

- Goldman Sachs maintains its forecast of China’s 2023 GDP growth unchanged at 6%.

- Citi raised forecast of China’s 2023 GDP growth to 6.1% from previous forecast of 5.7%

- JPMorgan raised its forecast of China’s 2023 GDP growth to 6.4% from previous 6%.

- China Said To Warn Of ‘Major Military Action’ In Yellow Sea On Tuesday

- China’s Commodities Output Roars Ahead As Economy Reopens – BBG

- China’s Crude Oil Refiners Smash Record on Recovery, Expansion

Overnight Data/News (the rest)

- UK ILO Unemployment Rate 3M Feb: 3.8% (exp 3.7%; prev 3.7%) – UK Employment Change (3M/3M) Feb: 169K (exp 50K; prev 65K) – UK Average Weekly Earnings 3M (Y/Y) Feb: 5.9% (exp 5.1%; prevR 5.9%) – UK Weekly Earnings Ex Bonus 3M (Y/Y) Feb: 6.6% (exp 6.2%; prevR 6.6%

- UK Jobless Claims Change Mar: 28.2K (prevR -18.8K) – UK Claimant Count Rate Mar: 3.9% (prev 3.8%) – UK Payrolled Employees Monthly Change Mar: 31K (exp 48K; prev 98K)

- German ZEW Expectations Apr: 4.1 (exp 15.6; prev 13.0) – German ZEW Current Situation Apr: -32.5 (exp -40.0; prev -46.5)

- Eurozone ZEW Expectations Apr: 6.4 (prev 10.0)

- Investors Bet That US Dollar Has Further To Fall – FT

- BofA April Global Fund Manager Survey: “Long Big Tech” And “Short Us Banks” Most Crowded Trades

- Few Banks Are Hedging Interest-Rate Risk – WSJ

- Fund managers are further cutting exposure to British stocks, according to Bank of America

- HSBC Urged To Break Up By Largest Shareholder And Accused Of ‘Exaggerating’ Risk – FT

- Bank Of America Q1 23 Earnings: – Adj EPS $0.94 (est $0.81) – Rev $26.26B (est $25.32B) – Trading Revenue Ex. DVA $5.05B (est $4.46B) – Net Interest Income FTE $14.6B (est $14.42B) – Total Deposits $1.91T (est $1.88T) – Ended Quarter With $ 904B Of Global Liquidity Sources

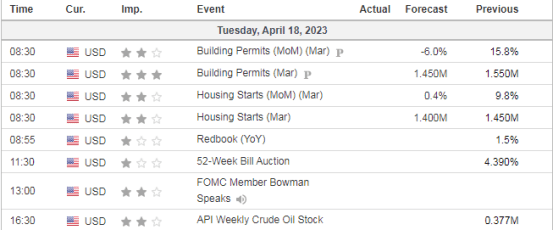

US DATA TODAY