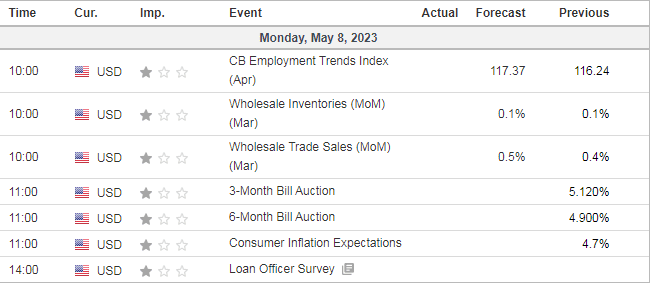

Update May 8 US data today

FOMC last week 25 bps hike as expected.

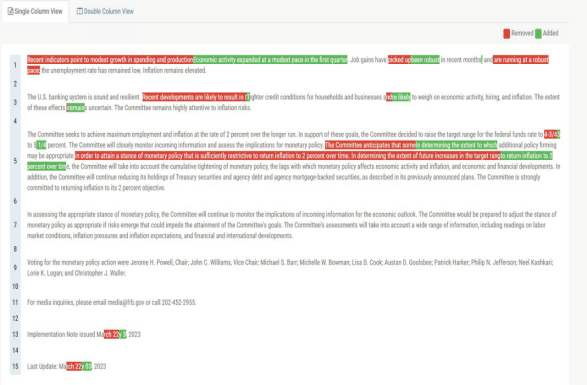

Statement changes

Powell had to balance signaling a pause while remaining hawkish..tough job

Recap via Chatham Financial:

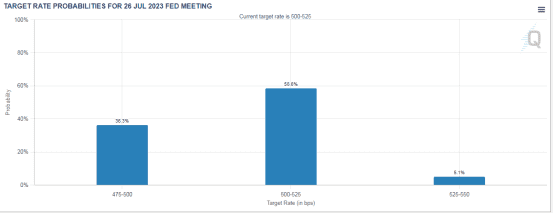

The FOMC voted unanimously to increase the fed funds target range by 25 basis points to a range of 500-525. Tighter credit conditions in the U.S. are likely to weigh on economic activity, which may lead to fewer hikes than previously expected. The Committee views the credit tightening due to the recent bank failures to be equivalent to interest rate hikes. Their goal is to bring inflation to 2% and they believe it will take some time at a restrictive policy level to achieve this goal. Chair Powell also noted that the FOMC’s inflation outlook currently would not support any rate cuts in 2023 and would need to see data that shows softening of labor market conditions and demand prior to any rate cuts. The current range is where the Committee’s median projection for the end of 2023 was set at the March meeting. This indicates that the FOMC expects rates to remain flat for the rest of the year unless any economic data suggests a pivot.

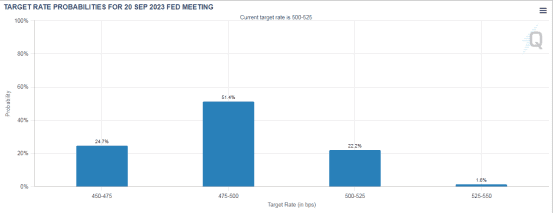

Regardless, the market started to price in rate CUTS immediately afterward starting in July at 36.3% by September which moved to 51.4%!

This is even with the blowout NFP number on Friday at 253k beating the expectations of 185K and the unemployment rate falling from 3.4% to 3.5%. That said, March was revised down from 235K to 165K and February was further revised down.

The question here is are markets pricing in another revision? (yes is my guess).

Side note: What I would like to see is, the unemployment rate versus a comparison to how many left the workforce and are never coming back (ie retirement (boomers), other reasons (medical, etc))

REGIONAL BANKING SECTOR

Moving onto the regional banking sector (the shocker crisis is not yet contained) we saw PacWest, Western Alliance, and Zion’s banks in peril last week. Most notably PacWest ($PACW) lost almost 50% overnight on Thursday.

According to Edward Jones:

Despite the Fed’s more optimistic take on the banking sector, regional banks in the U.S. continue to come under pressure. After First Republic Bank was acquired by J.P. Morgan last weekend, this past week additional West Coast-based regional banks, including PacWest Bancorp, Western Alliance, and Zions Bank, all saw substantial declines in their share prices, before rebounding somewhat on Friday1. PacWest, which is lower by over 70% year-to-date, had announced that it is seeking strategic alternatives, including a potential sale of its business, and will seek to maximize shareholder value1. This comes even as PacWest highlighted that it has not experienced out-of-the-ordinary deposit outflows and that its cash and liquidity position exceeds its uninsured deposits. Nonetheless, markets have been searching for “who is next” among regional banks, and we would expect further intervention and consolidation among the 4,100 commercial banks in the U.S. in the months ahead.

Long short/ markets are skittish in this sector even though we saw a rebound on Friday. Just watch this sector, imho, not sure the crisis is over.

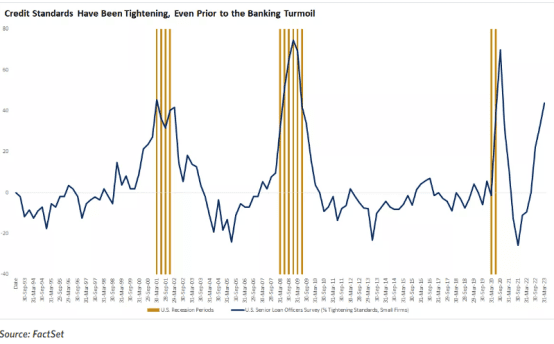

CREDIT

Credit standards have been tightening…this is definitely something to watch …I think the Fed is behind the curve on this with their focus solely on employment.

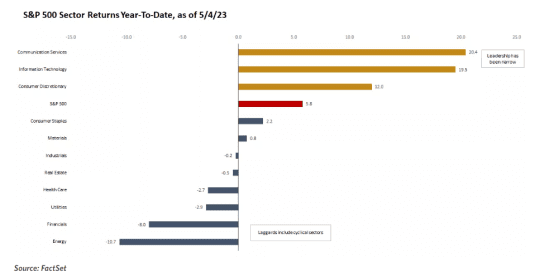

Last but not least, let’s look at S&P 500 returns ytd as we are wrapping up earnings.

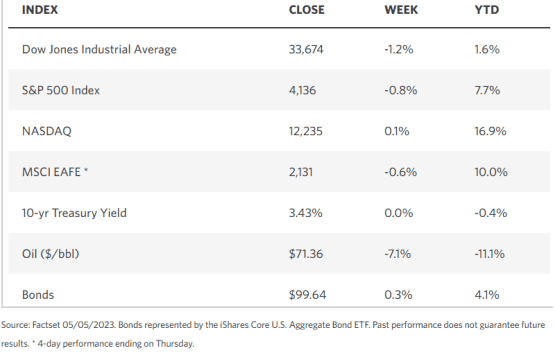

Weekly Market Stats

TECHNICALS

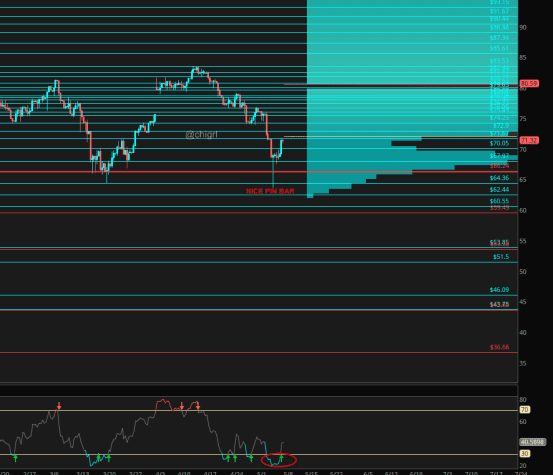

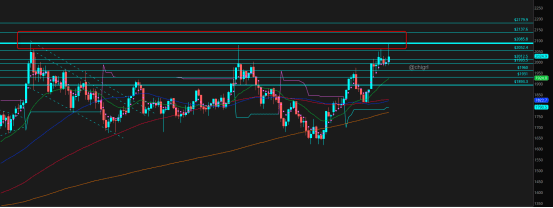

Crude Oil

A very oversold nice pin bar (do not think this chart needs much explanation)

Nat Gas

I will let you know when to get excited…still not yet (LOL)

Gold

Last week I noted that: Indeed we did see a larger pullback (April 16), we are still a bit overbought BUT chart is still bullish overall.

Keep an eye on this banking crisis

The triple top still in play…if this breaks above it likely will not be a small move

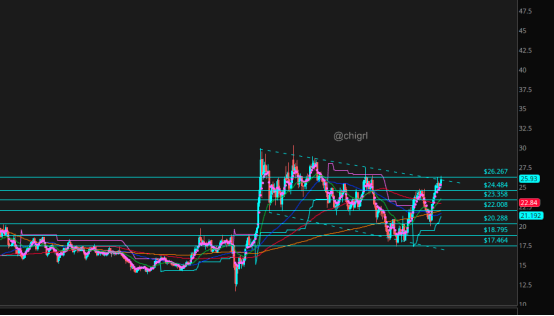

Silver

I noted silver for the first time last week, and it did not disappoint! Backing out of the daily, this market looks like a massive multi-year bull flag on the weekly.

That said, trading this intraday can be super tricky…so stay nimble!

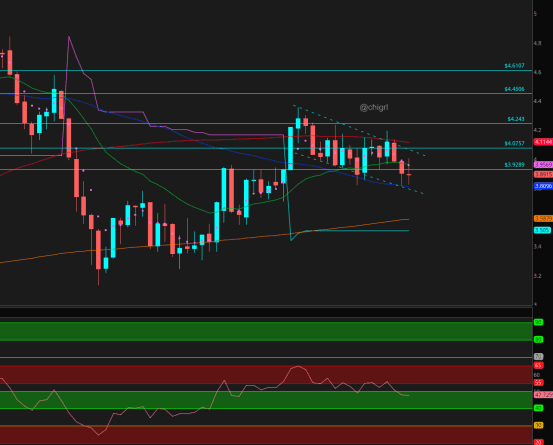

Copper

Copper again is still waffling in that weekly bull flag, but fundamentals remain strong despite that weekly indecision candle, nice bounce off the bottom of the flag.

LAST BUT NOT LEAST

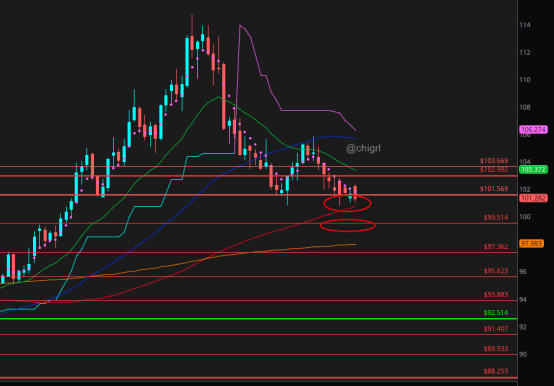

USD $DXY

Last week I noted: We double bottomed so far…perhaps a bounce on another rate hike from the Fed, but I still do not feel we have seen the extent of a pullback overall..let’s see

No change to my thoughts this week, despite it being a rather volatile week between the FED and ECB rate decisions last week.

Financial Disclaimer: This material has no regard for specific investment objectives, financial situations, or particular needs of any user. This material is presented solely for informational and entertainment purposes and is not to be construed as a recommendation, solicitation, or an offer to buy or sell / long or short any securities, commodities, or any related financial instruments. Nor should any of its content be taken as investment advice. The views expressed here are completely speculative opinions and do not guarantee any specific result or profit. Trading and investing are extremely high risk and can result in the loss of all of your capital. Any opinions expressed here are subject to change without notice. We may have an interest in the securities, commodities, and/or derivatives of any entities referred to in this material. We accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. We recommend that you consult with a licensed and qualified professional before making any investment or trading decisions.