Another US regional bank down! PacWest $PACW shares stumbled 50% overnight after it is reported that they are looking for a buyer

China market back open….mixed markets in Asia, Europe RED

- Hong Kong: Hang Seng closed up +1.27%%

- China CSI 300 +0.03%

- Taiwan KOSPI -0.02%

- India Nifty 50 +0.84%

- Australia ASX -0.95%

- Japan Nikkei -0.23%

- All European bourses all in negative territory so far this morning

- US indices in negative territory, Nasdaq FLAT so far this morning in pre-market USD -0.10%

Overnight Data/News

- Chinese Caixin Manufacturing PMI Apr: 49.5 (exp 50.0; prev 50.0)

- PBoC Fixes USDCNY Reference Rate At 6.9054 (prev fix 6.9249 prev close 6.9179)

- PBoC To Inject CNY33Bln Via 7 Day Reverse Repos At 2.0% In Open Market Ops

- German Trade Balance SA (EUR) Mar: 16.7B (est 16.3B; prevR 16.1) – German Exports SA (M/M) Mar: -5.2% (est -2.2%; prevR 4.2%) – German Imports SA (M/M) Mar: -6.4% (est -2.1%; prev 4.6%)

- Swedish Swedbank/Silf Services PMI Apr: 50.5 (prevR 49.9) – Swedish Swedbank/Silf Composite PMI Apr: 49.1 (prev 47.8)

- Spanish Unemployment Change Apr: -73.9K (prev -48.8K)

- Spanish HCOB Composite PMI Apr: 56.3 (est 58.5; prev 58.2) – Spanish HCOB Services PMI Apr: 57.9 (est 59.9; prev 59.4)

- Italian HCOB Composite PMI Apr: 55.3 (est 55.5; prev 55.2) – Italian HCOB Services PMI Apr: 57.6 (est 56.5; prev 55.7)

- French HCOB Composite PMI Apr F: 52.4 (est 53.8; prev 53.8) – French HCOB Services PMI Apr F: 54.6 (est 56.3; prev 56.3)

- German HCOB Services PMI Apr F: 56.0 (est 55.7; prev 55.7) – German HCOB Composite PMI Apr F: 54.2 (est 53.9; prev 53.9)

- Eurozone HCOB Composite PMI Apr F: 54.1 (est 54.4; prev 54.4) – Eurozone HCOB Services PMI Apr F: 56.2 (est 56.6; prev 56.6)

- Norway Central Bank Rate Decision Hikes 25Bps To 3.25%; As Expected

- UK New Car Registrations (Y/Y) Apr: 11.6% (prev 18.2%)

- UK Mortgage Approvals Mar: 52.0K (est 41.1K; prev 43.5K) – UK Net Consumer Credit Mar: £1.6B (est £1.2B; prev £1.4B) – UK Consumer Credit (Y/Y) Mar: 7.9% (prev 7.7%) – UK Net Lending Sec. On Dwellings Mar: £0.0B (prev £0.7B)

- UK M4 Money Supply (M/M) Apr: -0.6% (prevR -0.3%) – UK M4 Money Supply (Y/Y) Apr: 0.4% (prevR 1.1%) – UK M4 Ex IOFC’s 3M Annualised Apr: 2.3% (prevR -0.5%)

- UK S&P Global/CIPS Services PMI Apr: 55.9 (est 54.9; prev 52.9) – UK S&P Global/CIPS Composite PMI Apr: 54.9 (est 53.9; prev 52.2)

- Eurozone PPI (M/M) Mar: -1.6% (est -1.7%; prevR -0.4%) – Eurozone PPI (Y/Y) Mar: 5.9% (est 5.8%; prevR 13.3%)

- Shell Beats Estimates With Profit of Nearly $10 Billion, Sets $4 Billion Buyback

- UK Auto Industry Body Says April New Car Sales Rise 10%, Raises 2023 Forecast – RTRS

- Oil’s Dramatic Open Leaves Traders Puzzled After WTI Crashes

- Treasury Yields May Fall to 2% as Gundlach, Banks Eye Recession

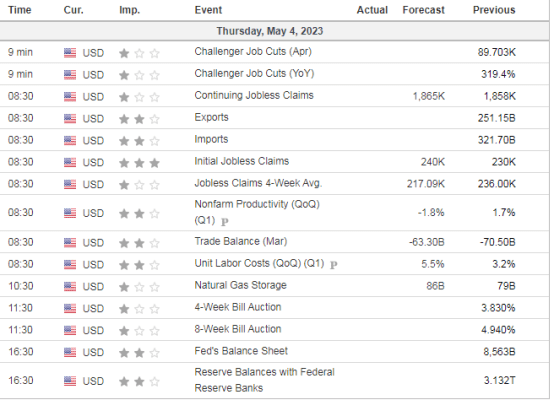

US DATA TODAY