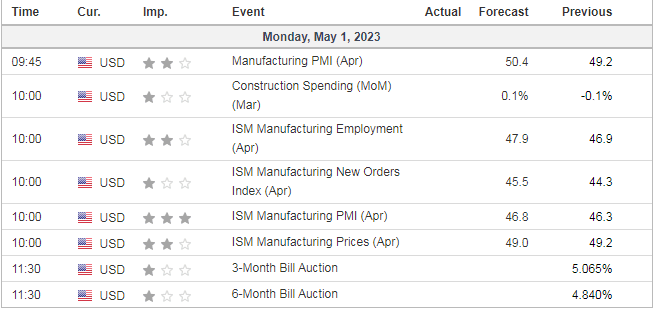

Monday May 1 update: US DATA TODAY

BIG WEEK AHEAD! FOMC, FOMC, FOMC!!

Recap April 24-28

- Stocks added to 2023’s gains last week, including a 2% rally on Thursday, the best day since January 6. Markets have logged a healthy rally so far this year, including the following year-to-date:

- The S&P 500 is up 8%.

- The Nasdaq has seen the strongest momentum, up 16%, as technology and growth stocks have rallied on the back of lower rates.

- Global markets have also rallied, with international developed-market equities up 11%.

- Bonds have also participated in the rebound, returning 3%, as yields have pulled back from last year’s peak.

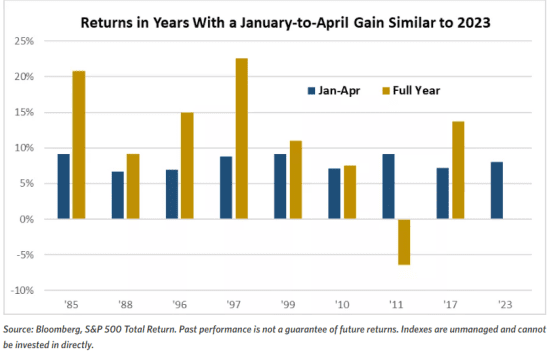

- Since 1982, when the stock market was higher on the year heading into May, it went on to post a full-year gain 89% of the time, averaging an annual return of 12%. 1987, 2011 and 2015 were the only years in which the market was higher from January to April but finished the year lower1.

- There were eight years in which the year-to-date increase heading into May was in the 6.5%-9.5% range, comparable to 2023’s 8% year-to-date gain. In those instances, the stock market went on to post an average full-year increase of 11.7%1.

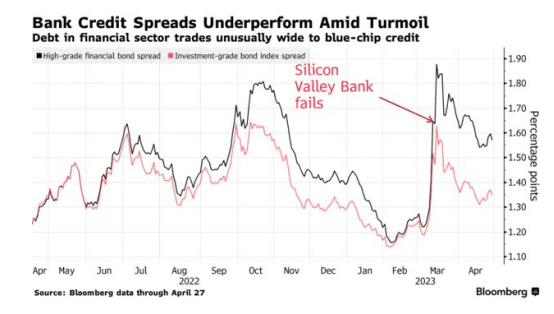

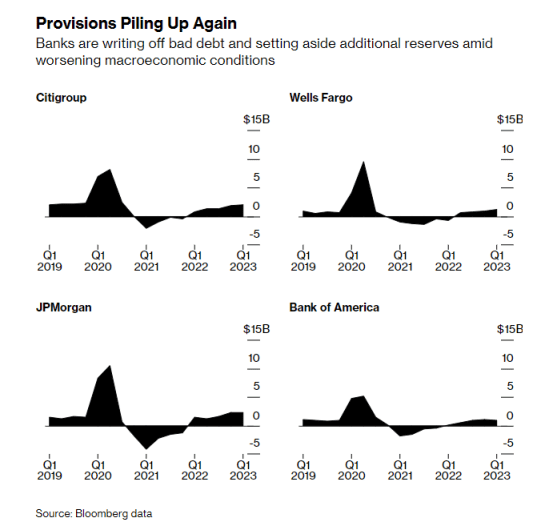

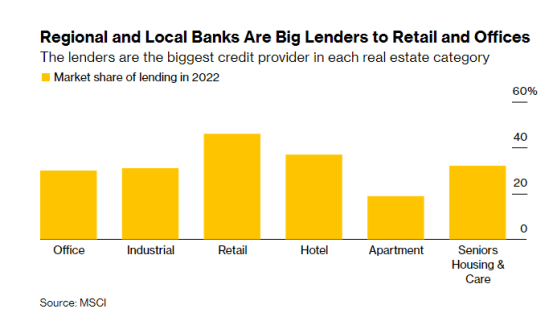

Signs Are Mounting That a Debt Crunch is Looming (Bloomberg)

Funding crunch complicates the Fed’s decision-making next week

Lending is shrinking and the money supply is contracting

Just when it seemed the US regional banking strains were starting to ease, First Republic Bank has leaped back into headlines, reigniting concerns of rising pain in the lending system.

Banks increased emergency borrowing from the Federal Reserve for the second week in a row in a sign of the ongoing stress in the system. Last week, the New York Fed reported that financial conditions in its region had deteriorated sharply.

The trouble is rekindling concern that a credit crunch is underway. And it further complicates the plan for next week’s Fed policy meeting, where officials have to figure out how to balance the risks of tighter borrowing conditions against stubbornly high inflation.

Below are six charts that help explain why and how borrowing is getting harder in vast parts of the economy:

Lending Contraction

Money Supply

Consumer Headwinds

Office Woes (CRE)

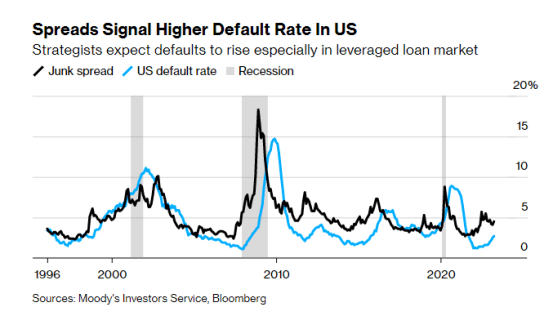

Higher Defaults

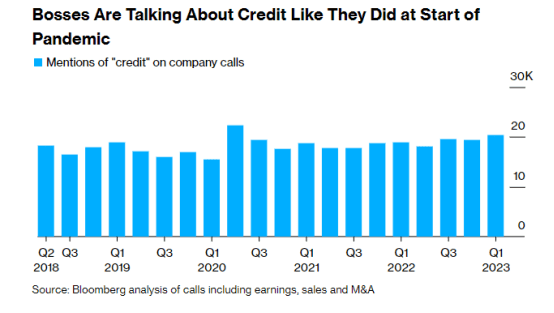

Credit Chatter

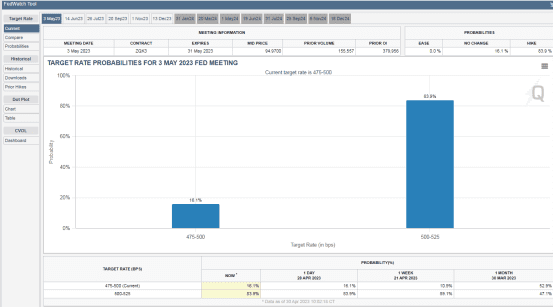

COMMENTARY: Data is definitely beginning to weaken, that said CME Group Fed Watch tool is still factoring in another 25 bps hike with an 83.9% probability.

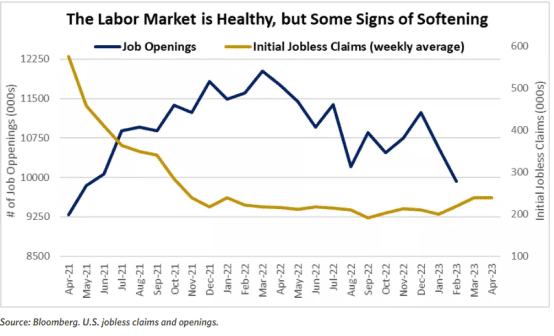

Last week we had some stronger-than-expected data with regard to unemployment claims, but weaker GDP.

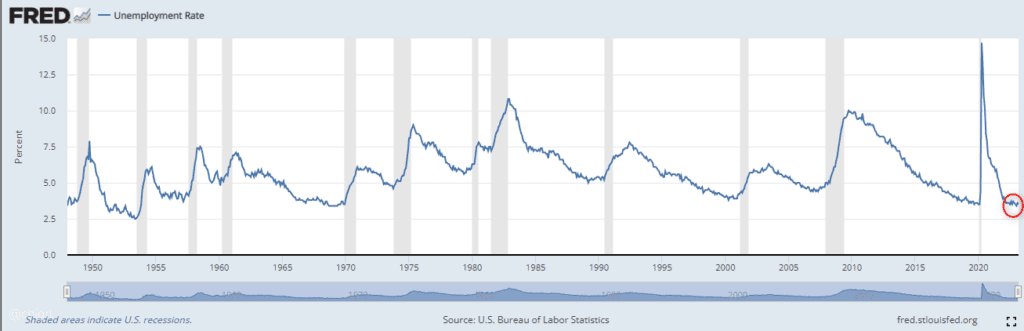

That said, the labor market is showing some signs of softening, but not enough for the Fed.

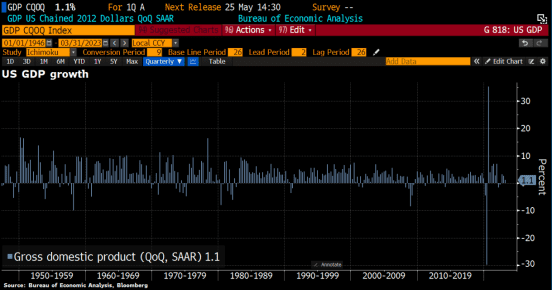

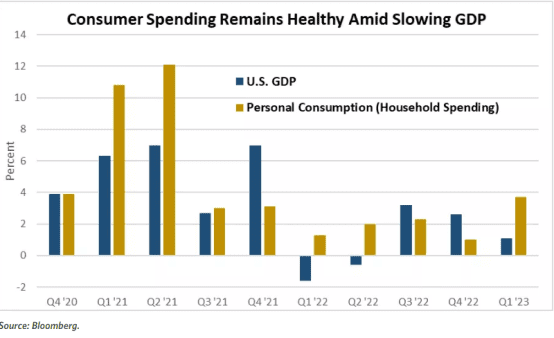

The US GDP grew 1.1% in Q1 2023 annually, slower than the expected 1.9% & slower than previous quarter (2.6%). The main drag came from significantly lower inventory accumulation, while private consumption remained strong. (Holger Zschaepitz)

Consumer spending is another problem for the Fed, although showing some signs of weakness, overall still too strong.

The unemployment rate still at 3.5% is a problem. That said, much of this is due to people leaving the workforce entirely after covid in the aging population.

The Fed is now caught between a rock and a hard place. Their focus remains on employment, and with that data rather resilient, they likely hike until something breaks. Also, keep an eye on the banks, this crisis is obviously not over yet.

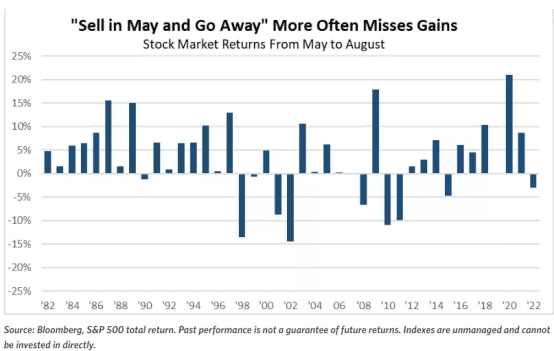

SELL IN MAY AND GO AWAY?

The summer brings the shift toward travel and leisure, but the market doesn’t pack its bags, as the old phrase suggests. Over the last 40 years, the average return for the stock market from May to August was a respectable 3.2%, hardly a period worth missing. The market was higher in 75% of those summer periods, with the best May through August gains coming in 1987 (+16%), 2009 (+18%) and 2020 (+21%). The worst periods were in 1998 (-14%), 2002 (-14%) and 2010 (-11%) – Edward Jones

TECHNICALS

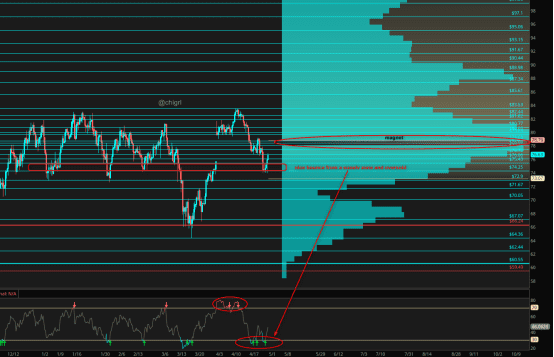

Crude Oil

There was no report last week as the PYT team was in Las Vegas for the Money show, that said the April 16th I noted that: We are well overbought, I would like to see some of this bullishness worked off

And indeed we did!

The gap has been filled from the Sunday open when OPEC announced voluntary cuts of 1.6M bpd as the market like to close gaps and recession fears loom once again.

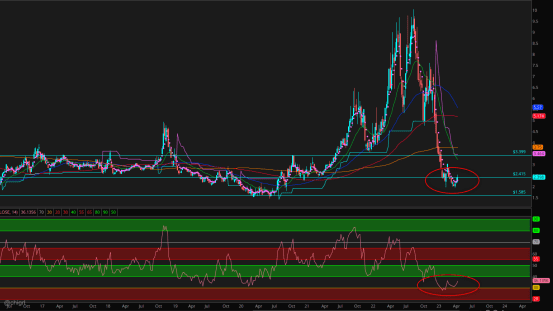

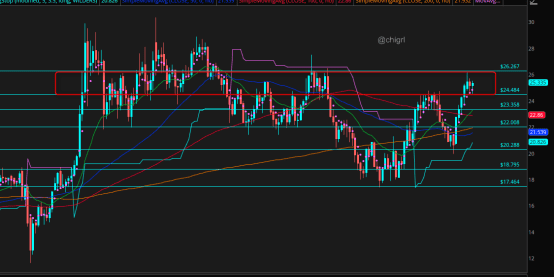

Nat Gas

Weeks of no real change of view from me:

This market still looks a bit LESS terrible, but honestly, I do not think we see much movement until summer (weather-depending).

Nat gas is still waffling in a supply zone, again, really hard for me to get excited about this market.

I want to see a clear break over $3.40/75 for the futures or over $11.70 in UNG to get bullish on this market over the longer term, we just are not even close yet.

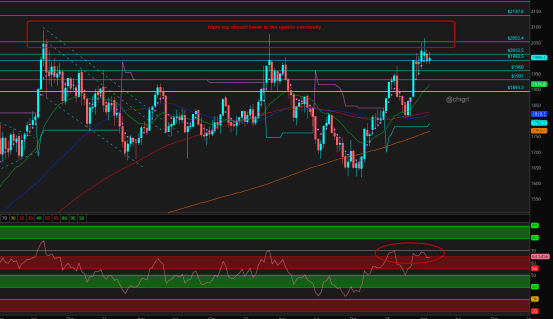

Gold

April 16th I noted: Last week I noted we broke to the upside and may see a pullback…not surprisingly, we did …

We could see a larger pullback, but still, overall chart is still bullish

Indeed we did see a larger pullback, we are still a bit overbought BUT the chart is still bullish overall.

Keep an eye on this banking crisis

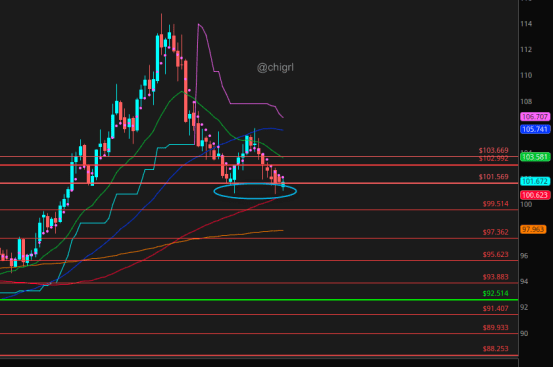

Copper

Copper is still waffling in that weekly bull-flag. It tagged the 50-day and bounce.

This market still looks strong to me although we have seen a pullback from the recent highs.

We are short supply and high in demand over the longer term.

Silver

Silver is looking interesting here to the upside as long as this recent low holds.

LAST BUT NOT LEAST

USD $DXY

April 16th I noted:It still looks as though we have a bigger pullback in store.

We did indeed get a bigger pullback

We double bottomed so far…perhaps a bounce on another rate hike from the Fed as we are pretty oversold, but I still do not feel we have seen the extent of a pullback overall..let’s see

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.